Form 2553 Instructions

Form 2553 is used by limited liability companies (LLCs) and corporations to elect the S corporation (S corp) tax classification with the US Internal Revenue Service (IRS).

Our Form 2553 Instructions guide below covers:

- Form 2553 due dates

- How to complete form 2553

- Where to file form 2553

- When to elect S corp status

Need to speak to a tax professional? Call (801) 790-0473 or schedule a meeting here.

IRS Form 2553 Instructions

There are three steps to completing form 2553 and electing S corp status for your small business:

- Check S Corp Eligibility

- Check Form 2553 Due Dates

- Complete and File Form 2553

Step 1: Check S Corp Eligibility

The following statements must be true in order to elect S corp status:

- Form 2553 was filed on time by an eligible business entity. Eligible business entities include, but are not limited to, corporations, LLCs, and partnerships.

- There are no more than 100 shareholders.

- Shareholders are individuals, estates, or exempt organizations

- Shareholders are resident aliens or US citizens.

- The business has only one class of stock

- Each shareholder consents to the election

Step 2: Check Form 2553 Due Dates

You must file form 2553:

- No more than 2 months and 15 days after the beginning of the tax year that you want the S corp election to be in place

- Any time in the year before the tax year that you’d like the S corp election to be in place

Businesses can elect a variety of tax years and still be eligible for S corp election. To learn more, view the “general” section of the IRS instructions to Form 2553.

Section I is for late filers. For information on relief for late filers, review the “general” section of the IRS instructions to Form 2553.

Step 3: Complete and File Form 2553

Start by accessing Form 2553 PDF on the IRS website. For assistance, review the “specific instructions” section of the IRS instructions to Form 2553.

How To Complete Form 2553:

Part I

Part one of form 2553 includes your business’s name and address, incorporation date, and tax year.

Applicants without more than 100 shareholders can skip section G.

For help with choosing a tax year in section F, view the instructions.

Section I is for late filers. For information on relief for late filers, review the “general” section of the IRS instructions to Form 2553.

The final section must include the name and address of all shareholders and their signatures consenting to S corp election.

Part II

You’ll only need to complete part II if you selected box 2 or 4 in part I, in item F.

Part II can be challenging to complete. We suggest reviewing the “specific instructions” section of the IRS instructions to Form 2553 and consulting with an accountant if you have additional questions or concerns.

Part III

Part III is only for subchapter S qualified trusts. Most small business owners will not complete any of the information in this part.

Part IV

Part IV is rarely used. It is only completed if “a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective”. If this is the case for your small business, refer to “specific instructions” for Part IV of Form 2553.

Where to Send Form 2553:

Where to send form 2553 depends on which state your principal business, office, or agency is located in.

State Set 1:

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Form 2553 Mailing Address

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

Form 2553 Fax Number

855-887-7734

State Set 2:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming

Form 2553 Mailing Address

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Form 2553 Fax Number

855-214-7520

For a Free Consultation with a Tax Professional

LLC Electing S Corp Status

When to Use the S Corp Tax Classification

It only makes sense to file taxes as an S corp if there is enough profit to pay owners a reasonable salary and substantial distributions.

The S corp tax classification allows business owners to be taxed as employees of an LLC. Under an S corp, the LLC business owner pays FICA (Medicare and Social Security Tax) and income tax on their salary. Owner-employees pay only income tax on distributions.

S Corp Tax Benefit: In an S corp tax structure, a business owner can become an employee of the business and avoid paying self-employment taxes.

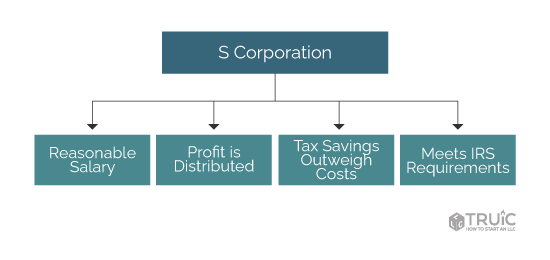

The following criteria determine whether electing the S corp tax classification makes sense for an LLC:

- The LLC business owners must earn a “reasonable salary”.

