Maintain your LLC's Corporate Veil

Forming an LLC is the first step toward protecting against personal liability arising in business, but it’s not the last step. Learn the steps smart business owners can take to maintain limited liability protection ("the corporate veil").

Recommended: Northwest ($29 + State Fees) will form your LLC for you and help create your corporate veil.

What is the Corporate Veil?

Subscribe to our YouTube channel

The corporate veil is a legal concept that distinguishes between a company and its owners, thereby shielding the owners from personal liability for the company's debts. This means, generally speaking, the financial obligations of the business don't become the personal liabilities of the owners.

However, just forming your business as an LLC is not alone sufficient to ensure the limited liability protection for your business. When a creditor of an LLC goes unpaid, the creditor may sue the business’s owners, asserting that they should be personally liable for the business’s debts. This is known as piercing the corporate veil.

Situations where the corporate veil can be pierced include:

- The company is severely undercapitalized

- The company and its owners did not maintain their separate identities in their business affairs

- The actions of the company were fraudulent or wrongful.

How to Maintain the Corporate Veil

To preserve the corporate veil, there are a handful of guidelines that business owners should consider:

1. Have Adequate Start-Up Capital

If the business did not ever have sufficient capital to cover its liabilities, creditors will argue that it was not sufficiently separate or independent from its owners to give rise to a corporate veil. When starting a company, it is important to make a reasonable initial investment in the business in order to avoid this claim.

What does this mean for you and your business?

Money is often tight at the outset for new businesses, but every business must make a judgment about how much capital is reasonably necessary to cover its initial cost and liabilities, including payments due to creditors and potential liabilities to third-parties. Maintaining solvency—company assets in excess of liabilities— in the early days of your businesses reduces the chances of a successful veil piercing. Find out what your financing options are and whether you need outside investing.

Recommended: If a small business loan is right for your business we suggest you read our review of the Best Small Business Loans to find the best lender.

2. Do not commingle financial affairs

The company should have its own bank account and credit card and engage in its own transactions separate from the owners. The individual owners should not utilize the company’s money for their own individual purposes (for example, paying home cable bills) without adequately documenting the transaction as a loan or a draw. If the company needs additional funds and the owner wishes to contribute, this should be documented as a capital contribution, with appropriate documentation created at the time of the transaction.

How do you stay compliant?

The following steps help establish clear separation between personal and business finances:

- Create a dedicated business bank account well as a dedicated business credit card, so that the transactions for the company are kept separate from the transactions for the company’s owners.

- Maintain a book of accounts documenting business expenses.

- If it is necessary for the owners to personally contribute funds, document that transaction with a written agreement between the owner and the LLC (such as a promissory note), and a supporting resolution by the LLC authorizing the transaction

Recommended: Compare the best small business checking options in our Best Banks for Small Business in 2024 review.

