How to Start an S Corp

You can start an S corporation (S corp) by forming a limited liability company (LLC) or corporation and then electing S corp status from the IRS.

We will explain the steps you need to take to start an S corp in our How to Start an S Corp guide below.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

How to Form an S Corp

Forming an S corp is easy. Choose your state to get started:

Steps to Forming an LLC and Electing S Corp Status

Starting an LLC and electing S corp tax status is easy. You can use our step-by-step guides to start an LLC with the S corp status yourself, or you can hire a service provider like Northwest to do it for you.

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

Choose your state from the list to get started:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Five Basic Steps to Start an LLC and Elect S Corp Status:

Step 1: Name Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN and File Form 2553 to Elect S Corp Tax Status

Step 1: Name Your LLC

You will need to provide your state with a unique name that is distinguishable from all registered names when you file your LLCs formation documents.

Our Business Name Generator and our How to Name a Business guide are free tools available to entrepreneurs that need help naming their business.

Step 2: Choose an LLC Registered Agent

Your LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Step 3: File Your LLC’s Articles of Organization

The Articles of Organization, also known as a Certificate of Formation or a Certificate of Organization in some states, is the document you will file to officially register an LLC with the state.

Step 4: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

Our operating agreement tool is a free resource for business owners.

Step 5: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly with the IRS.

Elect S Corp Tax Status

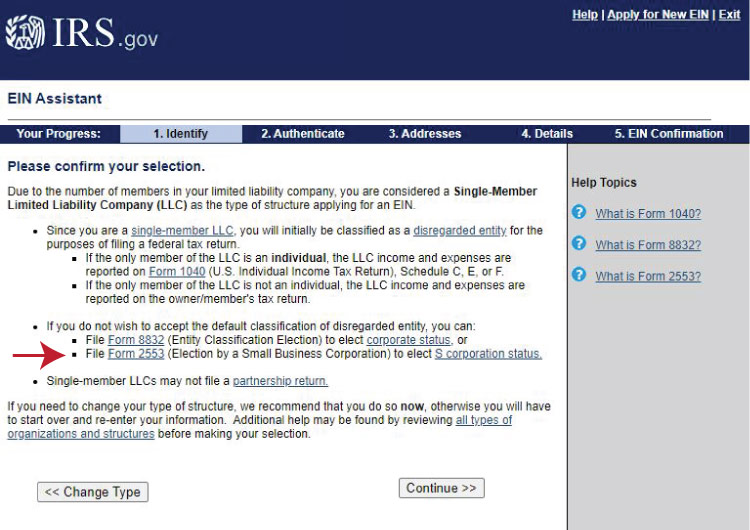

During the online EIN application, the IRS will provide a link to Form 2553, the Election By a Small Business form.

Visit our Form 2553 Instructions guide for detailed help with completing the form.

This is the form to elect S corp tax status for your LLC:

Factors to Consider Before Starting an S Corp

Before you form an S corp, you have to consider the following factors on how to start an S corp:

- Is an S corporation the best strategy for your business?

- S corporation requirements and restrictions

- Why an LLC is the best business structure for the S corp tax status

- Are S corp tax benefits right for you?

Key Takeaways on how to start an S corp:

- Form a formal business structure, such as an LLC or corporation

- Elect S corp status from IRS Form 2553 (in NYC also form CT-6)

- Meet all S corp IRS requirements

- Must be U.S. citizen or permanent resident alien

- Owners must pay themselves a reasonable salary

- Business should at least make $80,000 in profits with $20,000 in distributions

Is an S Corporation the Best Strategy for Your Business?

For help with choosing the right structure for your business (LLC vs corporation), visit our Choosing a Business Structure guide.

Businesses that elect S corp status will need to hire payroll and accounting services.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

S Corporation Requirements

The IRS requires that businesses that elect the S corp status:

- Have 100 shareholders or less

- Are domestic LLCs or corporations

- Issue only one class of stock

- Shareholders are U.S. citizens or permanent resident aliens

- Are owned by private individuals

Read our What is an S Corporation to learn more about S corps.

Why an LLC is the Best Structure for an S Corp Tax Status

As entrepreneurs, we believe that starting an LLC is the best way for forming an S corporation because any advantages of forming a corporation are negated by S corp restrictions. Also, LLCs are easier to maintain than corporations.

