Indiana Registered Agent

Limited liability companies (LLCs) and corporations are required to appoint an Indiana registered agent.

Even though you can be your own agent, many business owners choose to hire a service. Using a registered agent service will:

- Add a layer of privacy

- Allow you to be away from your registered office address during regular business hours

- Help you avoid potential penalties and/or fines and reduce risk

We’ll help you make the best choice for your business.

Recommended: Northwest Registered Agent offers free registered agent services with LLC or corporation formation ($29 plus state fees).

Choosing a Registered Agent in Indiana

An Indiana registered agent serves as your business’s point of contact with the state, and will receive important correspondence that relates to tax updates and annual reports.

Indiana registered agents are also responsible for receiving service of process in the event that a lawsuit is filed against your business.

In Indiana, appointing an agent is a legal requirement for LLCs and corporations. This can be a registered agent service or an individual (e.g., yourself, etc.), so long as:

- They’re at least 18 years old.

- They have a physical address in the state of Indiana.

- They’re always available during normal business hours at their registered business address.

Indiana Registered Agent Services

- Convenience: Hiring a third-party service instead of acting as your own agent will allow you to operate with more flexibility. This is because you will not need to be physically present in your address during regular business hours in order to receive service of process.

- Privacy: Since your registered agent’s address and name will become publicly available as soon as your business is registered, you can choose to hire a third-party service in order to protect your private information.

- Legal compliance: Most third-party service providers offer additional features that can help your business remain compliant and avoid potential fines (e.g., annual report reminders, etc.).

Let’s Find the Right Registered Agent for Your Business

We’ve tested and reviewed the most popular registered agent services.

Can You Be Your Own Registered Agent?

Yes you can.

Acting as your own agent can be a great idea if you are operating on a tight budget and will struggle to pay the $90 per year fee of hiring a third-party service.

Having said that, we recommend avoiding this route if you can due to its significant drawbacks.

All in all, acting as your own agent will mean that:

- You will need to be physically present in your registered office address during regular business hours.

- You will potentially open yourself up to fines and/or penalties from federal agencies.

- You will be solely responsible for going through all of the paperwork sent to you from the SOS; this can be quite time-consuming.

If you are forming a new LLC, it makes sense to hire a formation service that includes a free year of registered agent services. These can charge as little as $29 per formation (excluding state fees).

If you are forming an LLC but prefer to file the paperwork yourself and act as your own registered agent, take a look at our How to Start an LLC in Indiana guide.

Best Indiana Registered Agent Service

If you’re in Indiana and either looking to form a new LLC or switch your existing registered agent, it’s crucial to consider factors like cost, range of services, reputation, and customer support.

Many people seek registered agents offering features like mail forwarding, document scanning, and compliance monitoring.

Northwest Special Offer

If you haven’t formed your LLC yet, consider Northwest’s LLC formation package for $29 plus state fees, which includes a free first year of registered agent service.

- Premium customer service

- Streamlined ordering

- Robust privacy features

To help you make an informed choice, we’ve compiled a table comparing the top 5 Indiana registered agent services below.

|

Best Registered Agent Services |

|

|

Northwest 4.7/5 |

BEST REGISTERED AGENT SERVICE

|

VISIT SITE |

|

LegalZoom 4.5/5 |

TRUSTED AND WELL-KNOWN COMPANY

|

VISIT SITE |

|

ZenBusiness 4.3/5 |

|

VISIT SITE |

|

Bizee 4.1/5 |

|

VISIT SITE |

|

Rocket Lawyer 3.9/5 |

|

VISIT SITE |

Whether you’re starting a new business or considering a change, it’s crucial to weigh factors like pricing, services, reputation, and customer support when choosing a registered agent in Indiana. Compare quotes and read online reviews to find the best fit for your needs.

Benefits of Using a Registered Agent Service

Many businesses choose to use a commercial registered agent service when they form an LLC. This is because it can offer a number of benefits, including:

- Legal compliance: A registered agent service will ensure that you don’t miss an important legal document or notification (e.g., service of process, etc.) as a result of not being in your office (or as a result of a human error).

- Improved privacy: If you act as your own agent, your name and address will become public record on the Indiana Business Search. Using a professional registered agent service will help keep your information private.

- Discretion: When it comes to legal disputes, you will want to avoid receiving lawsuit-related documents in front of your clients and/or some employees.

- Better storage: Your service will generally scan all documents received and upload them online in PDF form. This means that you will always be able to access them online, and won’t have to worry about losing an important document.

A registered agent service can also be beneficial if you plan to expand into other states as a foreign LLC. This is because, otherwise, you would need to find an individual or business entity that is a resident — or is allowed to transact business — in each state that you want to register in.

