How To Get An EIN as a Foreign Person

If you recently moved to the United States and want to start a business or expand your existing business to the US, you may be interested in learning about EINs.

We will explain what an EIN is and show you how to get an EIN for free with the Internal Revenue Service (IRS).

Important: We recommend waiting to apply for an EIN until you’ve formed your business. Our LLC before EIN article explains why and our Opening a Company in the US guide will help you get started.

International EIN Applicants

If you don’t have a Social Security number (SSN) and you are not a U.S. citizen, you can still get an EIN. Continue reading to learn more about an EIN and how to apply for one as an international applicant.

What is an EIN?

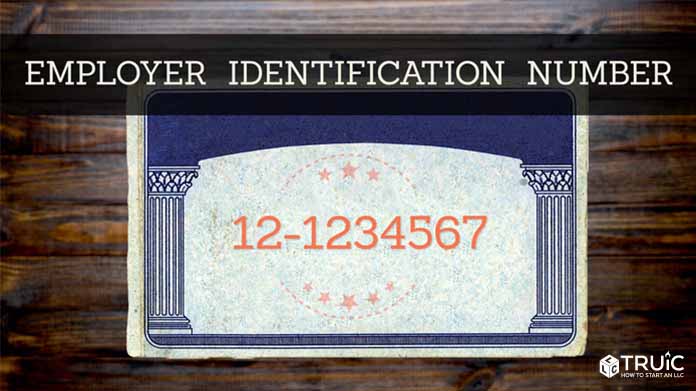

Before we help you understand how you can get an EIN, it is important to understand what an EIN is and what it stands for. EIN stands for Employer Identification Number. It is also known as a Tax Identification Number (TIN) or a Federal Tax ID Number.

This number specifically identifies your business with the IRS to track your business’s monetary flow. An EIN can be assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities.

For more information about whether your LLC is required to obtain an EIN, visit our EIN for LLC guide.

What is an EIN used for?

There are several uses for an EIN. The main reason to get one is to file your company’s taxes and for tax reporting purposes. Every financial decision made on your business’s behalf will be tied to its EIN. Here are some other benefits:

- Maintaining corporate veil

- Hiring employees

- Useful for international businesses and foreign entrepreneurs

When you file your business’s taxes, you want to separate yourself from your company to maintain your corporate veil. This protects your assets from being taken away in case of a lawsuit by distinguishing your money from the company’s money.

Using an EIN identifies your company as its own entity connected to your company’s expenses and filings. It is a way for the IRS to track where money is coming from and going to.

An EIN is necessary for tax withholding purposes when you hire employees. It is also the identification you will use when you file your company taxes with the IRS at the end of the year.

If you’re a foreign person, an EIN allows you to start a business in the United States even if you don’t have a Social Security number (SSN). The EIN allows you to collect payment in the form of salary, distribute cash in and out of the company, hire employees, and report and file taxes through your business as its own entity.

How Do I Get an EIN as a Foreign Person?

Unless you have a Tax Identification Number, you will be expected to fill out Form SS-4, Application for Employer Identification Number from the IRS website. This form is for foreign applicants who would like to start a business in the United States, but do not have a Social Security number (SSN) or an existing physical address.

If your business was initially created outside the United States, you will not be able to apply for an EIN online.

There are various ways to apply for an EIN as an international applicant. Here are all the options:

- Phone – You may call Monday through Friday from 6 a.m. to 11 p.m. Eastern Standard Time. The phone number is 267-941-1099 and it is not a toll-free number.

- Fax – You may apply by faxing Form SS-4 to 304-707-9471

- Mail – You may complete and mail your application to the Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you choose to apply for an EIN by phone, consider using a web calling service to save money. You should expect to be on the phone for at least an hour answering questions before you receive your EIN.

Make sure to complete Form SS-4 before contacting the IRS since they will ask you the same questions on the questionnaire; this will expedite the process. At the end of your conversation with the IRS representative, you will be assigned your EIN. You will want to write it on the upper right hand corner of Form SS-4, sign it, and date it.

What is a Third Party Designee?

You may assign a third party to obtain your company’s EIN by having the person fill out the Third Party Designee section. This will authorize the assigned person to both, answer the questions on Form SS-4 and receive your company’s EIN when you apply by phone.

The designee will no longer have authority to contact the IRS on your company’s behalf after the EIN has been assigned. You may be asked to submit a copy of the form and the signed authorization.

FREQUENTLY ASKED QUESTIONS

You don’t need an EIN if you’re self-employed; you can simply use your Social Security number. However, some people who are self-employed choose to apply for an EIN instead of using their Social Security number to reduce the risk of identity theft; it’s less likely for someone to break into your accounts when you keep business finances and personal finances separate.

No, there is not a difference between an Employer Identification Number (EIN) and a Taxpayer Identification Number (TIN). Both refer to the nine-digit number issued by the IRS for your business.

No, there is not a difference between an EIN and a Federal Employer Identification Number (FEIN). A FEIN can also be referred to as a Federal Tax Identification Number.

It is very easy to look up your EIN, and there are several ways you can do so. First, the IRS will typically quickly email or send a physical letter confirming your EIN application. You can also check business documents such as tax returns to find your EIN printed there.

You can look up another business’s EIN by searching for the company on the Securities and Exchange Commission (SEC) EDGAR online Forms and Filings database.

If you still aren’t able to find your EIN by checking for a confirmation email or letter, or by identifying it on your business documents, you can simply call the IRS EIN Department at 1-800-829-4933 to speak with one of their representatives. Their hours of operation are Monday-Friday from 7 a.m. to 7 p.m.

An EIN is a nine-digit number issued by the IRS to keep track of a business’s tax reporting. The Data Universal Numbering System (DUNS) is a nine-digit number issued by Dun & Bradstreet, a business analytics company. A DUNS number helps businesses create and identify their credit reports.