Pool Service Insurance

Getting insurance for your pool service is essential.

Pool services need to be protected against claims arising from things like hour and wage disputes, breaches of contract, and negligence.

For example, your business does not satisfy the duties it owes a customer under contract, or an employee damages a customer’s pool during a cleaning job.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Pool Service

General liability insurance is — generally speaking — one of the most important insurance policies for pool services.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

With that being said, if you want more comprehensive protection for your pool service, it would be worth looking into some of the following policies:

- Commercial auto insurance: A legally required policy for any vehicles used on public roads for primarily commercial purposes.

- Professional liability insurance: A great option to protect your business from lawsuits arising due to negligence or errors and omissions in the provision of your pool services.

- Workers’ compensation insurance: Offers workers financial support for their medical costs and lost wages if they have suffered an injury or illness related to work.

While deciding where to purchase your pool service’s coverage, it is key to bear in mind the differences between the two main types of insurance providers:

- Traditional brick-and-mortar insurers — Primarily operate out of a physical storefront, such as Nationwide or Hiscox.

- Online insurers — Primarily operate online and make use of AI instead of insurance agents, such as Tivly and Next.

Let's Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

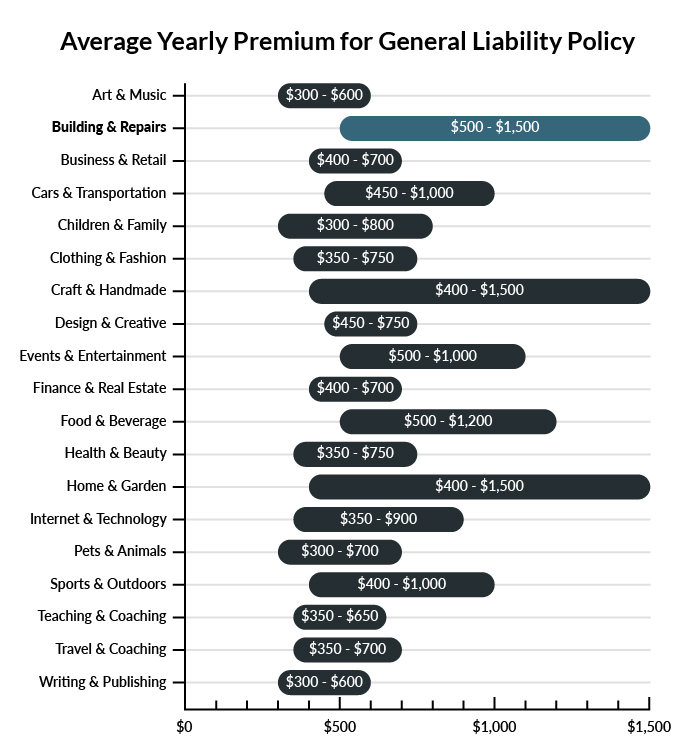

The average pool service company in America spends between $500-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a pool service to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Provided by

Common Situations That General Liability Insurance May Cover for a Pool Service

Example 1: An employee is smoking during work and accidentally lights a client’s pool shed on fire, destroying a large amount of pool equipment and machinery. If found liable, your business could probably rely on general liability insurance to help cover damages owed as mandated by the court or any settlement reached with the client.

Example 2: A new employee is alone on a maintenance job and encounters a pool pump that he doesn't fully understand. He fiddles with it and causes a leak, which later results in the client slipping and falling. If the client were seriously injured, general liability insurance could probably help your business cover the resulting damages, assuming you were found liable.

Example 3: Your employees accidentally cause a pool to overflow, leading to a sizeable flood that leaks into the neighbor’s yard and ruins his extensive garden and backyard with oversaturation and chlorine content. If found liable, your company could probably expect coverage through a general liability insurance policy for damages owed to the neighbor.

Other Types of Coverage Pool Services Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Auto Insurance

This is a business that will without a doubt require vehicles to transport its equipment and personnel to client locations. All vehicles intended for use on public roads must be insured, either personally or commercially. Get your vehicles covered with commercial auto insurance to help cover damages sustained in the event of a car accident. Depending on the success of your business, your vehicles may see quite a bit of use, making this a policy you simply should not leave home without.

Professional Liability Insurance

This policy helps to cover businesses that provide professional services with potentially significant consequences. It also covers businesses that give advice or otherwise inform clients in a professional capacity. If your pool service company fails to perform to the client’s standards or provides pool maintenance advice that is ultimately damaging to the pool in a serious way, this policy can cover your losses and minimize the damage of lawsuits.

Workers' Compensation Insurance

Unless you prefer to service client pools solo, your company will employ workers, which will legally require you to have workers’ compensation insurance. So unless you’re working exclusively with independent contractors, this policy is a must-have. Compensation policies cover your employees in the event that they are injured on the job. Medical expenses, as well as disability and death benefits, are provided through this insurance.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your pool service:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Pool Service Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

"Business insurance" is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Proactively obtaining business insurance for your pool service before it gets up and running is essential to limit the potential financial losses it could suffer.

Moreover, this business is involved in a very risky industry with many liabilities. If one of these were to be realized and your business was unprotected, it could spell disaster.

Not necessarily. Certain exceptions may be written directly into your pool service insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.