New Jersey LLC Operating Agreement

Every New Jersey LLC should have an operating agreement in place.

While not legally required by the state, having a written operating agreement will set clear rules and expectations for the management and operations of your LLC.

Download our free New Jersey operating agreement template below or sign up to create a custom operating agreement using our free tool.

Forming an LLC? Get a free operating agreement when you use Northwest to start an LLC for $29 (plus state fees).

Free New Jersey LLC Operating Agreement Templates

We offer operating agreement templates for single-member LLCs and multi-member LLCs (including member-managed and manager-managed) as well as a customizable operating agreement tool.

Single-Member LLC Operating Agreement

Our single-member LLC operating agreement template was created for limited liability companies with only one member, where the sole member has full control over all affairs of the LLC and no other individuals have a membership interest in the company.

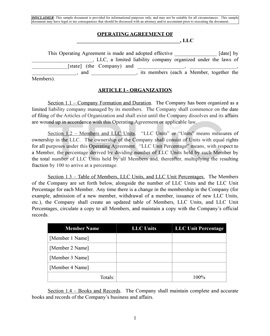

Multi-Member LLC Operating Agreements

Our multi-member LLC templates are meant for LLCs with more than one member. There are two types available: manager-managed and member-managed.

Create Custom Operating Agreement

Create a custom operating agreement using our free tool. Just answer a few basic questions, and the tool will develop an operating agreement for your new LLC.

To use our tool, you will need to sign in to our Business Center. A Business Center account will also grant you access to many other free tools, special discounts on business services, and much more.

What Is a New Jersey LLC Operating Agreement?

Subscribe to our YouTube channel

An operating agreement is a legal document that outlines the ownership structure and operating procedures of an LLC.

Whether you are starting a single-member or multi-member LLC, your operating agreement should address all of the topics below. Some of these stipulations will not have much bearing on the actual operations of a single-member LLC, but are still important to include for the sake of legal formality.

- Organization: When the LLC was officially formed, who its members are, and how ownership is divided. Multi-member LLCs may utilize an equal ownership structure or assign various members different “units” of ownership.

- Management & Voting: Whether the LLC will be managed by its members or by an appointed manager, and how members will go about voting on business matters. Typically, each member has one vote, but you may wish to give some members more voting power than others. For more information on managing your LLC, read our Member-Managed vs Manager-Managed guide.

- Capital Contributions: The amount of money each member has invested in the business. This is also where you should establish an approach to raising additional funds in the future.

- Distributions: How profits and losses will be divided among the members. The most common option is to distribute profits evenly. If you want them divided a different way, this should be detailed in your operating agreement. For more information on the basics of LLC ownership, read our Contributions and Distributions guide.

- Changes to Membership Structure: How roles and ownership will be transferred in the event that a member leaves the company. It’s essential to lay out the process for buying out and/or replacing a member in the LLC’s governing document.

- Dissolution: Dissolution: If at some point all the members of your LLC decide you no longer wish to conduct business, you should officially dissolve it. Outlining the hypothetical process of dissolving your business is an important aspect of your operating agreement. To learn how to dissolve your New Jersey LLC, read our New Jersey LLC Dissolution article.

We reviewed the top LLC formation services. Find which service is right for you.

Ready to Form an LLC?

Get a free operating agreement when you form an LLC with Northwest ($29 plus state fees).

Why Should I Have a New Jersey LLC Operating Agreement?

No matter what type of New Jersey LLC you're starting, you'll want to create an operating agreement. Here's why:

- It’s recommended by the state. According to New Jersey Revised Statutes, Uniform Partnership Act § 42:2C-11, all members of a New Jersey LLC may enter into a written operating agreement to regulate the internal affairs of the company.

- It'll prevent conflict among your business partners. If you're starting a multi-member LLC, having an operating agreement will prevent misunderstandings amongst your team by setting clear expectations about each partner's role and responsibilities.

- It helps preserve your limited liability status. If you're the sole owner of a single-member LLC in New Jersey, having an operating agreement will help to ensure your limited liability status is upheld by court officials, and add to your business's credibility as a whole.

