Best Accounting Software for Small Business in 2026

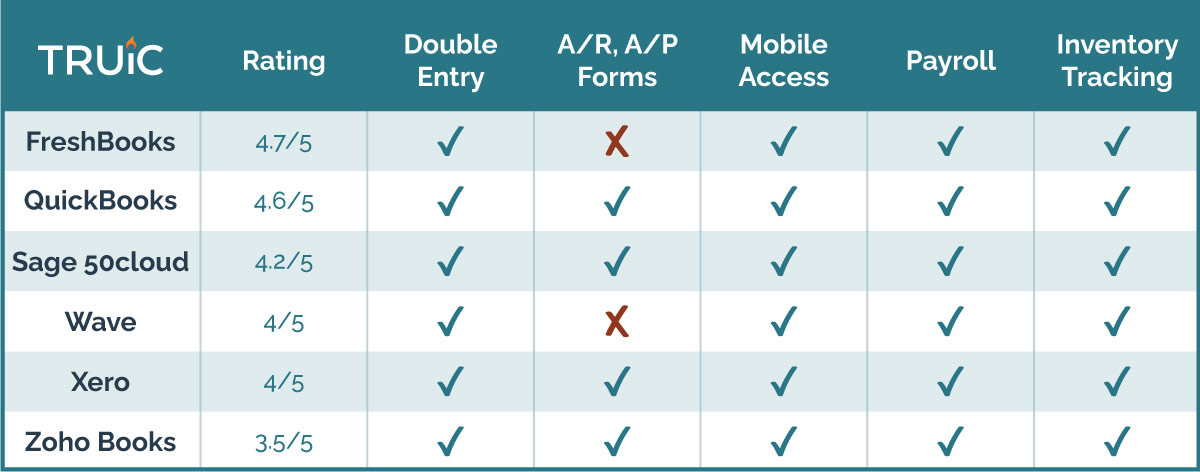

For 2026, FreshBooks is our top accounting software pick for small businesses thanks to its intuitive interface, double-entry accounting, and affordable pricing.

Other top contenders include QuickBooks for growing businesses that need advanced features, Wave for free basic accounting, Xero for add-on integrations, Sage 50cloud for inventory-heavy businesses, and Zoho Books for mobile access.

Recommended: Freshbooks is our number one choice for accounting software.

Best Accounting Software for Small Business

Our Approach:

Our review of the best accounting software for small businesses looked at a number of factors these systems should have to be truly effective. These include:

- User-friendliness

- Remote control capability

- Ability to prevent and flag errors

- Adjusting inventory automatically after sales

- Cost-effectiveness

- AI-driven automation

Our Small Business Accounting Software Picks for 2026:

- FreshBooks: Best for Sole Proprietorships and Partnerships

- Intuit QuickBooks: Best for Small and Midsize Businesses

- Sage 50cloud: Best for Inventory Tracking

- Wave: Best for Free Accounting

- Xero: Best for Integrated Add-ons

- Zoho: Best for Mobile Access

Recommended: Freshbooks has depth, flexibility, and add-on capability that’s hard to beat. It’s easy to use and well-suited for a variety of businesses. Its pricing plans are also quite affordable.

6 Best Small Business Accounting Software

1. FreshBooks: Best Accounting Software for Sole Proprietorships and Partnerships

Freshbooks is ideal for unincorporated businesses like sole proprietorships and small partnerships. Its features are set out in an intuitive way that’s easy to understand and easy to use. Its simplicity and attractive design also make it suitable for freelancers and part-time users.

Price

Free trial: Yes, up to 30 days.

Pricing comes in three tiers.

- The Lite plan allows you to bill up to five customers for $4.50 per month.

- The Plus plan costs $7.50 and allows up to 50 customers to be billed.

- The Premium plan allows up to 50 customers to be billed for $15 per month.

Features

Here is a quick summary of what FreshBooks’ accounting software offers:

- Double-entry integrated throughout daybooks, journals, and ledgers

- Automatic inventory adjustment

- Payroll

- Mobile access

- Customer and vendor portals

FreshBooks Pros and Cons

Pros:

- Double-entry accounting

- Satisfying user experience

- Detailed client records

- Team collaboration and time tracking tools

- Inventory tracking

- Automatic mileage tracking on iOS

Cons:

- Not much help in setting up

- Few options to customize invoices

- Mobile apps lack some desktop features

Recommended: Freshbooks is great accounting software for businesses like sole proprietorships and partnerships. Try them out with a 30-day free trial.

2. Intuit QuickBooks: Best Accounting Software for Small and Midsize Businesses

Intuit QuickBooks is our top recommended accounting software for small business. Its simple navigation and conveniently laid out features will also make it the first choice for a wide range of businesses. Intuit QuickBooks

Price

Free Trial: Yes, up to 30 days.

