How to Start an LLC in West Virginia (2026 Guide)

Wondering how to start a limited liability company (LLC) in West Virginia? We’ve got you covered.

To get started, you’ll need to pick a suitable business name, choose a registered agent, and file your Articles of Organization with the West Virginia Secretary of State. The cost to form an LLC in West Virginia is $100.

You can do this independently, consult with a business attorney for specialized legal guidance, or join the other 65% of our readers and hire a specialized West Virginia LLC formation service (recommended).

How to Form an LLC in West Virginia in 5 Steps

In order to form your LLC in West Virginia, there are certain steps you’ll need to complete:

- Name Your West Virginia LLC

- Choose an Agent of Process

- File the Articles of Organization

- Create an LLC Operating Agreement

- Obtain an EIN

West Virginia LLC Launchpad

Name Your West Virginia LLC

The first step is picking a business name for your West Virginia LLC

Step 1: Name Your West Virginia LLC

Before you get started, you will need to pick a suitable name for your West Virginia LLC.

This will need to comply with all applicable naming requirements under West Virginia law and be both succinct and memorable, as this will make it easily searchable by your potential clients.

1. West Virginia LLC Naming Guidelines

- Your name must include the ending “Limited Liability Company” or “Limited Company” , or the abbreviations “LLC”, “L.L.C.”, “LC”, or “L.C.”. Keep in mind that “Limited” can be abbreviated into “Ltd” and “Company” can be abbreviated into “Co.”

- Your name cannot include words that imply that it’s affiliated with a state or government body. Examples of such words include State Department, Treasury, and FBI.

- Your name cannot include certain restricted words (e.g., Architect, Dentist, Accountant, etc.) unless it’s a Professional Limited Liability Company (PLLC) and has received written approval from the relevant state body.

For more information, have a look at West Virginia’s Official LLC Naming Guidelines.

2. West Virginia Name Availability Search

To check whether your desired name has already been taken by another business entity in West Virginia, you can perform a business name search on the West Virginia Secretary of State’s website.

If you’re not going to start your LLC right away, it might be a good idea to consider reserving your name for up to 120 days by filing a Name Reservation application and paying the $15 filing fee.

For more information, you can have a look at our West Virginia LLC Name Search guide.

3. Finding the Right Domain

We recommend that you check to see if your business name is available as a web domain. Even if you don’t plan to start a business website right away, this is an extremely important step as it will prevent others from acquiring it, potentially saving you both time and money in the long term.

Once you have verified your name is available, you may now select a professional service to complete the LLC formation process for you.

FAQ: Naming a West Virginia LLC

LLC is short for “limited liability company.” It is a simple business structure that offers more flexibility than a traditional corporation while still providing legal protection for your personal assets. Read our What is a Limited Liability Company guide for more information.

Or, watch our two-minute video: What is an LLC?

You must follow the West Virginia LLC naming guidelines when choosing a name for your LLC:

- Include the phrase “limited liability company” or one of its abbreviations (LLC or L.L.C.).

- Do not use words that could confuse your business with a government agency (FBI, State Department, CIA, etc.).

- Receive the proper licensing when using the words such as lawyer or doctor.

If you are having trouble coming up with a name for your LLC, use our LLC Name Generator. That will not only find a unique name for your business but an available URL to match.

Most LLCs do not need a DBA, known as a trade name in West Virginia. The name of the LLC can serve as your company’s brand name and you can accept checks and other payments under that name as well. However, you may wish to register a DBA if you would like to conduct business under another name.

To learn more about DBAs in your state, read our How to File a DBA guide.

Step 2: Choose an Agent of Process in West Virginia

After you find the right name for your LLC, you will need to nominate a West Virginia Agent of Process. This is known as a registered agent in states outside of West Virginia, and is a necessary step in your Articles of Organization (i.e., the document used to file and register your LLC with the Secretary of State).

An agent of process is an individual or business entity responsible for receiving important tax forms, legal documents, notice of lawsuits, and official government correspondence on behalf of your business. You can think of your West Virginia registered agent as your business’s primary point of contact with the state.

Who can be an agent of process?

An agent of process must be a resident of West Virginia or a corporation — such as a registered agent service — that is authorized to transact business in the state of West Virginia. You can choose to elect an individual within the company (e.g., yourself, etc.), use an attorney (not recommended due to the high cost), or go with a registered agent service.

Get Free Registered Agent Services

Form an LLC with Northwest Registered Agent to get one year of registered agent services free of charge.

FAQ: Nominating a Registered Agent

Yes.

