How to Start an LLC in Arizona (2026 Guide)

To start an LLC in Arizona, you’ll need to pick an available business name, choose a statutory agent, and file your Articles of Organization with the Arizona Corporation Commission. The cost to form an LLC in Arizona is $50.

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized Arizona LLC formation service (recommended).

How to Form an LLC in Arizona in 6 Steps

In order to form your LLC in Arizona, there are certain steps you’ll need to complete:

- Name Your LLC: This will need to be available and satisfying the naming guidelines of Arizona

- Choose an Arizona Statutory Agent: This is an individual or business entity that will accept service of process on your behalf

- File Your Articles of Organization: This is the actual “formation document” you’ll file with the Arizona Corporation Commission

- Complete the Arizona LLC Publication Requirement: This is a mandatory notice of your LLC’s formation that must be published in a newspaper for three consecutive weeks (unless you are exempt)

- Create an LLC Operating Agreement: This is an internal legal document that outlines your ownership structure and operating procedures

- Obtain an Employer Identification Number (EIN): This is issued by the IRS and is required to open a business bank account, hire employees, and file taxes.

Arizona LLC Launchpad

Name Your Arizona LLC

The first step is picking a business name for your Arizona LLC

Step 1: Name Your Arizona LLC

The first start towards forming an LLC is choosing a business name.

Your LLC’s name should be memorable and easily searchable while meeting Arizona naming requirements.

1. Important Naming Guidelines for Arizona LLCs:

- Your name must include the words “limited liability company,” “limited company,” or one of the following abbreviations: “L.L.C.,” “L.C.,” “LLC,” or “LC”.

- Your name cannot contain the words “association,” “corporation,” “incorporated,” or any abbreviations of these terms.

- Your name cannot include words that could confuse your LLC with a government agency (e.g., FBI, Treasury, State Department, etc.).

- Your name cannot include phrases such as “bank,” “credit union,” “trust,” “trust company,” or “deposit” unless the LLC is expressly engaged in banking or trust activities.

- Other restricted words (e.g., Attorney, University) may require additional paperwork and a licensed individual, such as a doctor or lawyer, to be part of your Arizona LLC.

- Your name must be distinguishable from any other Arizona business or trade name.

We recommend checking out the Arizona Corporation Commission for a complete list of naming rules in this state.

2. Conduct a Business Name Search in Arizona

To check whether your desired name has already been taken by another business entity in Arizona, you can perform a business entity search on the Arizona eCorp website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 120 days. This includes a $10 processing fee by mail.

For more information, you can have a look at our Arizona LLC Name Search guide.

3. Conduct a Domain Name Search

We recommend that you check online to see if your business name is available as a web domain. Even if you don’t plan to make a business website right away, this is an extremely important step as it will prevent others from acquiring it.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

FAQ: Naming an Arizona LLC

LLC is short for “limited liability company.” It is a simple business structure that offers more flexibility than a traditional corporation while providing many of the same benefits. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute What is an LLC video.

Most LLCs do not need a doing business as (DBA) name, known as a trade name in Arizona. The name of the LLC can serve as your company’s brand name, and you can accept checks and other payments under that name as well. However, you may wish to register a DBA to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA in Arizona guide.

Step 2: Choose a Statutory Agent in Arizona

After you find the right name for your LLC, you will need to nominate an Arizona statutory agent. This is known as a registered agent in most states outside of Arizona, and is a necessary step in your Articles of Organization (i.e., the document used to file and register your LLC with the Arizona Corporation Commission).

What is a statutory agent? A statutory agent is an individual or business entity responsible for receiving notice of lawsuits on behalf of your business. You can think of your statutory agent as your business’s primary point of contact with the state.

Who can be a statutory agent? A statutory agent must be a resident of Arizona or a corporation – such as a registered agent service, individual (e.g., yourself, etc.), or a business attorney – authorized to transact business in Arizona.

Keep in mind that your statutory agent must be at the business address or another physical street address within Arizona during regular business hours.

Note: Arizona requires all statutory agents to complete and sign Form M002: Statutory Agent Acceptance upon appointment. You will need to file this in conjunction with your LLC’s Articles of Organization.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a statutory agent

Yes. You can choose to act as your own statutory agent, appoint a member of your LLC, work with a business attorney, or hire a professional registered agent service (recommended).

Read more about being your own statutory agent.

Using a professional registered agent service is an affordable way to manage government filings for your LLC. For most businesses, the advantages of using a professional service significantly outweigh the annual costs.

