Workers’ Compensation Insurance for Small Business

Workers’ Compensation Insurance, also known as workers’ comp, is a type of insurance that’s designed to cover an employee’s medical expenses and other losses in the event of a work-related injury. Some businesses are required by law to carry a workers’ comp policy.

Recommended: Ergo Next Insurance combines a high level of protection with the best premiums. Get an online quote.

What Does Workers’ Compensation Insurance Cover?

Workers’ compensation insurance is intended to do three things:

- Provide financial assistance for injured employees

- Protect your company in the event of a lawsuit

- Minimize risk of employee lawsuits

Below, we’ll dive into the specific ways in which workers’ comp offers these protections.

Provide Financial Assistance for Injured Employees

A workers’ comp policy benefits your injured employees by providing:

- Reimbursement for medical & rehabilitation expenses: If an employee gets injured due to a work-related incident (such as an on-the-job fall), workers’ comp will cover the cost of any medical procedures or rehabilitation the employee requires to get back to a healthy state.

- Replacement wages: If an on-the-job injury renders an employee unable to work, your workers’ comp policy will pay the employee partial wages for a specified period of time.

- Death benefits: In the case of a fatal work-related injury, your workers’ comp policy will pay out death benefits to the employee’s family.

Let’s Find the Right Workers’ Comp Coverage for your Business

We recommend using a fully online provider dedicated to low-cost, high-protection coverage for small businesses.

Protect Your Company in the Event of a Lawsuit

In a case where an injury is not covered by workers’ compensation insurance, it is possible for an employee to sue their employer for the cost of medical fees and lost compensation. Workers’ comp insurance is there to help cover the legal fees incurred by the business throughout the course of a lawsuit.

Minimize Risk of Employee Lawsuits

In a case where an injury is not covered by workers’ compensation insurance, it is possible for an employee to sue their employer for the cost of medical fees and lost compensation. Workers’ comp insurance is there to help cover the legal fees incurred by the business throughout the course of a lawsuit.

Do I Need Workers’ Compensation Insurance

Workers’ compensation insurance is managed at the state level, and each state has its own rules, regulations, and requirements.

Most states mandate that you carry this coverage if you have one or more employees (not including yourself). Some states only require you to carry a policy once your company reaches three or five employees.

We recommend that regardless of workers’ compensation state regulations, all businesses with employees should carry worker’s compensation insurance policy.

Even if your company hasn’t reached the number of employees at which your state requires coverage, just one accident could result in medical expenses or legal fees high enough to put your entire business at risk.

If your business meets the criteria for state-mandated workers’ comp coverage and you refuse to purchase a policy, you will be in non-compliance with the law and could be subject to severe penalties. Fines of up to $10,000 are not uncommon for non-compliance. Some states even consider it a criminal matter, punishable by prison time.

The drop down below outlines the basics of each state’s workers’ compensation requirements.

Workers Compensation Requirements in Your State

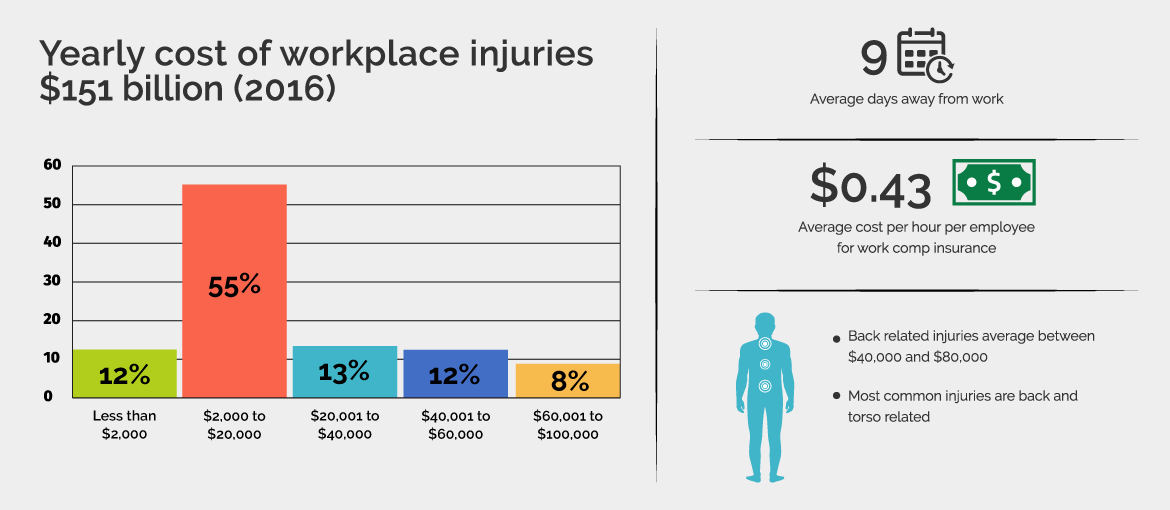

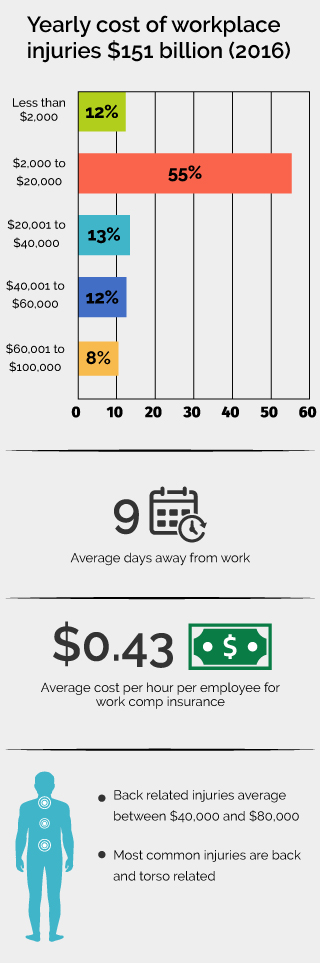

How Much Does Workers’ Compensation Insurance Cost?

The average cost of workers’ compensation insurance across all locations and industries is about $0.47 per hour per employee. This means that if you have a single employee who works a standard full-time schedule (40 hours per week, 2,080 hours per year), the annual cost of your workers’ comp policy will be around $978.

You Need Workers’ Compensation Insurance

Save time and use our Worker’s Compensation Insurance review to get an online quote.

That said, there are several factors that contribute to cost differences among workers’ compensation policies. These include:

- Location

- Industry

- Number of employees

- Claim history

- Total annual payroll

How Do I Get Workers’ Compensation Insurance?

In most states, you can purchase workers’ compensation insurance through standard insurance providers. If your business has a poor claim history, you may need to get coverage through a state-administered program. These policies tend to be more expensive, but if you aren’t able to purchase coverage from a standard provider, this is the only way to ensure you’re compliant with the law.

Frequently Asked Questions

The most common types of business insurance include general liability and commercial property insurance, which can typically be found in a business owner’s policy (BOP).

At a minimum, we recommend that all businesses carry general liability insurance.

No. There are certain incidents that do not qualify for coverage. For instance:

- Drug or alcohol-related injuries

- Injuries from fights or altercations initiated by your employees

- Injuries caused during violations of company policy

- Independent contractor injuries

- A workers’ comp policy also cannot compensate for any fines from OSHA violations.

In most states, no. However, some states allow sole proprietors to cover themselves under this type of policy.

No. The three standard coverages bundled in a business owner’s policy (BOP) are general liability insurance, commercial property insurance, and business interruption insurance. Workers’ compensation insurance is not included.

Check Out Our Other Insurance Articles

Professional Liability Insurance