You can choose to act as your own agent of process, appoint a different member of your LLC (if applicable), work with a business attorney, or hire a professional registered agent service (recommended). Keep in mind that the registered agent address you include in your Articles of Organization will become publicly searchable.

Read more about being your own agent of process.

Generally speaking, yes.

This is because using a professional registered agent service is an affordable way of ensuring that you do not accidentally miss important legal notifications from the Secretary of State. It can also help protect your privacy (since your registered agent’s address will become publicly available).

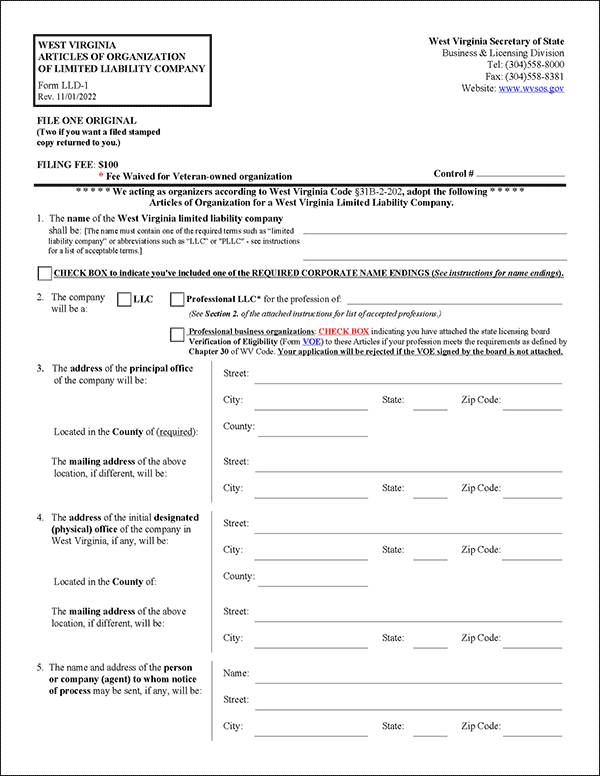

Step 3: File Your West Virginia LLC Articles of Organization

To register your West Virginia LLC, you’ll need to file Form LLD-1: Articles of Organization with the Secretary of State. You can do this online, by mail, or by fax.

Before filing, make sure you have completed your Certificate of Formation correctly. You will need to have filled in the following sections:

- Your LLC’s name

- The LLC’s structure (e.g., standard LLC, professional LLC, etc.)

- The address of your LLC’s principal office

- The full name and address of your LLC’s agent of process

- The email address that the SOS will use to send your LLC business correspondence

- The business website address of your LLC (optional)

- The names and addresses of your LLC’s organizers

- Your LLC’s management structure (e.g., member-managed, manager-managed, etc.) and term

- The business purpose of your LLC

- Your LLC’s requested effective date (can be up to 90 days post-filing)

Note: Qualifying veteran-owned businesses in West Virginia can file the Articles of Organization for free. Section 18 of the Articles of Organization includes all conditions that must be met for an LLC to be considered “veteran-owned.”

File the Articles of Organization

OPTION 1: File Online With the West Virginia Secretary of State

File Online– OR –

OPTION 2: File Form LLD-1 by Mail, by Fax, by Email, or In Person

Download FormState Filing Cost: $100, payable to the West Virginia Secretary of State (Nonrefundable)

Filing Addresses:

Charleston Office

One-Stop Business Center

1615 Washington St. E.

Charleston, WV 25311

Clarksburg Office

North Central WV Business Center

200 W. Main St.

Clarksburg, WV 26301

Martinsburg Office

Eastern Panhandle Business Center

229 E. Martin St.

Martinsburg, WV 25401

Fax: (304) 558-8381

Email: [email protected]

For help with completing the form, visit our West Virginia Articles of Organization guide.

Note: If you’re expanding your existing business to the state of West Virginia, you’ll need to register as a foreign limited liability company (LLC).

FAQ: Filing West Virginia LLC Documents

The standard processing time for the Articles of Organization in West Virginia is between five and 10 business days, according to the Secretary of State. Having said that, expedited services are available for an additional fee:

- 24-Hour: $25

- 2-Hour: $250

- 1-Hour: $500

Note: The Secretary of State reserves the right to extend the expedited period in times of “extreme volume, staff shortages, or equipment malfunction”.

An LLC is referred to as a “domestic LLC” when it conducts business in the state where it was formed. A foreign limited liability company must be formed when an existing LLC wishes to expand its business to another state.

Read our What Is a Foreign LLC article to learn more.

The total cost of starting a West Virginia LLC will depend on several factors, such as on whether you use an LLC formation service, reserve a business name, and/or use an expedited filing service.

Having said that, the cost of filing your formation documents with the Secretary of State is $100.

To learn more, read our guide on the cost to form a West Virginia LLC.

Step 4: Create a West Virginia LLC Operating Agreement

An operating agreement is not required for forming an LLC in West Virginia, but it’s a good practice to have one.

What is an operating agreement? An operating agreement is a legal document outlining the ownership and operating procedures of an LLC.

Why are operating agreements important? A comprehensive operating agreement ensures that all business owners are on the same page and reduces the risk of future conflict.

You can use the free tool in our Business Center to create a custom operating agreement in minutes — or download our free templates:

- West Virginia Single-Member LLC Operating Agreement

- West Virginia Multi-Member LLC Operating Agreement

FAQ: Creating a West Virginia LLC Operating Agreement

No. The operating agreement is an internal document that you should keep on file for future reference. However, many states do legally require LLCs to have an operating agreement in place.

Step 5: Get an EIN for West Virginia LLC EIN

You can get an Employer Identification Number (EIN) from the IRS for free. It is used to identify a business entity and keep track of a business’s tax reporting. It is essentially a Social Security number (SSN) for the company.

If you are filing your LLC online, getting an EIN is included in the registration process on the WV One Stop Business Portal.

Why do I need an EIN? An EIN is required for the following:

- To open a business bank account for the company

- For federal and state tax purposes

- To hire employees for the company

Where do I get an EIN? An EIN is obtained from the IRS (free of charge) by the business owner after forming the company. This can be done online or by mail.

FOR INTERNATIONAL APPLICANTS: You do not need an SSN to get an EIN. Learn more here.

Get an EIN

Option 1: Request an EIN from the IRS

– OR –

Option 2: Apply for an EIN by Mail or Fax

Mail to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Fax: (855) 641-6935

Fee: Free

FAQ: Getting an EIN

A Social Security number is not required to get an EIN. You can simply fill out IRS Form SS-4 and leave section 7b blank. Then call the IRS at (267) 941-1099 to complete your application. Learn more here about applying as an international applicant.

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.

Learn why we recommend always getting an EIN and how to get one for free in our Do I Need an EIN for an LLC guide.

When you get an EIN, you will be informed of the different tax classification options that are available. Most LLCs elect the default tax status.

However, some LLCs can reduce their federal tax obligation by choosing the S corporation (S corp) status. To learn more, read our LLC vs. S Corp guide.

Best LLC Services in West Virginia Compared

| Service | Total Cost* | Filing | Registered Agent | EIN | Operating Agreement |

|---|---|---|---|---|---|

|

Northwest

TOP PICK

25% TRUiC Discount

|

$179 | $29 | Free 1st Year $125/yr after | $50 | Free |

|

Tailor Brands

35% TRUiC Discount

|

$427 | $0 | $199/yr | $99 | $29 |

|

ZenBusiness

|

$397 | $0 | $99 1st Year $199/yr after | $99 | $99 |

|

LegalZoom

|

$527 | $0 | $249/yr | $79 | $99 |

For a comprehensive comparison, read our Best LLC Service guide. We reviewed and ranked the top LLC formation services to help you determine the best fit for your new business.

Important Next Steps to Protect Your West Virginia LLC

After you’ve formed your LLC, you’ll need to complete several key steps in order to:

- Separate your personal and business assets

- Stay compliant with state and federal laws

1. Get a Business Bank Account and Credit Card

Getting a dedicated business bank account is an essential part of operating legitimately because it keeps your personal and business assets separate therefore helping to shield your personal limited liability.

Skipping this step can often lead to:

- Courts determining you haven’t been treating your LLC as a separate entity

- Your “corporate veil” being pierced, meaning you’ll no longer benefit from limited liability in law

Recommended: Have a look at our Best Business Bank Accounts for LLCs in 2026 review.

You also may choose to acquire a corporate credit card if you’re interested in building your LLC’s credit and potentially raising capital down the line.

2. Obtain a West Virginia Business License

West Virginia requires LLCs to obtain a business license in order to operate. Your LLC also may be subject to additional local, state, and federal licensing requirements, depending on your exact location and industry:

- Local Licenses: You’ll need to check with your city or county clerk’s office to identify any local licensing requirements, such as zoning permits or health department approvals, your LLC will need.

- State-Level Licenses: You’ll need to obtain a Business Registration Certificate from the West Virginia Tax Division before conducting any business activities in the state. This functions as the state’s general business license and can be obtained online through WV One Stop Business Portal or by submitting Form WV BUS-APP along with a $30 registration fee.

