How to Start an S Corp in Georgia

Thinking about forming an S corporation (S corp) in Georgia? It’s a smart move if your business stands to benefit from the potential tax savings.

This guide outlines the steps required to create an S corp in Georgia and will help you decide if it’s the right choice for your company.

Read on to discover how forming a Georgia S corp can help you optimize your tax strategy.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

Factors to Consider Before Starting an S Corp in Georgia

Before forming an S corp, you have to consider the following factors:

- Is an S corporation the best strategy for your business?

- S corporation requirements and restrictions

- Are S corp tax advantages right for you?

Is an S Corporation the Best Strategy for Your Business?

For help with choosing the right structure for your business, visit our Choosing a Business Structure guide.

S Corporation Restrictions

S corps have several restrictions, such as being limited to one class of stock and 100 shareholders. Read our What Is an S Corporation guide for full details.

Are S Corp Tax Advantages Right for You?

An S corporation is a tax designation that can be elected by a limited liability company (LLC) or corporation. With an S corp, business owners are considered employees of the company and must receive a reasonable salary. Since all S corps technically have employees, the s corp must run payroll.

In order to benefit from a Georgia S corp tax designation, your business needs to make enough money to offset payroll expenses. Furthermore, S corps are beneficial for business owners who take large distributions in addition to their salary.

To learn more about the tax advantages of an S corp, read our LLC vs. S corp guide and take a look at our S Corp tax calculator.

Pro Tip: Get a free consultation with a tax professional to determine if an S corp is right for you.

How to Form a Georgia S Corp

There are two main ways to start an S corp:

- By forming an LLC and electing S corp tax status from the Internal Revenue Service (IRS) when you request your employee identification number (EIN)

- By forming a corporation and electing S corp status from the IRS

We recommend forming an LLC because it’s simpler and more cost-effective.

Want to form an S corp elsewhere? Check out our other How to Start an S Corp guides to learn more.

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

Steps for Forming an LLC and Electing S Corp Status in Georgia

Starting a Georgia LLC and electing S corp tax status is easy. You can use our guides to start an LLC with the S corp status yourself, or you can hire a service provider like Northwest to guide you through this process.

There are five basic steps to start an LLC and elect S corp status:

Step 1: Name Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN and File Form 2553 to Elect S Corp Tax Status

Step 1: Name Your LLC

Choosing a company name is the first and most important step in starting your LLC in Georgia.

Be sure to choose a name that complies with Georgia naming requirements and is easily searchable by potential clients.

1. Follow the naming guidelines for a Georgia LLC:

- Your name must contain one of the following terms or abbreviations: limited liability company, limited company, L.L.C., LLC, L.C., or LC. It is permitted to abbreviate the word “limited” as “ltd.” and the word “company” as “co.”

- Your name must be distinguishable from all other entities on file with the Georgia Secretary of State.

- Your name cannot exceed 80 characters.

- You must get approval from the Georgia Office of Insurance and Safety Fire Commissioner to use one of the following words: insurance, assurance, surety, fidelity, reinsurance, reassurance, or indemnity.

- You must get approval from the Georgia Department of Banking and Finance to use one of the following words: bank, banc, banque, banker, banking company, banking house, bancorp, bankruptcy, credit union, savings & loan, trust, or trust company.

- You must get approval from the Georgia Nonpublic Postsecondary Education Commission to use the words “college” or “university.”

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- You can find state-specific LLC naming guidelines on the Georgia Secretary of State website.

You can also read the Georgia state statute about LLC naming guidelines for more information.

2. Is the name available in Georgia? You can use the eCorp business search on the Georgia Secretary of State website to see if your desired LLC name is available.

3. Is the URL available? We recommend checking to see if your business name is available as a web domain. Even if you don’t plan to create a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Step 2: Choose Your Georgia Registered Agent

You must elect a registered agent for your Georgia LLC.

An LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Many business owners choose to hire a registered agent service. Many of these services will form your LLC for a small fee and include the first year of registered agent services for free.

Step 3: File the Georgia LLC Articles of Organization

The Georgia Articles of Organization is used to officially register an LLC.

File Your Georgia Articles of Organization

OPTION 1: File Online With Georgia eCorp

File Online– OR –

OPTION 2: File Form CD 030 by Mail or in Person

Download FormState Filing Cost: $100, payable to the Secretary of State (Nonrefundable)

Filing Address:

Corporations Division 2

Martin Luther King Jr. Dr.

SE, Suite 313 West Tower

Atlanta, GA 30334

Note: You must file Form CD 231: Transmittal Information Form along with your Articles of Organization

Step 4: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

For more information, read our Georgia LLC Operating Agreement guide.

Our operating agreement tool is a free resource for business owners.

