Furniture Store Insurance

Getting insurance for your furniture store is essential.

To protect themselves from financial hazards inherent in running a business, furniture stores typically require protection. Insurance can protect them from a range of liabilities for things like property damage, bodily injury, and breaches of contract.

For example, a customer could slip and fall in your store, or a furniture manufacturer could sue your company for breach of contract.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Furniture Store

General liability insurance is — generally speaking — one of the most important insurance policies for furniture stores.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance covers many risks, there are some risks it doesn’t cover that your furniture store could face. As a result, consider purchasing specialized policies like:

- Commercial property coverage: This protects the company's physical assets, such as buildings, equipment, and inventory, from damage or loss due to theft, fire, or other covered events.

- Professional liability insurance: This protects a business against claims of negligence, errors, or omissions in providing services. It can cover legal fees and damages if the company is sued for failing to meet professional standards.

- Directors and officers (D&O) insurance: This protects a business’s directors and officers from lawsuits pertaining to actions taken or decisions made while performing their official duties.

When acquiring your business coverage, you will generally be able to choose between the following two types of insurers:

- Traditional brick and mortar insurers: Traditional insurers, like Allstate, use insurance agents to sell policies out of physical offices.

- Online insurers: Online insurers like Corvus and Next use AI and machine learning algorithms to underwrite policies, which is a cheaper process. As a result, they often charge less and can be more flexible. We recommend online insurers for most small businesses.

Let's Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

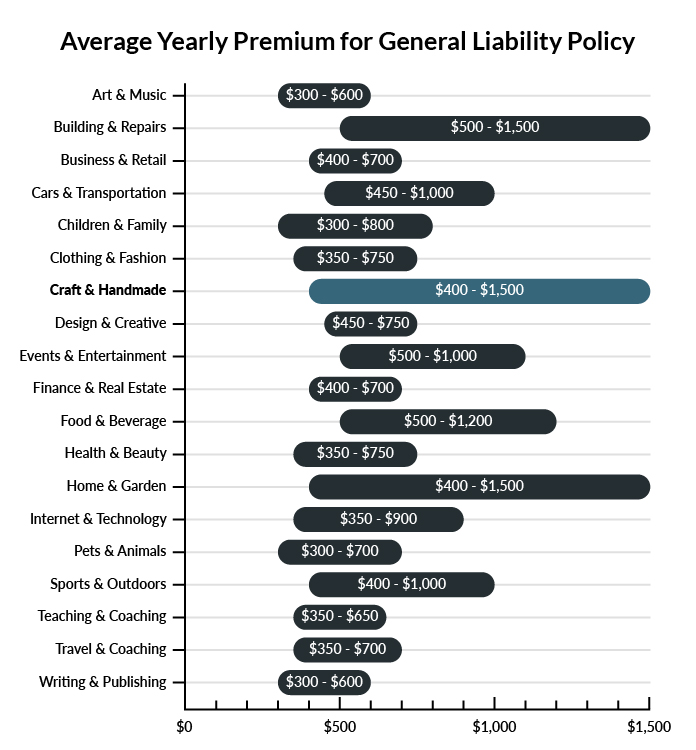

The average furniture store in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a furniture store to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Furniture Store

Example 1: One of your employees is bringing in a new load of sofas to the showroom floor when he loses control of the dolly and hits a customer in the back. The customer falls forward, breaking her wrist. She demands that your business pay for her medical treatment. Your general liability insurance will likely cover this expense.

Example 2: The child of a customer is playing with her brother on the bunk beds in your store when she falls to the floor. She breaks her leg, requiring medical attention. The father of the girl sues your business for damages. Your general liability insurance policy would pay for your legal defense, including the cost of a settlement if you settle out of court.

Example 3: The owner of a competing furniture store accuses you of slander and hires an attorney to file a lawsuit. While you disagree that you have slandered his business, you know that you need to hire an attorney to protect your business from the lawsuit. Your general liability insurance will pay for your legal fees when defending yourself against charges of slander, libel, and more. It will also pay for a settlement if one is necessary.

Other Types of Coverage Furniture Stores Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

There is always the possibility that one of your employees will sustain an injury from a work-related task. If this happens, your workers’ comp policy will pay for medical treatment for those work-related injuries. It will also pay for some of the lost wages the employee suffers if they cannot work while they are recovering. Most states require workers’ comp for employers, so carrying a policy not only protects your employees, but it also ensures that you meet the legal requirements of your state.

Commercial Property Insurance

Your furniture inventory is the foundation of your business. If you were to lose a major portion of your inventory, or all of it, you might have a difficult time paying to have it replaced. Unexpected events like fires or major storms can occur and cause extensive damage. With commercial property insurance, you can get money from your insurer to replace inventory and other commercial property that was destroyed by a covered event like a fire.

Commercial Umbrella Insurance

If you are in a situation where your general liability policy limits are exceeded, such as if you lose a lawsuit and are required to pay extensive damages, an umbrella policy would provide additional protection. Without an umbrella policy, your business would be on the hook to pay damages that exceeded those paid by your general liability insurance. But with an umbrella policy, the extra policy would kick in when the general liability insurance limits are reached so you would not have to cover the excess damages out of pocket.

Commercial Auto Insurance

Commercial auto insurance is required for any automobile you use primarily for business. For instance, if you have a delivery vehicle for furniture, you should carry commercial auto. Your policy will cover damages if your vehicle is involved in an accident. If your driver caused the accident, your policy will pay for the damages to the other vehicles and for medical care for the injured. Your state likely requires that you carry commercial auto insurance if you have a vehicle for work.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your furniture store:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Furniture Store Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

"Business insurance" is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, business insurance should be purchased before accepting orders for your furniture store. If you don’t have coverage from the start, your business is at financial risk.

Some types of insurance, such as workers’ compensation and commercial auto, are required by law. Check your local laws and regulations to see about the rules where you operate.

Not necessarily. Certain exceptions may be written directly into your furniture store insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.