Mobile Bartending Business Insurance

Every mobile bartending business needs insurance. Knowing which type of insurance you need and the best place to get it is the next step.

This article will cover the main types of business insurance and help you find the best mobile bartending business insurance.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Mobile Bartending Business

The most common and comprehensive type of mobile bartending business insurance is general liability insurance. We recommend general liability insurance as your first line of defense against a variety of the most general and commonly occurring claims.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While a mobile bartending business isn’t legally required to carry general liability insurance, operating without it is extremely risky. If your mobile bartending business is sued, you could face fees totaling hundreds of thousands of dollars (or more).

Let's Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

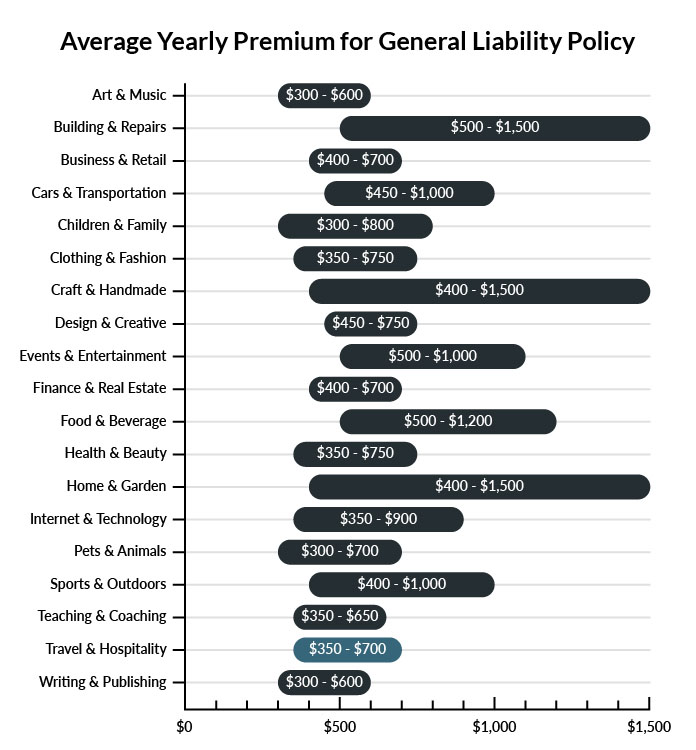

The average mobile bartender in America spends between $350-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a mobile bartending business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Common Situations That General Liability Insurance May Cover for a Mobile Bartending Business

Example 1: While bartending an event, a guest was served two shots of tequila and three beers. While leaving the party, he runs off the road, hitting a parked car and a street sign in the process. The driver was seriously injured, resulting in over $60,000 in medical costs, $4,000 damage to his vehicle, and $2,000 to the city’s street sign. While each state has its own rules regarding what type of policy would cover this loss, they all agree on one detail; a general liability policy must be in place for any coverage to kick in.

Example 2: The host of an event has asked you to provide a specialty drink for each guest to try. The cocktail is made with lemon zest. Unaware of its contents, one guest drinks several sips before realizing it contains lemon, which she is highly allergic to. She is rushed to the hospital, where she is treated for anaphylactic shock. General Liability insurance would your legal costs in the matter.

Example 3: A museum is hosting a fundraising event and they have hired your company to serve wine and beer to its guests. Upon leaving the party, a guest runs off the road and hits a city worker who was picking up trash on the side of the road. His family sues for medical expenses, pain, and suffering. While additional policies may apply, your business must carry General Liability coverage to assist in paying for this loss.

Other Types of Coverage Mobile Bartending Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

Since you will be driving your bar on public roadways, you are mandated by the state to carry a commercial auto policy. Auto insurance protects not only your vehicle but any liability you may have in an accident. Your personal car insurance will not cover you if you are driving the tow truck, even if you are off duty.

Liquor Liability Insurance

Also known as dram shop insurance, liquor liability coverage is necessary for anyone in the business of selling and/or serving alcohol. It covers medical payments, court settlements, and legal fees associated with the incident. To purchase this policy, you must have a General Liability policy as underlying coverage.

Workers' Compensation Insurance

If your towing company has any employees (full-time or part-time), you are legally required to carry workers’ compensation insurance. This type of coverage will help compensate your employees in the case that they get injured on the job.

Business Interruption Insurance

In the event of a fire, flood, or other catastrophes, there is a good chance your business operations will be halted for some time. Business interruption coverage is designed to help you recoup a portion of the revenue your business would lose due to the inability to operate.

This type of insurance is typically included in a business owner’s policy.

Commercial Umbrella Insurance

Umbrella coverage allows you to extend above and beyond the standard limits of your other business insurance policies. If you are faced with a large lawsuit or other claim situation, there’s a possibility that the coverage limits of your standard policies will be insufficient. In this case, your umbrella policy will allow you to surpass these limits.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your mobile bartending business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Mobile Bartending Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

"Business insurance" is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

You should invest in business insurance coverage for your business before your first interaction with a customer. Although the cost of insurance may seem high for a brand new business, it’s best to be proactive when it comes to protecting your assets. After all, you can’t buy insurance to cover a loss that has already occurred.

Not necessarily. Certain exceptions may be written directly into your mobile bartending business insurance policy, and some perils may be entirely uninsurable.

A general liability insurance policy covers only liability losses. A business owner's policy covers both liability and property losses.

The best general liability coverage for your business really depends on the amount of coverage you’re comfortable with and how often you expect to file a claim. A relatively safe business with a very low risk of accident or legal liability could opt for lower premiums with higher deductibles.

However, if you are in an accident or injury-prone industry or are making advertising claims about the effectiveness of your service or product, you may wish to consider more extensive coverage. We recommend using a digital insurance provider like Next Insurance.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.