How Much Does It Cost to Start an LLC?

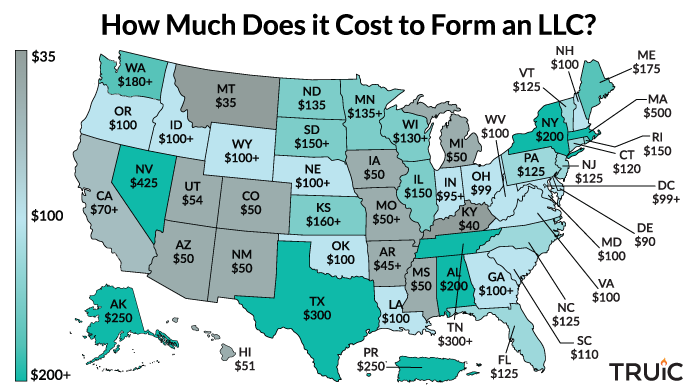

Depending on the state in which your business will be based, as well as how you plan to register it, the cost of LLC formation you’ll be faced with can vary from anywhere between $35 and $500.

While state filing fees will be the biggest factor contributing to your overall LLC cost, there are a number of additional expenses you’ll also need to budget for when starting out — such as a registered agent service, naming your LLC, and any publication costs (if applicable).

In this How Much Does it Cost to Start an LLC article, we’ll break down all the key costs associated with forming and maintaining a limited liability company (LLC).

Recommended: More than 84% of our readers form their LLC through a professional service to save time and avoid mistakes.

Northwest ($29 + State Fees)

LLC Cost By State

As we mentioned above, the main cost of forming an LLC is the fee you’ll need to pay in order to file your LLC’s Articles of Organization with the Secretary of State.

Since these filing fees vary significantly from state to state, we’ve outlined them for you in the table below so that you can quickly find the information that’s relevant to your location.

|

State Filing Fees |

| State | Initial Filing Fee(s) |

| Alabama | $200 + $25 Name Reservation Fee |

| Alaska | $250 |

| Arizona | $50 + Publishing Requirement |

| Arkansas | $50 |

| California | $70 |

| Colorado | $50 |

| Connecticut | $120 |

| Delaware | $110 |

| Florida | $100 + $25 Registered Agent Fee |

| Georgia | $100 |

| Hawaii | $51 |

| Idaho | $100 |

| Illinois | $150 |

| Indiana | $95 |

| Iowa | $50 |

| Kansas | $160 |

| Kentucky | $40 |

| Louisiana | $100 |

| Maine | $175 |

| Maryland | $100 |

| Massachusetts | $500 |

| Michigan | $50 |

| Minnesota | $135 |

| Mississippi | $50 + $4 Processing Fee |

| Missouri | $50 |

| Montana | $35 |

| Nebraska | $100 + Publishing Requirement |

| Nevada | $425 |

| New Hampshire | $100 |

| New Jersey | $125 |

| New Mexico | $50 |

| New York | $200 + Publishing Requirement |

| North Carolina | $125 |

| North Dakota | $135 |

| Ohio | $99 |

| Oklahoma | $100 |

| Oregon | $100 |

| Pennsylvania | $125 |

| Rhode Island | $150 |

| South Carolina | $110 |

| South Dakota | $150 |

| Tennessee | $300 |

| Texas | $300 |

| Utah | $54 |

| Vermont | $125 |

| Virginia | $100 |

| Washington | $180 |

| Washington D.C. | $99 + DC Zoning Permit and District Business License |

| West Virginia | $100 |

| Wisconsin | $130 |

| Wyoming | $100 |

Of course, the process of getting your LLC up and running involves far more than just paying the relevant formation fee. In fact, it can actually involve a range of complicated tasks, including filing paperwork, drafting operating agreements, and ensuring compliance with ongoing state regulations.

To avoid the headaches associated with navigating the specific filing requirements in each state, many business owners prefer to let a professional handle this on their behalf for a nominal fee.

Recommended Service

More than 84% of our readers form their LLC through a professional service to save time and avoid mistakes. If you’re interested in getting started, we’ve also negotiated a tailored discount that brings the total cost of LLC formation down to just $29 (excluding state fees).