Pricing is monthly for four increasingly advanced versions:

- Simple Start: $25

- Plus: $70

- Advanced: $150

- Freelancer: $15

Example business types that might be best suited to Intuit QuickBooks include freelance software developers, ecommerce stores, property managers, massage therapists, and those running a bed and breakfast establishment.

Features

Here is a quick summary of what Intuit QuickBooks’ accounting software offers:

- All major A/R and A/P forms

- Automatic inventory adjustment

- Payroll

- Mobile access

- Time tracking

Intuit Quickbooks Pros and Cons

Pros:

- Easy to use navigation and interface

- Detailed contact records and transaction forms

- Can assess profitability by project

- Reports that can be customized

- Payroll support

- Extensive range of add-ons and integrations available

- Cash flow pages

- Hybrid sales tax option

Cons:

- Quite costly

- Online support not up to mark

- Mobile apps lack desktop features

Recommended: Intuit QuickBooks is great for a number of different types and sizes of small- to medium-sized businesses.

3. Sage 50cloud: Best Accounting Software for Inventory Tracking

Sage 50cloud is the online version of Sage’s comprehensive accounting solution, which is especially good at tracking inventory. Sage 50cloud integrates with Microsoft 365, which means it can share data with productivity applications through the cloud. It is the most expensive system in our review.

Price

Sage 50cloud has three pricing plans; all three require you to commit to a 12-month subscription.

For one user for one year:

- Pro Accounting costs $340

- Premium Accounting costs $510

- Quantum Accounting costs $842

Microsoft 365 can also be added for an additional $150 per annum.

Features

Here is a quick summary of what Sage 50cloud accounting software offers:

- Double-entry accounting

- All major A/R and A/P forms

- Mobile access

- Inventory tracking

- Payroll

Sage 50cloud Pros and Cons

Pros:

- Sophisticated feature set

- Can be customized extensively

- Detailed contact and item records

- Very strong inventory management tools

- Capability to scale up

- Good support

- Microsoft 365 integration

Cons:

- No Android or iOS versions

- Lacks a comprehensive mobile app

- Costly

Visit Sage to learn more about its Sage 50cloud accounting software.

4. Wave: Best Accounting Software for Free Invoicing

Wave is a freelancer’s dream. Its primary accounting features are free. Using the accounting software costs nothing, but certain features, such as payroll, do incur a charge. In addition, there are charges for payments — such as for processing debit and credit card payments.

Price

$0 for primary accounting features.

Features

Here is a quick summary of what Wave’s accounting software offers:

- Free accounting system

- Attractive user interface and navigation tools

- Instant payouts – get payments in minutes instead of days

Wave Pros and Cons

Pros:

- Free for basic accounting functions

- Good invoice and transaction management

- Attractive user interface and navigation tools

- Context-sensitive help

- Instant payouts – expedited payment processing

Cons:

- Not many fields on the record templates

- Mobile app lacks features

- Cash receipts by Wave unavailable on Android

Open an account with Wave to get low-cost payroll for your small business.

5. Xero Accounting Software: Best Accounting Software for Integrated Add-Ons

Xero accounting software is good for sales and purchase transactions as well as account reconciliations and project tracking. Its setup process is easy, and the system is a breeze to use.

Price

Free trial: Yes, up to 30 days.

There are three pricing levels:

- Xero Early costs $9 per month

- Xero Growing costs $30 per month

- Xero Established costs $60 per month

Features

Here is a quick summary of what Xero’s accounting software offers:

- Mobile access

- Time tracking

- Payroll

- Inventory tracking

- CRM Integration

Xero Accounting Software Pros and Cons

Pros:

- Attractive dashboard

- Easy setup process

- Tools to enable speedy reconciliation

- Good online support

- Project tracking available

- Integrates with Gusto payroll

Cons:

- No phone or chat help

- Mobile apps lack some desktop features

- Expenses handled in separate mobile app

- No reorder level for inventory

Open an account with Xero to get low-cost payroll for your small business.

6. Zoho Books: Best Accounting Software for Mobile Access

Zoho Books is a good cloud-based small business accounting software option since its mobile access capabilities are outstanding. In addition, the system offers an exceptional user experience, a rich set of tools, and an attractive price.

Price

Free Trial: Yes, there is a 14-day free trial.

