S Corp vs C Corp – What’s the Difference?

C corp vs S corp – First thing to know is that these are both types of tax structures that a formal business such as a corporation or LLC (Limited liability Company) can elect to be taxed as by the IRS.

Basically, all this means is that there are multiple ways of being taxed by the IRS and businesses can choose which one they prefer. Each method has its advantages and disadvantages. Deciding which one is right for your business really depends on what your goals for your business are and how much profit it’s making.

For S Corp Tax Questions schedule a free call now.

What are the Tax Structures of S Corp and C Corp

The C corp or C corporation is the default way that a corporation is taxed by the IRS.

The S corporation is a tax election that corporations can choose. S corps offer advantages under the right circumstances.

LLCs can also choose to be taxed as an S or C corp.

In our S Corp vs C Corp – What’s the Difference guide below, we’ll explain:

- The advantages and disadvantages of a C corp vs S corp

- How to choose between an S vs C corp

- How to Start an S corp or C corp

Recommended: Read our How to Choose a Business Structure guide. If you decide an S corp is best for your business, let Northwest start your S corp, handle your monthly accounting, and more.

The Difference Between an S Corp and C Corp

The difference between an S and a C corp has to do with taxes. In a C corporation, income is taxed at the business level and then again when the income is distributed to owners and investors. In an S corporation, income isn’t taxed at the business level. Distributions and the owner’s percentage of profit passes through to the owner’s personal income taxes.

S Corp Taxes

The S corporation tax status (also called subchapter S) allows income to pass through to the owner’s personal tax return instead of being taxed first at the business level. S corp status also allows business owners to elect to be taxed as employees of the company.

These attributes could be beneficial under the right circumstances.

S Corp Tax Advantages

- S corps can avoid double-taxation when compared to C corp tax status.

- When owners of an LLC elect S corp status, they become employees of the LLC for tax purposes. Owners can reduce self-employment taxes by electing S corporation status.

S Corp Tax Disadvantages

- For corporations, S corp status can rule out the benefits of being a corporation, such as attracting investors. It also limits businesses to one class of stock and presents several other restrictions.

- For LLCs, using the S corp status only helps if you can meet S corp restrictions and save money by being taxed as an employee-owner. We’ll cover this in more detail below.

When to Choose S Corp Tax Status

You can elect S corp status when you form a legal business structure (LLC or corporation), specifically:

- New business (LLC or corporation)

- File Form 2553 2 months and 15 days or before, after starting your business

- Existing businesses (LLC or corporation)

- For S corp status the following year, file Form 2553 anytime the year before (e.g. file form in 2023 anytime to be taxed as S corp in 2024)

- For S corp status in the same year, file Form 2553 within the first 2 months and 15 days of the same year or before (meaning, you must file between January 1st and March 15th but no later. If you file by March 16th or after, you’ll miss the deadline and have to wait for the following year)

However, a business should never start out as a corporation taxed as an S corp. In a corporation, the S corp tax status rules out the benefits of a corporation and leaves you with a business structure that is complex to maintain.

Corporations should only use the S corp status if the corporation is already in existence and they’ve been instructed by an accountant to correct their tax status.

If a business owner is ready to form a legal business structure, and they want to be taxed as an S corp, they should form an LLC with S corp status.

We can help you do it yourself with our free guides to starting an S corp or you can hire a professional service to help.

LLCs should use the S corp status when:

- The business meets S corp restrictions

- The business earns enough in net profit to pay a “reasonable salary” and at least $10,000 in distributions annually

- The addition of payroll and accounting costs doesn’t outweigh tax advantages

C Corp Taxes

The term C corp is often used to mean the same thing as “corporation”. That is because corporations are taxed as a C corp by default. The IRS calls this type of corporation a “subchapter C corporation” or C corp.

LLCs can also be taxed as a C corp.

Businesses taxed as C corps pay a federal corporate tax rate of 21% on net profit.

C corps then distribute their profits to shareholders in the form of dividends. Shareholders then pay personal income tax on these dividends again. This is referred to as double taxation.

