Sales Tax for Small Businesses

For most new businesses, staying on top of sales tax obligations is a headache. This guide breaks down the key steps and concepts you need to know to be a sales tax pro. You can also use our sales tax calculator to look up the tax rates for any location in the United States, or check out our state specific guides for more information about sales tax in your state.

What is Sales Tax?

Sales tax, also called “Sales and Use Tax,” is a tax levied by states, counties, and municipalities on business transactions involving the exchange of certain taxable goods or services. State and local governments require businesses to collect sales tax from customers and submit tax payments to the appropriate governmental agencies.

Note: Not all states levy sales tax. Delaware, New Hampshire, Montana, Oregon, and most parts of Alaska do not have sales tax.

Taxable Goods and Services

Not all goods and services are taxed. Each state has its own set of policies, and rates can even vary from one county or city to another. However, there are some general guidelines for determining which goods and services are taxable and which aren’t.

Goods

Tangible, personal property is usually subject to sales tax. Some examples of commonly taxable goods include:

- Furniture

- Motor vehicles

- Computers

- Home appliances

- Books

- Raw materials (lumber, cloth, etc.)

- Potted plants

- Rental Properties

Most states do not tax goods that are considered “necessities.” Typical examples include: groceries, medications, clothing, and gasoline.

Services

There is no hard-and-fast rule for determining which services are taxable across all fifty states. However, note that your business may be required to collect sales tax if it offers one of the following services:

- Services to tangible personal property: installation, inspection, maintenance, or repair of your customers’ stuff.

- Services to real property: lawn mowing, snow removal, or utility repair of your customers’ property.

- Business services: advertising, consulting, public relations, or human resource services your company provides.

- Personal services: beauty care, pet grooming, dry cleaning, and tour guide services your company provides.

Tax-exempt services often include medical care, educational services, and some professional services. Other types of services are exempt on a state-by-state basis.

Register for Sales Tax

When you are registering for Sales Tax, you are essentially registering for a Seller’s Permit. There is also something called a Resale Certificate, which allows you to save money on purchases for resale.

Get a Seller’s Permit

All businesses that sell taxable goods or services need to get a seller’s permit. States issue these permits, sometimes called a Sales Tax Permit or Sales Tax Certificate of Authority, in order to keep track of where sales tax revenue is coming from.

To register for a seller’s permit, visit the sales tax section of your state’s Department of Revenue homepage. You will need some basic information about your business, so make sure you have access your business formation paperwork as well as your Employer Identification Number (EIN).

Although most states offer this permit for free, a handful of states assess a small registration fee.

Learn how to obtain a seller’s permit in your state.

Save Money with a Resale Certificate

Businesses can use a resale certificate, also known as a reseller’s permit, to avoid paying sales tax when purchasing goods for resale. Consider the following examples:

(1) Joe is the owner of an electronics store. His company purchases computers, smart phones, and software in bulk at wholesale prices to resell to his customers in his store. With a resale certificate, Joe’s business is able to avoid paying the extra cost of sales tax on these purchases.

(2) Wendy owns a business that builds and sells custom furniture. When her company purchases wood, fabric, fasteners, and other raw materials used in constructing their products, they use a resale certificate to avoid paying sales tax on these items.

In this way, resale certificates prevent goods from being taxed multiple times before they reach the end consumer.

Note: Not all business purchases are exempt from sales tax. Here’s a list of common items that are not eligible for resale exemption:

- Goods you or your employees purchase for personal use.

- Goods your business gives away for free or as gifts.

- Goods your business uses to conduct business, like office supplies, equipment, etc.

- Goods your business rents for use and not for re-leasing.

To obtain a resale certificate, visit the sales tax section of your state’s Department of Revenue homepage. Many states allow you to download the certificate online for free.

Calculate Your Sales Tax Obligations

To avoid fines and the risk of costly audits, it’s important for business owners to collect the correct rate of sales tax from paying customers.