Northwest ($29 + State Fees)

Alternatively, you can have a look at our Best LLC Formation Services review for more information.

Other LLC Costs and Fees

Alongside the initial filing fee you’ll be required to pay to register your LLC with the Secretary of State, there are a number of other potential and mandatory costs to be aware of when starting out.

Registered Agent Service ($130+)

As part of the process of submitting your LLC’s Articles of Organization — or your state’s equivalent of this document — you’ll typically be required to appoint what’s known as a registered or resident agent.

This is an individual or entity that must be selected to receive legal documents and official notices on behalf of your LLC. Though you can perform this role yourself, it’s recommended to instead appoint a third party — such as a business attorney or registered agent service — in order to ensure that your business stays compliant with all state regulations and keep your personal address private.

In general, you can expect to spend around $130 a year on a professional registered agent service, with the first year post-formation being offered for free with most reputable services.

Note: If you’re interested in finding out more about this, you can have a look at our detailed review of the Best Registered Agent Services in 2026.

Naming Your LLC ($0-$50)

When it comes to naming your LLC, there are two main potential costs to be aware of:

- Reserving a name for your business

- Obtaining a “Doing Business As” (DBA) name

With the exception of Alabama — where it’s mandatory to reserve an LLC’s name during the formation process — it’s important to note that both of these two costs are entirely optional. However, they can be quite beneficial in a number of situations, so it’s worth factoring them into your initial budget.

In most states, these two costs will typically each fall somewhere in the $10 to $50 range, though there are some states where they can be a little pricier (e.g., California).

Additionally, it’s important to note that in many states these reservations are only temporary, meaning you’ll need to keep paying in order to renew them and keep your desired business name or DBA name secure.

Note: If you are thinking about reserving a name to use later for your business, make sure to check it’s actually available by performing an LLC Name Search.

Operating Agreement ($0+)

An LLC operating agreement is an internal document that outlines how your business will be run, including the roles, duties, and obligations of its members, as well as how key decisions will be made and your company’s management structure.

If your LLC is based in any of the following states, it will be legally required to draft an operating agreement, though it won’t need to file it with the Secretary of State:

- California

- Delaware

- Maine

- Missouri

- New York

However, even in states where it’s not required, creating an operating agreement is highly recommended — especially for multi-member LLCs — as it can help to maintain your business’s corporate veil (which protects its limited liability status) as well as reducing the likelihood of internal conflicts.

Despite how important this document is, it’s not really necessary to pay an extortionate amount for a lawyer to draft one of these up for you, as you can easily do this yourself using a Free LLC Operating Agreement Template.

Initial Report Filing ($20-$200)

In a small handful of states, newly-formed LLCs will be required to file what’s known as an “initial report” with the Secretary of State within a set period of time after they’ve been registered.

The purpose of this report is similar to that of the annual and biennial reports that are required in most states — to provide the Secretary of State with key details regarding your LLC, such as its business address, registered agent information, and current ownership or management structure.

However, unless you’re looking to form an LLC in one of the following five states, you won’t need to complete this step:

- Alaska: LLC owners must submit their first biennial report to the Secretary of State within six months of being registered ($200 fee).

- California: LLCs must submit an initial report within 90 days of incorporation ($20 fee).

- Louisiana: LLCs must include an initial report alongside their Articles of Organization, which carries no fee unless the LLC needs to file these separately ($25 fee).

- Nevada: LLCs must submit an “initial list” — which is the local name for an initial report — as part of the formation process ($150 fee).

- Washington: LLCs based here must submit an initial report to the Corporations and Charities Division within 120 days of being registered ($10 fee).

Once this is complete, LLCs will be required to periodically submit these reports and pay the relevant filing fees — typically on an annual or biennial basis —- in order to keep the Secretary of State’s records up-to-date.

Publication Costs ($40-$1,500)

In some states, LLCs will also be required to publish a notice of their formation in a local newspaper before they can begin their operations.

