How to Choose a Business Structure

Knowing how to choose a business structure is easy.

When you choose a business structure, the most important thing to think about is whether you need limited liability protection. Limited liability protects your personal assets if your business is sued.

Any business that is more than a hobby needs liability protection and starting an LLC is the easiest and least expensive way to get it.

Business Structure Tool

Find the Right Business Structure For You

Figure out which business structure works best for you — in just a few easy questions.

Answer a few short questions about your business and we’ll recommend the right structure for you — plus show you how to get started.

Choosing a Business Structure

The first step in choosing a business structure is figuring out if you need personal liability protection.

Businesses that carry any amount of risk need liability protection.

What is personal liability protection? Liability protection can create a legal separation between your personal assets and your business.

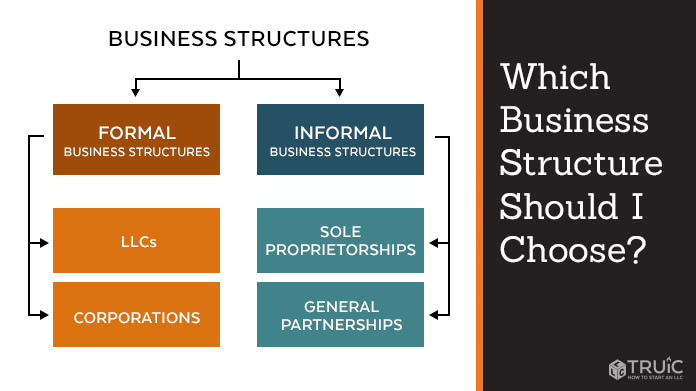

Formal business structures like LLCs and corporations offer liability protection because the business is legally separated from its owner. But only businesses that need outside investors should form a corporation.

Informal business structures like sole proprietorships and partnerships don’t offer protection because there isn’t any separation between the business and the owner. Therefore, the owner’s personal assets are completely exposed to creditors and lawsuits.

An LLC is the most popular, simple, and inexpensive way to get personal liability protection.

Northwest offers LLC formation for $29 plus state fees.

Sole Proprietorship and Partnership: Informal Business Structures

Informal business structures don’t offer taxation benefits or personal liability protection.

There are two main types of informal business structures:

Sole proprietorship. A business owned by an individual that isn’t formally organized. A sole proprietor files taxes under his or her own name and is personally liable for any actions taken against the business.

General partnership. A business owned by more than one individual that isn’t formally organized. A general partnership files taxes under the partners’ names and the partners are liable for any actions taken against the business.

When to Use a Sole Proprietorship or Partnership

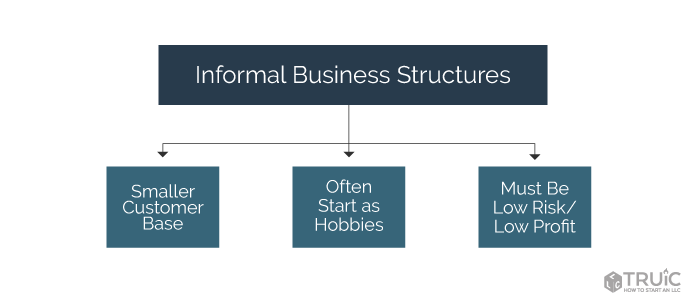

Informal business structures like sole proprietorships and general partnerships are best for businesses with the following characteristics:

- They MUST be very low risk (low chance of liability or financial loss)

- They have a smaller customer base; often friends, family, and neighbors

- They sometimes start as hobbies like photography, blogging, or video streaming

Advantages and Disadvantages of Informal Structures

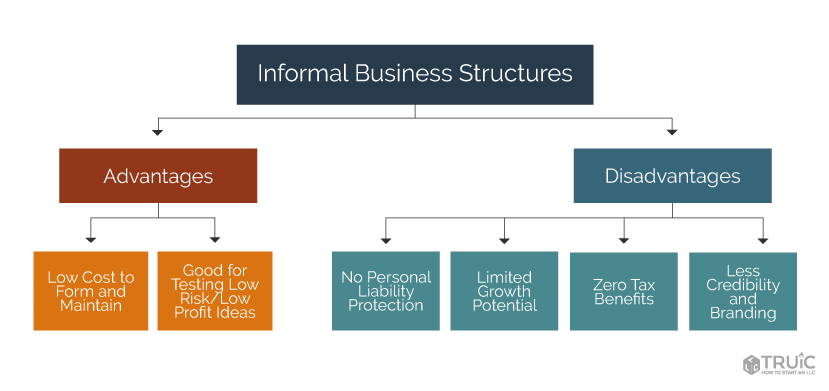

The biggest advantage of starting a sole proprietorship or partnership is simplicity; it couldn’t be any easier or less expensive to get a business up and running.

Disadvantages of Informal Business Structures:

- No Personal Liability Protection. Informal business structures don’t offer personal liability protection. This means your personal assets (car, house, bank account) are at risk in the event your business is sued or if it defaults on a debt. ONLY low profit/low-risk businesses should operate as informal businesses.

- Zero Tax Benefits. Sole proprietors and partnerships pay self-employment taxes and income taxes on their net profit. When a business becomes profitable, it will be very expensive to be taxed as an informal business structure.

- Limited Growth Potential. High tax burden and lack of liability protection can keep a business from being successful.

- Reduced Credibility and Branding Opportunities. A sole proprietor or partnership must invoice, receive payment, open a bank account, and market with their surname(s) unless their state allows them to register and maintain a doing business as (DBA) name.

LLCs and Corporations: Formal Business Structures

Formal business structures offer tax benefits, increased credibility, and most importantly, personal liability protection.

There are two main types of formal business structures:

Limited Liability Company (LLC). An LLC is a formal legal business structure that is owned by its members. An LLC is the simplest way of structuring your business to protect your personal assets in the event your business suffers a loss. LLCs also offer unique tax benefits.

Corporation. A corporation is a formal legal business structure that is owned by shareholders. A corporation offers personal liability protection and is more complex to maintain than an LLC. Setting up a corporation is most helpful when you need to attract outside investors.

LLCs are simple to start and maintain. Visit our Form an LLC guide for simple step-by-step instructions for forming your LLC.

When To Use A Formal Business Structure

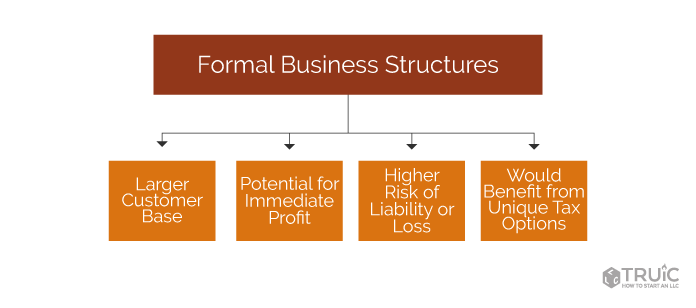

Formal business structures like LLCs and corporations are recommended for businesses with the following characteristics:

- Larger customer base

- Potential for immediate and sustainable profit

- Increased risk of liability or loss

- Would benefit from unique tax options

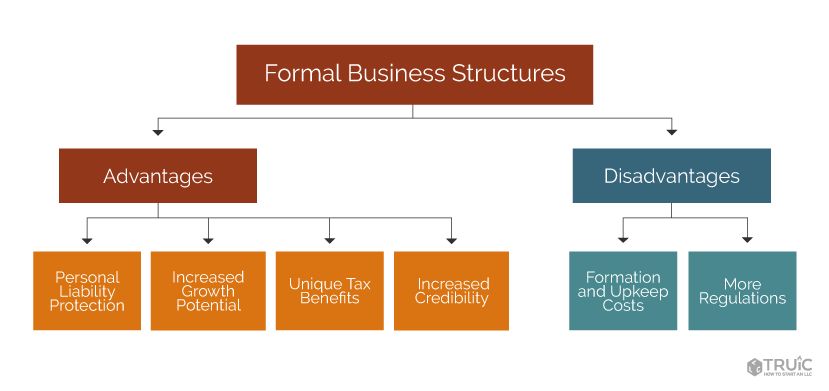

Advantages and Disadvantages of Formal Business Structures

The only disadvantages of forming a formal legal structure are cost and maintenance. For a profitable business, these disadvantages are outweighed by financial and legal advantages.

Advantages of Formal Business Structures:

- Personal Liability Protection. Formal business structures like LLCs and corporations provide personal liability protection. This means your personal assets (car, house, bank account) are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. Formal business structures like LLCs and corporations have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. Formal business structures like LLCs and corporations can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs and corporations generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a business’s ability to take out loans and can affect marketability.

Choosing an Informal vs Formal Business Structure

Personal liability protection is the primary factor to consider when choosing a business structure. Luckily, it’s fairly simple to tell if you need it.

If your business faces liability or risk, or uses business credit, you must have personal liability protection.

How to Form a Sole Proprietorship or Partnership

If you don’t expect to earn much of a profit or be held liable for an injury etc., you can form your business simply by operating it. In most states, a sole proprietorship doesn’t require any type of registration with the government.

Some states require general partnerships to register their business names. To research whether this applies in your state, visit our How to File a DBA guide and choose your state from the drop-down.

Form an LLC or Corporation

If you expect to earn a profit or if there is any potential risk in operating your business, you must operate under a formal legal structure to protect your personal assets.

LLCs are simple to start and maintain and most small business owners choose to form an LLC.

Our Cost to Form an LLC is a helpful guide for making the choice to operate as a sole proprietor vs LLC.

Next, we will guide you through choosing between an LLC vs a corporation. Then, we will discuss when it makes sense to opt for the S corp tax designation.

Visit our Form an LLC guide for simple step-by-step instructions for forming your LLC. You can also hire an LLC formation service to set up your LLC (for an additional small fee).

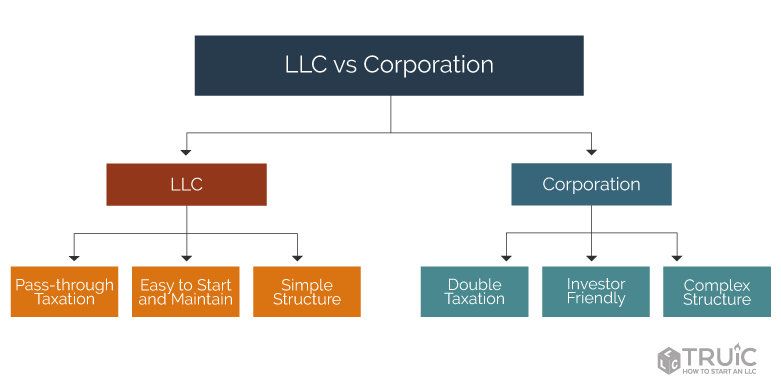

Choosing Between an LLC and Corporation

Most small businesses benefit the most by forming a limited liability company (LLC) vs a corporation. This is because corporations are hard to maintain and most small businesses don’t carry over enough profit each year for it to make sense to pay high corporate taxes.

However, if your business will need to rely on outside investors, a corporation will be the best choice.

When To Form an LLC

Most small businesses start as limited liability companies (LLCs). An LLC is most likely the best structure for your business if:

- you don’t need to attract investors

- you plan to invest most of your profit back into the business each year

- you would benefit most from an easy to maintain business structure

Pass-Through Taxation and S Corporation Election

If you expect to reinvest most of the profit back into your small business and you don’t need to attract investors, it would make sense to form an LLC.

Small businesses usually carry very little profit from one tax year to the next. This is because small businesses often spend most of their income on expenses to help the business grow.

LLCs can also elect the S corporation tax classification. This option is for LLCs that generate enough profit to pay it’s owner(s) a reasonable salary and regular yearly distributions of about $10,000 or more.

Pass-Through Taxation

Pass-through taxation means the net income (profit minus expenses) of the business passes through to the LLC member(s) individual tax returns. This means the business itself will not be taxed and you will only be subject to income tax on the business’s net income. Distributions are subject to both income tax and FICA taxes.

A corporation’s net income is taxed once on the corporate level at 21%. If any of that profit is paid as dividends to shareholders, they pay income tax and FICA taxes on the dividend as well.

To learn more, read our LLC vs. Corporation Taxes guide.

S Corporation Tax Option for LLCs

If you anticipate earning a substantial profit each year and don’t need to attract investors, then an LLC that is taxed S corporation would make the most sense for your business. We will cover this topic in detail in the last section of this guide.