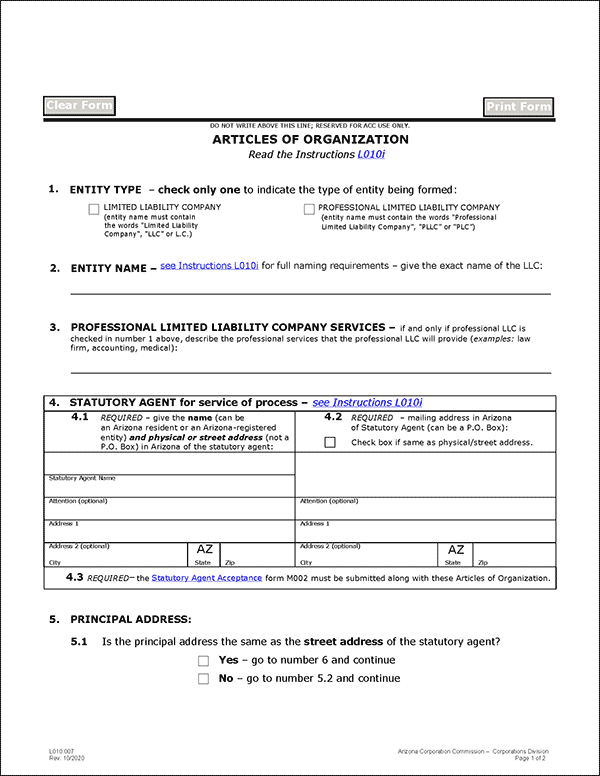

Step 3: File the Arizona LLC Articles of Organization

To register your Arizona LLC, you’ll need to file the following forms with the Arizona Corporation Commission:

- Form L010: Articles of Organization

- Form M002: Statutory Agent Acceptance

- Form L041: Member Structure Attachment or Form L040: Manager Structure Attachment

- Cover Sheet

This can be done online, by mail, or in person, alongside a $50 filing fee.

Before filing, you will need to make sure you have completed all forms correctly. You will need to have the following resources on-hand:

- Your statutory agent’s completed Statutory Agent Acceptance Form

- The names and addresses of your LLC’s members or managers, along with the attached structure attachment you choose.

- Your LLC’s information, including its name, classification, and principal address

- Your completed Cover Sheet, which includes expedited processing options.

File the Articles of Organization

OPTION 1: File Online With Arizona eCorp

File Online– OR –

OPTION 2: File by Mail or in Person

– Form L010: Articles of Organization

– Form M002: Statutory Agent Acceptance

– Form L040 (Manager) OR Form L041 (Member)

– Cover Sheet

State Filing Cost: $50 (Nonrefundable)

Filing Address:

Arizona Corporation Commission

Corporate Filings Section

1300 W. Washington St.

Phoenix, AZ 85007

For help with completing the form, visit our Arizona Articles of Organization guide.

If you’re expanding your existing LLC to the state of Arizona, you will need to form a foreign limited liability company (LLC).

FAQ: Filing Arizona LLC Documents

Regular Articles of Organization processing typically takes up to 30 business days.

While the Arizona Corporation Commission approves LLC formation paperwork on a first-come, first-served basis, you can expedite the processing of your forms for an additional fee:

- Regular Expedited Service: $35

- Next-Day Service: $100

- Same-Day Service: $200

- Two-Hour Service: $400

An LLC is called a “domestic LLC” when it conducts business in the state where it was formed. A foreign LLC must be formed when an existing LLC wishes to expand its business to another state.

The cost to form an LLC in Arizona is $50.

To learn more, read our guide on the cost of forming an Arizona LLC.

Step 4: Complete Arizona LLC Publication Requirement

Arizona requires all newly formed LLCs to publish a Notice of LLC Formation for three consecutive weeks in an approved newspaper in the county of the LLC’s principal office. This must be done within 60 days of formation.

Publication Exemption: According to A.R.S. § 29-3201, you are exempt from publishing a notice if your Statutory Agent’s street address is in Maricopa or Pima county.

This exemption is based on your agent’s address, not your business address. If your business is located in a county that requires publication (like Yavapai or Coconino), you can avoid the publication fees by hiring a Statutory Agent service located in Maricopa or Pima county.

What does my Notice of LLC Formation need to include? You will need to publish the following information:

- Your LLC’s name

- The name and street address of your Statutory Agent

- The address of the LLC’s principal place of business (if different from that of the Statutory Agent)

- Whether your LLC is member-managed or manager-managed

- The name(s) and address(es) of either your LLC manager or each member of your LLC

For more information, have a look at our Arizona Publication Requirement Guide.

Approved Newspapers

Get the complete list of newspapers organized by county, courtesy of the Arizona Corporation Commission, Corporations Division.

DOWNLOAD PDFFee: $30-$300 (Varies by County)

Step 5: Create an Arizona LLC Operating Agreement

An operating agreement is not required for an Arizona LLC, but having one is a good practice.

An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

A comprehensive operating agreement ensures that all LLC members are on the same page and reduces the risk of future conflict.

You can use the free tool in our Business Center to create a custom operating agreement in minutes — or download our free templates:

FAQ: Creating an Arizona LLC Operating Agreement

No. The operating agreement is an internal document that you should keep on file for future reference. However, many other states legally require LLCs to have an operating agreement.

Step 6: Get an EIN for Your Arizona LLC

You can get an Employer Identification Number (EIN), also known as the Federal Employer Identification Number or Federal Tax Identification Number, from the IRS for free. It is used to identify a business entity and keep track of a business’s tax reporting – essentially acting as a Social Security number (SSN) for the company.

Why do I need an EIN? An EIN is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

– OR –

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

A Social Security number is not required to get an EIN. Fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your application.

