Indoor Trampoline Park Business Insurance

Getting insurance for your indoor trampoline park business is essential.

Indoor trampoline park businesses need to be protected against a variety of different risks, such as those that relate to bodily injuries and property damage.

For example, if a visitor accidentally falls off a trampoline and injures their neck, or a group of visitors damages a trampoline by being too rowdy.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for an Indoor Trampoline Park Business

General liability insurance is — generally speaking — one of the most important insurance policies for indoor trampoline park businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Having said that, you should keep in mind that not all trampoline parks will be holistically covered with a simple general liability policy.

Consequently, you may be required to purchase additional coverage depending on your unique risks:

- Damage to a trampoline: Commercial property coverage

- Employee-related disputes: Workers’ compensation coverage

- Lost income as a result of shutting down: Business income insurance

You will also want to decide what type of insurer you will purchase your coverage from. There are two options available as of 2024:

- Brick and mortar insurers (e.g., Nationwide, etc.).

- Online insurers (e.g., Next Insurance, Tivly, etc.).

All in all, we recommend going for an online insurer as a small business owner due to the fact it’s the most affordable option. This is because online insurers have significantly lower overheads.

Let's Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

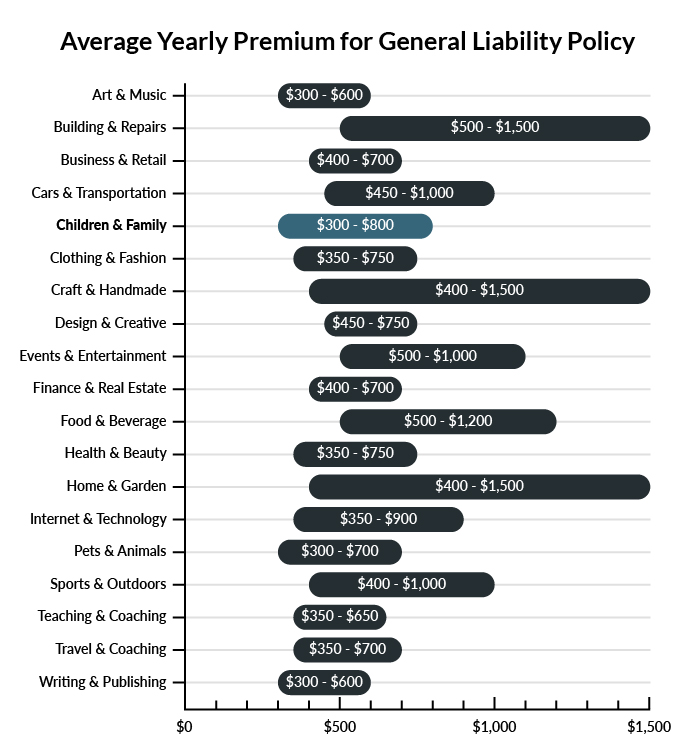

The average trampoline park in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a indoor trampoline park business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our affordable business insurance review.

Provided by

Common Situations That General Liability Insurance May Cover for a Indoor Trampoline Park Business

Example 1: The risk of your patrons colliding with another person on a trampoline or landing improperly while doing stunts on a trampoline is very high. If one or more customers become injured at the park and you are found to be negligent, general liability insurance will likely cover any damages.

Example 2: A child is running to keep up with their friends during a birthday party at the trampoline park and trips over a vacuum cord that is being used by an employee. If your business is sued to help pay for medical costs, general liability coverage will likely pay for damages.

Example 3: Your trampolines were checked and serviced last week, but a visitor has just started jumping in a section where a spring came loose, and they’ve fallen through a hole, injuring their leg. Even though you’ve been keeping up with maintenance, you are found liable for their injuries. General liability will protect your business in the event that you are involved in a lawsuit.

Other Types of Coverage Indoor Trampoline Park Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

Your employees will work in an environment where they are at risk of becoming injured on the job. With workers’ compensation coverage, you can provide peace of mind for your employees with insurance that will help to cover medical costs and lost wages in the event that they are injured or become ill on the job.

Commercial Property Insurance

If you own the building that your trampoline park is located in, investing in commercial property coverage is a must. This type of insurance protects the building and covers any business-related items that are stored in the building in the event of an accident, natural disaster, theft, or vandalism

Commercial Umbrella Liability Insurance

Even if you require visitors to your trampoline park to sign waivers, your business still has a responsibility to do everything you can to prevent injuries. If you are found liable for an accident at your park, the costs of a lawsuit can easily surpass the limits of your primary policies. Commercial umbrella liability insurance is designed to go above and beyond those limits to protect your business.

Data Breach Insurance

If you offer a loyalty program as an incentive for your customers, you are likely storing personal information such as addresses, phone numbers, and credit cards in your computer system. Data breach insurance will step in to protect your business and cover damages in the event that your system is compromised and sensitive customer information is stolen.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your indoor trampoline park business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Indoor Trampoline Park Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

"Business insurance" is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes you do. Even though this isn’t a legal requirement, purchasing the right business insurance policies (e.g., general liability insurance, workers’ compensation, etc.) before you start will ensure that you are covered before you begin interacting with clients and/or employees.

This can end up saving you thousands of dollars in the long term.

Not necessarily. Certain exceptions may be written directly into your indoor trampoline park business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.