How to Start an LLC in California (2024 Guide)

Wondering how to start an LLC in California? We’ve got you covered.

To get started, you'll need to pick a suitable business name, choose a registered agent, and file your Articles of Organization and Initial Statement of Information with the California Secretary of State (which can cost between $90 and $120 in processing fees).

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized California LLC formation service (recommended).

How to Form an LLC in California in 7 Steps

In order to form your LLC in California, there are certain steps you’ll need to complete:

- Name Your LLC

- Choose a California Agent for Service of Process

- File Your Articles of Organization

- Create an LLC Operating Agreement

- Obtain an EIN

- File Your Initial Statement of Information

- File a Beneficial Ownership Information Report

Step 1: Name Your California LLC

Before you get started, you will need to pick a suitable name for your California LLC.

This will need to comply with all applicable California naming requirements and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. Important Naming Guidelines for California LLCs:

- Your name must include the phrase “Limited Liability Company or the abbreviations “LLC” or “L.L.C.” The words “Limited” and “Company” may be abbreviated to “Ltd.” and “Co.”

- Your name must be considered distinguishable from other entities in California. Differences in business identifier (e.g., Inc., LLC, etc.), uppercase and/or lowercase letters, spacing (if the meaning of the word doesn’t change), or using an ampersand instead of “and” do not make a name distinguishable.

- Your name cannot include words that create a false implication of government affiliation. Examples of such words include abbreviations of cities, counties, or states, as well as words used to identify government organizations (e.g., Department, Commission, Division, etc.).

- Your name cannot include words that create a false implication of your business’s purpose. For example, the words “insurance” or “surety” cannot be included unless you’re an insurance company that will be subject to the California Insurance Code (Section 17701.08(e)).

We recommend checking out the California Code of Regulations for a complete list of naming rules in this state.

2. Is the name available in California?

To check whether your desired name has already been taken by another business entity in California, you can perform a Business Name Search on the State of California’s website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 60 days.

For more information, you can have a look at our California LLC Name Search guide.

3. Is the URL available?

It's a good idea to check if your business name is available as a web domain. Even if you don't plan to make a business website right away, as this is an extremely important step that can help prevent others from acquiring it, potentially saving you both time and money in the long term.

Once you have verified your name is available, you can select a professional service to complete the California LLC formation process.

Subscribe to our YouTube channel

We reviewed and ranked the best LLC services. Find out which is best for you.

FAQ: Naming a California LLC

LLC is short for “limited liability company.” It is a simple business structure offering more flexibility than a traditional corporation while providing many benefits. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute What is an LLC video.

You must follow the California LLC naming guidelines when choosing a name for your LLC:

- Include "limited liability company" or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble creating a name for your LLC, use our LLC Name Generator. You'll find a unique name for your business and an available URL to match.

Most limited liability companies (LLCs) do not need a DBA, known in California as a fictitious business name. The name of the LLC can serve as your company’s brand name, and you can accept checks and other payments under that name as well. However, you may wish to register a DBA to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

Step 2: Choose a Registered Agent in California

After you find the right name for your LLC, you will need to nominate a registered agent, known in California as an agent for service of process. This is a necessary step in your Articles of Organization (i.e., the document used to file and register your LLC with the Secretary of State).

What is an agent for service of process? An agent of service of process is a person or business entity responsible for receiving important tax forms, legal documents, notices of lawsuits, and official government correspondence on behalf of your business.

Who can be an agent for service of process? An agent of service of process must be a full-time resident of California or a corporation, such as a registered agent service, individual within the company (e.g., yourself, or a business attorney, authorized to conduct business in the state of California.

Tip: A substituted service of process through the Secretary of State’s office may be made upon a business entity if:

- Direct service of process has proven to be unsuccessful

- Attempts at direct service have been proven to be diligent in court

- A court order is hand-delivered to the Secretary of State’s Office in Sacramento with a copy of the process to be served, a copy of the court order permitting the service, and a $50 statutory fee.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes. You can choose to act as your own agent for service of process, appoint a member of your LLC, work with a business attorney, or hire a professional registered agent service (recommended).

Read more about being your own registered agent.

Using a professional registered agent service is an affordable way to manage government filings for your California LLC. For most businesses, the advantages of using a professional service significantly outweigh the annual costs.

