Free LLC Operating Agreement Template

The LLC operating agreement outlines ownership, management, profit distribution, and dispute resolution processes. While not mandatory in every US state, it remains crucial for smooth operation.

Download our LLC operating agreement template below or sign up to create a custom operating agreement using our free tool.

Forming an LLC? Get a free operating agreement when you use Northwest to start an LLC for $29 (plus state fees).

Create a Free LLC Operating Agreement

We offer a customizable operating agreement tool as well as operating agreement templates for single-member LLCs and multi-member LLCs (including member-managed and manager-managed).

Create a Custom Operating Agreement

Create a custom operating agreement using our free tool. Just answer a few basic questions, and the tool will develop an operating agreement for your new LLC.

To use our tool, you will need to sign in to our Business Center. A Business Center account will also grant you access to many other free tools, special discounts on business services, and much more.

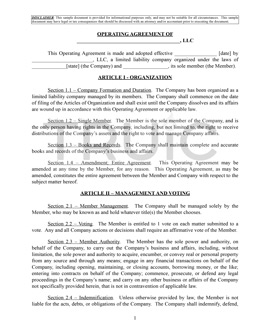

Single-Member LLC Operating Agreement

Our single-member LLC operating agreement template PDF was created for limited liability companies with only one member, where the sole member has full control over all affairs of the LLC and no other individuals have a membership interest in the company.

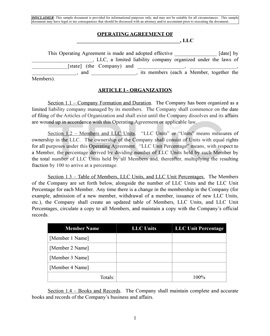

Multi-Member LLC Operating Agreements

Our multi-member LLC templates are meant for LLCs with more than one member. There are two types available: manager-managed and member-managed.

LLC Operating Agreement by State

Get Your Free state specific LLC Operating Agreement templates below, simply select your state.

What Is an LLC Operating Agreement?

An LLC operating agreement, known in some states as an LLC company agreement or limited liability company agreement, is a legal document that outlines the ownership and member duties of your limited liability company.

This agreement allows you to set out the financial and working relations among business owners ("members") and between members and managers.

LLC operating agreements are an internal document. This means that they are stored by the LLC owners and members and don’t need to be sent to the state or any other type of government agency.

The contents of an LLC operating agreement differ depending on the number of owners in your LLC.

If you are the sole owner of your business, then you need an operating agreement for a single-member LLC.

If your business has multiple owners, then you will need either a member-managed LLC operating agreement or a manager-managed LLC operating agreement.

Generally speaking, an operating agreement should address the following topics:

- Organization of your LLC — Who are the LLC members, and what are their shares of ownership?

- Management — Who is responsible for running the business? How will major business decisions be made?

- Capital Contributions — How will the operations of the LLC be funded?

- Distributions — How will the profits of the LLC be distributed among the owners?

- Membership Changes — Will the LLC be able to add new members later on? What is the process for removing an existing LLC member?

- Dissolution — If and when the owners decide to dissolve the LLC, how will that happen?

Although there are other minor topics that can be included in an operating agreement, these six sections are the most important.

Does My Business Need an Operating Agreement?

The significant protections offered by a written operating agreement make it a crucial document for any business.

Single-Member LLCs

If you are the sole LLC owner, creating an operating agreement brings credibility to your LLC. This helps to ensure courts uphold the limited liability status of your LLC by strengthening your corporate veil.

Without an operating agreement, a single-member LLC could look dangerously similar to a sole proprietorship, and you could potentially lose your limited liability.

Multi-Member LLCs

If you have business partners, an operating agreement will help prevent misunderstandings by setting clear expectations about partner roles and responsibilities. Going into business without an operating agreement is never recommended, but when you have partners or other members involved, this document becomes an invaluable asset to your future success.

State Requirements

Though it’s an essential document, most states don’t require businesses to have an operating agreement, and no state requires your operating agreement to be on file in their records. Even if an operating agreement is not required in your state, we strongly recommend creating one.

The operating agreement is used in court and amongst members to settle disputes or to make general decisions. If you don’t have one, the state's default LLC rules will be applied.

