Screen Repair Business Insurance

Every screen repair business needs insurance. Knowing which type of insurance you need and the best place to get it is the next step.

This article will cover the main types of business insurance and help you find the best screen repair business insurance.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Screen Repair Business

The most common and comprehensive type of screen repair business insurance is general liability insurance. We recommend general liability insurance as your first line of defense against a variety of the most general and commonly occurring claims.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While a screen repair business isn’t legally required to carry general liability insurance, operating without it is extremely risky. If your screen repair business is sued, you could face fees totaling hundreds of thousands of dollars (or more).

Let's Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

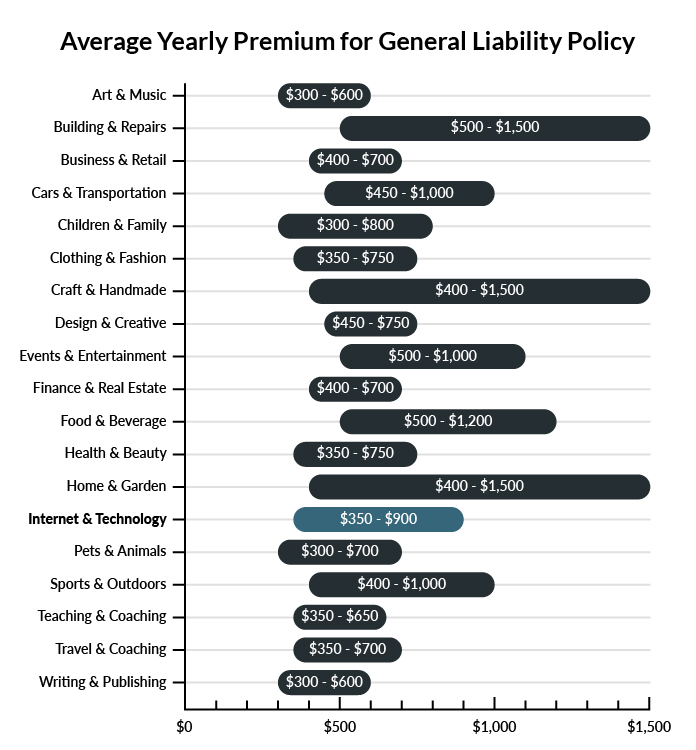

On average, screen repair businesses in America spend between $350 - $900 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a screen repair business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our low-cost business insurance review.

Common Situations That General Liability Insurance May Cover for a Screen Repair Business

Example 1: You fail to see a client behind you while repairing a screen and knock him over as you back up. He breaks his arm and demands that you pay for his medical treatment. Your general liability insurance policy will likely pay for his treatment if you file a claim.

Example 2: A competing screen repair business has filed a libel lawsuit against your business. Your general liability insurance policy will cover the legal defense costs when you face libel accusations. It will also pay for your attorney and for a settlement if you need one.

Example 3: Your employee is rounding a corner when he runs into her and she falls down, breaking her tailbone. She sues your business for damages. Your general liability insurance policy will pay your legal defense fees, including the cost of hiring a lawyer.

Other Types of Coverage Screen Repair Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

You do the best work you can when repairing screens. Yet you know that there is always the possibility that a customer could claim you made a mistake and sue you over that mistake. Professional liability insurance will pay for your legal costs in such circumstances. It will pay for your attorney and for a settlement if one is necessary.

Commercial Property Insurance

You have invested a lot of capital in the equipment, supplies, inventory, and other items you use to run your screen repair business. If you were to lose that property in an unexpected event like a fire, it would be difficult to replace. However, if you have commercial property insurance, you can file a claim and get help buying replacements.

Workers’ Compensation Insurance

If you have employees who work for you at your screen repair business, you are likely required by state law to carry workers’ comp insurance. Your policy will pay for treating injuries employees sustain performing their job-related duties. It will also help pay for their lost wages while they are away from work to recover.

Commercial Umbrella Insurance

An umbrella policy picks up where your general liability insurance policy leaves off. It will start paying when you exceed the limits of your general liability insurance policy—which can happen if you lose a big lawsuit. It will continue to pay the remaining damages until you reach the limits of the policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your screen repair business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Screen Repair Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

"Business insurance" is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

You should invest in business insurance coverage for your business before your first interaction with a customer. Although the cost of insurance may seem high for a brand new business, it’s best to be proactive when it comes to protecting your assets. After all, you can’t buy insurance to cover a loss that has already occurred.

Not necessarily. Certain exceptions may be written directly into your screen repair business insurance policy, and some perils may be entirely uninsurable.

A general liability insurance policy covers only liability losses. A business owner's policy covers both liability and property losses.

The best general liability coverage for your business really depends on the amount of coverage you’re comfortable with and how often you expect to file a claim. A relatively safe business with a very low risk of accident or legal liability could opt for lower premiums with higher deductibles.

However, if you are in an accident or injury-prone industry or are making advertising claims about the effectiveness of your service or product, you may wish to consider more extensive coverage. We recommend using a digital insurance provider like Next Insurance.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.