Step 3: File Your California LLC Articles of Organization

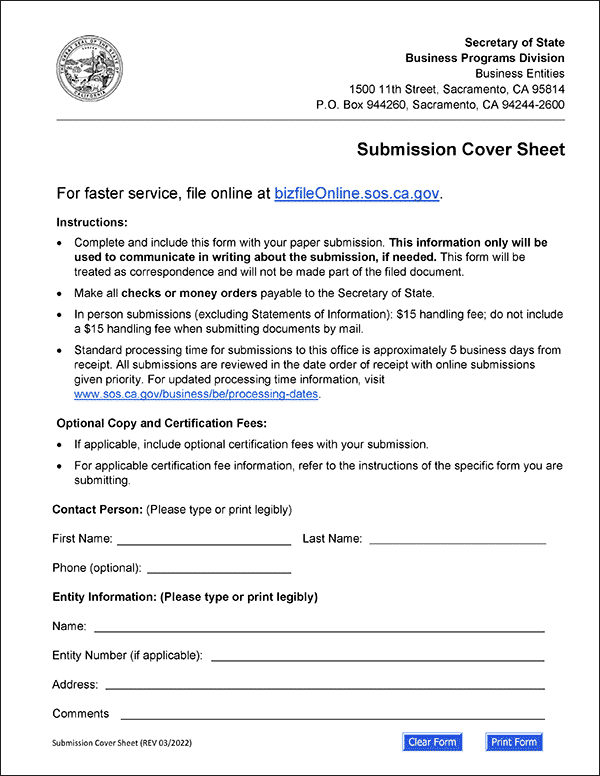

To register your California LLC, you must file Form LLC-1: Articles of Organization with the California Secretary of State ($70+ filing fee). You can apply online, by mail, or in person.

Before filing your LLC paperwork, make sure you have completed your Articles of Organization correctly. You will need to have filled in the following sections:

- Contact person information, including full name and phone number (optional)

- Entity information, including name, entity number, and address.

- Agent of service of process information

- Management structure (e.g., member- or manager-managed)

- Purpose statement approval and signature

File the Articles of Organization

OPTION 1: File Form LLC-1 Online With California bizfile Online

File Online- OR -

OPTION 2: File by Mail or In Person

Download FormCalifornia Filing Cost: $70 online and by mail, $85 in person

Mail To:

Secretary of State

Business Entities Filings

P.O. Box 944228

Sacramento, CA 94244

Submit In Person:

1500 11th St., 3rd Fl.

Sacramento, CA 95814

In-Person Filing Instructions: Articles filed in person at the Secretary of State Office in Sacramento are subject to an additional $15 drop-off fee. This provides priority processing over applications submitted by mail. Applications may be filed at the drop-off address Monday through Friday, 8:00 a.m. to 5:00 p.m. PT.

For help completing the form, visit our California Articles of Organization guide.

Note: If you're expanding your existing LLC to the state of California, you must form a foreign limited liability company.

FAQ: Filing California LLC Documents

California limited liability company (LLC) formation processing typically takes five business days online or by mail but may be expedited for an additional fee:

- Four-Hour: $500

- Same-Day: $750

- 24-Hour: $350

Go to our How Long Does it Take to Form an LLC in California guide to learn more.

An LLC is called a "domestic LLC" when it conducts business in the state where it was formed. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state.

Step 4: Create a California LLC Operating Agreement

An operating agreement is required when forming an LLC in California.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all LLC members are on the same page and reduces the risk of future conflict.

Read our California LLC operating agreement guide for more information on operating agreements.

FAQ: Creating a California LLC Operating Agreement

No. Though California requires LLCs to create and maintain an operating agreement, your operating agreement is an internal document that you should keep on file for future reference.

Step 5: Get an EIN for Your California LLC

What is an EIN? You can get an Employer Identification Number (EIN) from the IRS for free. It is used when you file and pay taxes and is essentially a Social Security number (SSN) for the company.

An EIN is sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN).

Why do I need an EIN? An EIN number is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? The business owner obtains an EIN for free from the IRS after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

- OR -

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

An SSN is not required to get an EIN. You can fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at 267-941-1099 to complete your EIN application. Read our guide for international EIN applicants.

You will be informed of the available tax classification options when you get an EIN. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

All LLCs with employees, or any LLC with more than one LLC member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

The IRS requires that sole proprietorships get a new EIN when converting to an LLC.

Step 6: File the Initial Statement of Information

All California LLCs (domestic and foreign) must file an Initial Statement of Information (Form LLC-12) with the California Secretary of State within 90 days of formation. This can be done in person, by mail, or on the Secretary of State's website.

File the Initial Statement of Information

OPTION 1: File the Statement Online through the California bizfile Online Platform

File Online- OR -

OPTION 2: File the Statement by Mail or In Person

Download FormFee: $20 online and by mail, $35 in person (Nonrefundable)

Online Instructions: The link to the online filing of the Statement of Information can be found under "Business Entities." Search for and select your business, then choose "File Statement of Information."

Mail To:

Secretary of State, Statement of Information Unit

P.O. Box 944230

Sacramento, CA 94244

Submit In Person:

California Secretary of State Sacramento Office

1500 11th Street

Sacramento, CA 95814

In-Person Filing Instructions: If you file your Initial Statement of Information in person, you must pay an additional $15 drop-off fee. Applications may be filed at the drop-off address Monday through Friday, 8:00 a.m. to 5:00 p.m. PT.

