How to File Your LLC Taxes

Depending on your LLC’s structure, there are several ways to tax an LLC at the federal level. In this guide, we will take you step-by-step through the filing process of the most common LLC tax structures—disregarded entities (Single-Member LLCs) and partnerships (Multi-Member LLCs).

Recommended: Freshbooks offers small businesses easy to use technology and excellent customer support to take away the stress of filing taxes and maintaining your books.

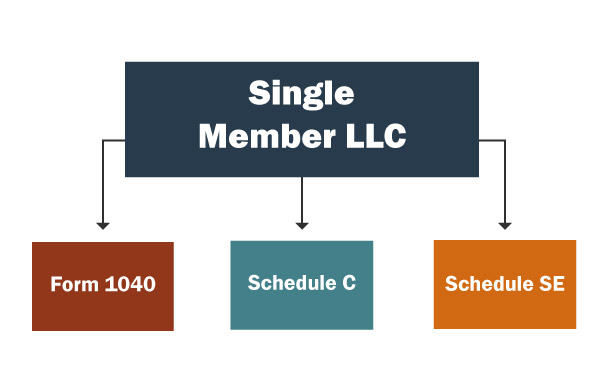

How Do I File My Single-Member LLC Taxes?

Single member LLCs are treated like sole proprietorships when it comes to taxes, unless they elect to be a corporation. Therefore, the IRS treats the LLC as a “disregarded entity,” which means you report all of your profits and losses on your personal tax return, otherwise known as form 1040.

In addition to this, disregarded entities must fill out separate forms (Schedule C and Schedule SE) concerning their business expenses and income. These “schedules” are attached to your personal tax return.

Form 1040

This is the form individuals use for their personal tax returns. For Single-Member LLCs acting as disregarded entities, owners must file form 1040 if they earn more than $400 from self-employment.

As the owner, you will fill out your personal tax return as normal, but with Schedule C attached. If you are the sole owner, you will have to calculate any income and expenses that are related to your business. The total profit you end up with is recorded on line 12 of your personal tax return.

If you work with rental real estate or have other business-related investments, your profits from those will be recorded on Schedule E. These calculations are also done on a separate sheet.

You must also report your self-employment tax deductions on Schedule SE.

Schedule C (Form 1040)

Schedule C of form 1040 is dedicated to tracking the profits and losses from businesses taxed like sole proprietorships; this includes Single-Member LLCs that have not elected corporation status. Any profits recorded in this form will be noted on line 12 of your personal tax return.

As an owner, you must provide the general nature of your business in the beginning section of Schedule C. This includes:

- Owner’s Name and Social Security Number (SSN)

- Description of Business and Professional Code: The codes for each profession can be found at the end of the IRS Schedule C instructions.

- Business Name and Address

- Employer Identification Number (EIN): If your LLC has employees, you must have an EIN. If you are alone, you do not need an EIN; this section can be left blank.

- Accounting Method: Select whether your business does its accounting on a cash basis—recording income as you receive it—or an accrual basis—recording income when you earn it.

- Material Participation: If you commit a substantial amount of activity to your business, you are considered to have been a “material” participant.

Schedule C is divided into five sections. Below are the basic instructions for each portion:

- Income: This is where you record all income your business received in the past tax year. This does not take into account any expenses or deductions; it is merely the sum of all amounts your business brought in from all sources. If your products have undergone a price reduction or have been returned, you must report this as well.

- Expenses: Part II is split into categories based on common business costs including advertising, travel, and rent. Business use of your home is calculated separately from these categories.

- Line 31: Net Profit (or loss): If you end up with a profit after taking your business expenses into account, you must record the amount on the indicated line. If there is a loss, you record that amount and specify how much of your personal money is at risk. In any case, your profit or loss must be recorded in your Form 1040.

- Cost of Goods Sold: If your business deals with producing and/or selling merchandise, you need to record your inventory at the beginning and end of the year.

- Information on Your Vehicle: Should you use a vehicle for business-related purposes, you have to record the miles that were driven for those purposes.

- Other Expenses: Any other transactions, such as start-up costs, are to be listed in the final section of this form.

Schedule SE (Form 1040)

Owners who make at least $400 must pay self-employment tax using Section B of Schedule SE.

Get a Free Consultation

A free consultation with 1-800 Accountant could save your business thousands in taxes, use them to file your taxes or download their intuitive software for DIY accounting and book-keeping.