All LLCs with employees, or any LLC with more than one member, must have an EIN. The IRS requires this.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the available tax classification options. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Best LLC Services in Arizona Compared

| Service | Total Cost* | Filing | Registered Agent | EIN | Operating Agreement |

|---|---|---|---|---|---|

|

Northwest

TOP PICK

25% TRUiC Discount

|

$129 | $29 | Free 1st Year $125/yr after | $50 | Free |

|

Tailor Brands

35% TRUiC Discount

|

$377 | $0 | $199/yr | $99 | $29 |

|

ZenBusiness

|

$347 | $0 | $99 1st Year $199/yr after | $99 | $99 |

|

LegalZoom

|

$477 | $0 | $249/yr | $79 | $99 |

For a comprehensive comparison, read our Best LLC Services review. We reviewed and ranked the top LLC formation services to help you determine the best fit for your new business.

Important Next Steps to Protect Your Arizona LLC

After you’ve formed your LLC, you’ll need to complete key steps in order to:

- Separate your personal and business assets

- Stay compliant with state and federal laws

Get a Business Bank Account & Credit Card

Using a dedicated business banking account and business credit card is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your LLC is sued. In business law, this is referred to as piercing your corporate veil.

You can protect your business with these two steps:

1. Opening a business bank account:

- Separates your personal assets from your company’s assets, which is necessary for personal asset protection.

- Makes accounting and tax filing easier.

2. Getting a business credit card:

- Helps you separate personal and business expenses.

- Builds your company’s credit history, which can be useful to raise capital later on.

Get Insurance

Even though an LLC offers limited liability, you’ll still likely need to purchase some form of business insurance to protect your LLC’s assets. The most common types are:

- General Liability Insurance: A broad insurance policy that protects your business from lawsuits. Most small businesses get general liability insurance.

- Professional Liability Insurance: A business insurance for professional service providers (consultants, accountants, etc.) that covers against claims of malpractice and other business errors.

- Workers’ Compensation Insurance: A type of insurance that provides coverage for employees’ job-related illnesses, injuries, or deaths. In Arizona, businesses with one or more employees, including LLC members and corporate officers, are required by law to have workers compensation insurance.

What This Means:

Without insurance: If someone sues your bakery for $40,000, they could take your commercial mixer and empty your business account ($25,000 total), but won’t be able to touch your house or personal savings.

With insurance: Your business liability policy could cover the $40,000 claim, meaning that both your personal and business assets would remain untouched.

That’s why many small business owners turn to providers like Ergo Next Insurance for affordable, tailored coverage. Get a free quote today.

Want to learn exactly what coverage your business may need? Read our full Arizona Business Insurance Guide.

Obtain Business Licenses If Needed

While Arizona doesn’t require a general state business license, your LLC may need specific licenses or permits based on its industry, location, and activities.

- State-Level Licenses: Use the Arizona State License Search to determine if your business requires any state-issued licenses or permits.

- Local Licenses: Check with your city or county clerk’s office to identify any local licensing requirements, such as zoning permits or health department approvals.

- Federal Licenses: If your business activities are regulated by a federal agency (e.g., selling alcohol, firearms, or operating in transportation), consult the U.S. Small Business Administration’s guide to determine necessary federal licenses or permits.

For a comprehensive overview and step-by-step instructions, refer to our Arizona Business License Guide.

If you’d rather have a service handle this step for you, we recommend checking out LegalZoom’s Business License service.

Pay Arizona LLC Taxes

Your Arizona LLC will have several key tax obligations:

Federal LLC Tax Requirements

As a pass-through entity, profits typically flow to your personal tax return. LLC members pay self-employment tax (15.3%) on their earnings.

Transaction Privilege Tax

If you are selling a physical product, you’ll need to register for Transaction Privilege Tax (TPT) with the Arizona Department of Revenue (ADOR).

This is set at a general statewide rate of 5.6% for businesses selling tangible goods, but can range up to 11.2% for certain localities and industries.

To register for TPT, you must submit an Arizona Joint Tax Application (JT-1) to the Department of Revenue before your business can begin its operations. The fee for this application ranges from $1-$50.

To determine whether this tax applies to your LLC, you can utilize the Department of Revenue’s Tax Rate Tables for all business activities and industries that are subject to TPT, as well as their specific tax rates.

Arizona Income Taxes

In addition to your federal income tax responsibilities, there are several statewide taxes you may need to pay on revenue sourced within Arizona, including:

- Personal Income Tax: 2.5%

- Small Business Income (SBI) Tax: 2.5%

- Corporate Income Tax: 4.9%

Property Taxes

In Arizona, there is no statewide property tax, and this is instead set and managed by 15 county officials across the state.

You can find out more about how property tax works in your local area by taking a look at the Arizona Association of Counties website.

Most Arizona LLCs must file their state tax returns by April 15. For help understanding your full tax obligations — and making sure nothing gets missed — check out our full Arizona LLC Tax Guide.

Need personalized help? Schedule a free consultation with 1-800Accountant to get expert guidance from CPAs who specialize in small business taxes.