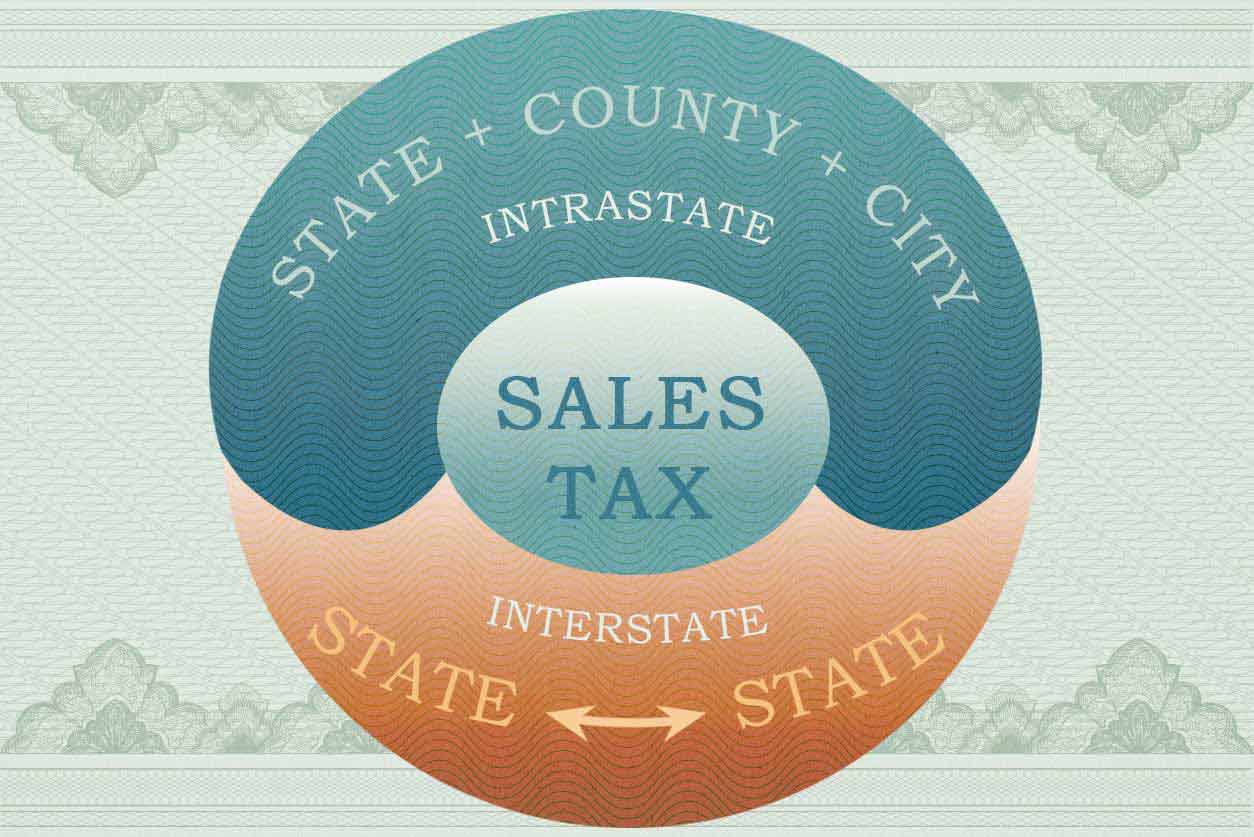

When calculating Sales Tax there are 3 kinds of sales you’ll need to consider:

- Store Sales

- In-State Sales

- Out-of-State Sales

Recommended: TaxCloud automates sales tax calculation, filing, and compliance for just $19 per month. Schedule a free call today.

Store Sales

For traditional business owners selling goods or services on site, calculating sales tax is a cinch: all sales are taxed at the same, local rate. Here’s an example of what this scenario looks like:

Emma owns and manages a hardware store in Columbus, Ohio. Since building and construction materials are taxable in the state of Ohio, Emma charges her customers a flat-rate sales tax of 7.5% on all sales. This includes Ohio’s sales tax rate of 5.75%, Franklin County’s sales tax rate of 1.25%, and Emma’s local district tax rate of 0.5%.

In-State Sales

To determine the correct rate of tax to collect when shipping goods within your state, you’ll first need to determine whether your state levies sales tax on a destination-of-sale or origin-of-sale basis.

Destination-Based

In most states, when a customer in your business’ home-state purchases one of your products remotely, from a mail-order catalogue or your company website, sales tax is calculated based on applicable local and county tax rates at the address of the customer. This is known as destination-based sales tax:

Wendy just had an online sale of two custom chairs to a new home owner in Lafayette, Louisiana. Wendy’s business is based out of Baton Rouge, Louisiana, where sales are taxed at a 10.0% rate. However, since Louisiana is a destination-based state, Wendy collects the Lafayette rate of 9.0

Origin-Based

Twelve states always assess sales tax according to the local and county tax rates at the address of the seller. This is known as an origin-based sales tax:

Emma has a customer who orders an electric drill set from her online store. Because Ohio is an origin-based sales tax state, Emma would charge the standard 7.5% sales tax on the price of the drill.

Out-of-State Sales

To know if you’ll need to collect tax on out-of-state sales, you must first determine if your business has a nexus outside of your business’ home state. Nexus is a legal term for a business’ physical presence in a state. Here are the most common types of nexus:

- A physical location, such as an office, store, or warehouse

- An employee who works remotely or who is a traveling sales representative

- A marketing affiliate

- Drop-shipping from a third party seller.

- A temporary physical location, including festival and fair booths.

Whenever a customer outside your state makes a remote purchase, you are only obliged to collect sales tax if your business has a nexus in that state.

Consider the following example:

A resident of Illinois finds Emma’s hardware store online, and orders a chainsaw and a twenty-foot extension cord. Because Emma’s business doesn’t have nexus in the state of Illinois, she does not have to charge that customer any sales tax.

Almost all states calculate the sales tax rate of out-of-state purchases based on the location of the customer.