How to File the Maryland LLC Articles of Organization

The Maryland Articles of Organization is the LLC form you fill out and file with the state to form an LLC.

Follow the steps in our How to File the Maryland LLC Articles of Organization guide below to get started.

Or simply use a professional service:

Northwest ($29 + State Fees)

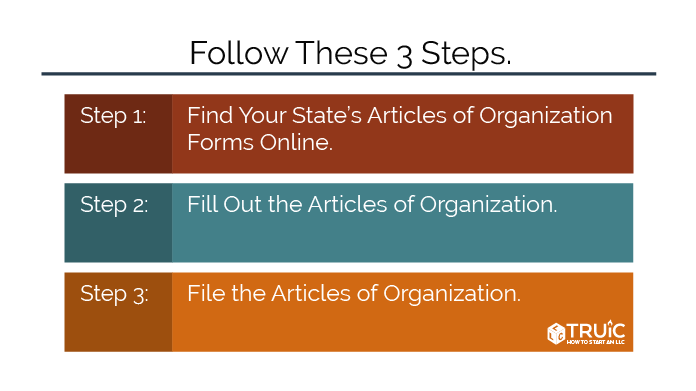

Filing the Maryland Articles of Organization Is Easy!

We’ll take you through three easy steps for filing the Maryland LLC Articles of Organization.

- Get Your Articles of Organization Forms

- Fill out the Articles of Organization

- File the Articles of Organization

Step 1: Get Your Articles of Organization Forms

You can download and mail in your Maryland Articles of Organization, OR you can file online. For this first step, choose your preferred method below.

Get Your Maryland Articles of Organization Forms

Option 1: Create an account to file your Articles of Organization on the Maryland Business Express website. Once logged in, select “Start a New Filing,” and then “Register a Business.”

Create Account– OR –

Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website. This form will need to be submitted to the Maryland State Department of Assessments and Taxation.

Download PDFStep 2: Fill Out the Articles of Organization

In this step, we will help you complete the Maryland Articles of Organization form.

You will need to know the following information to complete the form:

- Entity Name and Address

- Registered Agent Name and Registered Office Address

- Business Purpose

Entity Name and Address

Having a creative and smart business name is important but not as important as having a legally correct name.

When you choose a name for your business, you have to make sure the name:

- meets Maryland naming guidelines.

- is not already in use by another business in Maryland.

Follow the Maryland Naming Guidelines:

- Your name must include the phrase “limited liability company” or one of the following abbreviations: LLC, L.L.C., LC, or L.C.

- Your name cannot imply that the LLC is organized for a purpose other than the one outlined in its articles of organization.

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- In some states, restricted words (e.g., Bank, Attorney, University) may require additional paperwork and a licensed individual to be part of your LLC.

- Your name must be distinguishable from any existing business in Maryland. This includes reserved names.

Check Name Availability:

Is your name available in Maryland? Make sure the name you want isn’t already taken by doing a name search on the Maryland Business Express website.

To learn more about naming your business, including best practices and creative branding, visit our How to Name a Business in Maryland guide.

Not sure what to name your business? Check out our Business Name Generator.

Register Your Domain Name:

We recommend checking to see if your business name is available as a web domain. Even if you don’t plan to make a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Registered Agent and Registered Office

A registered agent accepts and sends legal documents on your LLC’s behalf. When you register your Maryland LLC, you are required to list your registered agent and your registered office.

Your registered agent can be anyone 18 years or older that lives in Maryland. Your registered agent must always be available at the registered office during regular business hours.

To learn more about choosing a Maryland registered agent, read our How to Choose a Maryland Registered Agent guide.

To learn more about what a registered agent does and how to choose one, read our What is a Registered Agent guide.

Purpose

You must include one to two sentence description of your LLC’s business purpose.

Keep in mind that a business purpose that involves licensing, tax-exemption, or tax-deductible status requires specific language from the IRS or a professional license.

Step 3: File the Articles of Organization

To register your LLC, you will need to file the Articles of Organization with the Department of Assessments and Taxation.

There are two ways to file your Articles of Organization:

- Complete the forms online.

- Submit a hard copy by mail or in person.

File the Maryland Articles of Organization

Option 1: Create an online account or log in to the Maryland Business Express website. Then, select “Maryland Limited Liability Company” on the “Register a New Business” page.

File Online– OR –

Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website.

Download PDFState Filing Cost: $100

Mail to:

Department of Assessments and Taxation

700 East Pratt Street, Suite 2700

Baltimore, MD 21202

Submit In-Person:

Department of Assessments and Taxation

700 East Pratt Street, Suite 2700

Baltimore, MD 21202

Turnaround Time: 4 to 6 weeks online or by mail, but can be expedited for an additional fee.

Steps After Your Maryland LLC Is Officially Formed

Once you’ve filed your Articles of Organization, you should take the following steps:

Create an Operating Agreement

A Maryland LLC Operating Agreement is a legal document that outlines the ownership structure and member roles of your LLC.

In Maryland, you aren’t required to have an Operating Agreement to officially form an LLC, but it’s still a good idea to have one. You can start your operating agreement before, during, or after you file your Articles of Organization.

Your operating agreement will be kept in your LLC’s private business records; you do not file it with the state.

Use our free Operating Agreement Tool to draft a customized operating agreement for your LLC.

Get an EIN

An Employer Identification Number (EIN) is like a social security number for your LLC. You will need an EIN if you want to hire employees or open business bank accounts.

You can get your EIN for free through the IRS website, via fax, or by mail. If you would like to learn more about EINs and how they can benefit your LLC, read our What is an EIN article.

Open a Business Bank Account

Using dedicated business banking and credit accounts is essential to protect your business’ corporate veil. When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your LLC is sued.

For reviews on some of our most trusted business banks, visit our Best Banks for Small Business review.

Get Licenses and Permits

When you are registering an LLC, you need to determine if your business needs any licenses or permits in order to remain compliant. On the federal level, there are a handful of business activities that require licenses and/or permits.

Find out how to obtain necessary licenses and permits for your business or have a professional service do it for you:

- Federal: Use the U.S. Small Business Administration (SBA) guide to federal business licenses and permits.

- State: Apply for or learn more about licenses, permits, and registration with the Comptroller of Maryland.

- Local: Contact your local county clerk and ask about local licenses and permits.

State of Maryland Quick Links

Brand Your Business

The strongest and most memorable businesses are built on a solid brand. When developing your brand, think about what your business stands for. Customers and clients are looking for companies that have a compelling brand, as much as they are shopping for high-quality products and services.

Creating a logo for your business is vital for increasing brand awareness. You can design your own unique logo using our Free Logo Generator. Our free tool can help you design your own unique logo for your new business idea.