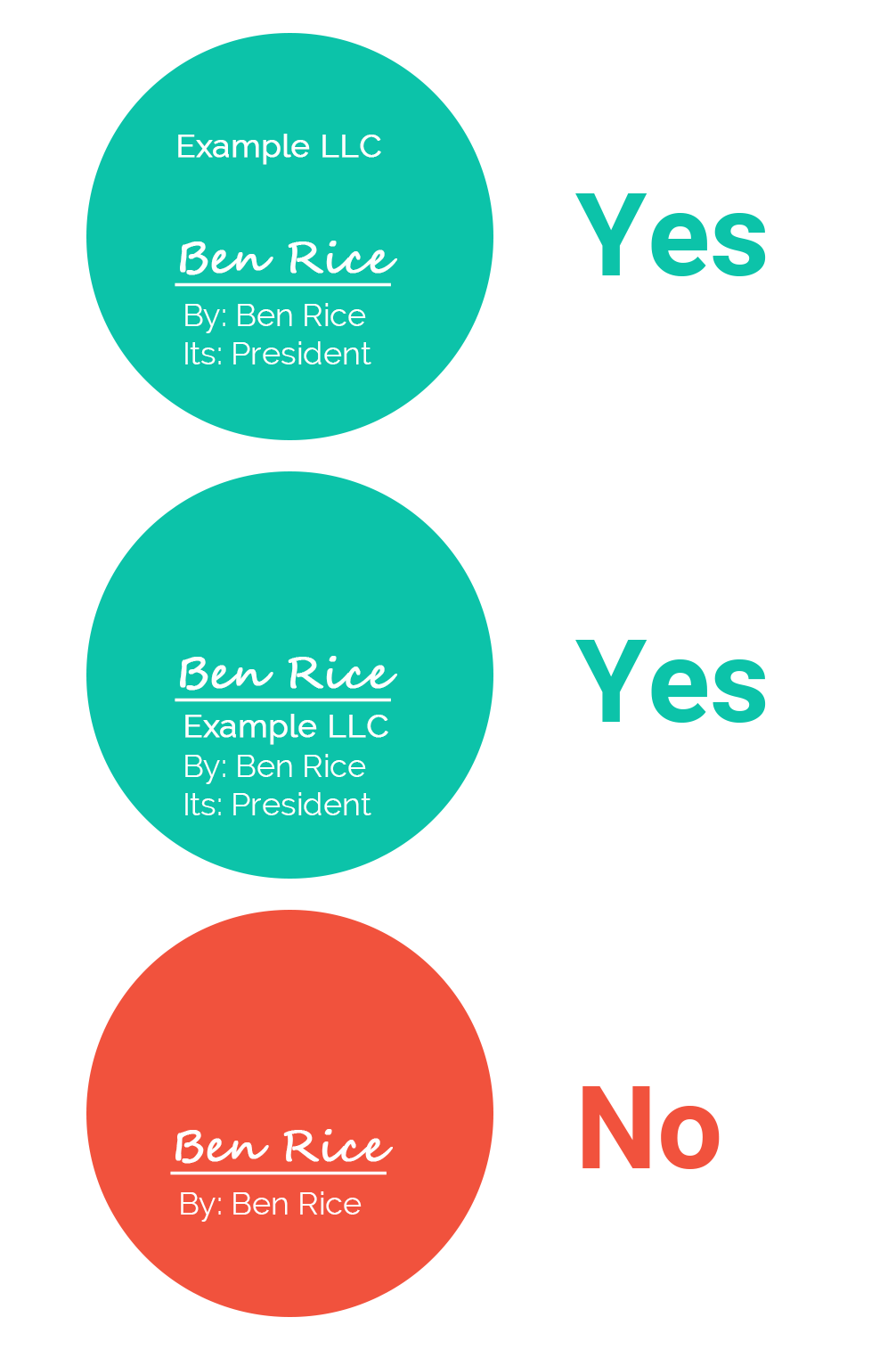

3. Sign correctly

The business dealings of the company should be carried out in the name of the company, with the company as the named party to any contracts and the individual signer clarifying below the signature line that they are signing for the company—for example: John Smith, as Authorized Member of ABC LLC, for and on behalf of ABC LLC. This reflects the name of the signer, the authority / title of the signer, and the company for which the signature is made.

What is the big deal?

How you sign documents on behalf of the company needs to reflect that the company is separate from you as a person. If, in a company contract, you sign a signature line with your name under it, are you signing for the company or for yourself individually? Keeping this clear will help to demonstrate on an ongoing basis that the company is separate from you and that you are not individually responsible for the company’s debts.

How do I sign?

4. Document company business

Meetings of the company, if required under the LLC’s operating agreement, should be documented in formal minutes maintained in a professional way with the records of the company. Decisions of the company should be reflected in resolutions signed by the members. These tasks are often called “corporate formalities.” The term “formalities” may be misleading, though, in that it may be thought to imply that the tasks are not necessary, or are “just formalities.” In the context of maintaining the corporate veil, however, this documentation is important and necessary.

