Single-Member LLC Taxes

The IRS treats single-member LLCs as disregarded entities for tax reasons by default. However, single-member LLCs can also choose to be taxed like a corporation.

Which is right for your business? Read on to find out more about how single-member LLCs are taxed and what forms they need to file.

Recommended: One consultation with 1-800 Accountant could save your business thousands in taxes. Schedule Your Free Call.

What is a Single-Member LLC?

A single-member LLC is a business with only one owner that is not taxed separately from their business. Like a sole proprietorship, a single-member LLC is taxed as a disregarded entity by default.

Because the government ignores disregarded entities, they undergo “pass-through taxation.” This means all profits or losses from the business pass through the business directly to you, the business owner. You, in turn, are responsible for paying income and employment taxes on your earnings via your personal tax return.

For more information about paying yourself as a single-member LLC, visit our guide.

C Corp and S Corp Taxation

Single-member LLCs can choose two other ways of paying income tax: C corporation or S corporation.

C corporation (C corp) taxation means that the LLC pays taxes on gross income, then distributes the profit to the owner. The owner then pays income tax on the dividends, which is also known as “double taxation.”

S corporation (S corp) taxation means that the LLC owner can enjoy limited liability status while avoiding double taxation. The owner can be considered an employee of the LLC, meaning they only have to pay tax on the salary they set for themselves and not on the remaining profits.

LLC Federal Taxes

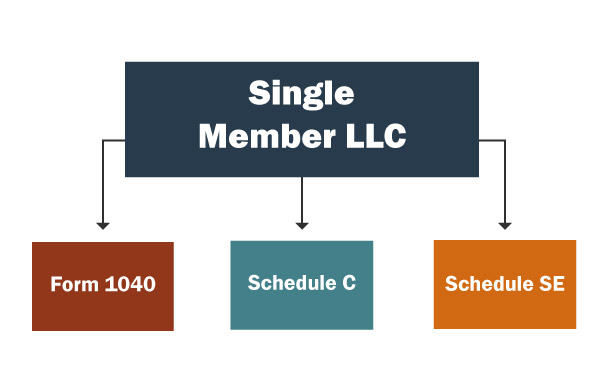

To file your income taxes as the owner of a disregarded entity, you must file the following documents:

- Income 1040: Individual Income Tax Form. All taxpayers must file this form.

- Schedule C: The form for reporting income specifically from your business (i.e. profits and losses).

- Schedule E: The form for reporting income from rental properties and other investments.

- Schedule SE: The form for filing and paying your self-employment taxes. The owner of a disregarded entity must pay Medicare and Social Security taxes.

LLC State Taxes

State taxes are pass-through taxes. The only difference between paying federal and state income taxes will be the forms you need to file.

Some states require LLCs to pay a special business tax. This tax is usually called a franchise tax, but can also be a “Business Excise Tax” or a “Privilege Tax.” This tax can either act as an annual fee with a flat amount, or it can be a percentage of the business like any other tax.

If you are selling a product or service, you will most likely have to pay sales tax. See our sales tax guide so you can learn everything you need to know about collecting sales and use tax.

Check out our guide for a complete list of business taxes by state.

LLC Employee Taxes

If you hire employees for your business, you will have to register for your state’s employee taxes. These taxes can include things like paying for workers’ compensation and withholding income taxes on behalf of your employees.

In order to report employee taxes, you’ll need an EIN for your LLC.

FICA Taxes

Taxes that are part of the Federal Insurance Contributions Act (FICA) include two types of taxes that are paid by all employers and employees: Social Security tax and Medicare tax. Employers are required to match their employees’ FICA tax obligations. The result is that an employer and employee each pay one half of the total FICA tax rate.

Unemployment Taxes

Employers are required to pay both federal unemployment taxes (FUTA) and state unemployment taxes (SUTA). These taxes go toward unemployment benefit funding for workers between jobs.

Bookkeeping and Accounting for Single-Member LLCs

You must keep your single-member LLC’s finances in order to protect your corporate veil. Single-member LLCs often find more difficulty protecting the corporate veil due to the fact that there is only one member maintaining the finances.

However, by opening a dedicated business bank account, getting a business credit card, and creating a good bookkeeping system, you can easily separate your personal and business finances.

Benefits of Good Accounting

By making sure every possible deduction is monitored and recorded, good accounting can provide some considerable advantages:

- Cuts your tax bill by thousands every year.

- Prevents trouble with the IRS and state governments.

- It provides insight into where your money is going and how to spend it.

- Saves time and frustration

For more on the importance of small business bookkeeping and accounting, visit our guide.

Get a Free Consultation

1-800 Accountant has all the accounting and bookkeeping features you need to easily manage your finances.

Single-Member LLC FAQ

If your business works out of a local physical store or only hires local employees, it is best to form your LLC within that state.

Business owners tend to form companies in states that have no income tax and offer other forms of tax breaks. Keep in mind that these states can also come with Annual Report fees and can require LLCs to report income based on where profits are earned, not where the business is formed.

If your business does not need to be focused in any one state, there are three popular states in which business owners like to form their companies:

- Delaware: This state offers low filing fees and does not tax out-of-state income.

- Nevada: A good choice for businesses that want to save on taxes that pertain to business income and capital gains. Additionally, Nevada does not require meetings or operating agreements.

- Wyoming: Wyoming has multiple tax benefits, including a lack of business and franchise taxes. There are also added privacy bonuses, as officers can elect to remain anonymous and owners can appoint a “proxy” to vote on their behalf.

Spouses that wish to become owners of an LLC together can choose to become a Qualified Joint Venture. With this title, both spouses are considered one whole owner (e.g. “Mr. Smith” and “Mrs. Smith” become “Mr. & Mrs. Smith”). In other words, they are treated as a single-member LLC.

No. A sole proprietorship is a separate business entity from an LLC. Single-member LLCs are automatically taxed as disregarded entities like a sole proprietorship, but a single-member LLC benefits from the limited liability protection of an LLC.

A single-member LLC can enjoy the same pass-through tax benefits of a sole proprietorship while still maintaining limited liability protection. Single-member LLCs can also choose to be taxed as a corporation if they want.

Yes. Although not legally required, having a business bank account will help separate your personal and business finances, which in turn will help protect your LLC’s corporate veil.