Double Taxation: When the profits of a company are taxed at the corporate level and again at the shareholder level, they are said to be double taxed.

The tax rate on the ordinary dividends paid to shareholders is the same as the individual federal income tax rate, which means it will vary depending on your income.

C Corp Tax Advantages

- A small business taxed as a C corp can attract investors. This is because shareholders only pay taxes on dividends they receive, not the entire profit of the business. In any other tax structure, the shareholder would owe taxes on profit regardless if they received payment.

- C corps only pay 15% taxes on profit carried from tax year to tax year. In rare circumstances, small businesses might carry-over enough profit from tax year to tax year to warrant being double-taxed.

- A corporation is taxed at about 15% for all profits that carry over to the next tax year. A business owner taxed as an S corp would pay FICA taxes and income taxes on the carry-over which would be higher than the 15% corporate rate.

C Corp Tax Disadvantages

- Under a C corp, business owners face double-taxation. Double-taxation is only favorable if outweighed by C corp benefits, like being investor friendly or carrying high amounts of profit from year to year.

When to Choose C Corp Tax Status

A small business should choose C corp status when they need to:

- Attract investors

- Carry large amounts of profit from one year to the next

Visit our How to Start a Corporation guide to learn how to start a C corporation yourself.

Choosing a Business Structure

Corporation

Most small businesses start as limited liability companies (LLCs) but there are some instances when starting as a corporation makes sense.

Your small business would benefit from a corporate structure if:

- you need to attract venture capitalists and investors

- you need to carry significant profit over from tax year to tax year (rare for small businesses)

- there is benefit in managing a complex business structure

Corporation Electing S Corp:

The only time a business owner would benefit from having a corporation taxed as an S corp is if they mistakingly formed a corporation in the beginning and need to correct their tax status.

Before LLCs were introduced, small businesses could only get limited liability protection by forming a corporation.

Limited liability protected small business owners’ assets, but unfortunately, the double-tax burden of a C corp was too much for most small businesses.

Double-Taxation: A C corp’s net profit is taxed once and then all profit is taxed again once distributed to shareholders/business owners.

The S corp was introduced to relieve the burden of double-taxation.

But, S corp tax status rules out the advantages of operating a corporation, like being investor-friendly, and leaves you with a complex business structure that is challenging to maintain.

Recommended: If you think S corp status might be right for your business, you can form an LLC and elect S corp status.

Limited Liability Company (LLC)

An LLC is most likely the best structure for your business if:

- you don’t need to attract investors

- you plan to invest most of your profit back into the business each year

- you would benefit most from an easy to maintain business structure

Visit Our Guides to Learn More About Forming an LLC

LLC Electing S Corp:

It could make sense for an LLC to file taxes as an S corp if there’s enough net profit to pay owners a reasonable salary and at least $10,000 in annual distributions.

The S corp tax classification allows business owners to be taxed as employees of an LLC. Under an S corp, the business owner doesn’t have to pay self-employment tax on their salary, and distributions are only subject to income tax.

S Corp Tax Benefit: Instead of paying self-employment tax and income tax on all distributions from the business, an S corp owner pays only FICA and income taxes on their salary and only income taxes on distributions. This could lead to major tax savings under the right circumstances.

When to Start an S Corp

Only LLCs should elect to be taxed as an S corp. We can help you decide if S corp status is right for your small business.

S Corp Savings Calculator

Calculate how much you can save by choosing an S Corp tax classification

As a Sole Proprietorship or Single-Member LLC

Net Income:

Self Employment Tax:

S Corp

Net Income:

Salary:

Salary Employer Tax

(S Corp pays)

Dividend

Total Employment

Taxes Paid

Savings on Self Employment Taxes

Savings =

Against this savings, you have to balance the time and costs of running payroll and tax withholding. To learn more about what this will cost, get a free tax consultation.

