What is an S Corporation (Subchapter S)?

What is an S corporation (S corp)? An S corp is an IRS tax classification that can be elected by LLCs and corporations. Small businesses can elect the S corp tax status (Subchapter S) by filing Form 2553 with the Internal Revenue Service (IRS) to enjoy the tax benefits and save money.

In this guide, we will cover:

- What is an S corporation (Subchapter S)?

- S corp advantages and disadvantages

- How and when to convert your small business into an S corp

Recommended: If you have at least $60,000 in net earnings, an S corp may offer tax advantages. Let Northwest start your S corp today.

S Corporations

You may be wondering, what is an S corporation (S corp)? An S corp is a tax classification under Subchapter S Chapter 1 of the IRS (Internal Revenue Service) code for federal, state, and local tax purposes. Although an S corp is not a legal business structure by itself, LLCs and corporations can elect to be taxed as an S corp for its tax advantages. S corps are generally not taxed at the business level. Instead, the shareholders are taxed on their individual tax return.

Key Takeaways:

- An S corporation is an IRS tax classification and not a business structure

- LLCs and corporations can elect S corp status.

- Sole proprietorships and partnerships can not elect to become an S corp

- S corps have pass-through taxation

- S corp taxation generally occurs at the shareholder level instead of the business being taxed itself. Some exceptions exists, such as in the state of California (franchise tax) and New York City (city tax)

- An S corporation saves a business money on self-employment taxes (social security and medicare) on business distributions

- S corps have limited liability protection

In an S corp, an owner is required to become an employee (for tax purposes) and receives a reasonable salary for the position and title held within the company. Having a salary allows business owners to save on self-employment taxes on the distributions. Many small business owners prefer to convert their sole proprietorships and partnerships into formal business structures, such as LLCs and corporations, to elect S corp status.

For a Free Consultation With a Tax Professional

Pass-Through Taxation

Generally, S corps are not taxed at the corporate level and instead have pass-through taxation which means that profits, credits, deductions, and losses pass directly to the individual shareholder as in a default LLC. As a result, shareholders benefit from federal income tax savings. In contrast to S corps, C corporations (C corps) are more complicated to run and have double taxation, since they are taxed at the business level and at the shareholder level after.

Limited Liability Protection

S corps also have limited liability protection since they are formed as LLCs or corporations. This means that they are separate entities from their members (owners/shareholders), so your personal assets are protected in case of a lawsuit or if creditors need to be paid (as long as you don't pierce the corporate veil).

If your business makes at least $80,000 in annual profits, consider using Northwest to form your S corp as you may be losing out on potential tax savings, and they'll handle all the paperwork, so you can focus on what matters most — your business!

S Corp Election IRS Deadline

A new corporation and LLC must elect S-corp status within two months and 15 days of the date of formation (based on the date the Articles of Organization, Certificate of Formation, or Articles of Incorporation were filed with the state) to receive the tax benefits within the first tax year of starting a business. The S corporation status may also be elected anytime the year prior to the year a business expects to be taxed as a Subchapter S entity. Forming an S corp requires filing Form 2553 Election by a Small Business Corporation from the IRS. In some states or cities, there may be other forms you'll have to file before becoming an S corporation. For example, in New York City, you'll also have to submit Form CT-6 from the city's Department of Taxation and Finance.

S Corp Election Deadline Recap:

- File Form 2553 2 months and 15 days or before after starting your business

See Internal Revenue Code 26 USC Subtitle A, Chapter 1, Subchapter S to learn more.

S Corp Tax Advantages

S corps are not taxed at the business level so there is no double taxation as in a C corporation (some exceptions include California and New York). Instead, S corp business owners benefit from pass-through taxation where income, profits, credits, and losses are taxed at an individual level on the shareholder’s personal income tax return.

Here’s how taxes work in an S corp:

- A member’s (owner’s) salary pays

- The remaining earnings or net profits, called distributions, are only subject to pay

By only paying income tax on distributions, an S corp saves the business owner(s) money on taxes under the right circumstances. In contrast to an S corp, a default LLC's owner is not a salaried employee, therefore, all the net profits pass down to the owner as distributions. These distributions are then subject to both self-employment taxes and income tax on the owner’s personal tax return.