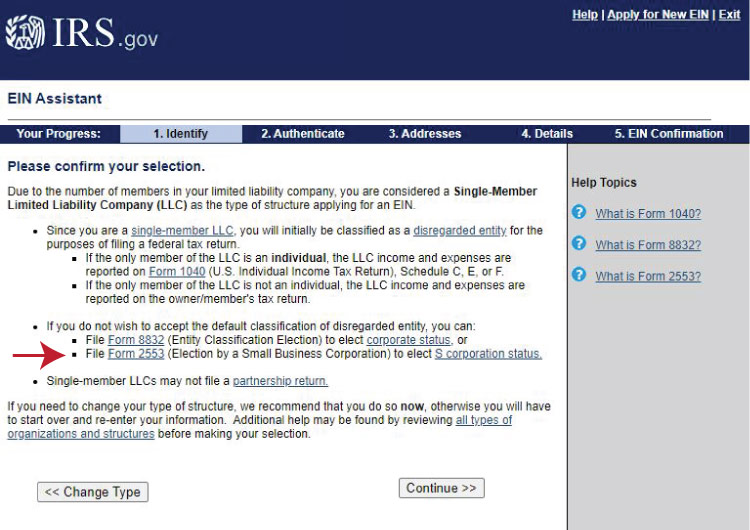

Step 5: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly with the IRS.

Elect S Corp Tax Status

During the online EIN application, the IRS will provide a link to Form 2553, the Election By a Small Business form.

Visit our Form 2553 Instructions guide for detailed help with completing the form.

This is the form to elect S corp tax status for your LLC:

Ready to start saving on your taxes?

We recommend using a formation service to start your Georgia S corp for you, so you can focus on the things that matter most — growing your business.

Keep Your Georgia S Corp Compliant

Once your Georgia S corp is established, it’s vital to follow state regulations to ensure your business remains in good standing and compliant with all legal requirements.

File the BOI Report

The federal government requires that all S corporations — whether LLCs or corporations — submit a Beneficial Ownership Information (BOI) report to the Financial Crimes Enforcement Network (FinCEN). This report is essential for keeping federal records accurate regarding the individuals who own and/or control your business.

You can file the BOI report through the FinCEN website.

Open a Business Bank Account

It’s crucial to maintain a clear separation between your personal and business finances to safeguard your S corp’s liability protection. Opening a business bank account also is a fundamental step in keeping your financial operations organized and compliant.

For tailored options, explore our guide on the Best Banks for Small Business.

Secure the Necessary Business Licenses

Georgia requires that all businesses obtain the appropriate state and local licenses to operate legally. The specific licenses you need will depend on your business’s industry and location.

To get started with securing the proper licenses, visit our Georgia Business License guide.

Submit Your Annual Registration

Georgia S corps must file an Annual Registration with the Georgia Secretary of State to keep the business in active status. This filing is due by April 1 each year. Failure to file can result in penalties or administrative dissolution.

You can complete your Annual Registration through the Georgia Corporations Division website.

Understand S Corp Tax Responsibilities

Georgia imposes a state corporate income tax on businesses, including S corps, that generate income within the state. Additionally, your S corp must meet all federal tax obligations.

For comprehensive details on Georgia’s tax requirements, visit the Georgia Department of Revenue’s Corporate Income Tax page.

Meet Georgia Sales Tax Requirements

Georgia has a statewide sales tax, and local jurisdictions also may impose additional sales taxes. If your S corp sells taxable goods or services, you’ll need to register for sales tax and comply with state and local tax laws.

For more information on Georgia’s sales taxes, visit the Georgia Department of Revenue’s Sales & Use Tax page.

Start a Georgia S Corp FAQ

An S corporation (S corp) is a tax designation that an LLC or a corporation can elect.

No. The default taxes for an LLC and taxes for an S corp are not the same.

With an S corp, owners pay personal income tax and self-employment tax on a predetermined salary. They may then withdraw any remaining profits from the business as a “distribution,” which isn’t subject to self-employment tax.

With an LLC, all company profits pass through to the owners’ personal tax returns, and then the owners must pay personal income tax and self-employment tax on the entire amount.

S corp owners are required to earn a “reasonable” salary, which basically means a fair market rate based on the individual’s qualifications as well as their duties and responsibilities at the company. The purpose of this requirement is to prevent S corp owners from paying themselves an artificially low salary in order to pay less self-employment tax.

A distribution is a dividend that a shareholder/owner can take from the business profits that remain after a company pays all of its employee salaries. Shareholders must pay personal income tax on distributions, but distributions aren’t subject to self-employment tax.

LLCs and corporations that operate under a “doing business as” (DBA) name can choose the S corp election.

If you later decide you want to have the IRS tax your business as an S corp, you can update its tax status as long as you meet the IRS’s S corp requirements. Structuring your business as an S corp follows the same process and requires the same forms as an LLC — with just one simple extra step to get you set up.

Forming an S corp in Georgia can prove beneficial given its low statewide sales tax, supportive business climate, and graduated income tax rates that top out at 5.75%. You can save money on your taxes, which’ll enable you to reinvest more in the growth of your business.