Nevada LLC Operating Agreement

Every Nevada LLC should have an operating agreement in place.

While not legally required by the state, having a written operating agreement will set clear rules and expectations for the management and operations of your LLC.

Download our free Nevada operating agreement template below or sign up to create a custom operating agreement using our free tool.

Forming an LLC? Get a free operating agreement when you use Northwest to start an LLC for $29 (plus state fees).

Free Nevada LLC Operating Agreement Templates

We offer operating agreement templates for single-member LLCs and multi-member LLCs (including member-managed and manager-managed) as well as a customizable operating agreement tool.

Single-Member LLC Operating Agreement

Our single-member LLC operating agreement template was created for limited liability companies with only one member, where the sole member has full control over all affairs of the LLC and no other individuals have a membership interest in the company.

Multi-Member LLC Operating Agreements

Our multi-member LLC templates are meant for LLCs with more than one member. There are two types available: manager-managed and member-managed.

Create Custom Operating Agreement

Create a custom operating agreement using our free tool. Just answer a few basic questions, and the tool will develop an operating agreement for your new LLC.

To use our tool, you will need to sign in to our Business Center. A Business Center account will also grant you access to many other free tools, special discounts on business services, and much more.

What Is a Nevada LLC Operating Agreement?

Subscribe to our YouTube channel

An operating agreement is a legal document that outlines the ownership structure and operating procedures of an LLC.

Whether you are starting a single-member or multi-member LLC, your operating agreement should address all of the topics below. Some of these stipulations will not have much bearing on the actual operations of a single-member LLC, but are still important to include for the sake of legal formality.

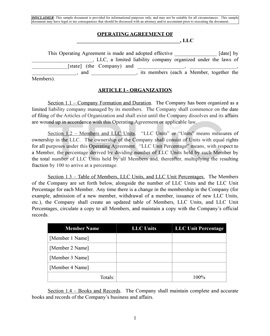

- Organization: When the LLC was officially formed, who its members are, and how ownership is divided. Multi-member LLCs may utilize an equal ownership structure or assign various members different “units” of ownership.

- Management & Voting: Whether the LLC will be managed by its members or by an appointed manager, and how members will go about voting on business matters. Typically, each member has one vote, but you may wish to give some members more voting power than others. For more information on managing your LLC, read our Member-Managed vs Manager-Managed guide.

- Capital Contributions: The amount of money each member has invested in the business. This is also where you should establish an approach to raising additional funds in the future.

- Distributions: How profits and losses will be divided among the members. The most common option is to distribute profits evenly. If you want them divided a different way, this should be detailed in your operating agreement. For more information on the basics of LLC ownership, read our Contributions and Distributions guide.

- Changes to Membership Structure: How roles and ownership will be transferred in the event that a member leaves the company. It’s essential to lay out the process for buying out and/or replacing a member in the LLC’s governing document.

- Dissolution: Dissolution: If at some point all the members of your LLC decide you no longer wish to conduct business, you should officially dissolve it. Outlining the hypothetical process of dissolving your business is an important aspect of your operating agreement. To learn how to dissolve your Nevada LLC, read our Nevada LLC Dissolution article.

We reviewed the top LLC formation services. Find which service is right for you.

Ready to Form an LLC?

Get a free operating agreement when you form an LLC with Northwest ($29 plus state fees).

Why Should I Have a Nevada LLC Operating Agreement?

No matter what type of Nevada LLC you're starting, you'll want to create an operating agreement. Here's why:

- It’s recommended by the state. According to Nevada Revised Statutes § 86.286, all members of a Nevada LLC may enter into an operating agreement to regulate the affairs of the company.

- It'll prevent conflict among your business partners. If you're starting a multi-member LLC, having an operating agreement will prevent misunderstandings amongst your team by setting clear expectations about each partner's role and responsibilities.

- It helps preserve your limited liability status. If you're the sole owner of a single-member LLC in Nevada, having an operating agreement will help to ensure your limited liability status is upheld by court officials, and add to your business's credibility as a whole.

The full text of the statutes can be found below:

1. A limited-liability company may, but is not required to, adopt an operating agreement. An operating agreement may be adopted only by the unanimous vote or unanimous written consent of the members, which may be in any tangible or electronic format, or by the sole member. If any operating agreement provides for the manner in which it may be amended, including by requiring the approval of a person who is not a party to the operating agreement or the satisfaction of conditions, it may be amended only in that manner or as otherwise permitted by law and any attempt to otherwise amend the operating agreement shall be deemed void and of no legal force or effect unless otherwise provided in the operating agreement. Unless otherwise provided in the operating agreement, amendments to the agreement may be adopted only by the unanimous vote or unanimous written consent of the persons who are members at the time of amendment.

