Sole Proprietorship

A sole proprietorship is an informal, unincorporated business structure. As a sole proprietor, you are personally liable for the business’s debts and legal issues.

If someone sues your business, you risk losing not just your business assets but everything you own.

For this reason, most people start an LLC to keep limited liability protections in place. LLCs are easy to set up and manage, and you’ll pay taxes just like you would normally.

Recommended: Northwest can help you establish your LLC for just $29 + State Fees.

What is a Sole Proprietorship?

Sole Proprietorship Definition: A sole proprietorship is an informal, unincorporated business entity that isn’t legally separated from its owner. Profit and losses are reported on the individual’s tax return, and the business owner is personally liable for all debt and risk.

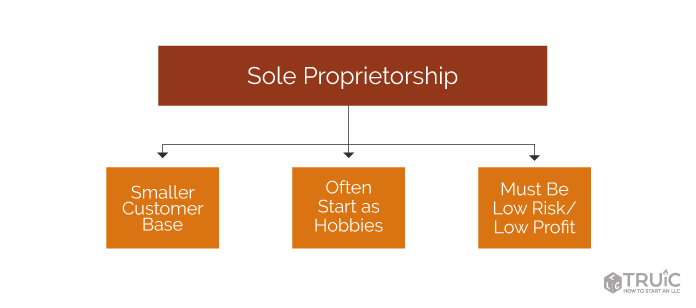

Sole proprietorships are best for small businesses with the following characteristics:

- They MUST be low-profit and low-risk (low chance of liability or financial loss).

- They have a smaller customer base — often friends, family, and neighbors.

- They sometimes start as hobbies like photography, blogging, or video streaming.

Sole Proprietorship Examples

Any low-profit/low-risk business that could be operated by one person could be a sole proprietorship.

For example, artists, counselors, freelancers, independent contractors, tutors, and musicians are all professions that could potentially be ran as sole proprietorships.

Doing Business as a Sole Proprietorship

Because a sole proprietorship isn’t a separate legal entity, the owner typically signs checks, contracts, and lease agreements in his or her own name. Likewise, payments made to a sole proprietorship are made out to the owner’s name.

If you operate a sole proprietorship and wish to conduct business under an assumed name, you can register a “doing business as” (DBA) name for your company. You can even open a business bank account with a DBA and receive payments under your fictitious name.

Employees and EINs

Although sole proprietorships are usually one-person businesses, they can hire employees if the owner obtains an Employer Identification Number (EIN).

Sole Proprietorship Taxes

Because a sole proprietorship isn’t a legally distinct business entity, your business income as an owner is included on your personal tax return. Remember that as a sole proprietor, you’re technically self-employed, so you’ll need to pay income and self-employment taxes each year.

What are the Advantages and Disadvantages of a Sole Proprietorship?

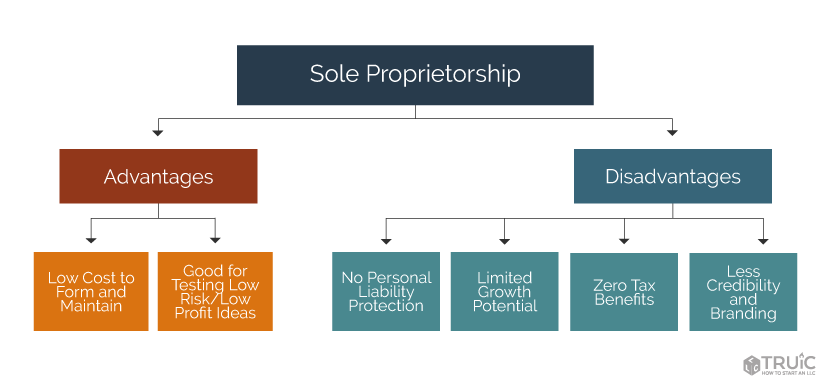

Under certain circumstances, sole proprietorships offer small advantages and benefits over formal business structures (like LLCs and corporations).

Example: A sole proprietorship can be a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Sole Proprietorship Advantages:

The only advantage to starting a sole proprietorship vs. an LLC is having to spend no money or energy up front to form a business. This advantage may seem attractive, but it can be costly in the long run.

Some people who start these businesses don’t even maintain a separate business bank account to keep track of their business profits and income tax withholding.

Sole Proprietorship Disadvantages:

- No Personal Liability Protection. Your personal assets (car, house, bank account) are at risk in the event your business is sued or if it defaults on a debt.

- Limited Growth Potential. When a business becomes more profitable, risk increases. When risk and profit increase, so does the need for a legal formal business structure.

- Less Credibility and Branding Opportunities. A sole proprietor must invoice, receive payment, open a bank account, and market with their surname unless their state allows them to register and maintain a doing business as (DBA) name.

- Self-Employment Taxes. As a sole proprietor, you are subject to self-employment taxes on your personal tax returns. Self-employment taxes consist of both the employer and employee portions of Social Security and Medicare taxes.

Unlike employees of a company, sole proprietors are responsible for paying the full amount of these taxes themselves. This means you are required to pay both the employer and employee portions, which can have an impact on your overall tax liability. It’s important to consider these tax obligations when operating as a sole proprietor.

To avoid these issues, you can form a limited liability company (LLC). An LLC offers many of the same advantages of a sole proprietorship while also providing asset protection.

Use our state-specific guides below to learn how to start an LLC in your state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

You can also use an LLC formation service to register your LLC for you.

When Should a Sole Proprietorship Become an LLC?

It is time to go from a sole proprietorship to an LLC when you are serious about growing your business and earning a profit.

Sole proprietorships are only good for very low-profit/low-risk businesses.

Example: A sole proprietorship is a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Forming an LLC allows business owners to grow their businesses and take on risk. This is because LLCs provide personal liability protection.

What is personal liability protection? When a business owner has personal liability protection, they can’t be held personally responsible if the business suffers a loss. This means personal assets (car, house, and bank account) are protected.

Why You Should Form an LLC

There are several benefits to starting an LLC that may or may not matter to a business owner. But, regardless of any other factor, a business owner needs to form an LLC when they start to earn a profit or carry risk.

This is because profit and risk open the door to liability. A sole proprietor’s personal assets are completely exposed to creditors and lawsuits because legally, the sole proprietor is the business. In an LLC, the business can be legally separate from the business owner.

By changing your business from a sole proprietor to LLC you will:

- Protect your savings, car, and house

- Increase your peace of mind

- Protect your privacy

- Increase business growth

- Allow for greater profit

- Allow for accelerated growth

- Increase credibility

Sole Proprietorship FAQ

Sole proprietorships are easy and inexpensive to start and maintain, but they don’t offer any personal liability protection or tax advantages.

In most states, there are no filings or fees required to form a sole proprietorship—you only need to start doing business under your own name.

Sole proprietorships are subject to pass-through taxation, which means the profits or losses of the business pass through to the owner’s individual tax return without being taxed at the company level. Sole proprietors must also pay self-employment tax.

Yes. The Internal Revenue Service (IRS) requires sole proprietors to pay estimated quarterly income tax if they expect to owe $1,000 or more for the year.

You can pay yourself as a sole proprietor by withdrawing money from your business bank account. This is commonly called a “draw.”

Sole proprietors do not receive salaries as part of the company’s payroll.

Yes, but having employees as a sole proprietorship is uncommon.

No. A single-member LLC is a formal business structure with one owner. Single-member LLCs are taxed in the same way as sole proprietorships.