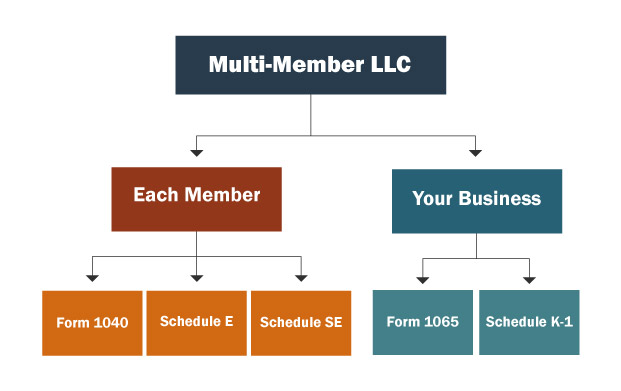

How Do I File My Multi-Member LLC Taxes?

If you are a Multi-Member LLC, the IRS automatically views you as a partnership for tax purposes. Like a Single-Member LLC, your taxes will pass through the LLC and onto each owners’ personal tax returns.

Unlike Single-Member LLCs, Multi-Member LLCs do not need to fill out a Schedule C form. Instead, the owners will fill out forms that detail the total partnership income as well as their personal share.

Form 1040

As a member, you will fill out form 1040 as normal. If you are a partnership, S Corporation, work with rental real estate, or have other business-related investments, your profits from those will be recorded on line 17. These calculations are also done on a separate sheet known as Schedule E.

Under the “Adjusted Gross Income” section, you must report your self-employment tax deductions.

Schedule SE (Form 1040)

Owners who make at least $400 must pay self-employment tax using Section B of Schedule SE.

Schedule E (Form 1040)

When completing your personal tax form, you will need to file this form to report any extra income from your partnership.

Part two of Schedule E concerns the income and loss from a partnership; because this is a part of your personal taxes, you only need to report your share of your business’ income. You will need to use the figures from your Schedule K-1 in order to complete your Schedule E.

Form 1065

While each owner will report their shares on Form 1040 and Schedule K-1, your business will use this form to report the total income and loss from your Multi-Member LLC. You will need to provide the following information about your business:

- Business Name and Address

- Principal Business Activity: This is where you describe what your business does. In line C, you must provide a code that best fits your activity. The list of codes can be found on page 49 of the IRS form 1065 instructions.

- Employer Identification Number (EIN): This is required for Multi-Member LLCs. You can apply for an EIN using Form SS-4.

- Total Assets: If your business made less than $1 million by the end of the tax year, you do not need to report your total assets in line F.

- Return Status: This is only relevant if you are filing for the first time as a business (initial return), the last time (final return), or if you need to make changes to an already submitted form (amended return).

- Accounting Method: Select whether your business does its accounting on a cash basis—recording income as you receive it—or an accrual basis—recording income when you earn it.

There are seven main sections of Form 1065. Below are the basic instructions for each portion:

- Income: This is where you record all income your business received in the past tax year. This does not take into account any expenses or deductions; it is merely the sum of all amounts your business brought in from all sources. If your products have undergone a price reduction or have been returned, you must report this as well.

- Deductions: Your deductions come from areas like workers’ salaries (excluding the owners), rent, and employee benefits. section is to determine what your profits and losses were for the tax year.

- LINE 22: Ordinary Business Income: The result of subtracting your deductions from your income.

- Schedule B: This section consists of multiple questions and concerns the structure of your business and any entities that have an interest in your business. If your business is owned in part by another entity, you may be required to file Schedule B-1.

- Schedule K: The “Partners’ Distributive Share Items” section summarizes the shares of all partners. Each owner will need a separate sheet, Schedule K-1, to report their own share of the business.

- Schedule L: The balance sheet section details your business’ liabilities, equities, and assets. This information should be readily available to you if you already use a balance sheet to keep track of your accounting.

- Schedule M-1: If you have expenses that are in your accounting books but aren’t necessarily tax deductible, you would record them in this section.

- Schedule M-2: The final section of this form is meant to calculate the amount of money your business has available for spending purposes after taxes.

Schedule K-1 (Form 1065)

- Part I: This section contains information about the partnership as an entity, including the EIN, address, and location of IRS filing.

- Part II: Part two concerns the owners themselves, including their personal address and taxpayer identification number (SSN, ITIN, or EIN). You will report your percentage share of the profits and losses. If you deal with capital accounts and liabilities, you would record your shares and balances in the designated sections.

- Part III: Knowing your share of the profits and losses, you can calculate your share of the total income. If your business deals with rental real estate, you will also need to fill out additional information on Schedule E (1040). For the specific Schedule K-1 codes, check page 2 of the form.