S Corp Disadvantages

An S corporation can come with some initial and ongoing expenses. First, you must formalize your business by starting an LLC or a corporation if you have a sole proprietorship or a partnership. To do so, you'll have to file the Articles of Organization (LLC) or Articles of Incorporation (corporation) at the state level. Second, you’ll have to appoint a registered agent (also known as a resident agent and an agent for service of process), obtain an EIN, and pay the appropriate state fees. Some states will have additional fees, such as an annual report and/or franchise tax.

Once you start or convert your S corp, you’ll have to carefully review your S corp financial statements, since they will be subject to closer IRS scrutiny. You’ll also have additional fees depending on the state where you established your business.

Although these are a few extra factors to consider when starting an S corp, there's no need to worry. Since S corp business owners can become salaried employees and save on taxes, the additional fees can be paid with the tax savings and you can hire a service to handle your LLC formation or if you choose to start a corporation.

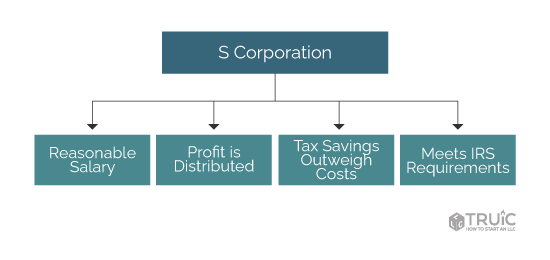

When Should A Business Elect S Corp Status?

A small business could save on taxes by electing the S corp tax status if the following criteria is met:

- The business meets S corp requirements and restrictions

- The business earns enough in net profits to pay a "reasonable salary" and at least $20,000 in annual distributions

- The addition of payroll and accounting costs doesn't outweigh tax advantages

S Corp Requirements and Restrictions

The IRS requires that businesses that elect the S corp status:

- Have 100 shareholders or less

- Are domestic LLCs or corporations

- Issue only one class of stock

- Shareholders are U.S. citizens or permanent resident aliens

- Are owned by private individuals

Net Profit, Reasonable Salary, and Distributions

To benefit from electing S corp tax status, a business must have enough profit left over (net profit) after running and growing the business to pay the owner(s):

- a reasonable salary

- at least $20,000 in distributions.

After electing an S corp tax status, business owners are treated as employees for tax purposes. The IRS requires owner-employees to be paid a "reasonable salary."

A reasonable salary is any salary that you would pay someone to do the same job. Websites like Glassdoor or the US Bureau of Labor Statistics are a good place to start researching.

Businesses taxed as S corps are subject to increased scrutiny by the IRS. It is important that your duties and salary match.

In addition to a reasonable salary, we estimate that distributions need to be at least $20,000 annually to create tax savings for business owners.

S Corp Savings Calculator

Calculate how much you can save by choosing an S Corp tax classification

As a Sole Proprietorship or Single-Member LLC

Net Income:

Self Employment Tax:

S Corp

Net Income:

Salary:

Salary Employer Tax

(S Corp pays)

Dividend

Total Employment

Taxes Paid

Savings on Self Employment Taxes

Savings =

Against this savings, you have to balance the time and costs of running payroll and tax withholding. To learn more about what this will cost, get a free tax consultation.

For a Free Consultation With a Tax Professional

Looking for the right business structure?

Visit our How to Choose a Business Structure guide for help.

Choosing a Business StructureHow to Start an S Corp

There are two main ways to start an S corp:

- By forming an LLC and electing S corp tax status from the IRS when you request your employee identification number (EIN)

- By forming a corporation and electing S corp status from the IRS

We recommend not starting a corporation with the S corp tax status because the S corp negates all of the benefits of a corporation.

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

Steps to Forming an LLC and Electing S Corp Status

Starting an LLC and electing S corp tax status is easy. You can use our guides to start an LLC with the S corp status yourself, or you can hire a formation service to do it for you.

Six Basic Steps to Start an LLC and Elect S Corp Status:

Step 1: Select a State

Step 2: Name Your LLC

Step 3: Choose a Registered Agent

Step 4: File the Articles of Organization

Step 5: Create an Operating Agreement

Step 6: Get an EIN and File Form 2553 to Elect S Corp Tax Status

Step 1: Select Your State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Step 2: Name Your LLC

You will need to provide your state with a unique name that is distinguishable from all registered names when you file your LLCs formation documents.

Our Business Name Generator and our How to Name a Business guide are free tools available to entrepreneurs that need help naming their business.

