How Do I Pay Myself From My LLC?

LLCs are taxed differently depending on the number of members, profit-sharing agreements, sweat equity terms, etc.

For the average single-member LLC owner, you can pay yourself a draw that passes through to your personal tax return. Once you form an LLC, this is the simplest way to file.

Find out how to pay yourself from an LLC using our simple guide.

Recommended: Northwest – They offer comprehensive LLC formation services to simplify the process and ensure compliance with tax requirements.

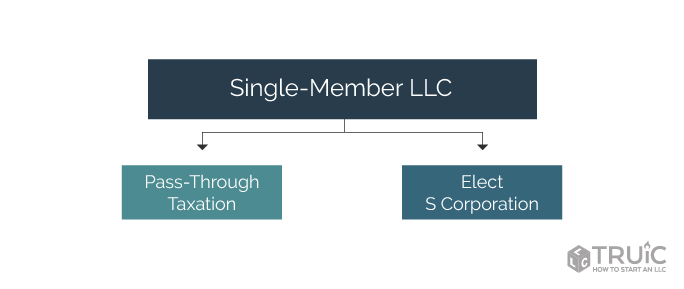

How to Pay Yourself in a Single-Member LLC

As a single-member LLC owner, you can pay yourself:

- a distribution (or draw) that by default passes through to your individual tax return, or

- a reasonable salary and distribution as an S corporation (S corp)

Most small business owners choose to pay themselves a distribution that passes through to their individual tax returns.

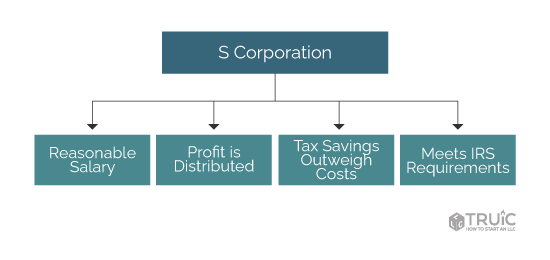

Being taxed as an S corp makes sense for businesses that are generating enough profit to pay the owner a reasonable salary and at least $10,000 in annual distributions.

How to Pay Yourself as a Default LLC (Pass-Through Taxation)

When your single-member LLC (SMLLC) is taxed in the default way by the IRS, you can choose to pay yourself a distribution. The distribution, or draw, then passes through to your individual tax return. This is known as pass-through taxation.

Pass-through taxation means the LLCs profit passes through to the member’s individual tax returns. This is the way the IRS taxes LLCs by default.

Pass-through taxation allows single-member LLCs to avoid “double taxation”. This means the IRS only taxes your business’s total profit one time.

How Pass-Through Taxation Works For A SMLLC

Imagine your single-member LLC earns $6,000 in profits one year. You report these earnings on your personal tax return.

From this $6,000 you decide to take $1,000 as a distribution. Because you already paid income tax on the whole $6,000 on your tax return, you don’t have to pay any more income tax on your $1,000 distribution.

You will have to pay FICA self-employment tax on only the $1,000 distribution.

IMPORTANT: The amount you pay yourself from your LLC can have serious implications. It is crucial that you keep enough funds (or capital) in your business bank account to maintain your LLCs corporate veil. To learn more about this important topic, read our Maintain Your LLC’s Corporate Veil guide

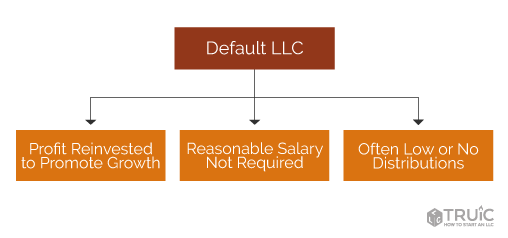

When Is It Best To Choose Pass-Through Taxation?

Most small business owners choose to pay themselves a distribution that passes-through to their individual tax return. The S corp and C corp tax statuses only make sense for businesses have a significant annual net profit.

Small businesses usually carry very little profit from one tax year to the next because their owners reinvest most of the profit to help the business grow.

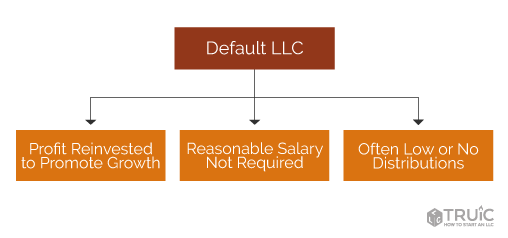

The default LLC status is best suited for small businesses with these characteristics:

- Their owners reinvest profit back into the business to promote growth

- The cost of bookkeeping and payroll services would outweigh the tax benefit of an S corp or C corp

For more details about choosing between the default LLC status and S corp, read our LLC vs S Corp guide.

