S Corp vs LLC

S corp is a tax classification that LLCs can elect. S corp tax status allows LLC owners to be treated like an employee of the business for tax purposes.

This can help LLC owners save (a lot of) money on self-employment taxes.

Read on to learn how to choose between S corp vs LLC.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

LLC vs. S Corp

Before we explore the main differences between LLCs and S corps, it’s essential that you understand what each of these actually are.

What Is an LLC?

An LLC, or limited liability company, is a business structure that combines the personal liability protection of a corporation with the tax flexibility of a sole proprietorship or general partnership.

If you’re a startup or small business owner who is looking for simplicity, flexibility, and low cost, an LLC can offer an easy-to-manage option that shields your personal assets from most potential business debts.

For more information, we recommend having a look at our What is an LLC article.

What Is an S Corp?

An S corp – which stands for “Subchapter S Corporation” in the Internal Revenue Code – isn’t a separate business entity type. Instead, it’s a special tax election which you can select as either an LLC or a C corporation.

S corp status allows owners to classify a portion of their income as dividends, which are subject to neither self-employment nor FICA taxes. This can make S corps ideal for businesses that surpass a certain annual revenue threshold.

See our What is an S Corporation article for a more in-depth look at the requirements and specifications of an S corp.

What’s the Difference Between an S Corp and an LLC?

There are several important differences between an LLC and a business structure that has elected S corp status. We’ve broken down the most important ones below.

S Corp Taxes vs. LLC Taxes

In an LLC, all earnings and losses are passed directly to individual members, who are then required to report income on their personal tax returns. This arrangement is known as “pass-through taxation.”

LLCs are not subject to corporation taxes, but all the income that’s generated is funneled directly to the applicable owners, who then pay self-employment taxes.

In contrast, an S corp permits you to categorize part of your income as dividends or distributions. While the business still avoids corporate income taxes (similar to an LLC), the significant advantage is that income earmarked as dividends is exempt from both self-employment and payroll taxes. This setup can yield considerable tax savings for business owners.

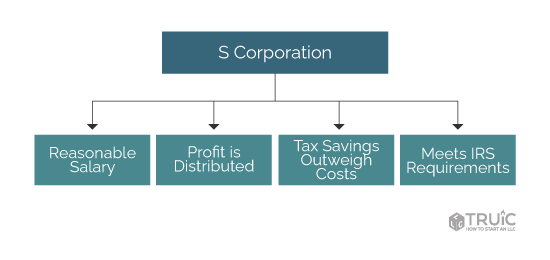

Having said that, it’s essential to note that S corp shareholders are considered employees and must pay themselves “reasonable compensation” or a “reasonable salary.” This salary needs to be in line with current market rates and is subject to FICA taxes.

This means that — depending on your expected annual revenue — it might not make financial sense for you to elect to be taxed as an S corp.

Example:

Imagine you own a small digital marketing agency with an annual revenue of $70,000. After paying yourself a reasonable salary in line with industry standards (let’s assume $65,000), there would only be $5,000 left to take as dividends exempt from self-employment and payroll taxes. In this scenario, the extra paperwork and regulatory requirements of maintaining an S corp might not be worth the relatively minimal tax benefit that you’d gain.

Start an S Corp with Northwest

Northwest will form an LLC and select S corp status for you, saving you time in the long run.

Fees and Paperwork

LLCs are generally easier and less costly to start and operate. The paperwork is more straightforward, and the annual requirements are less complex, making it a popular choice for small businesses.

S corps, on the other hand, require meticulous recordkeeping, adherence to strict corporate governance procedures, and compliance with additional regulations. This often means more paperwork and, in some cases, higher administrative costs.

Profit Distribution

LLCs provide greater freedom in the distribution of profits and losses among members. This is because LLC owners retain complete autonomy when it comes to how profits and revenue can be distributed (e.g., through an operating agreement, etc.).

On the other hand, owners of S corporations have significantly less flexibility and can actually be at a disadvantage when they’re looking to re-invest a significant amount of revenue back into their business.

This is because all owners are required to receive “reasonable compensation,” which can significantly limit how much revenue is left for reinvestment.

All in all, choosing between an LLC and an S corp is not a one-size-fits-all decision. The tax benefits of an S corp, such as saving on self-employment and FICA taxes, become increasingly advantageous as your income grows. However, these come at the cost of additional operational complexities and administrative fees.

Given the differences in tax treatment, administrative burdens, and operational flexibility, your choice should hinge on your specific needs. We recommend considering your projected income, willingness to handle paperwork, and preferred management structure as crucial variables in your decision.