The following states require all LLCs to have operating agreements:

- Maine

- Missouri

- New York

Find your state’s statute regarding operating agreements below:

|

State Operating Agreement Statutes |

|

|

Alabama |

§ 10A-5A-1.08 | |

|

Alaska |

||

|

Arizona |

||

|

Arkansas |

||

|

California |

||

|

Colorado |

||

|

Connecticut |

||

|

Delaware |

||

|

Florida |

||

|

Georgia |

||

|

Hawaii |

||

|

Idaho |

||

|

Illinois |

||

|

Indiana |

||

|

Iowa |

||

|

Kansas |

||

|

Kentucky |

||

|

Louisiana |

||

|

Maine |

||

|

Maryland |

||

|

Massachusetts |

||

|

Michigan |

||

|

Minnesota |

||

|

Mississippi |

||

|

Missouri |

||

|

Montana |

||

|

Nebraska |

||

|

Nevada |

||

|

New Hampshire |

||

|

New Jersey |

||

|

New Mexico |

||

|

New York |

||

|

North Carolina |

||

|

North Dakota |

||

|

Ohio |

||

|

Oklahoma |

||

|

Oregon |

||

|

Pennsylvania |

||

|

Rhode Island |

||

|

South Carolina |

||

|

South Dakota |

||

|

Tennessee |

||

|

Texas |

||

|

Utah |

||

|

Vermont |

||

|

Virginia |

||

|

Washington |

||

|

Washington D.C. |

||

|

West Virginia |

||

|

Wisconsin |

||

|

Wyoming |

||

What Is the Purpose of an LLC Operating Agreement?

Here are the core purposes of an LLC operating agreement:

1. Outlines Rules for the Business

One of the main purposes of an LLC operating agreement is to set the ground rules for running your business. It serves as an internal manual outlining your LLC's governance and operational procedures, thus providing a clear guide for managing your business affairs.

2. Defines Ownership and Contributions

The agreement goes into detail specifying who the owners (members) of the LLC are, their respective ownership percentages, and their initial capital contributions. This aspect brings clarity and certainty to the ownership structure and reduces the potential for misunderstandings and disputes down the line.

3. Determines Profit and Loss Distribution

A key part of the agreement is determining how the LLC's profits and losses will be allocated among the members. This provision brings transparency to financial matters and ensures that all members are clear about their financial rights and obligations.

4. Plans for Future Changes

The agreement is designed to be forward-thinking. It includes provisions for changes in membership, like adding new members or handling the departure of existing ones. This helps the business to adapt smoothly to future changes and provides a clear process for transitioning ownership.

5. Sets Dispute Resolution Methods

Disputes and disagreements can arise in any business venture. An operating agreement outlines the methods for resolving these disputes, potentially saving significant time, stress, and legal fees.

6. Strengthens Limited Liability Protection

By clearly distinguishing the company as a separate legal business entity, the operating agreement can strengthen the LLC's limited liability status. This provides an extra layer of protection for members' personal assets against business debts or lawsuits. Without an operating agreement, the LLC could essentially be invalid, and its members will not be protected from personal liability.

7. Provides Credibility

An operating agreement can also serve as a symbol of credibility to outside parties. Potential investors, lenders, and partners often see a well-crafted operating agreement as a sign of professionalism and preparedness, enhancing your business's reputation.

8. Facilitates Decision-Making

The agreement lays out voting rights and procedures for making major decisions, helping to streamline business operations and prevent potential conflicts among members.

How to Write an LLC Operating Agreement

While the sections of your operating agreement may vary based on your LLC’s unique needs, there are six main articles you should consider including.

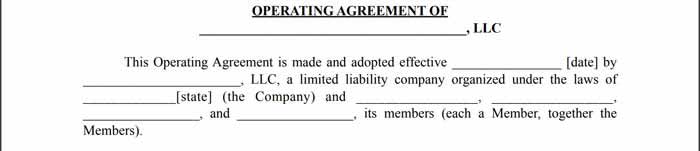

Introduction

The beginning of your LLC’s operating agreement should include the basic information about your company, including:

- Your LLC’s name

- The date that the operating agreement will be effective

- The state your LLC is formed in

- The names of each member

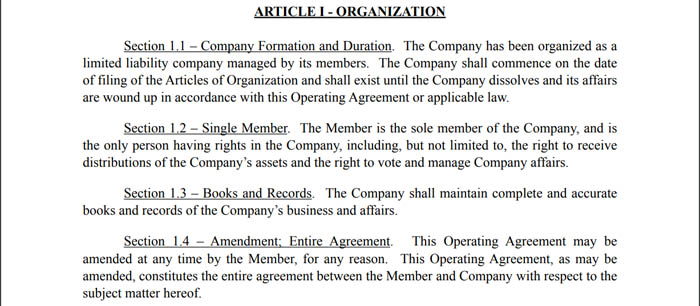

Article 1. Organization

The first official article of your operating agreement should outline your company’s formation basics (e.g., formation date, overall purpose, etc.) and its ownership structure.