Step 3: Choose an LLC Registered Agent

Your LLC registered agent will accept legal documents and tax notices on your LLC's behalf. You will list your registered agent when you file your LLC's Articles of Organization.

Step 4: File Your LLC's Articles of Organization

The Articles of Organization, also known as a Certificate of Formation or a Certificate of Organization in some states, is the document you will file to officially register an LLC with the state.

Step 5: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

Our operating agreement tool is a free resource for business owners.

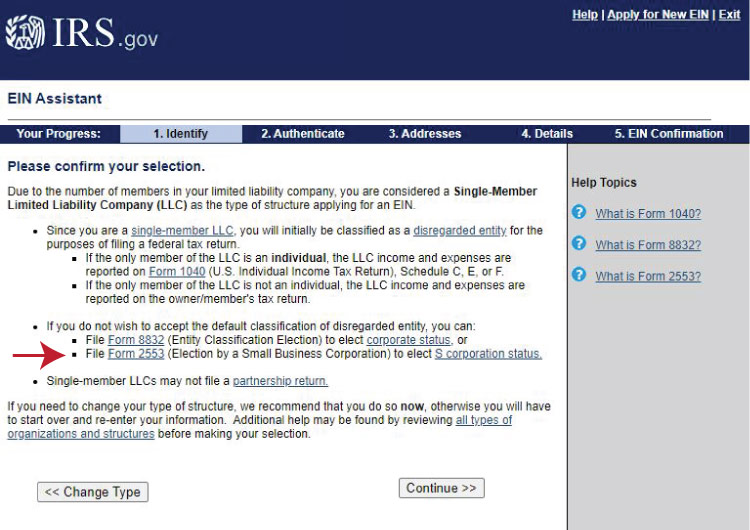

Step 6: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly with the IRS.

Elect S Corp Tax Status

During the online EIN application, the IRS will provide a link to Form 2553, the Election By a Small Business form.

You will elect S corp on the IRS website as shown here:

Looking to start an S corp and potentially start saving on taxes? Find your all-in-one S Corp business solution with Northwest.

Steps to Take After Setting Up an S Corp

Once you formalize your S corp, consider adding a business phone line to protect your personal information with phone.com.

If you need to build your S corp credit, read our guide on how to build business credit and get a business credit card through BILL.

For business banking check out our guide on the best banks for small businesses.

Different Business Structures and Taxes Simplified

Sole Proprietorship

Owner and business are the same for tax purposes

- Pass-through taxation (profits will pass through to its members to be reported on their personal tax returns)

- Single-member (owner) company

- Informal business structure

- No liability protection (if the business is sued, you could lose your personal assets)

Partnership

More than one owner, business and owners are the same for tax purposes

- Pass-through taxation (profits will pass through to its members to be reported on their personal tax returns)

- Informal business structure

- No liability protection (if the business is sued, you could lose your personal assets)

Limited Liability Partnership (LLP)

Business is not a separate entity

- Pass-through taxation (profits will pass through to partners to be reported on their personal tax returns)

- Corporation and partnership hybrid business

- Spreads business risk between partners by having a different set of skills and expertise.

- Limited liability (individual partners are protected when one partner is sued)

- In some states, may elect S corporation tax status

Limited Liability Company (LLC)

The business is a separate entity from its owners

- Pass-through taxation

- Formal business structure

- Liability protection (if sued, personal assets are protected as long as you don’t pierce the corporate veil)

Corporation (C Corp is the default IRS tax status)

The business is a separate entity from its owners

- Double taxation

-

- The business is taxed at a flat tax rate (currently 21%)

- The shareholders are then taxed on the distributions they receive from the business on their personal tax return at their income tax bracket

- Formal business structure

- Includes protection of personal assets

- Can elect S corp tax status instead of the default C corp status

S Corporation (S Corp)

Not a business structure, it’s an IRS tax classification

- Tax classification for LLCs and corporations only (in some states LLPs)

- Asset protection since it’s formal business structure is an LLC or a corporation

- The business itself is not taxed

- There is pass-through taxation (as in a default LLC)

- Owner(s) and shareholders receive distributions - profits, deductions, credits, and losses are passed down to the owner(s)/shareholders

- Preferred by shareholders due to no double taxation

- Offers tax savings

-

- Owner(s) become employees and have a reasonable salary that pays employment taxes and income tax

- Distributions pay only income tax at shareholder’s individual tax bracket - leads to tax savings!