This requirement is only applicable to LLCs based in Arizona, Nebraska, and New York, though the costs associated with it can vary significantly depending on the location and newspaper used — from anywhere between $40 and $2,000.

The reason for this wide variation in cost is largely due to differences in local newspaper rates between these states, as well as the minimum length of time the notice must be published for. For example, while Nebraska requires LLCs to publish a notice for three consecutive weeks, LLCs in New York must do so for six weeks in two newspapers.

Similarly, publishing costs can vary greatly depending on the county you’re based in, with rural areas (e.g., Allegany) typically charging far less than larger, urban ones (e.g., New York County).

For this reason, many LLC owners in these states choose to hire a professional registered agent, as they can use their RA’s office as their business’s principal office — which in turn allows them to publish their notices in a more affordable county. (if applicable).

Ongoing Maintenance Costs

Once you’ve registered your business, there are still certain mandatory costs you’ll need to take into consideration that are associated with the general maintenance of your LLC.

We’ve covered the key ongoing costs you should be aware of in more detail below.

Annual/Biennial Report Fees ($0-$500)

As we mentioned above, LLCs in almost all states will be required to periodically submit either an annual or biennial report with the Secretary of State in order to remain in good standing.

This requirement is generally quite straightforward to comply with and normally costs around $50, though it can carry a significant cost in some cases — with annual reports reaching up to as much as $500 in some states.

Example: LLCs based in Florida must pay $138.75 annually in order to submit this report and remain compliant, while those based in New York only need to pay $9 every other year.

Since it’s easy to lose track of these filings — and non-compliance with these requirements can incur heavy fines and harsh penalties — many businesses prefer to leave it in the hands of a professional LLC formation service.

State Business Licenses ($0-$200)

Another important ongoing cost to bear in mind is the expense associated with obtaining any state business licenses that an LLC may need, as well as keeping them valid.

In a small handful of states a universal business license is required for all local LLCs to be able to operate legally, such as Delaware ($75 annual fee), Alaska ($50 annual fee), and Nevada ($200 annual fee).

On top of these general statewide licenses, there are also a number of others that your LLC may be required to obtain based on the business activities that it engages in.

For example, any LLCs involved in construction or building work in California will be required to obtain a contractor’s license, which typically costs $450 to apply for.

Franchise Taxes

The final key ongoing cost your LLC will need to budget for is franchise tax. This tax, which goes by various names depending on the state, is levied by a number jurisdictions, including:

- Arkansas: Annual Franchise Tax ($150)

- California: Annual Tax ($800)

- Delaware: Annual Franchise Tax ($300)

- Minnesota: Annual Partnership Tax

- New Hampshire: Annual Business Enterprise Tax

- Ohio: Annual Commercial Activity Tax

- Tennessee: Annual Franchise/Excise Taxes ($50 per member)

- Texas: Annual Franchise Tax

This tax is often fixed at a set amount, though some states apply it according to an LLC’s annual earnings. You can find out more about this in our in-depth LLC Taxes overview.

How Much Does it Cost to Start an LLC FAQs

The cost to start an LLC varies by state, but it typically falls somewhere between $50 and $500 to submit your LLC’s formation documents (known as the Articles of Organization or Certificate of Formation).

In addition to this, you may face costs for business licenses, operating agreements, and hiring registered agent services (among other things).

You can find out more about this by checking out our How to Form an LLC guide.

Yes, in most states, LLCs are required to pay ongoing fees to maintain their legal status. These may include annual or biennial report fees, which can range from $0 to $500 depending on the state.

If you’re interested in finding out more, we discuss some money saving tips in our How to Save Money Forming Your LLC guide.

An LLC is not legally required for every business, but it provides significant advantages, particularly in terms of the limited liability protection it provides for your personal assets, as well as the tax flexibility and additional credibility it grants.

Be sure to check out our guide on Should I Start an LLC for a more in-depth look into this topic.

It’s typically best to form your LLC in the state where your business will operate. While some states like Delaware and Nevada are popular for their business-friendly laws, forming an LLC outside your home state may result in additional costs and compliance requirements.

To learn more, have a look at our Best State to Form an LLC guide.