Why is this necessary?

In your day-to-day life, you do not, as a person, need to document your decisions—it is enough that you know in your mind why you took certain actions, and that you remember that information. Starting an LLC, however, is creating a separate entity—a separate “self”—apart from you and your mind. The company has no brain to remember the decision process and reasoning for actions, so it is necessary to document those things on paper. This “paper trail” is important for maintaining the company’s liability shield—the corporate veil—because it shows that you are treating the company’s affairs as separate from your own.

5. Maintain your LLC

Keep up with State Filings

In some states, failure to file an annual or biennial report with the state of formation can result in automatic dissolution of your LLC. If your LLC is dissolved by the state, the owners of the business no longer have limited liability protection. Find out the what state filings are required by clicking your state below.

The following states do not require LLCs to file an annual or biennial report:

Alabama, Arizona, Arkansas, Delaware, Missouri, New Mexico, Ohio, and South Carolina

- Alaska

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Get Business Insurance

Forming an LLC or other business entity separates your business activities from your personal assets, creating the corporate veil. The major benefit of this separation is that if your business is sued, your personal assets (like your home and savings account) will be protected.

But what about your business assets? If your business is sued, the LLC does not protect the assets of your business (your business’s bank accounts, property, inventory, etc…). This is where Business Insurance comes in.

Recommended: If you haven't already found insurance for your small business or if you want a new quote of services read our review of the best small business insurance companies.

Know the Limits of the Corporate Veil

Even where the company and owners perfectly maintain the separate identity of the company, there are still some situations in which the owners of the company may become liable to creditors. These include the following:

1. Personal guarantee obligations

Creditors will often ask for the owners of the company to sign a personal guarantee of the company’s obligations—for example, when signing a commercial lease agreement or a business loan agreement. Be aware that a personal guarantee is a voluntary agreement to be liable for the company debt at issue, in essence a voluntary waiver of the protections of the corporate veil.

What is a personal guarantee?

This is any promise by you personally to be responsible for a debt or obligation of the LLC. These are sometimes included as separate paragraphs in contracts, or they can be an addendum or separate document altogether. Read these carefully, and make sure you understand them! By signing a personal guarantee, you are effectively waiving the protections of the corporate veil. It may make perfect business sense to do so, and may be necessary sometimes as a matter of negotiation, but you should think carefully about this decision each time it presents itself.

2. Liability for personal acts or carelessness

There are some situations where courts may determine that individual members, although they were acting on behalf of the company, have personal liability for their own actions or carelessness, regardless of the corporate veil. If, for example, a member recklessly drives a delivery van and injures a pedestrian, that member may be found individually liable for that reckless conduct. The company may also be liable for the resulting harm.

Why are you personally liable?

It is sometimes said that business owners wear “multiple hats.” You occasionally have on your “owner” hat, where you are deciding company affairs. Then you take a personal phone call, during which you have on your “individual” hat. And so on. While you are engaging with the world—driving vehicles, operating machinery, moving equipment or stock, etc.—you wear both hats. In other words, you are acting as a business owner and also as an individual. If you cause harm or an injury, the acts you performed while wearing both hats can be used to establish liability against your business and you personally.

3. Liability for taxes

Members of limited liability companies are personally liable for their own taxes resulting from company operations. They may also be personally liable for certain taxes of the company (for example, certain state and federal withholdings for employees) if they are “responsible persons” who controlled the company’s money and ability to pay the company’s debts.

Wait, I am personally responsible for the LLC’s taxes?

Yes, depending on the particular taxing jurisdiction, if you are a “responsible person” for the company’s finances, you may be personally liable. To protect yourself, it is critical to properly account for company transactions and remit all taxes due to the various taxing authorities by the deadlines. It is not enough to simply remit payment to a payroll company without any follow up or confirmation that the payroll company does its job and sends the money to the government on your behalf. At the end of the day, if you are responsible for the company’s finances, you may be personally obligated for payment of the company’s taxes.