Form An LLC

Visit our free Form An LLC guide for step-by-step instructions for starting your LLC.

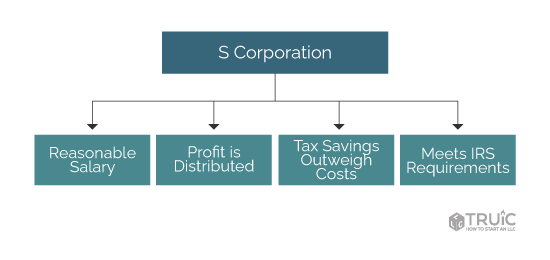

How to Pay Yourself as an S Corp

If you are an LLC owner that chooses to be taxed as an S corp, you are considered an employee of the business and you must pay yourself:

- a reasonable salary

- at least $10,000 in distributions (for the S corp to make sense financially)

The benefit of electing the S corp tax classification is being able to avoid paying FICA self-employment taxes on your distribution(s).

S corp owners pay only income taxes on distributions but must pay income tax and FICA self-employment taxes on their salaries.

What is a reasonable salary for an S corp owner? A “reasonable salary” is any salary that you would pay someone to do the same job duties that you perform.

We recommend using ZenBusiness to form your S corporation.

How S Corp Taxation Works

Imagine you are the sole owner, shareholder, and employee of your S corp LLC. Your business made a $100,000 profit last year.

You decide that the average salary for someone in your field with your experience is $80,000.

You pay yourself:

- $80,000 as a salary

- $10,000 in distributions

When it’s time to file taxes, you will report your salary from your W-2 on your individual tax return. Your portion of the FICA taxes will automatically be taken out of your salary by your bookkeeper or payroll service.

The S corp will file its own tax return that reports business income, profits, and losses. The business will pay their portion of FICA taxes as well as FUTA taxes on your employee salary.

You will report your distributions on your individual tax return and you will only pay income taxes on them.

When Is It Best To Elect S Corp Tax Status?

We estimate that if a business can pay its owner a “reasonable salary” and at least $10,000 in distributions per tax year, then it would make sense for a single-member LLC to elect the S corp classification.

NOTE: Most small businesses don’t earn enough profit in the early stages for it to make financial sense to elect S corp status.

S corp owners save about 16% on taxes by not paying FICA taxes on distributions. Tax savings must be balanced against the cost of payroll and accounting services required to maintain S corp status.

How to Pay Yourself as a C Corp

Like an S corp, LLC C corp owners must pay themselves a “reasonable salary” for their services to the business.

Business owners pay both FICA and income taxes on their salary but any dividends are only subject to income taxes. Unlike S corps, the C corp itself must also pay a corporate tax on the total profits.

How C Corp Taxation Works

You are the sole owner, shareholder, and employee of your C corp LLC. Your business made a $500,000 profit last year.

You determine that the average salary for someone in your field with your experience is $80,000. You pay yourself the following:

- $80,000 as a salary

- $10,000 in dividends

When it’s time to file taxes, you will report your salary from your W-2 on your individual tax return. Your portion of the FICA taxes will automatically be taken out of your salary.

The C corp must file its own tax return that reports business income, profits, and losses. The company must pay their portion of FICA taxes as well as FUTA taxes on your employee salary.

The C corp must also pay the 21% corporate tax on its profits.

Since you are the only shareholder, your dividends will be shown on Form 1099-DIV. You will then report these dividends on your individual tax return and pay income tax on them.

When Is It Best To Elect C Corp Tax Status?

LLCs taxed as C corps have the following characteristics:

- investor and capital venture friendly

- increased tax deductions and qualifying business expenses

- increased complexity and maintenance costs

- 21% tax rate and double taxation

C corporations attract investors because of their straightforward tax requirements. Investors only have to pay taxes on what dividends they’ve received. In other LLC tax scenarios, investors would have to pay taxes on profit even if they didn’t receive a disbursement/dividend.

Certain tax savings must be balanced against the 21% corporate tax rate as well as the cost of payroll and accounting services required to maintain C corp status.

How to Pay Yourself in a Multi-Member LLC

Before choosing a tax structure for their business, multi-member LLC owners must first determine how profits will be shared and distributed between LLC members.

Once members have agreed upon ownership percentages, they can choose a pay structure for the business that includes:

- distributions (or draws) that by default pass through to the owners’ individual tax returns, or

- reasonable salaries and distributions as LLC S corp employees

Guaranteed Distributions, Profit Sharing, and Sweat Equity

Your multi-member LLC operating agreement will need to outline each member’s guaranteed distributions and the division of the remaining profit.

What is a guaranteed distribution? A guaranteed distribution is a planned and agreed upon payment given to an LLC member for services performed without regard to the amount of profit earned by the business.

In a multi-member LLC, the remaining profits are divided into percentages that are equal to each member’s ownership interest. This is the default scenario. The profit share and distributions pass through to the owners’ individual tax returns.

Sometimes ownership interest isn’t as simple as two people each investing equally into a business. Your multi-member LLC operating agreement might need to define the percentage of ownership for each member based on two factors:

- Amount invested

- Amount of work done or “sweat equity”

Investment Percentages and Sweat Equity

There are scenarios in which an LLC operating agreement might need to balance the percentage of ownership between a members’ monetary investment in the business and a members’ sweat equity.

What is sweat equity? Sweat equity in an LLC is unpaid work completed by a member of the LLC.

Example: Imagine member A invests $2500 into the LLC. Member B does not have cash on hand and instead spends her time actively starting the business and then running the business thereafter. These members agree the sweat equity is valued at $7500 at startup and each year thereafter.

In this example, the operating agreement would outline the profit sharing and distributions in alignment with the percentages of monetary investment versus sweat equity. Profit-sharing might look like 25% for member A and 75% for member B.

What is a Sweat Equity Agreement? A sweat equity agreement outlines what is expected of the member earning equity and how much equity will be earned for a task.

You should consider including the following in your sweat equity agreement:

- Type of Equity. What type of equity will the employee receive and how much are you offering?

- Defined Performance Criteria. What must the employee do to receive their equity?

- A Defined Vesting Period. How long must an employee work with the company before they receive their equity?

- Separation Stipulations. Who can break this agreement and how?

Recommended: Use our free operating agreement tool to make a custom operating agreement for your LLC

How to Pay Yourself as a Partnership (Pass-Through Taxation)

When a multi-member LLC is taxed as a default LLC, or “partnership”, owners can choose to pay themselves a distribution. The distribution, or draw, then passes through to the owner’s individual income tax return. This is known as pass-through taxation.

Pass-through taxation means the LLCs profit passes through to the member’s individual tax returns. This is the way the IRS taxes LLCs by default.

Multi-member LLCs treated as pass-through entities avoid “double taxation”. This means the IRS doesn’t tax your business’s total profit and then tax your distribution from the business again.

Most small business owners choose to pay themselves as pass-through entities under the default LLC tax status. This is because there usually isn’t enough profit carried over by a small business from year to year to justify electing the S corp or C corp tax designation.

How Pass-Through Taxation Works For A MMLLC

Imagine your multi-member LLC earns $50,000 in profits one year. According to your LLC’s operating agreement, each owner has a 25% share of the LLC.

You will each only pay income tax on $12,500 when filing your individual tax returns.

From that $12,500 you all decide to take $6,000 as an owner’s distribution. Because you already paid income tax on your total shares, you won’t have to pay income tax again on your distributions.

You will, however, have to pay a self-employment FICA tax on $6,000.

IMPORTANT: The amount you pay yourself from your LLC can have serious implications. It is crucial that you keep enough funds (or capital) in your business bank account to maintain your LLCs corporate veil. To learn more about this important topic, read our Maintain Your LLC’s Corporate Veil guide.

When Is It Best To Use the Partnership Status?

Most multi-member LLC owners choose to pay themselves as partnerships (pass-through taxation). Pass-through taxation makes sense for small businesses that plan to reinvest most of their profits into the business.

Small businesses usually carry very little profit from one tax year to the next because their owners reinvest most of the profit to help the business grow.

The default LLC tax structure is best suited for small businesses with these characteristics:

- The owners reinvest profit back into the business to promote growth

- The cost of bookkeeping and payroll services would outweigh the tax benefit of an S corp or C corp

Form An LLC

Visit our free Form An LLC guide for step-by-step instructions for starting your LLC.

How to Pay Yourself as an S Corp

When an MMLLC elects S corp status, “active shareholders” must be paid:

- a reasonable salary

- at least $10,000 in distributions (for the S corp to make sense financially)

What is an active shareholder? An active shareholder is an owner of an LLC S corp that plays an active role in business operations. Active shareholders are basically owner-employees in an S corp.

Owner-employees pay only income taxes on distributions but must pay income tax and FICA self-employment taxes on their reasonable salaries.

What is a reasonable salary for an S corp owner? A “reasonable salary” is any salary that you would pay someone to do the same job duties that you perform.

We recommend using ZenBusiness to form your S corporation.

How S Corp Taxation Works

You are one of four owners and shareholders of your S corp LLC. Your business made a $500,000 profit last year. Each shareholder has a 25% ownership interest, meaning your share is $125,000.

You decide that the average salary for someone in your field is $100,000.