Step 7: File a Beneficial Ownership Information Report

Beginning January 2024, LLC owners will need to file a Beneficial Ownership Information (BOI) Report with the US Financial Crimes Enforcement Network (FinCEN). Existing LLCs can file their report any time between January 1, 2024, and January 1, 2025, while new LLCs will need to file their report within 90 days of formation.

This contains similar information to that of your Articles of Organization, such as your LLC name and member information, and can be filed online for free. Failure to file an accurate report on time can result in a $500 per day fine.

Note: There are certain filing exemptions, such as for large companies (i.e., more than 20 full-time employees), tax-exempt entities, and publicly traded companies.

Considering Using an LLC Formation Service?

We reviewed and ranked the top LLC formation services. Find out which is best for you.

BEST LLC SERVICESMaintain Your California LLC

After you’ve successfully formed your LLC, there are a couple of steps you’ll need to periodically take in order to maintain it, including:

- Filing a biennial Statement of Information

- Paying the annual LLC fee (if applicable)

- Sorting out your taxes

We’ve broken down how to complete each of these steps in greater detail below.

File the Biennial Statement of Information

After registering your LLC and filing a Statement of Information with the California Secretary of State, you’ll need to continue to submit this statement every two years thereafter. The deadline for this will depend on your initial filing date.

The purpose of this biennial statement is to keep the state updated on important details regarding your LLC, such as:

- Changes in its name;

- New owners or members; and

- Updates in its business description.

You can submit a Statement of Information for your LLC online by mail alongside a $20 filing fee, though in-person filings require an additional $15 fee. It’s worth noting that no fee is due when your LLC submits a statement between applicable filing periods to report a change of information.

Pay the Annual LLC Fee

If your LLC generates more than $250,000 in gross annual revenue in California, it will need to pay an LLC fee to the California Franchise Tax Board each year. The exact fee amount varies depending on your LLC’s income:

- $250,000–$499,999: $900

- $500,000–$999,999: $2,500

- $1 million–$4.99 million: $6,000

- $5 million+: $11,790

Note: The LLC fee is due by the 15th day of the sixth month of your LLC's taxable year. You can submit the return by mail using Form 3536.

Sort Out Your Taxes

LLCs in California will need to pay a number of taxes at a local, state, and federal level. With that said, the taxes your LLC must pay will vary depending on the nature of your business (e.g., its industry, niche, and number of employees, etc.).

Below, we’ve broken down the most common taxes in California that your LLC may be expected to pay:

Franchise Taxes

Your LLC will be required to pay an annual franchise tax for the privilege of doing business in California.

The rate for this tax is $800, which you’ll have to pay regardless of whether you operate at a loss; keep in mind that this is not the case for your first year of operation post formation.

Your LLC will typically need to pay its franchise tax bill by the 15th day of the fourth month of the current taxable year. The simplest way to pay this tax is online through the California Franchise Tax Board’s Web Pay platform.

Note: If you decide to cancel your LLC within one year of organizing, you will be able to file a Short Form Cancellation Certificate (Form LLC-4/8) with the Secretary of State in order to avoid the $800 annual tax.

Income Taxes

This category includes the taxes imposed by the state of California on the income of individuals and businesses in the state. Apart from the franchise tax, there are two main types to be aware of:

- Personal Income Tax: This is set at a gradual rate that ranges between 1% and 12.3% depending on the taxable entity’s income. You can use the California Franchise Tax Board’s Tax Calculator to find out how much you owe.

- Corporate Income Tax: The net taxable income of an LLC business classified as C corps is subject to a flat tax rate of 8.84%.

- Alternative Minimum Tax: Each LLC taxed as a C Corp is allowed a maximum of $40,000 in deductions. After these reductions are made, your Minimum Taxable Income (AMTI) is taxed at a rate of 6.65%, which is used to determine your provisional tax rate - known as Tentative Minimum Tax (TMT). If your TMT exceeds the amount you’d owe in regular corporate income tax, your business will be required to pay the difference.

Sales and Use Taxes

In California, sales tax is levied on the price of tangible goods and services sold within the state at a flat rate of 7.25%. However, it can vary up to as much as 10.75% based on the area in which your LLC is located. This is because, while local areas typically only impose additional rates that vary between 0.10% and 1.0%, these can overlap, leading to localities that are affected by multiple concurrent rates.

That being said, the maximum rate of 10.75% is very uncommon and is only currently present in six cities – all of which are located within Alameda County. More than 60 local jurisdictions have opted to impose no additional sales taxes at all.

Note: If your business plans to sell any taxable goods or services in the state, it will need to first obtain a Seller’s Permit by registering with the California Department of Tax and Fee Administration (CDTFA).

Steps After LLC Formation

After forming your LLC, you will need to get a business bank account and website, obtain all required business licenses, and get business insurance, among other things.

Visit our After Forming an LLC guide to learn more.