How to Start an LLC in Hawaii (2024 Guide)

Wondering how to start an LLC in Hawaii? We’ve got you covered.

To get started, you'll need to pick a suitable business name, choose a registered agent, and file your Articles of Organization with the Department of Commerce and Consumer Affairs ($51 processing fee).

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized Hawaii LLC formation service (recommended).

How to Form an LLC in Hawaii in 6 Steps

In order to form your LLC in Hawaii, there are certain steps you’ll need to complete:

- Name Your LLC in Hawaii

- Choose a Registered Agent

- File the Articles of Organization

- Create an LLC Operating Agreement

- Get an EIN

- File a Beneficial Ownership Information Report

Step 1: Name Your Hawaii LLC

Before you get started, you will need to pick a suitable name for your Hawaii LLC.

This will need to comply with all applicable naming requirements under Hawaii law and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. Important Naming Guidelines for Hawaii LLCs:

- Your name must contain the words “limited liability company” or the abbreviations “LLC” or “L.L.C.”

- Your name cannot be “substantially identical” with any other name registered with the Hawaii Business Registration Division.

- Your name cannot include certain words without prior authorization and/or licensing (e.g., bank, olympiad, CPA, etc.).

- Your name cannot state or imply that your LLC is connected with a government agency unless this has been permitted in advance.

We recommend checking out Hawaii's official naming guidelines for a complete list of naming rules in the state.

2. Is the name available in Hawaii?

If you’re interested in checking whether your desired name has already been taken by another business entity in Hawaii, you can perform a business name search on the Secretary of State’s website.

Keep in mind that, if you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 120 days. This can be done online through the Hawaii Business Express website, and includes a $10 processing fee.

For more information, you can have a look at our Hawaii LLC Name Search guide.

3. Is the URL available?

You should check online to see if your business name is available as a web domain. Even if you don’t plan to make a business website right away, this is an extremely important step as it will prevent others from acquiring it, potentially saving you both time and money in the long term.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

Subscribe to our YouTube channel

If you need additional information before getting started, you can have a look at our in-depth comparison of the Best LLC Services in 2024 instead.

FAQ: Naming a Hawaii LLC

LLC is short for "limited liability company". It is a simple business structure that offers more flexibility than a traditional corporation while still providing legal protection for your personal assets. Read What is a Limited Liability Company for more information.

Or, watch our two-minute video: What is an LLC?

You must follow the Hawaii LLC naming guidelines when choosing a name for your LLC:

- Include the phrase "limited liability company" or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble coming up with a name for your LLC use our LLC Name Generator. That will not only find a unique name for your business but an available URL to match.

Most LLCs do not need a trade name or DBA. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

Step 2: Choose a Registered Agent in Hawaii

After you find the right name for your LLC, you will need to nominate a Hawaii registered agent. This is a necessary step in your Articles of Organization (i.e., the document used to file and register your LLC with the Hawaii Department of Commerce and Consumer Affairs).

What is a registered agent? A registered agent is an individual or business entity responsible for receiving important legal documents on behalf of your business. You can think of your registered agent as your business’s primary point of contact with the state.

Who can be a registered agent? A registered agent must be a resident of Hawaii or a business entity (i.e., a commercial registered agent) that has the authority to conduct business in the state. Examples of registered agent options include registered agent services, LLC members, and business attorneys.

Note: Keep in mind that a Commercial Registered Agent Listing Statement (Form X-11) will need to be submitted to the State of Hawaii’s Business Registration Division if you plan to use a commercial agent. The filing fee for this is $100.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes.

You can choose to act as your own registered agent (as long as you are a resident of Hawaii), appoint a member of your LLC, work with a business attorney, or hire a professional registered agent service (recommended).

For more information, you can have a look at our What is a Registered Agent article.

Using a professional registered agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages of using a professional service significantly outweigh the small annual costs.

