ADP Payroll Software Review

Payroll specialists like ADP not only help you pay your employees, but also take care of ongoing payroll taxes and year-end tax forms.

We tried ADP and compared it to other payroll services on the market. Read on to find out if it’s the best fit for your business’ needs.

Skip ahead

Best Payroll Services

Recommended: To help you select a payroll service for your business, we’ve reviewed the best payroll services for small businesses.

Summary

ADP is the industry leader in payroll services. They’ve set the standard for modern payroll software, which has virtually eliminated the need for human toil in payroll calculation. ADP’s highly sophisticated and reliable services allow businesses to dramatically reduce the risk of payroll errors and misfilings.

Who is ADP Right For?

ADP is ideal for any business in need of a dependable, no-fuss program to streamline the payroll process for employers and employees alike.

PROS

- As previously mentioned, ADP’s highly reliable and user-friendly services have made them the industry leader in payroll software.

- ADP offers 24/7 phone and email support, along with helpful community forums.

- They offer frequent discounts and other promotional incentives.

- ADP has a variety of payroll delivery methods, from physical checks to direct deposit.

- The way the software is designed allows users to access account data through a variety of platforms.

CONS

- Although ADP offers 24/7 phone and email support, their customers often experience relatively lengthy wait times.

- The ADP setup process is somewhat difficult, especially for novice users.

- ADP charges a fee per pay period, making their services more expensive for business owners who wish to pay their workers on a weekly or bi-weekly basis.

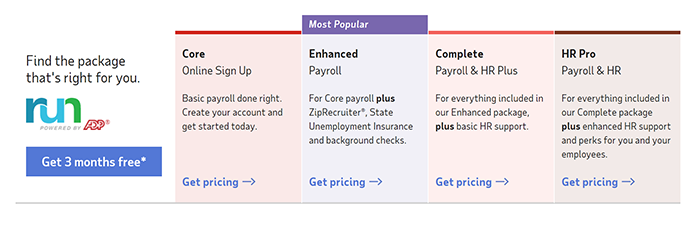

Pricing

ADP offers custom pricing based on your business’ specific needs. To give you a very general idea of what their services cost, a business owner with 10 or fewer employees should expect to pay somewhere between $50 and $150/month (depending on the plan they choose).

Below we’ll discuss the features included in each of ADP’s payroll plans.

Core Payroll

- Payroll & Taxes:

- Direct deposit payroll delivery

- Electronic reports

- General ledger interface

- New hire reports

- 1099 and W-2 filings

- Human Resources:

- ADP® Employee Access

- New hire onboarding

- Employee discounts

Enhanced Payroll

- Additional Payroll Features:

- Check signing and stuffing

- Secure checks

- Prepaid cards

- Poster compliance

- State unemployment insurance (SUI)

- Garnishment payment service

Complete Payroll + HR

- Additional HR Features:

- Employee handbook wizard

- ZipRecruiter®

- Background checks

- Job description wizard

- New hire onboarding

- HR HelpDesk

- HR forms & document vault

- HR training & toolkits

- HR QuickAnswers

- Audit wizard

- HR compliance database & alerts

- HR tracking

HR Pro

- Additional HR Features:

- Enhanced HR HelpDesk Support

- Work-Life Employee Assistance Programs

- Enhanced Employee Handbook Support

- Employee Discount Program

- Trainings

- Legal Assistance – including employment matters – from Upnetic Legal Services, powered by Legal Club®

Ratings

Value – 4/5

ADP’s high functionality and versatility have made them the industry leader in payroll services. Unfortunately, however, their monthly rates are significantly more expensive than some of their competitors’. Plus, many of the features that set ADP apart from other providers come with additional fees (for example, their W-2 and 1099 processing services).

All that said, it’s worth mentioning that ADP is known for throwing in discounts, voiding fees, and making other efforts to demonstrate flexibility with their clients. So basically, they’re not the cheapest option on the market, but they offer industry-standard features and truly care about their customers’ satisfaction.

Customer Service – 4/5

ADP provides 24/7 phone and email support, helpful community forums, and virtual training sessions to help you set up their payroll program. This is much more than other providers have to offer, but that’s not to say ADP’s customer support is without its pitfalls. Depending on the volume of customers contacting them at any given time, you may experience lengthy wait-times on the phone, or delays in email responses.

Ease of Use – 4/5

ADP can be quite difficult to set up, but once you get it up and running, the platform is actually really intuitive. Their administrative portal makes it easy for managers to keep track of their payroll data, while their employee accounts allow workers to access their personal documents and account information themselves. Most importantly, ADP will effectively remove payroll (and HR, depending on the plan you choose) from your list of business-related concerns.

Included Features – 4.5/5

As previously discussed, ADP provides industry-standard payroll features. Their super-secure platform makes it easy to deliver employee payments by check or direct deposit, and enables users to access electronic reports at any time.

With ADP, you’ll receive all necessary workplace signage to comply with labor laws, and have all wage garnishments and withholdings taken care of. They’ll even help out with your year-end tax forms (for an extra fee).

Conclusion

All in all, ADP successfully does what it’s designed to do: eliminate the need to worry about payroll and employee taxes on a day-to-day basis. While it’s not the cheapest option on the market, ADP is a great choice for business owners who are looking for top-notch functionality in their payroll service. We encourage you to consider all of the perks and downfalls we’ve discussed throughout this review when deciding whether or not ADP is the right fit for your business.

Gusto: ADP Payroll Alternative

Gusto’s transparently priced, 100% paperless payroll and HR services are quickly rising in popularity among modern-minded small businesses.

Gusto: $45/month

Read our Gusto review

Try Accounting Software:

Recommended: Having the right accounting software can save your business thousands of dollars in taxes each year and help with financial questions.