- Federal Licenses: While most West Virginia LLCs won’t be subject to federal regulation, those involved in heavily regulated industries, such as agriculture, alcohol, and firearms, will be. Visit the U.S. Small Business Administration’s website for the relevant federal agency you’ll need to contact.

If your business involves professional services (e.g., legal, medical, or engineering) or activities that could affect public health or the environment, you also may need additional occupational, environmental, or public safety licenses from the relevant state board or agency.

For more information, read our West Virginia Business License guide. If you’d rather have a service handle this step for you, we recommend checking out LegalZoom’s Business License service.

3. Understand Your West Virginia LLC Tax Obligations

West Virginia LLCs aren’t all taxed in the same way because LLCs are taxed as pass-through entities by default. This means they’re largely taxed similarly to sole proprietors — the business gets paid, the profits pass to you as the owner, and you get taxed. There’s no “corporate” tax involved.

Federal Tax Implications

You’ll need to submit personal income tax returns using either Form 1040 (for single member LLCs) or Form 1065 (for multi-member LLCs). If you have employees, you’ll also be subject to federal income tax withholding.

State Tax Implications

West Virginia currently imposes a graduated personal income tax with rates that range from 2.36% to 5.12% that you may need to pay on your share of the LLC’s profits. You also may be responsible for state sales and use tax if your business sells taxable goods or services.

If your LLC is taxed as a corporation, you’ll need to file Form CIT-120 and pay West Virginia’s 6.5% corporate income tax. If you hire employees, you’ll also need to register for employer state tax withholding.

Local Tax Implications

Your LLC also may be required to pay additional local taxes, such as local sales and use taxes, hotel occupancy taxes, or property taxes, depending on the city or county in which it operates.

For more information on the West Virginia-specific LLC tax obligations that may apply to you, refer to our in-depth West Virginia LLC Taxes guide. Alternatively, you can schedule a free online consultation with 1800-Accountant for all your tax-related questions.

4. Get Business Insurance for Your LLC in West Virginia

Even though an LLC offers limited liability, you’ll still likely need to purchase some form of business insurance to protect your LLC’s assets.

This is because an LLC’s default limited liability protects your personal assets, not the business’s. Some of the most common types of business insurance include:

- General Liability Insurance: This is a broad insurance policy that protects your business from lawsuits. Most small businesses end up getting general liability insurance.

- Professional Liability Insurance: This is a business insurance policy for professional service providers (consultants, accountants, etc.) that covers the LLC against claims of malpractice and other business errors.

- Workers’ Compensation Insurance: This insurance covers medical costs and lost wages if an employee is injured on the job. It’s legally required in West Virginia for any business with one or more employees.

What This Means:

Without insurance: If a power tool malfunctions at your job site and injures a bystander, leading to a $92,000 lawsuit for medical bills and legal fees, your LLC’s equipment, work truck, and $18,000 in pending client payments could be targeted — although your personal assets would still be protected.

With insurance: Your general liability policy could cover the full $92,000 claim, meaning both your personal assets and business property would remain protected.

That’s why many small business owners turn to providers like Ergo Next Insurance for affordable, tailored coverage. Get a free quote today.

Want to learn exactly what coverage your business may need? Read our full West Virginia Business Insurance guide.

5. Learn How to Properly Sign Your LLC’s Legal Documents

Improperly signing a document as yourself and not as a representative of the business can leave you open to personal liability.

When signing legal documents on behalf of your company, you we recommend following this formula to avoid any problems:

- Formal name of your business

- Your signature

- Your name

- Your position in the business as its authorized representative

It’s important to be consistent and sign all official documents using this format. This’ll help protect your personal assets by clearly showing that the agreement is with the LLC, not you as an individual.

6. Submit an Annual Report for Your West Virginia LLC

In order to remain in good standing with the Secretary of State, LLCs based in West Virginia are required to file an annual report.

This is meant to ensure that your LLC’s information is up to date, including its name, tax ID, and principal mailing address.

You will need to file your LLC’s annual report — alongside a $25 filing fee — by June 30 of each year. If you miss this deadline, your LLC may face a fine or even suffer administrative dissolution.

Note: Your annual report can be filed online using the WV One Stop Business Portal.

To stay on top of this deadline and other important compliance tasks, we recommend hiring a professional registered agent service — they can help ensure you never miss a filing.

West Virginia Business Resources

Business Center

Check out our business center for regular updates, vetted reviews, free downloadable templates, and video guides that aim to help you start and grow your business.

Local Resources

- West Virginia Secretary of State Business Division

- West Virginia Small Business Resources

- West Virginia Statutes