Sole Proprietorship vs S Corp

If you are operating a small business as a sole proprietorship (or are thinking about starting a business), it might make sense to start an S corporation (S corp).

An S corp will help protect your personal assets and can help you save on self-employment taxes compared to a sole proprietorship.

In our Sole Proprietorship vs S Corp guide below, we will help you understand the key differences between a sole proprietorship and S corp and how to make the right choice for your business.

Recommended: If you have at least $60,000 in net earnings, an S corp may offer tax advantages. Let Northwest start your S corp today.

Sole Proprietorship vs S Corp: What’s the Difference?

A sole proprietorship is an unincorporated business that doesn’t have any legal separation from its owner.

An S corp is an LLC or corporation that has elected to be taxed as an S corporation.

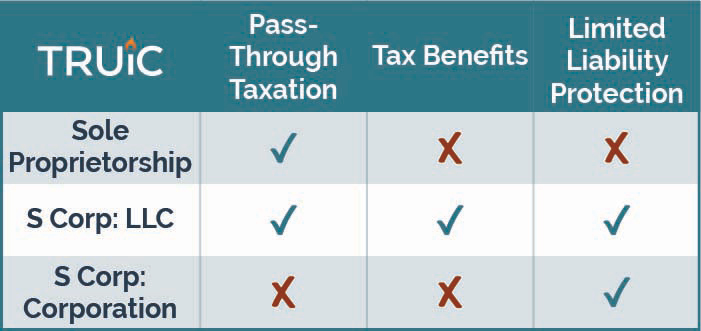

Sole Proprietorship vs S Corp The main difference between a sole proprietorship and an S corp is that S corps have limited liability protection and tax options, whereas sole proprietorships do not.

What is a Sole Proprietorship?

A sole proprietorship is an unincorporated business structure that isn’t legally separated from its owner. Sole proprietorships don’t offer limited liability protection or tax options.

Limited Liability Protection A type of legal protection that shields a business owner’s personal assets from losses and debts incurred by the business.

Sole Proprietorship Taxes

Sole proprietors pay income tax and self-employment tax on their business’s net profit. The business’s income passes-through to the owner’s individual tax return.

Pass-Through Taxation A system of taxation whereby the business’s profits or losses aren’t taxed at the business level. Instead, they “pass-through” to the owners’ personal tax returns and are taxed at each owner’s personal income tax rate.

When a sole proprietor has significant profit and minimal expenses, paying self-employment tax and income tax can create a heavy tax burden. An example would be an electrician or other skilled trades professional.

What is an S Corporation?

An S corporation (S corp) is an IRS tax status that incorporated businesses, like LLCs and corporations, can elect.

In fact, the S corp tax status can only be elected by an LLC or corporation. This means any business that operates as an S corporation also offers limited liability protection, just like any other LLC or corporation would.

Most small businesses should have liability protection so that the business owner’s personal assets are protected in the event of a business loss.

Sole proprietorships can elect S corp status when they form their LLC (or corporation). You can learn more about this process in our How to Change From a Sole proprietorship to LLC guide.

S Corporation Taxes

S corporations are taxed under Subchapter S of the IRS internal code. Under the S corp tax election, the IRS treats the business owner as an employee. As an owner-employee, the business owner doesn’t have to pay self-employment tax on their portion of the business’s profit.

In an S corp, the owner-employee pays FICA taxes and income taxes on their reasonable salary. Distributions are subject to only income taxes.

This can lead to significant tax savings under the right circumstances. Tax savings must be weighed against additional payroll and accounting taxes.

Learn more in our S Corp Taxes guide.

The Difference Between Sole Proprietorship vs S Corp Taxes

Sole proprietors pay self-employment taxes and income taxes on the net profit of the business.

In an S corp, the business owner pays FICA and income taxes on their “reasonable salary” and only income taxes on distributions.

Ready to get started?

Let Northwest form your S corp today.

Choosing a Business Structure: Sole Proprietorship vs S Corp

In order to be taxed as an S corp, a sole proprietor would need to change their business structure into a corporation or LLC. We recommend using an LLC as your S corp business structure because a corporation would very rarely benefit from electing S corp tax status.

TIP: A corporation with S corp status never makes financial sense unless the business was already established as a corporation.

We will help you decide when it makes sense to:

- Operate as an LLC taxed as an S corp

- Operate as a sole proprietorship

- Operate as an LLC taxed in the default way

When to Start an LLC Taxed as an S Corp

A business can choose to form an LLC and then elect S corp status. Under the right circumstances, S corp tax status allows business owners to pay fewer taxes on their earnings.

