Sample Operating Agreements

An operating agreement is an important legal document that helps ensure your business stays on track operationally. It details your LLC's ownership, member roles, and operating norms. We offer three free LLC operating agreements.

- Single-Member LLC Operating Agreement: An LLC with one owner requires a specific type of agreement. This outlines the single member's rights and duties and secures their limited liability status.

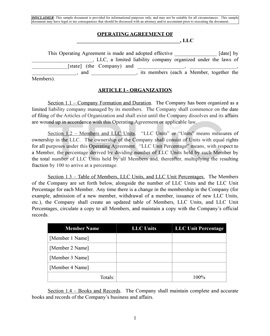

- Member-Managed Multi-Member LLC Operating Agreement: A member-managed LLC template is used when the LLC's members are managing the company. It defines each member's roles, rights, and responsibilities, including profit shares and decision-making norms.

- Manager-Managed Multi-Member LLC Operating Agreement: A manager-managed LLC operating agreement is still a multi-member LLC, but the LLC members (owners) have chosen a manager to manage. Use this template for LLCs opting for a manager or a group to oversee daily operations.

If you want more information about operating agreements, we have a detailed guide on free LLC operating agreements. Here, you'll learn about the structure of these agreements and how to fill them out with precision.

Select one of our free LLC operating agreement templates below.

- Single Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (Member Managed)

- Multi-Member LLC Operating Agreement (Manager Managed)

for free download

LLC Resolutions

LLC resolutions are used to document important corporate decisions. They serve as an official record, capturing what members agree to and helping ensure transparency within the organization.

Here are two important resolutions your LLC might need:

- LLC Resolution: Use this when making any major company decisions, put them in writing. An LLC resolution documents significant choices like real estate purchases, partnerships, or taking on debt.

- Banking Resolution Form: Use this form when opening a bank account for your LLC. It proves to banks that your LLC authorizes the new account.

Drafting resolutions doesn't have to be overly complicated. Our free LLC resolution template and banking resolution form are designed to simplify the process. Clear documentation is an important step to take for creating a well-structured LLC. Download our free resolution forms below.

for free download

Hiring Documents

As your LLC grows, it's natural to expand your team. Whether you're onboarding full-time employees or independent contractors, the right documents are essential. We've created several resources to help.

Here's what you'll find:

- Employment Contract: Welcoming a new employee? This agreement covers job responsibilities, work terms, compensation, and more. It clarifies expectations, ensuring a smooth start for both you and the new hire.

- Independent Contractor Service Agreement (ICSA): Engaging a freelancer or consultant? An ICSA is important. It defines project specifics, payment terms, and other vital details, keeping everyone on the same page.

- Non-Disclosure Agreement (NDA): Protecting your LLC's proprietary information is vital. An NDA safeguards your business secrets, whether you're hiring an employee or an independent contractor.

Before you start hiring, ensure your LLC has an Employer Identification Number (EIN) for tax and payroll purposes. If you haven't applied yet, you can do so on the IRS.gov website.

The hiring process can be straightforward and effective with the right documents. Our free hiring forms are designed to make onboarding new team members hassle-free. Download these necessary hiring forms below.

- Employment Contract

- Independent Contractor Service Agreement (ICSA)

- Non-Disclosure Agreement (NDA)

for free download

Frequently Asked Questions

Why do I need an operating agreement?

Depending on your state, an operating agreement may be required to form an LLC. At a minimum, all multi-member LLCs are highly recommended to have one. Read our What is an LLC Operating Agreement article to learn more.

Which operating agreement should I use?

If you are the sole LLC owner, consider using the single-member LLC Operating Agreement. If you have multiple members, read our Management by Members or Managers article for more information.

Why do I need a banking resolution?

A banking resolution is required to authorize a member of the LLC to open a business bank account.

How do I use an LLC resolution template?

For more information about when to use a resolution and how to fill out the LLC resolution template, read our Understanding LLC Resolutions guide. It may be helpful to use our LLC meeting minutes template when discussing resolutions when you meet with your members.

What is the difference between an employee and an independent contractor?

When hiring workers for your business, it is important to observe the IRS' laws related to worker classification. For an overview of the topic, read our article, Contractors vs. Employees: What You Need to Know.

Are there tax obligations associated with hiring employees?

Yes. To learn more about how employee taxes will impact your business, read our Employee Taxes for Small Businesses guide.

What is a limited liability company?

A limited liability company (LLC) is a type of business structure that combines the flexibility of a partnership with the liability protection of a corporation. This means owners (known as members) are not typically personally responsible for the company's debts and liabilities, and the management structure can be versatile.

How do I form an LLC?

To form an LLC: (1) Select a unique name, (2) Appoint a registered agent, (3) File Articles of Organization, (4) Create an operating agreement, (5) Get an EIN, (6) Get a business bank account, (7) Register for taxes, (8) Obtain business licenses. Most companies hire a low-cost LLC service provider to do all of this.