LLCs are Easy to Start and Maintain

Limited liability companies (LLC) are a simple business structure: they require less paperwork, less administrative overhead, and are much easier to start and maintain than a corporation.

LLCs are also adaptable and can elect to become corporations at a later date. This makes LLCs a great starting point for your business to grow.

When to Form a Corporation

Most small businesses start as limited liability companies (LLCs) but there are some instances when starting as a corporation makes sense.

Your small business would benefit from a corporate structure if:

- you need to attract venture capitalist and investors

- you need to carry significant profit over from tax year to tax year

- there is benefit in managing a complex business structure

Profit Carryover from Year to Year

If a small business is unable to spend a significant amount of its profit during a tax year on expenses to grow the business, it could make sense to structure the business as a corporation rather than an LLC. This is because of the difference in the way the two business entities are taxed.

A corporation is taxed at about 15% for all profits that carry over to the next tax year. In this same scenario, an LLC member’s tax burden would be greater because they pay FICA taxes and federal and state income taxes, which are higher than the 15% corporate rate.

That said, a business owner who anticipates needing to carry profit into the next tax year should look closely at the financial benefits of forming a corporation.

Venture Capital and Investors

If you need to attract investors, starting a corporation could be the best choice for your small business.

An investor in a corporation pays taxes on dividends only when they receive them whereas an investor in an LLC would have to pay taxes regardless of whether they received a distribution or not. The LLC investor might never see a return on their investment but might have to pay taxes every year regardless. This is why investors prefer C corps.

Managing a Complex Business Structure

If the benefits of managing a complex business structure outweigh the costs, starting a corporation could make sense for your small business.

Corporations are more complex organizations compared to LLCs, with increased administrative overhead, more paperwork, and complex compliance requirements. Managing a corporation may require help from an attorney or accountant which can increase overall business costs.

To learn more about the complexities of running a corporation, visit our How to Start a Corporation guide.

Form an LLC or Corporation

Most small business owners choose to form an LLC rather than a corporation. Follow the steps below to get started with the best option for your business.

Next Steps for Starting a Corporation

If your business will benefit most from a corporate structure, visit our How to Start a Corporation page and select your state from the drop-down menu. We provide easy to follow steps for starting (and running) a corporation yourself.

Next Steps for Starting an LLC

Small businesses often benefit most from forming an LLC vs a corporation. We offer easy to follow guides for starting an LLC in every state. Visit our How to Form an LLC page and select your state from the drop-down menu to get started today.

Recommended: Continue reading below for more information about the S corporation tax designation for LLCs.

S Corporation Tax Designation

Most small businesses file taxes under the default LLC tax classification. This is because small businesses don’t usually generate (or net) the amount of profit that would make the S corp tax designation beneficial.

Under an S corp, business owner(s) can save about 17 percent on the distribution portion of their income if the following statements are true:

- The business can pay the owner(s) a “reasonable salary”.

- There are substantial distributions year over year.

- There is a positive return on investment for payroll service costs.

- The business meets S Corp requirements.

When to Elect the S Corp Tax Designation

The S corp tax classification allows business owners to be taxed as employees of an LLC. Under an S corp, the LLC business owner pays FICA (Medicare and Social Security Tax) and federal income tax on only their salary. Distributions are then only subject to income tax.

S Corp Savings Calculator

Calculate how much you can save by choosing an S Corp tax classification

As a Sole Proprietorship or Single-Member LLC

Net Income:

Self Employment Tax:

S Corp

Net Income:

Salary:

Salary Employer Tax

(S Corp pays)

Dividend

Total Employment

Taxes Paid

Savings on Self Employment Taxes

Savings =

Against this savings, you have to balance the time and costs of running payroll and tax withholding. To learn more about what this will cost, get a free tax consultation.

Form an S Corp

You can start an S corp yourself or have ZenBusiness form your S corp for you.

When To Use The Default LLC Classification

Many LLCs will benefit most from the default LLC tax classification. LLC owners often put any profit right back into their small businesses each year to promote growth. And without profit and distributions, there's no basis for electing an S corp.

Default LLC Tax Benefit: Business owners can choose to invest as much of the businesses profit as they see fit in any given tax year.