2. An operating agreement may be adopted before, after or at the time of the filing of the articles of organization and, whether entered into before, after or at the time of the filing, may become effective at the formation of the limited-liability company or at a later date specified in the operating agreement. If an operating agreement is adopted:

(a) Before the filing of the articles of organization or before the effective date of formation specified in the articles of organization, the operating agreement is not effective until the effective date of formation of the limited-liability company.

(b) After the filing of the articles of organization or after the effective date of formation specified in the articles of organization, the operating agreement binds the limited-liability company and may be enforced whether or not the limited-liability company assents to the operating agreement.

3. An operating agreement may provide that a certificate of limited-liability company interest issued by the limited-liability company may evidence a member’s interest in a limited-liability company.

4. An operating agreement:

(a) May provide, but is not required to provide:

(1) Rights to any person, including a person who is not a party to the operating agreement, to the extent set forth therein;

(2) For the admission of any person as a member of the company dependent upon any fact or event that may be ascertained outside the articles of organization or the operating agreement, if the manner in which the fact or event may operate on the determination of the person or the admission of the person as a member of the company is set forth in the articles of organization or the operating agreement;

(3) That the personal representative of the last remaining member is obligated to agree in writing to the admission of the personal representative, or its nominee or designee, as a member of the company effective upon the occurrence of the event that terminated the last remaining member’s status as a member of the company;

(4) For the admission of any person as a member of the company upon or after the death, retirement, resignation, expulsion, bankruptcy, dissolution or dissociation of, or any other event affecting, a member or the last remaining member, or after there is no longer a member of the company; or

(5) Any other provision, not inconsistent with law or the articles of organization, which the members elect to set out in the operating agreement for the regulation of the internal affairs of the company.

(b) Must be interpreted and construed to give the maximum effect to the principle of freedom of contract and enforceability.

5. If, and to the extent that, a member or manager or other person has duties to a limited-liability company, to another member or manager, or to another person that is a party to or is otherwise bound by the operating agreement, such duties may be expanded, restricted or eliminated by provisions in the operating agreement, except that an operating agreement may not eliminate the implied contractual covenant of good faith and fair dealing.

6. Unless otherwise provided in an operating agreement, a member, manager or other person is not liable for breach of duties, if any, to a limited-liability company, to any of the members or managers or to another person that is a party to or otherwise bound by the operating agreement for conduct undertaken in the member’s, manager’s or other person’s good faith reliance on the provisions of the operating agreement.

7. An operating agreement may provide for the limitation or elimination of any and all liabilities for breach of contract and breach of duties, if any, of a member, manager or other person to a limited-liability company, to any of the members or managers, or to another person that is a party to or is otherwise bound by the operating agreement. An operating agreement may not limit or eliminate liability for any conduct that constitutes a bad faith violation of the implied contractual covenant of good faith and fair dealing.

8. The Secretary of State may make available a model operating agreement for use by and at the discretion of a limited-liability company according to such terms and limitations as established by the Secretary of State. The use of such an operating agreement does not create a presumption that the contents of the operating agreement are accurate or that the operating agreement is valid.

After Creating Your Nevada LLC Operating Agreement

Once you have finished your operating agreement, you do not need to file it with your state. Keep it for your records and give copies to the members of your LLC.

Following any major company event, such as adding or losing a member, it is a good idea to review and consider updating the operating agreement. Depending on how your operating agreement is written, it may require some or all of the members to approve an amendment to the document.

Get a Free Operating Agreement

Create a free account with our Business Center to access operating agreement templates and dozens of other useful guides and resources for your business.

INSTRUCTIONS: Create your business center account. After logging in, scroll down to "TOOLS" and select "Free Legal Forms".

Frequently Asked Questions

Yes. Although you won’t file this document with the state, having an operating agreement in place is the best way to maintain control of your Nevada LLC in the face of change or chaos.

While it's a good idea to create an operating agreement before filing your Articles of Organization, the state does not discourage LLCs from waiting until the formation process is complete. It's worth noting that some banks require you to submit an operating agreement in order to open a business bank account.

No. Operating agreements are to be retained by the LLC members. There is no need to file your operating agreement with the Nevada Secretary of State.