- The business should consistently earn a profit and pay distributions.

- The financial tax advantage must offset the cost of maintaining the S corp.

- The business must meet IRS S corp requirements.

Reasonable Salary

Under an S corp election, LLC owners become employees. The IRS requires owner-employees to be paid a reasonable salary. A reasonable salary is any salary that you would pay someone to do the same job.

LLCs taxed as S corps are subject to increased scrutiny by the IRS. If the owner is not paid a reasonable salary, this may lead to the IRS denying S corp status and may lead to fines and back taxes.

To determine a reasonable salary for your position, you can compare similar salaries on websites like Glassdoor or the US Bureau of Labor Statistics.

Profit and Distribution

The S corp election allows a business owner to disburse an LLC’s profit to owner-employees in the form of salary and distributions. The IRS then applies FICA and income taxes to only the salary. Distributions are subject to only income tax.

If the LLC doesn’t earn enough profit to cover a reasonable salary and distribution, it won’t make financial sense to elect the S corp tax classification. And, if the LLC owner(s) would like to forfeit salary for any reason, they could be subject to fines by the IRS.

Positive Return on Investment

It costs money to elect and maintain an S corp. Filing fees with the IRS are minimal but the additional bookkeeping and payroll costs are not. For LLCs that already have employees and payroll costs, this factor won’t hold as much weight.

Business owners should weigh the cost of maintaining these services against the fiscal tax advantage of electing the S corp classification. Generally speaking, a reasonable salary plus $10,000 in annual distributions is often enough to make electing the S corp financially viable.

IRS S Corp Requirements

The IRS requires that businesses that elect the S corp status have 100 shareholders or less and they are only allowed to issue one class of stock.

The owners of the business must be US citizens or permanent resident aliens. Owners must also be private individuals and not business entities such as LLCs, corporations, or trusts.

When to Use the Default LLC Classification

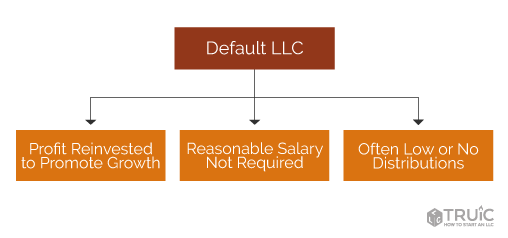

Many LLCs will benefit most from the default LLC tax classification. LLC owners often put any profit back into their small businesses each year to promote growth. And without profit and distributions, there’s no basis for electing an S corp.

Default LLC Tax Benefit: Business owners can choose to reinvest as much of the business’s profit as they see fit in any given tax year.

The default LLC tax structure is best suited for businesses with these characteristics:

- Their owners reinvest profit back into the business to promote growth

- The cost of bookkeeping and payroll services would outweigh the tax benefit of an S corp

Reinvesting LLC Profit and Pass-Through Taxation

If you expect to reinvest most of the profit back into your small business, default LLC status is the right choice.

Small businesses usually spend most of their income/profit on expenses like marketing, software, and office equipment to help the business grow. Some owners also want the choice to not pay themselves and that’s not possible with an S corp classification.

Pass-Through Taxation

When LLC owners choose to reinvest profit, very little net income (profit minus expenses) from the business will pass-through to the LLC member(s) individual tax returns.

You can visit our LLC Pass-Through Taxation guide to learn more about how default LLCs are taxed.

Return on Investment

For some LLCs, the cost of hiring a payroll service and bookkeeper would outweigh the financial tax advantages of electing S corp tax classification. These LLCs would be best to operate as a default LLC.

Should Your LLC Elect S Corp Classification?

Whether or not an LLC should elect S corp status depends on how much profit the business is going to earn.