How to Elect a Registered Agent in Indiana

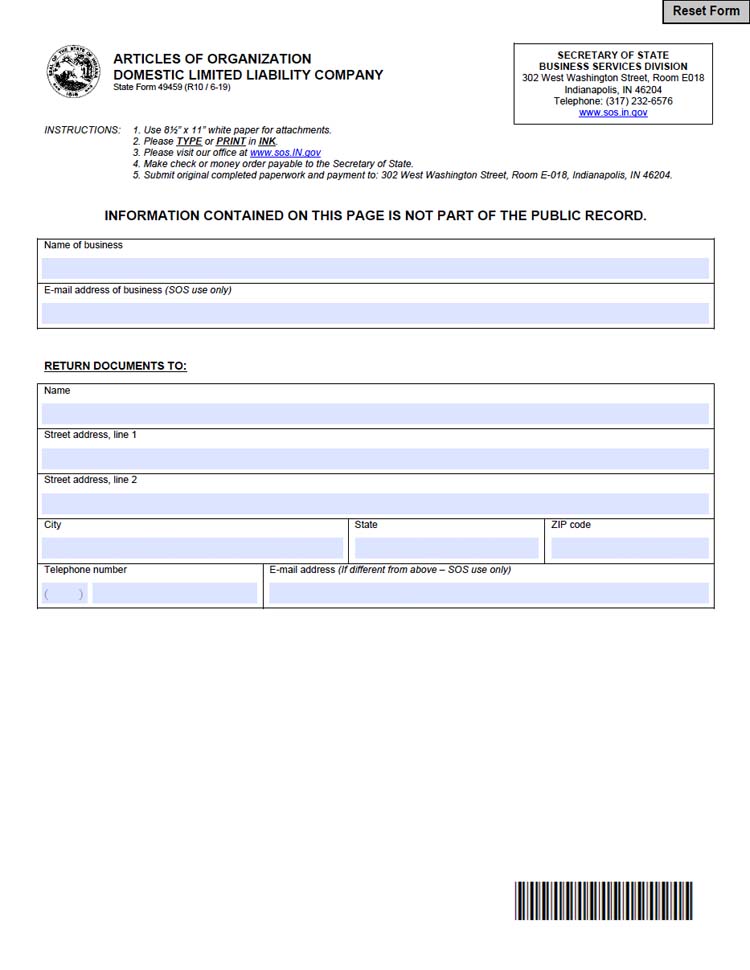

For your LLC in Indiana, you will be required to elect your registered agent when you complete your LLC’s Articles of Organization.

This is the main formation document that you will need to file with the Indiana Secretary of State in order to form your LLC (Form 49459).

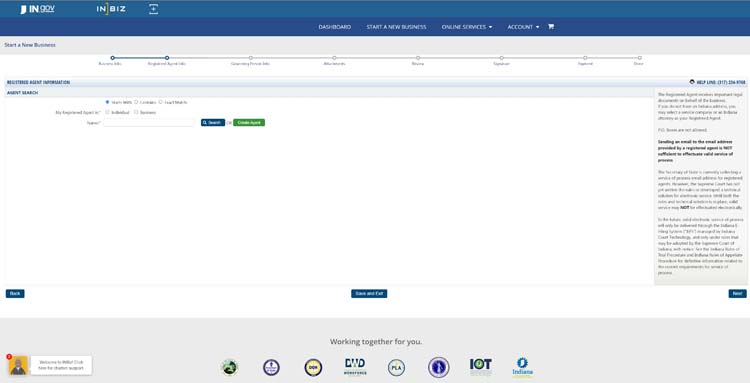

Electing a Registered Agent Online

You can form your LLC online on the Indiana Secretary of State IN.gov website ($95 filing fee required). Your registered agent’s name and contact information will be requested when you file your LLC’s Articles of Organization online:

Electing a Registered Agent by Mail

To form your LLC by mail, download the Articles of Organization form ($100 filing fee required), fill out the required fields, and submit a physical copy to the Indiana Secretary of State. You’ll be asked to provide your registered agent’s information in the middle of page 2

How to Change Your Registered Agent in Indiana

If you want to appoint a new agent, you will need to file a Statement of Change of Registered Agent form (Form 56367) with the Secretary of State’s Business Services Division.

There is no filing fee that needs to be paid.

This can be done online or by mail.

Mail:

Secretary of State

Business Services Division

302 West Washington Street, Room E018

Indianapolis, IN 46204

Consent to Appointment

Your new registered agent also will need to consent to their appointment. You must affirm on the Statement of Change form that your newly appointed registered agent has given their consent.

For more information read our how to change registered agents in Indiana guide.

Indiana Registered Agent FAQs

Yes, you can, presuming that you are at least 18 years old, have a physical address in Indiana, and will always be available at your address during normal business hours.

Having said that, being your own agent can come with significant drawbacks, which is why it is seldom recommended.

See our Indiana Registered Agent article for more information.

This will depend on who your registered agent — also known as a statutory agent — is.

If you choose to hire a third-party service, you should expect to pay anywhere between $90 and $300 per year.

Keep in mind that you can get the first year free of charge if you use an LLC formation service when getting started.

A registered agent — also known as a resident agent — is a third-party service or individual that receives legal correspondence from the Secretary of State and other federal agencies.

This can include annual report reminders and tax-related notifications.

Your registered agent will also receive service of process in the event that a lawsuit is filed against you.

Yes you do.

This can be yourself, a registered agent service, or another partner, so long as:

- Your agent is at least 18 years old.

- Your agent has a physical address in Indiana

- Your agent will always be available at their address during regular business hours.

You can find an agent through our review of the best registered agent services of 2026.

Alternatively, you can act as your own agent (not recommended) by filling in your personal details in your LLC’s Articles of Organization.