S Corp vs. LLC Calculator

We’ve developed our own S corp vs. LLC calculator, which you can use in order to determine whether electing S corp status would make financial sense for your business.

S Corp Savings Calculator

Calculate how much you can save by choosing an S Corp tax classification

As a Sole Proprietorship or Single-Member LLC

Net Income:

Self Employment Tax:

S Corp

Net Income:

Salary:

Salary Employer Tax

(S Corp pays)

Dividend

Total Employment

Taxes Paid

Savings on Self Employment Taxes

Savings =

Against this savings, you have to balance the time and costs of running payroll and tax withholding. To learn more about what this will cost, get a free tax consultation.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

Is an S Corp Right for Me?

Deciding whether to elect S corp status for your LLC will largely depend on your business's financial projections, as well as on your plans for profit distribution.

As a general rule of thumb, if you anticipate your annual company profits to exceed $10,000 after drawing a reasonable salary, electing S corp status could offer substantial tax benefits that justify the drawbacks.

However, if you're still uncertain about your business's profitability or plan on reinvesting most of your profits back into the company, maintaining your default LLC tax classification with the IRS might be your best course of action.

Many LLC owners opt for this path because it allows for greater operational and financial flexibility. This is particularly beneficial for small businesses that commonly reinvest profits into growth initiatives, such as marketing and equipment upgrades.

So, if you intend to channel most of your profits back into your business for growth, or if you prefer the option to not pay yourself a salary, the default LLC classification provides more flexibility and is likely the better choice for you.

How to Start an S Corp

Before you start an S corp, you will need to ensure that you satisfy the following IRS requirements:

- Be a domestic corporation or limited liability company

- Have only allowable members (i.e., individuals, certain trusts, and estates.).

- Have no more than 100 shareholders (if applicable)

- Have only one class of stock (if applicable)

- Not be a non-resident alien shareholder, partnership, or ineligible corporation (e.g., financial institution, insurance company, etc.).

- Be a US citizen or resident

If you meet all of these prerequisites and your current business is generating enough revenue, you will likely benefit from electing S corp status.

You can do this by submitting Form 2553: Election by a Small Business Corporation with the IRS, hiring a third-party formation service (recommended), or working with a business attorney.

Recommended Formation Service

We recommend using Northwest professional S corp formation service in order to save time and ensure that all of the required paperwork is filed correctly.

Alternatively, you can have a look at the IRS’s Form 2553 Instructions page or check out our state-specific How to Start an S Corp guide for more information.

LLC vs. S Corp FAQs

Electing an S corp tax status can be better than an LLC if your business is generating a sufficient amount of revenue.

Having said that, it’s important to understand that S corps retain less autonomy when it comes to how they can operate and are also more expensive.

See our S Corp vs.LLC comparison above for more information.

An S corp can be more beneficial from a tax point of view. This is because dividends received are not subject to either FICA or self-employment taxes, and an S corp is also not subject to corporate income tax.

Having said that, this will ultimately depend on how much annual revenue a business is generating.

The disadvantage of an S corp (in comparison to an LLC) is that it offers less autonomy when it comes to how revenue can be invested, and is also more expensive to maintain.

S corps are required to pay all owners a “reasonable salary”, which can mean that there’s less revenue left for reinvestment. On the other hand, LLCs can distribute revenue with complete flexibility.

An S corporation is an IRS tax classification that limited liability companies and corporations can choose to elect. It is not its own business structure.

LLC stands for limited liability company. An LLC is a relatively simple type of business structure that small business owners can use to protect their personal assets. LLCs can have one or more owners called “members.”

While it may depend on your specific circumstances, in general, a default LLC tax structure is better than an S corp for holding rental properties. This is because rental income is typically considered passive income, which means it's not subject to self-employment tax.

In order to elect S corp status, you will need to satisfy the following prerequisites:

- Be a domestic corporation or LLC

- Have only allowable members (i.e., individuals, certain trusts, and estates.).

- Have no more than 100 shareholders (if applicable)

- Have only one class of stock (if applicable)

- Not be a non-resident alien shareholder, partnership, or ineligible corporation (e.g., financial institution, insurance company, etc.).

- Be a US citizen or resident

You can start an S corp yourself or hire a professional formation service to start an S corp for you.

If you want to handle this process independently, you will need to first register your business as an LLC or a C Corporation, and then file Form 2553: Election as a Small Business Corporation with the Internal Revenue Service (IRS).

Learn more in our How to Start an S Corp guide.