Generally, if you know your business is going to be able to provide an annual distribution that is greater than $10,000 after paying yourself a reasonable salary, then your business has enough profit to justify becoming an S corp.

If you are unsure how much profit the LLC will make or if you want to reinvest the profits back into your LLC, it’s best to remain in the default LLC classification with the IRS. You can apply for an S corp status when it better suits your business.

To elect to become an S corp, file Form 2553 with the IRS.

S Corp Savings Calculator

Calculate how much you can save by choosing an S Corp tax classification

As a Sole Proprietorship or Single-Member LLC

Net Income:

Self Employment Tax:

S Corp

Net Income:

Salary:

Salary Employer Tax

(S Corp pays)

Dividend

Total Employment

Taxes Paid

Savings on Self Employment Taxes

Savings =

Against this savings, you have to balance the time and costs of running payroll and tax withholding. To learn more about what this will cost, get a free tax consultation.

Most small businesses file taxes under the default LLC tax classification. This is because small businesses don't usually generate the amount of profit required to make the S corp tax designation beneficial.

Under an S corp, business owner(s) can save about 17 percent on the distribution portion of their income if the following statements are true:

- The business can pay the owner(s) a "reasonable salary".

- There are substantial distributions year over year.

- There is a positive return on investment for payroll service costs.

- The business meets S Corp requirements.

Form 2553 FAQ

Where you send your form depends on what state your principal place of business is located in.

State Set 1:

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Form 2553 Mailing Address

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

Form 2553 Fax Number

855-887-7734

State Set 2:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming

Form 2553 Mailing Address

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Form 2553 Fax Number

855-214-7520

An S corporation (S corp) is a tax designation for which an LLC or a corporation can apply.

No. An S corp is a tax designation for which an LLC or a corporation can elect.

You can form an S corp by filing Form 2553 with the Internal Revenue Service (IRS).

S corps must meet four requirements:

- They can have no more than 100 shareholders.

- All shareholders must be private individuals (not other business entities).

- Shareholders cannot be nonresident aliens.

- The business may only issue one class of stock.

Owners of S corps are considered employees of their company and they can save thousands of dollars on self-employment taxes as a result.

No. The default taxes for an LLC and taxes for an S corp are not the same.

With an S corp, owners pay personal income tax and self-employment tax on a predetermined salary. They may then withdraw any remaining profits from the business as a “distribution,” which isn’t subject to self-employment tax.

With an LLC, all company profits pass through to the owners’ personal tax returns, and then the owners must pay personal income tax and self-employment tax on the entire amount.

Both LLCs and S corps benefit from a provision in the Tax Cuts and Jobs Act of 2017 that allows qualifying owners of pass-through entities to deduct 20% of qualified business income (QBI) from their tax returns. However, for S corps, the deduction doesn’t apply to profits paid out as wages.

Unlike the default LLC business structure, in which owners must pay self-employment tax on all of the company’s profits, owners of S corps are considered employees of the business and only have to pay self-employment tax on a salary they receive. Any other money they take from the company’s profits in the form of disbursements isn’t subject to self-employment tax.

S corp owners are required to earn a “reasonable” salary, which basically means a fair market rate based on the individual’s qualifications as well as their duties and responsibilities at the company. The purpose of this requirement is to prevent S corp owners from paying themselves an artificially low salary in order to pay less self-employment tax.

A distribution is a dividend that a shareholder/owner can take from the business profits that remain after a company pays all of its employee salaries. Shareholders must pay personal income tax on distributions, but distributions aren’t subject to self-employment tax.

Pass-through taxation is a system of taxation that generally applies to sole proprietorships, partnerships, LLCs, and S corps. In this system, the profits or losses of the business are not taxed at the business level. Instead, they pass through to the owners’ personal tax returns and are taxed at each owners’ personal income tax rate.

There’s no corporate tax rate for S corps. Instead, owners of S corps pay personal income tax on the company’s profits. This rate depends on each owner’s personal income tax bracket.

LLCs and corporations that operate under a DBA name can choose the S corp election.