You should elect to be taxed as an S corp if these four things are true:

- You know you’ll want to take a substantial portion of money out of your business rather than reinvest profit to grow the business, year over year

- You know your business will generate enough profit to pay the owner(s) a reasonable salary and at least $10,000 in annual distributions

- Your business is an LLC or corporation

- The business meets S corp requirements

For a Free Consultation with a Tax Professional

schedule a call now.S Corp Requirements, Advantages, and Disadvantages

Reasonable Salary

Under an S corp election, LLC owners become employees. The IRS requires owner-employees to be paid a reasonable salary. A reasonable salary is any salary that you would pay someone to do the same job.

LLCs taxed as S corps are subject to increased scrutiny by the IRS. If the owner is not paid a reasonable salary, this may lead to the IRS denying S corp status and may lead to fines and back taxes.

To determine a reasonable salary for your position, you can compare similar salaries on websites like Glassdoor or the US Bureau of Labor Statistics.

Profit and Distribution

The S corp election allows a business owner to disburse an LLC’s profit to owner-employees in the form of salary and distributions. The IRS then applies FICA and income taxes to only the salary. Distributions are subject to only income tax.

If the LLC doesn’t earn enough profit to cover a reasonable salary and distribution, it won’t make financial sense to elect the S corp tax classification. And, if the LLC owner(s) would like to forfeit salary for any reason, they could be subject to fines by the IRS.

Positive Return on Investment

It costs money to elect and maintain an S corp. Filing fees with the IRS are minimal but the additional bookkeeping and payroll costs are not. For LLCs that already have employees and payroll costs, this factor won’t hold as much weight.

Business owners should weigh the cost of maintaining these services against the fiscal tax advantage of electing the S corp classification. Generally speaking, a reasonable salary plus $10,000 in annual distributions is often enough to make electing the S corp financially viable.

IRS S Corp Requirements

The IRS requires that businesses that elect the S corp status have 100 shareholders or less and they are only allowed to issue one class of stock.

The owners of the business must be US citizens or permanent resident aliens. Owners must also be private individuals and not business entities such as LLCs, corporations, or trusts.

When to Operate as a Sole Proprietorship

Sole proprietorships are best for businesses with these characteristics:

- They MUST be low risk (low chance of liability or financial loss)

- They have a smaller customer base; often friends, family, and neighbors

- They might be hobbies like photography, blogging, or video streaming

Sole Proprietorship Advantages

The biggest advantage of starting a sole proprietorship is simplicity; it couldn’t be any easier or less expensive to get a business up and running.

Sole Proprietorship Disadvantages

No Personal Liability Protection. Sole proprietorships don’t offer personal liability protection. This means your personal assets (car, house, bank account) are at risk in the event your business is sued or if it defaults on a debt.

Zero Tax Benefits. Sole proprietors pay self-employment taxes and income taxes on their net profit. When a business becomes profitable, it will be very expensive to be taxed as an informal business structure.

Limited Growth Potential. High tax burden and lack of liability protection can keep a business from being successful.

Reduced Credibility and Branding Opportunities. A sole proprietor or partnership must invoice, receive payment, open a bank account, and market with their surname(s) unless their state allows them to register and maintain a doing business as (DBA) name.

How to Start an S Corp

There are two main ways to start an S corp:

- By forming an LLC and electing S corp tax status from the IRS when you request your employee identification number (EIN)

- By forming a corporation and electing S corp status from the IRS

Steps to Forming an LLC and Electing S Corp Status

Starting an LLC and electing S corp tax status is easy. You can use our guides to start an LLC with the S corp status yourself.

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

Six Basic Steps to Start an LLC and Elect S Corp Status:

Step 1: Select a State

Step 2: Name Your LLC

Step 3: Choose a Registered Agent

Step 4: File the Articles of Organization

Step 5: Create an Operating Agreement

Step 6: Get an EIN and File Form 2553 to Elect S Corp Tax Status

Step 1: Select Your State

Go to How to Start an S Corp to choose your state.

Step 2: Name Your LLC

You will need to provide your state with a unique name that is distinguishable from all registered names when you file your LLCs formation documents.

Our Business Name Generator and our How to Name a Business guide are free tools available to entrepreneurs that need help naming their business.

Step 3: Choose an LLC Registered Agent

Your LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Step 4: File Your LLC’s Articles of Organization

The Articles of Organization, also known as a Certificate of Formation or a Certificate of Organization, is the document you will file to officially register an LLC with the state.

Step 5: Create an LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

Our operating agreement tool is a free resource for business owners.

Step 6: Get an EIN and Complete Form 2553 on the IRS Website

An EIN is a number that is used by the US Internal Revenue Service (IRS) to identify and tax businesses. It is essentially a Social Security number for a business.

EINs are free when you apply directly with the IRS.

Elect S Corp Tax Status

During the online EIN application, the IRS will provide a link to Form 2553, the Election By a Small Business form. This is the form to elect S corp tax status for your LLC.

Visit our Form 2553 Instructions guide for help with filling out form 2553.