You pay yourself:

- $100,000 as a salary

- $20,000 in distributions

When it’s time to file taxes, you will each report your salary from your W-2 on your individual tax returns. Your portion of the FICA taxes will automatically be taken out of your salary by your bookkeeper or payroll service.

The S corp must file its own tax return that reports business income, profits, and losses. The company must pay their portion of FICA taxes as well as FUTA taxes on your employee salary.

You will report your distributions on your individual tax return and you will only pay income taxes on them.

When is it Best to Elect S Corp Tax Status?

We estimate that if a business can pay its owners “reasonable salaries” and at least $10,000 in distributions per tax year, then it would make sense for a multi-member LLC to elect the S corp classification.

NOTE: Most small businesses don’t earn enough profit in the early stages for it to make financial sense to elect S corp status.

S corp owners save about 16% on taxes by not paying FICA taxes on distributions.

Tax savings must be balanced against the cost of payroll and accounting services required to maintain S corp status.

How to Pay Yourself as a C Corp

Like an S corp, LLC C corp owners must pay themselves a “reasonable salary” for their services to the business.

What is a reasonable salary for an C corp owner? A “reasonable salary” is any salary that you would pay someone to do the same job duties that you perform.

Business owners pay both FICA and income taxes on their salary but any dividends are only subject to income taxes. Unlike S corps, the C corp itself must also pay a corporate tax on the total profits.

How C Corp Taxation Works

You are one of four owners and shareholders of your C corp LLC. Your business made a $500,000 profit last year. Each shareholder has a 25% ownership interest, meaning your share is $125,000.

You determine that the average salary for someone in your field with your experience is $100,000. You decide to pay yourself the following:

- $100,000 as a salary

- $20,000 in dividends

When it’s time to file taxes, you will report your salary from your W-2 on your individual tax return. Your portion of the FICA taxes will automatically be taken out of your salary.

The C corp must file its own tax return that reports business income, profits, and losses. The company must pay their portion of FICA taxes as well as FUTA taxes on your employee salary.

The C corp must also pay the 21% corporate tax on its profits.

Since you are the only shareholder, your dividends will be shown on Form 1099-DIV. You will then report these dividends on your individual tax return and pay income tax on them.

When Is It Best To Elect C Corp Tax Status?

LLCs taxed as C corps have the following characteristics:

- investor and capital venture friendly

- increased tax deductions and qualifying business expenses

- increased complexity and maintenance costs

- 21% tax rate and double taxation

C corporations attract investors because of their straightforward tax requirements. Investors only have to pay taxes on what dividends they’ve received. In other LLC tax scenarios, investors would have to pay taxes on profit even if they didn’t receive a disbursement/dividend.

Certain tax savings must be balanced against the 21% corporate tax rate as well as the cost of payroll and accounting services required to maintain C corp status.

FAQ

LLC members are paid differently, depending on the LLC’s tax structure.

Members of a limited liability company (LLC) can be paid a salary only if the LLC is taxed as an S corporation (S corp). In the default LLC tax structure, owners are paid by taking distributions.

LLC owners may only take a salary if the LLC is taxed as an S corp. If an LLC can afford to pay its owner(s) a reasonable salary plus at least $10,000 in distributions, it may make financial sense for it to be taxed as an S corp and pay its owner(s) a salary.

Being taxed as an S corp is probably not the best option, however, if the amount of the distribution after paying its owner(s) a salary is less than $10,000.

Yes, you can hire yourself as an independent contractor to perform work for your LLC. If you do that, the LLC would then issue you a Form 1099-MISC.

An LLC owner can typically write off the following expenses — at least partially — on their individual tax return:

- Business start-up costs

- Home office costs

- Office rental costs

- Business travel

- Business-related auto expenses

- Business insurance premiums

- Interest expenses

- Business-related equipment

- Education expenses (i.e., relevant training and workshops)

An owner’s draw is the share of an LLC’s profits taken by an owner. It’s sometimes called a distribution.

A distribution is the share of an LLC’s profits taken by an owner. It’s sometimes called an owner’s draw.

An LLC owner must pay Federal Insurance Contributions Act (FICA) self-employment taxes on their owner’s draw or distribution.

LLC members pay FICA self-employment taxes on all draws or distributions.

Members of an LLC taxed as an S corp or a C corporation (C corp) don’t have to pay self-employment taxes on the salary portion of their compensation because the LLC pays its portion and the other half is automatically withheld from each member’s paycheck.

Yes. An owner of an LLC is considered an employee if the LLC is taxed as either an S corp or a C corp.

Sweat equity in an LLC is any unpaid work completed by a member of the LLC.

All LLCs with employees or any LLC with more than one member must have an EIN. This is required by the IRS. Learn more in our EIN for LLC guide.