How to Choose Your LLC Tax Status

LLCs are one of the most flexible business structures, especially when it comes to tax purposes. But how do you decide which method of taxation is best for your business? Keep reading to learn which tax classification is right for your LLC and its members.

Recommended: One consultation with 1-800 Accountant could save your business thousands in taxes. Schedule Your Free Call.

Three Types of Tax Classifications

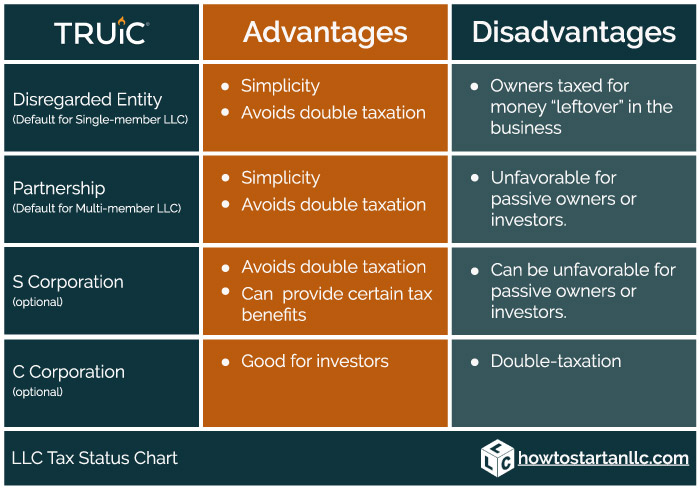

For tax purposes, you can choose your LLC to be classified as one of the following:

- Disregarded entity

- Partnership

- Corporation (either S corp or C corp)

An LLC is classified by default as either a disregarded entity or a partnership based on the number of owners (members). A single-member LLC is automatically treated as a disregarded entity by the IRS, and a multi-member LLC is considered a partnership.

In both of these cases, the LLC is treated as a “pass-through” entity. This means that the LLC income is not directly taxed. Instead, the income “passes through” to the owners, who then pay tax on their individual income tax returns.

Another option available for LLCs is to elect to be taxed as a corporation. Both single-member and multi-member LLCs can apply for C corp status. Keep in mind that this classification is for tax purposes only and does not change the nature of the LLC as an entity.

Deciding on a Tax Status

There are many factors to keep in mind when choosing a tax status for your LLC. Consider the size of your business, your financial plans, and your overall goals for the company

Companies are only allowed to change tax status once every five years. We recommend speaking with a tax professional to discuss your options before making a final decision.

Disregarded Entities

By default, single-member LLCs are taxed as disregarded entities.

Advantages

This is the simplest and most common tax status for single-member LLCs. As a disregarded entity, the LLC is not viewed as a taxable entity by the IRS. Instead, the income from the LLC passes through to the owner, who pays income tax on their personal tax return. This means that all income is only taxed once.

Disadvantages

The biggest disadvantage of the disregarded entity tax status is that the LLC owner is taxed on all LLC income, even if some earnings are kept in the business account at the end of the year for future expenses.

Who is this status right for?

Due to its simplicity and the fact that it doesn’t require any extra paperwork, the default tax status of a disregarded entity is a good fit for most new business owners. However, if you plan to keep a lot of money in your business account year after year, then you may want to consider opting for a different tax status.

Partnerships

Multi-member LLCs are normally taxed as partnerships. The partnership tax status is more or less identical to that of a disregarded entity, except that it is for businesses with multiple owners.

Advantages

Like disregarded entities, partnerships are not directly taxed by the IRS. Income from the partnership passes through to the different owners, who are then taxed according to their share of ownership. Business owners also avoid the “double-taxation” model of corporations.

Disadvantages

The partnership tax status can pose problems for businesses with passive LLC members. The reason is that all members must pay tax on their share of the LLC’s profits regardless of whether or not they received a distribution.

This is one of the main reasons why investors typically prefer investing in corporations versus LLCs.

Who is this status right for?

As a simple and effective tax structure, many multi-member LLCs will find the partnership tax status to be an ideal choice. However, if your company plans to seek funding from outside investors or other types of passive owners, you may want to consider being taxed as a corporation.

S Corporations

A Subchapter S (popularly known as an S corp) is a tax status available to corporations and limited liability companies. Both corporations and LLCs can elect to be taxed as an S corp.

Advantages

S corps offer pass-through taxation, much like an LLC’s default tax status. The business itself pays no federal income tax; however, the remaining profits, after expenses and distributions (ie. owner/member salaries and shareholder dividends), pass through to the owner and are subject to income tax only and not employment tax. After all distributions are allocated and properly taxed, these remaining business profits are then known as “retained earnings.” In this way, S corps avoid the double-taxation of traditional C corps.

Another advantage of S corps is that active business owners are considered employees of the corporation and the S corp pays payroll tax, like a normal employer. Any money remaining in the business at the end of the year can be distributed to active shareholders as dividends, thus reducing the business owners’ total tax obligations.

Keep in mind, however, that the IRS strictly requires all S corporations to pay shareholders a “reasonable salary.” This means that the owner of a business with S corp tax status cannot be paid a low salary in an attempt to avoid paying taxes.

Read this article to learn more about reasonable salaries.

Disadvantages

The IRS has certain limitations on what businesses can elect S corp status. In order to qualify, the LLC must:

- Have only allowable shareholders

- May be individuals, certain trusts, and estates

- May not be partnerships, corporations, or non-resident alien shareholders

- Have no more than 100 shareholders

- Have only one class of stock

Another disadvantage is that shareholders are taxed on LLC earnings regardless of whether or not they receive a distribution.

Who is this status right for?

The S corp tax status is ideal for successful business owners who earn more than average in their field, as in some cases it can allow for certain tax benefits. We recommend consulting with a local tax professional to learn more about this option and if it is a good fit for your business.

C Corporations

The final type of tax status LLCs can choose from is that of a C corp. Unlike most LLCs, C corporations pay taxes on their annual earnings. The corporation then distributes profits to shareholders (also known as owners), and they pay tax on the dividends. This process is popularly known as “double-taxation.”

Advantages

There are a number of advantages that come with the C corp tax status. Unlike S corps, C corporations are able to have an unlimited number of shareholders, and there are no limitations on who can hold shares.

Another advantage of being taxed as a corporation is that active shareholders are considered employees of the business. This means they can receive healthcare and other benefits packages from the company, without having to pay extra tax.

It is also significantly easier to transfer ownership of shares in a C corp versus an LLC.

Disadvantages

LLCs taxed as C corps are subject to double taxation. This means that the company and its owners will likely pay more in taxes overall. In addition, LLCs taxed as C corps require more paperwork.

Who is this status right for?

The C corp tax status is especially suited for companies that wish to work with outside investors.

We partnered with lawyers to create free legal forms for your LLC, including an operating agreement tool, LLC resolution templates, and valuable hiring documents.