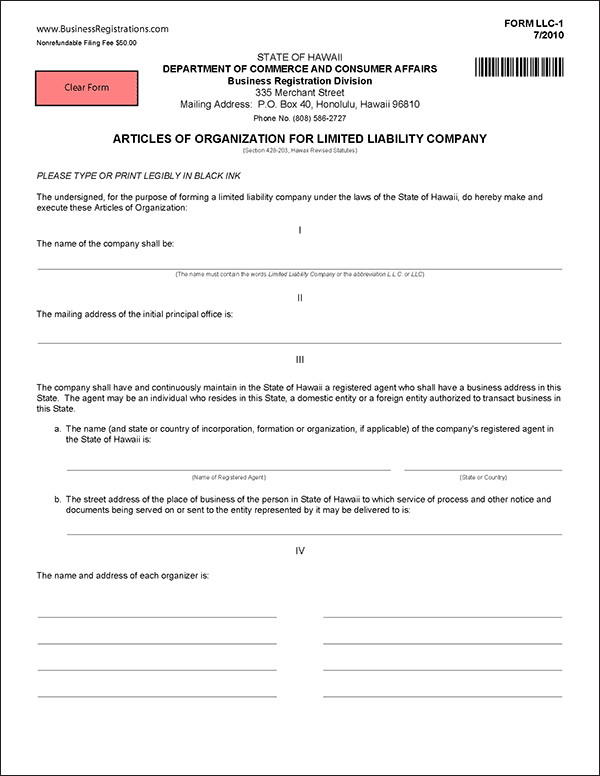

Step 3: File the Hawaii LLC Articles of Organization

To register your Hawaii LLC, you will need to file Form LLC-1: Articles of Organization with the Department of Commerce and Consumer Affairs. You can do this online, by mail, by fax, by email, or in person.

Before getting started, we recommend ensuring that you have the following information on hand:

- Your LLC’s finalized name and principal office address (cannot be a P.O. box)

- Your registered agent’s name and street address

- The names and addresses of your LLC’s organizers and members

- Your LLC’s duration period (can be at-will or have a specified termination date)

- Your LLC’s management structure

Keep in mind that this will need to be signed and certified by at least one LLC organizer.

File the Hawaii LLC Articles of Organization

OPTION 1: File Online With Hawaii Business Express

File Online- OR -

OPTION 2: File Form LLC-1 by Mail, by Fax, by Email, or in Person

Download FormState Filing Cost: $50, payable to the State of Hawaii (Nonrefundable) plus $1 State Archive Fee (May be refundable)

Mailing Address:

Department of Commerce and Consumer Affairs

Business Registration Division

335 Merchant St.

P.O. Box 40

Honolulu, HI 96810

Office Address:

335 Merchant St.

Room 201

Honolulu, HI 96813

Fax: (808) 586-2733

Email: breg-doci-filing@dcca.hawaii.gov

For help with completing the form, visit our Hawaii Articles of Organization guide.

Note: If you're expanding your existing business to the state of Hawaii, you'll need to register as a foreign limited liability company (LLC).

FAQ: Filing Hawaii LLC Documents

According to the Hawaii Secretary of State’s website, processing times are generally between three and five business days.

Keep in mind that an expedited filing option (24 hours) is available for an additional fee of $25.

An LLC is referred to as a "domestic LLC" when it conducts business in the state where it was formed. A foreign limited liability company must be formed when an existing LLC wishes to expand its business to another state.

Read our What Is a Foreign LLC article to learn more.

The minimum cost to start a Hawaii LLC is $50 for filing your Articles of Organization with the Hawaii Business Registration Division, plus a $1 state archives preservation fee.

Having said that, your total cost may be higher depending on how you go about filing.

To learn more, read our guide on the cost to form a Hawaii LLC.

Step 4: Create a Hawaii LLC Operating Agreement

When creating an LLC in Hawaii, LLCs are not required to have an operating agreement, but it's a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

For more information on operating agreements, read our Hawaii LLC operating agreement guide.

FAQ: Creating a Hawaii LLC Operating Agreement

No. The operating agreement is an internal document that you should keep on file for future reference. However, many other states do legally require LLCs to have an operating agreement in place.