The full text of the statute can be found below:

a. Except as provided in subsections b. and c. of this section, the operating agreement governs:

(1) relations among the members as members and between the members and the limited liability company;

(2) the rights and duties under this act of a person in the capacity of manager;

(3) the activities of the company and the conduct of those activities; and

(4) the means and conditions for amending the operating agreement.

b. To the extent the operating agreement does not otherwise provide for a matter described in subsection a. of this section, this act governs the matter.

c. An operating agreement may not:

(1) vary a limited liability company's capacity under section 5 of this act to sue and be sued in its own name;

(2) vary the law applicable under section 6 of this act;

(3) vary the power of the court under section 21 of this act;

(4) subject to subsections d. through g. of this section, eliminate the duty of loyalty, the duty of care, or any other fiduciary duty;

(5) subject to subsections d. through g. of this section, eliminate the contractual obligation of good faith and fair dealing under subsection d. of section 39 of this act;

(6) unreasonably restrict the duties and rights stated in section 40 of this act;

(7) vary the power of a court to decree dissolution in the circumstances specified in paragraphs (4) and (5) of subsection a. of section 48 of this act;

(8) vary the requirement to wind up a limited liability company's business as specified in subsection a. and paragraph (1) of subsection b. of section 49 of this act;

(9) unreasonably restrict the right of a member to maintain an action under Article 9 (sections 67 through 72 of this act);

(10) restrict the right to approve a merger, conversion, or domestication under section 86 of this act to a member that will have personal liability with respect to a surviving, converted, or domesticated organization; or

(11) except as otherwise provided in subsection b. of section 13 of this act, restrict the rights under this act of a person other than a member or manager.

d. If not manifestly unreasonable, the operating agreement may:

(1) restrict or eliminate the duty:

(a) as required in paragraph (1) of subsection b. and subsection i. of section 39 of this act, to account to the limited liability company and to hold as trustee for it any property, profit, or benefit derived by the member in the conduct or winding up of the company's business, from a use by the member of the company's property, or from the appropriation of a limited liability company opportunity;

(b) as required in paragraph (2) of subsection b. and subsection i. of section 39 of this act, to refrain from dealing with the company in the conduct or winding up of the company's business as or on behalf of a party having an interest adverse to the company; and

(c) as required by paragraph (3) of subsection b. and subsection i. of section 39 of this act, to refrain from competing with the company in the conduct of the company's business before the dissolution of the company;

(2) identify specific types or categories of activities that do not violate the duty of loyalty;

(3) alter the duty of care, except to authorize intentional misconduct or knowing violation of law;

(4) alter any other fiduciary duty, including eliminating particular aspects of that duty; and

(5) prescribe the standards by which to measure the performance of the contractual obligation of good faith and fair dealing under subsection d. and subsection i. of section 39 of this act.

e. The operating agreement may specify the method by which a specific act or transaction that would otherwise violate the duty of loyalty may be authorized or ratified by one or more disinterested and independent persons after full disclosure of all material facts.

f. To the extent the operating agreement of a member-managed limited liability company expressly relieves a member of a responsibility that the member would otherwise have under this act and imposes the responsibility on one or more other members, the operating agreement may, to the benefit of the member that the operating agreement relieves of the responsibility, also eliminate or limit any fiduciary duty that would have pertained to the responsibility.

g. The operating agreement may alter or eliminate the indemnification for a member or manager provided by section 38 of this act and may eliminate or limit a member's or manager's liability to the limited liability company and members for money damages, except for:

(1) breach of the duty of loyalty;

(2) a financial benefit received by the member or manager to which the member or manager is not entitled;

(3) a breach of a duty under section 36 of this act;

(4) intentional infliction of harm on the company or a member; or

(5) an intentional violation of criminal law.

h. The court shall decide any claim under subsection d. of this section that a term of an operating agreement is manifestly unreasonable. The court:

(1) shall make its determination as of the time the challenged term became part of the operating agreement and by considering only circumstances existing at that time; and

(2) may invalidate the term only if, in light of the purposes and activities of the limited liability company, it is readily apparent that:

(a) the objective of the term is unreasonable; or

(b) the term is an unreasonable means to achieve the provision's objective.

i. This act is to be liberally construed to give the maximum effect to the principle of freedom of contract and to the enforceability of operating agreements.

After Creating Your New Jersey LLC Operating Agreement

Once you have finished your operating agreement, you do not need to file it with your state. Keep it for your records and give copies to the members of your LLC.

Following any major company event, such as adding or losing a member, it is a good idea to review and consider updating the operating agreement. Depending on how your operating agreement is written, it may require some or all of the members to approve an amendment to the document.

Get a Free Operating Agreement

Create a free account with our Business Center to access operating agreement templates and dozens of other useful guides and resources for your business.

INSTRUCTIONS: Create your business center account. After logging in, scroll down to "TOOLS" and select "Free Legal Forms".

Frequently Asked Questions

Yes. Although you won’t file this document with the state, having an operating agreement in place is the best way to maintain control of your New Jersey LLC in the face of change or chaos.

While it's a good idea to create an operating agreement before filing your Business Registration Application, the state does not discourage LLCs from waiting until the formation process is complete. It's worth noting that some banks require you to submit an operating agreement in order to open a business bank account.

No. Operating agreements are to be retained by the LLC members. There is no need to file your operating agreement with the Department of Treasury.