The default LLC tax structure is best suited for businesses with these characteristics:

- Their owners reinvest profit back into the business to promote growth

- The cost of bookkeeping and payroll services would outweigh the tax benefit of an S corp

S Corp Tax Benefit: When a reasonable salary is present, the owner pays FICA and income taxes on salary only. LLC distributions are then only subject to income taxes.

The following criteria determine whether electing the S corp tax classification makes sense for an LLC:

- The LLC business owners must earn a "reasonable salary".

- The business should consistently earn a profit and pay distributions.

- There should be a positive tax advantage to offset the cost of maintaining S corp upkeep.

- The business must meet IRS S corp requirements.

To learn more about the difference and benefits of default LLC vs S Corp classifications, read our LLC vs. S Corp article.

Business Structure Resources

Business Structure FAQ

The steps to starting a business vary depending on the type of business you plan to start and the state in which it will operate. You can find detailed information in our How to Start a Business, How to Start a Corporation, and How to Form an LLC guides. Simply select your state from the drop-down menu to see its specific steps and requirements.

There are four main types of business structures:

Several additional types exist within these main groups, such as nonprofit corporations, benefit corporations, single-member, and multi-member LLCs, limited partnerships, general partnerships, and more.

Yes. The process for changing your business structure varies depending on the type of change and the state in which your business is located.

An informal business structure is a category that includes sole proprietorships and general partnerships. In these structures, there’s no legal separation between the business and the owners.

A formal business structure is a category that includes corporations and LLCs. In these structures, the businesses are separate legal entities from their owners.

The best type of structure for your business will depend on your business’s particular characteristics and needs. An LLC structure may be the best choice for some businesses while a corporation or partnership might work better for others.

The best business structure for a small business will depend on that business’s particular characteristics and needs. There is no single answer for all small businesses. However, small businesses use the LLC, partnership, and sole proprietorship structures more often than a corporate structure.

We recommend the LLC as the best business structure for most small businesses because they are simple to operate and create and they provide limited liability protection and pass-through taxation.

Visit our Should I Start An LLC for My Small Business guide to learn more.

Pass-through taxation is a system of taxation that generally applies to sole proprietorships, partnerships, LLCs, and S corps. In this system, a business’s profits or losses are not taxed at the business level. Instead, they pass through to the owners’ personal tax returns and are taxed at each owner’s personal income tax rate.

Limited liability protection means that a business owner’s personal assets are protected in the event that the company goes into debt or faces a lawsuit. Corporations, LLCs, and LLPs each offer limited liability protection. Sole proprietorships and partnerships do not.

Formal business structures, such as corporations and LLCs, potentially offer tax benefits. The best tax structure for a business will depend on its particular characteristics.

An S corporation (S corp) is a tax designation applicable to either an LLC or a corporation. Under this tax structure, the Internal Revenue Service treats owners as employees. The owner-employee then pays FICA taxes and income taxes on only their reasonable salary. Distributions are subject to only federal and state income taxes.

S corps can have additional advantages as well as disadvantages, which you can read about in our What is an S Corporation article.

The best structure will depend on your business’s particular characteristics and needs. However, it’s generally a good idea to choose a structure with limited liability protection when the business involves rental properties. This includes LLCs and corporations.

Hiring an attorney may or may not be necessary when starting a business. It depends on the type of business structure you choose and your level of comfort with the process. Starting a sole proprietorship is quite simple. Forming an LLC is a bit more complicated, but can typically be done without the help of an attorney. Starting a corporation is a more complex process than starting an LLC so hiring an attorney is often advised.

Read our How to Start a Business, How to Start a Corporation, and How to Form an LLC guides to learn more about the process of starting a business and decide if you need to hire an attorney.

With corporations, income is taxed at the corporate level and then the owners must pay personal income tax on the dividends they receive. Because profits are effectively taxed twice, this is often referred to as double taxation.

Different states and localities have their own rules regarding business licenses. Check with your state and local government offices to determine the specific requirements for your business.

If your business is a corporation, multi-member LLC, partnership, or trust, it needs an Employer Identification Number (EIN). Single-member LLCs and sole proprietorships that have employees also must obtain an EIN.