Zoho Books offers three pricing plans. Prices are per organization per month:

- The Basic plan costs $9 per month

- The Standard plan costs $19 per month

- The Professional plan costs $29 per month

Features

Here is a quick summary of what Zoho Books’ accounting software offers:

- Double entry

- All major A/R and A/P forms

- Mobile access

- Time tracking

- Payroll

- Customer/Vendor portals

- Tracks inventory

Zoho Books Pros and Cons

Pros:

- Excellent user interface and mobile apps

- Highly customized records and transaction forms, including dozens of custom fields

- Several payment gateways

- Document management available

- Good support

Cons:

- Payroll feature just for California, New York, and Texas

- Time tracking only available for projects

- Just a few accountant partners

Open an account with Zoho Books to get low-cost payroll for your small business.

How to Choose Small Business Accounting Software

Even though modern automation makes “keeping the books” easier than ever, you must still evaluate how a system will handle your unique workflow and compliance needs.

Below we’ve broken down the six main factors to consider before making your decision:

- Automation & AI: Look for “hands-off” features like automated receipt scanning, AI-driven expense categorization, and predictive cash flow forecasting that alert you to trends before they happen.

- Seamless Integrations: Ensure the tool supports your revenue streams. If you operate in E-commerce or the Creator Economy, the software must provide native, two-way syncing with platforms like Shopify, TikTok Shop, or Stripe to automate data flows between systems.

- Scalability: Don’t just buy for the business you have today. Choose a platform that allows you to add users, advanced reporting, and deeper inventory tools as you grow.

- Mobile Functionality: In 2026, business happens everywhere. Ensure that the mobile app version of your accounting software isn’t just a stripped-down “lite” version but a fully functional tool that lets you send invoices, track expenses, and review reports on the go.

- Tax Compliance: Prioritize systems that track contractor payments in real-time and automate year-end filings. Look for one-click e-filing for forms like 1099-NEC and 1099-MISC to meet IRS requirements without manual paperwork.

- Data Migration: Do not get locked into a system you will outgrow. Before committing to any accounting software, verify that it has built-in migration tools (e.g., switching from QuickBooks to Xero) that let you move your historical financial data easily as your business complexity grows.

It’s also a good idea to take advantage of free trials to test your top two or three choices with your actual business data. This hands-on experience will reveal which system fits your workflow best and help you avoid switching costs down the road.

Final Thoughts

Our review of small business accounting software has covered some very simple systems and some quite sophisticated ones. We hope that one of them will serve perfectly in your small business. It’s possible to experiment before actually committing to one. All of the systems we reviewed offer free trials for a limited time. Perhaps, the only way to know which one’s best is by actually using it.

FAQs

Why do I need accounting software?

Accounting is the language of business. An accounting software tracks and records the activities the small business carries out and produces reports that provide a picture of business performance.

What business reports do accounting software produce?

Accounting software reports vary. But all systems will produce an income statement, a balance sheet, and a cash flow statement.

Do I need to install accounting software on my computer?

No. Online accounting software requires no complicated installation. To use from your desktop, simply open an account, and work in the browser. For mobile use, you will need to download and install an app on your device.

Do I need to know bookkeeping or accounting to use accounting software?

You do not need to have a strong accounting background to use accounting software. It would certainly help to have bookkeeping knowledge, but it’s not absolutely necessary.

Is accounting software for individual or team use?

It can be for both. You can grant other people access to the system. For example, your accounting team and your accountant will require access to the software.

What are the three crucial financial statements produced by accounting software?

The three most important financial statements produced by accounting software are the income statement, the balance sheet, and the cash flow statement.

Some software may also show a statement of retained earnings, which shows how much profit remains after disbursements.

What is a balance sheet?

A balance sheet is a financial statement that shows the assets and liabilities of a business and the difference between the two, which is known variously as net assets, net worth, capital, or equity.

What is an income statement?

An income statement is a financial statement that shows small business owners their revenue, expenses, and the difference between the two, which is known variously as net profit, net earnings, or net income.

What is a cash flow statement?

A cash flow statement is a financial statement that shows small business owners their cash receipts and cash expenditure as well as opening and closing cash balances for a certain period. Its purpose is to identify the items affecting cash resources and their amounts.

How much does small business accounting software cost per month?

Most small business accounting software costs between $15 and $50 per month, though prices vary depending on how many features or users you need.

Can I use Accounting Software for my LLC’s taxes?

Yes. Most platforms allow you to categorize expenses and generate the specific financial reports (like profit and loss statements) required for tax filing. Nearly all modern software also allows you to invite your accountant directly to the platform to simplify your year-end filing.

Do I need an accountant if I have accounting software?

Accounting software automates daily tasks like tracking expenses and sending invoices, but you’ll still need an accountant for high-level tax strategy and year-end audits. That said, keeping your data organized in the software throughout the year makes the accountant’s job faster (and often cheaper).