Step 5: Get an EIN for Your Hawaii LLC

You can get an Employer Identification Number (EIN) from the IRS for free. It is used to identify a business entity and keep track of a business’s tax reporting. It is essentially a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

- OR -

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

A Social Security number is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your application. Learn more here about applying as an international applicant.

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Step 6: File a Beneficial Ownership Information Report

Beginning January 2024, LLC owners will need to file a Beneficial Ownership Information (BOI) Report with the US Financial Crimes Enforcement Network (FinCEN). Existing LLCs can file their report any time between January 1, 2024, and January 1, 2025, while new LLCs will need to file their report within 90 days of formation.

This contains similar information to that of your Articles of Organization, such as your LLC name and member information, and can be filed online for free. Failure to file an accurate report on time can result in a $500 per day fine.

Note: There are certain filing exemptions, such as for large companies (i.e., more than 20 full-time employees), tax-exempt entities, and publicly traded companies.

Considering Using an LLC Formation Service?

We reviewed and ranked the top LLC formation services. Find out which is best for you.

BEST LLC SERVICESMaintain Your Hawaii LLC

After you’ve successfully formed your LLC, there are a couple of steps you’ll need to periodically take in order to maintain it, including:

- Submitting an annual report

- Sorting out your taxes

Submit an Annual Report

Your Hawaii LLC will be required to file an annual report with the Department of Commerce each year in order to keep the state’s records on your business up to date.

This can be done online, by mail, by fax, by email, or in person along with a fee of either $15 (for hard copy filings) or $20 (for online filings).

The due date for your annual report will depend on the quarter in which it was registered. If your formation date is:

- Between January 1 and March 31, your filing due date is March 31

- Between April 1 and June 30, your filing due date is June 30

- Between July 1 and September 30, your filing due date is September 30

- Between October 1 and December 31, your filing due date is December 31

Note: Your LLC will need to pay a $10 penalty fee if it misses its filing deadline, and can even face administrative dissolution (after two years).

Sort Out Your Taxes

Regardless of where your LLC is registered, you will be required to pay certain federal taxes. This includes corporation and employer taxes (for LLCs filing as a C corporation) and federal income tax and self-employment taxes (for LLCs taxed as pass-through entities).

In addition, there are a number of different taxes you’ll be required to pay at a local and state level, which can vary depending on the nature of your business.

Below are some of the most common taxes in Hawaii:

Income Taxes

In addition to your federal tax obligations, your Hawaii LLC will be required to pay certain state income taxes on the revenue it generates. There are two key state income taxes to be aware of in particular:

- Personal Income Tax: In Hawaii, this tax is set at a gradual rate that ranges between 1.4% and 11% depending on a taxable entity’s income. You can find out the rate at which you’ll need to pay this tax using the Hawaii Department of Taxation’s Individual Tax Tables.

- Corporate Income Tax: This tax is levied at a gradual rate varying between 4.4% and 6.4% on the adjusted net income of any LLCs structured as C corps.

You can pay and file returns for both of these state income taxes free of charge using the Hawaii Tax Online (HTO) system.

General Excise Tax

Instead of a statewide sales tax, Hawaii charges a General Excise Tax (GET) on the gross income of businesses operating within the state. GET is set at a statewide rate of 4.00%, though additional surcharges can bring this up to as much as 4.50%.

Depending on how much your LLC owes, it will need to file a GET tax return on a monthly, quarterly, semi-annual, or annual basis. Except for annual filers, who must submit their return by the 20th day of the fourth month after the close of a taxable year, the due date for GET is the 20th day of the month after a filing period (e.g., a month or quarter).

Note: Your LLC will need to obtain a GET license in order to be able to pay this tax, which can be done through the Hawaii Tax Online system by completing the Hawaii Basic Business Application (Form BB-1) and paying a one-time registration fee of $20.

Steps After LLC Formation

After forming your LLC, you will need to get a business bank account and website, sort all required business licensing, and get business insurance, among other things.

Visit our After Forming an LLC guide to learn more.