The only state where this may not be true is in New York due to LLC publication requirements in the state.

Are S Corp Tax Advantages Right for You?

You need to know if the S corp tax status versus a default LLC tax status will be better for your business. To fully understand the tax advantages of an S corp, read our S corp vs LLC guide.

Start an S Corp FAQ

An S corporation (S corp) is a tax designation for which an LLC or a corporation can apply for through the IRS by completing and filing Form 2553 Election by a Small Business Corporation.

C corporations (C corps) and S corporations (S corps) are two different types of tax statuses. S corps and C corps are often misunderstood to be business structures.

S Corporation

In an S corp, the business itself is not taxed.

An S corp allows business owners to become employees of the business and can reduce the tax burden under the right circumstances. LLCs and corporations can elect an S corp status. S corps have pass-through taxation, meaning that all profits are passed down to the members as in a default LLC. The members (owners) of LLCs are not salaried employees like in an S corp, so profits pay both income tax and self-employment taxes on the shareholder’s personal income tax. In an S corp, the owners or members save on employment taxes due to only the salary being subject to self-employment taxes; the distributions only pay income tax.

Learn more in our S corp vs C corp guide.

C Corporation

In a C corp, the business is taxed at a flat rate (currently 21%). A business taxed as a C corp faces double taxation because after the business is taxed, the shareholders are then taxed on their distributions on their personal income tax. For some corporations, the benefits can outweigh the disadvantages of double taxation.

Learn more in our S corp vs C corp guide.

No. An S corp is a tax status that an LLC or a corporation can elect to report a business’s federal and state income taxes.

You can form an S corp by filing Form 2553 with the Internal Revenue Service (IRS).

S corps must meet four requirements:

- They can have no more than 100 shareholders.

- All shareholders must be U.S. citizens who are private individuals (not other business entities).

- Shareholders cannot be nonresident aliens.

- The business may only issue one class of stock — this means all members must have the same distribution amount.

Owners of S corps are considered employees of their company and they can save thousands of dollars on self-employment taxes as a result.

No. The default taxes for an LLC and taxes for an S corp are not the same.

With an S corp, owners pay personal income tax and self-employment tax on a predetermined salary. They may then withdraw any remaining profits from the business as a “distribution,” which isn’t subject to self-employment tax.

With an LLC, all company profits pass through to the owners’ personal tax returns, and then the owners must pay personal income tax and self-employment tax on the entire amount.

Both LLCs and S corps benefit from a provision in the Tax Cuts and Jobs Act of 2017 that allows qualifying owners of pass-through entities to deduct 20% of qualified business income (QBI) from their tax return. However, for S corps, the deduction doesn’t apply to profits paid out as wages.

Unlike a default LLC business structure, in which owners must pay self-employment tax on all of the company’s profits, owners of S corps are considered employees of the business and only have to pay self-employment tax on a salary they receive. Any other money they take from the company’s profits in the form of disbursements isn’t subject to self-employment tax.

S corp owners are required to earn a “reasonable” salary, which basically means a fair market rate based on the individual’s qualifications as well as their duties and responsibilities at the company. The purpose of this requirement is to prevent S corp owners from paying themselves an artificially low salary in order to pay less self-employment tax.

A distribution is a dividend that a shareholder/owner can take from the business profits that remain after a company pays all of its employee salaries. Shareholders must pay personal income tax on distributions, but distributions aren’t subject to self-employment tax.

Pass-through taxation is a system of taxation that generally applies to sole proprietorships, partnerships, LLCs, and S corps. In this system, the profits or losses of the business are not taxed at the business level. Instead, they pass through to the owners’ personal tax returns and are taxed at each owners’ personal income tax rate.

There’s no corporate tax rate for S corps. Instead, owners of S corps pay personal income tax on the company’s net profits. This rate depends on each owner’s personal income tax bracket.

LLCs and corporations that operate under a doing business as (DBA) name can choose the S corp election.

How LLC owners pay themselves depends on how the LLC is taxed, the number of members, and any agreements regarding profit sharing and sweat equity.

In a single-member LLC (SMLLC) or multi-member LLC (MMLLC), you can pay yourself:

- a distribution that passes through to your individual tax return, or

- a reasonable salary and distribution as an S corp

Read our guide to learn more about how to pay yourself from an LLC article.