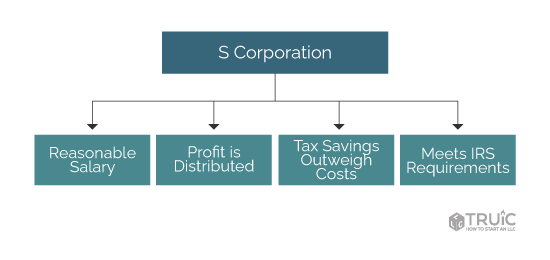

Businesses should use the S corp status when:

- The business meets S corp restrictions

- The business earns enough in net profit to pay a "reasonable salary" and at least $10,000 in distributions annually

- The addition of payroll and accounting costs doesn't outweigh tax advantages

Reasonable Salary

Under an S corp election, LLC owners become employees. The IRS requires owner-employees to be paid a reasonable salary. A reasonable salary is any salary that you would pay someone to do the same job.

LLCs taxed as S corps are subject to increased scrutiny by the IRS. If the owner is not paid a reasonable salary, this may lead to the IRS denying S corp status and may lead to fines and back taxes.

To determine a reasonable salary for your position, you can compare similar salaries on websites like Glassdoor or the US Bureau of Labor Statistics.

Profit and Distribution

The S corp election allows a business owner to disburse an LLC's profit to owner-employees in the form of salary and distributions. The IRS then applies FICA and income taxes to only the salary. Distributions are subject to only income tax.

If the LLC doesn't earn enough profit to cover a reasonable salary and distribution, it won't make financial sense to elect the S corp tax classification. And, if the LLC owner(s) would like to forfeit salary for any reason, they could be subject to fines by the IRS.

Positive Return on Investment

It costs money to elect and maintain an S corp. Filing fees with the IRS are minimal but the additional bookkeeping and payroll costs are not. For LLCs that already have employees and payroll costs, this factor won't hold as much weight.

Business owners should weigh the cost of maintaining these services against the fiscal tax advantage of electing the S corp classification. Generally speaking, a reasonable salary plus $10,000 in annual distributions is often enough to make electing the S corp financially viable.

IRS S Corp Requirements

The IRS requires that businesses that elect the S corp status have 100 shareholders or less and they are only allowed to issue one class of stock.

The owners of the business must be US citizens or permanent resident aliens. Owners must also be private individuals and not business entities such as LLCs, corporations, or trusts.

How To Start An S Corp

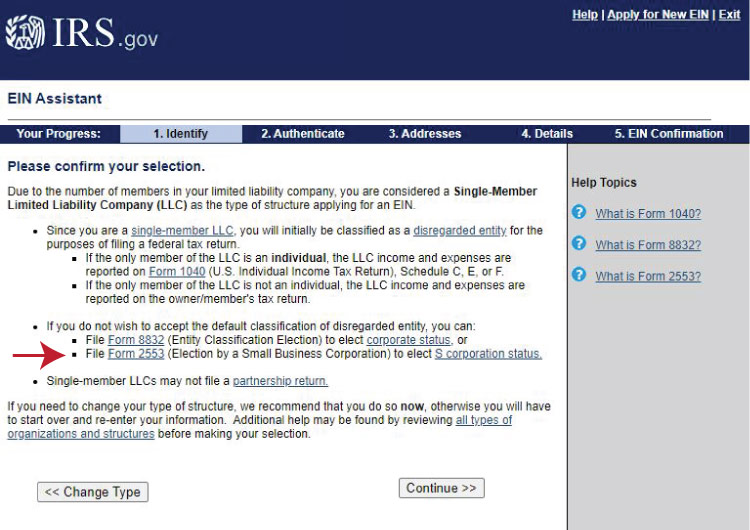

You can start an S corp by forming an LLC and then choosing S corp status when you request your Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Recommended: If you have an existing LLC, visit our How to Convert an LLC to S Corp guide.

You can use our How to Start an S Corp guide for step-by-step instructions or hire a professional formation service like Northwest to start an S corp for you.

There are five main steps to starting an LLC:

Step 1: Name Your LLC

Step 2: Choose a Registered Agent

Step 3: File the Articles of Organization

Step 4: Create an Operating Agreement

Step 5: Get an EIN and File Form 2553 to Elect S Corp Tax Status

You will elect S corp on the EIN form as shown here: