Sole Proprietorship vs LLC

How to Choose Between a Sole Proprietorship and an LLC

The main difference between a sole proprietorship and an LLC is that an LLC will protect your personal assets if your business is sued or suffers a loss.

Most serious business owners choose to form an LLC vs. a sole proprietorship.

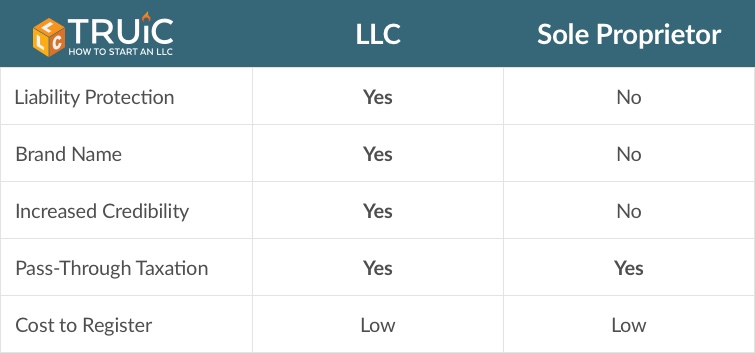

LLC vs. Sole Proprietorship Comparison

There are five main factors to compare between a sole proprietorship and LLC:

- Liability Protection

- Branding

- Credibility

- Pass-Through Taxation

- Cost to Register and Maintain

Liability Protection

A sole proprietorship doesn’t offer liability protection, but an LLC does. This value outweighs all other factors.

Branding

An LLC owner can use the business’s legal name as its brand name. A sole proprietor must use their surname as the business name or register and pay for a DBA (doing business as) name.

Credibility

Business owners gain credibility simply by forming an LLC.

Pass-Through Taxation

Both sole proprietors and LLCs are taxed as pass-through entities by the US Internal Revenue Service (IRS). This means that the business’s profits will pass through to its members to be reported on their personal tax returns. All profits are only taxed once, at each member’s individual income tax rate.

LLCs offer additional tax options such as being taxed as an S corporation. This option offers big savings for some business owners. Sole proprietorships don’t have tax options.

Cost to Register and Maintain

An LLC is a low-cost and low maintenance business structure. A sole proprietorship with a DBA (a registered “doing business as” name) is comparably priced.

Start an LLC with Northwest for $29 (plus state fees) and protect your personal assets.

Is a Single-Member LLC the Same as a Sole Proprietorship?

A sole proprietorship doesn’t provide personal liability protection but an LLC does. Sole proprietorships are considered informal businesses whereas an LLC is a formal legal business entity type.

They do share a few similarities:

- Pass-Through Taxation

- EIN requirements to open a bank account and hire employees

- Withholding payroll taxes if there are employees

When to Use a Sole Proprietorship

Sole proprietorships do offer small advantages and benefits in certain circumstances.

Example: A sole proprietorship can be a good way to start out if you are running a hobby business on a small scale or want to try out a low-risk venture to see how successful it will be.

Sole proprietorships are best for small businesses with the following characteristics:

- They MUST be low-profit and low-risk (low chance of liability or financial loss).

- They have a smaller customer base — often friends, family, and neighbors.

- They are often hobbies like photography, blogging, or video streaming.

Sole Proprietorship Advantages and Disadvantages

The only advantage to starting a sole proprietorship vs. an LLC is having to spend no money or energy up front to form a business. This advantage may seem attractive, but it can be costly in the long run.

Disadvantages:

- No Personal Liability Protection. Your personal assets (car, house, bank account) are at risk in the event your business is sued or if it defaults on a debt.

- No Tax Benefits. Sole proprietors pay taxes on their profits and also pay full FICA taxes (Medicaid and Social Security taxes). When your business becomes profitable, taxes will be expensive.

- Limited Growth Potential. When a business becomes more profitable, risk increases. When risk and profit increase, so does the need for a legal formal business structure.

- Less Credibility and Branding Opportunities. A sole proprietor must invoice, receive payment, open a bank account, and market with their surname unless their state allows them to register and maintain a doing business as (DBA) name.

When to Use an LLC

LLCs offer taxation benefits, increased credibility, and most importantly, personal liability protection.

LLCs are recommended for businesses with the following characteristics:

- Customers that aren’t family and friends

- It’s a business that’s meant to earn money

- It’s a real business that you want to grow

Advantages of LLCs

- Personal Liability Protection. LLCs provide personal liability protection. This means your personal assets (car, house, bank account) are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. LLCs and have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. LLCs can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a business’s ability to take out loans and can affect marketability.

Ready to Form Your LLC?

Our free guide walks you through the process of LLC formation in all fifty states. In just five easy steps, you can be on your way to owning your own business.

Choose your state from the list below to learn how to start an LLC:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

You can also use an LLC formation service to register your LLC for you.

How to Form an LLC

To form your LLC, you will need to complete these steps:

- Name Your LLC

- Choose a Registered Agent

- File Your Articles of Organization

- Create an Operating Agreement

- Get an EIN

You can start an LLC yourself using our free Form an LLC guide, or you can use an LLC formation service to register your LLC for you.

Step 1: Name Your LLC

You will need to provide your state with a unique name when you file your LLC’s formation documents.

Our Business Name Generator and our How to Name a Business guide are free tools available to entrepreneurs that need help naming their businesses.

Step 2: Choose a Registered Agent

Your LLC registered agent will accept legal documents and tax notices on your LLC’s behalf. You will list your registered agent when you file your LLC’s Articles of Organization.

Step 3: File Your Articles of Organization

The Articles of Organization, also known as a Certificate of Formation or a Certificate of Organization, is the document you will file to officially register an LLC with the state.

Step 4: Create an Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your LLC.

Step 5: Get an EIN

An Employer Identification Number (EIN) is a number that is used by the IRS to identify and tax businesses. It is essentially a Social Security number for a business.

You will need to get an EIN after you form your LLC. EINs are free when you apply directly with the IRS. Visit our EIN guide for instructions for getting your free EIN.