Single-Member LLCs

Since single-member LLCs only have one member to worry about, your “Organization” article can state that you, as the sole owner, are the only person with rights in your LLC.

What’s more, as the only member, your amendment protocol will be simple, as you may change your operating agreement as you see fit without having to vote on it.

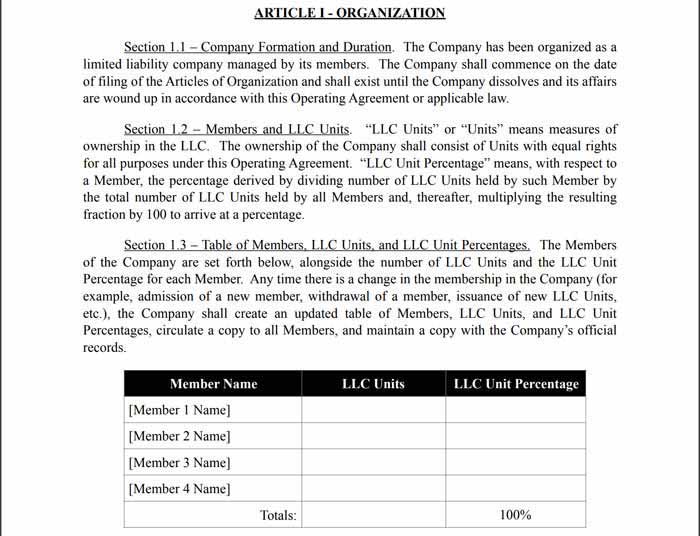

Multi-Member LLCs

The ownership details for multi-member LLCs will be more in-depth, as the operating agreement should detail each member’s number of LLC units as well as their LLC unit percentage.

For example, if your LLC has four members with equal ownership in the company, the number of LLC units per member would be 25, and the LLC unit percentage would be 25%.

When it comes to amending your LLC’s operating agreement, you will need to determine how the members will vote to make amendments to the document. We’ll go into more detail about this decision in Article 2.

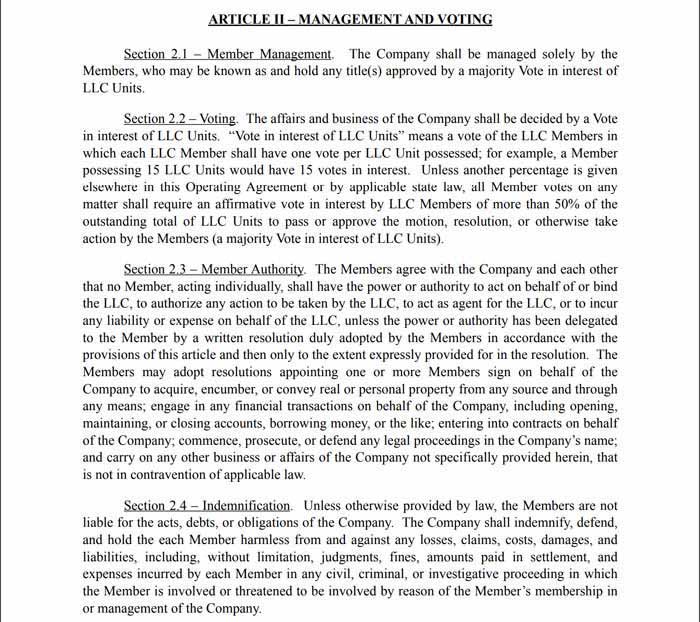

Article 2. Management and Voting

This article outlines how your LLC is managed (i.e., by its members or by a manager), as well as how votes will be held when making company decisions such as adding new members, raising capital, or dissolving the LLC.

Multi-Member LLCs

For multi-member LLCs, the members will need to determine whether votes will be determined by a unanimous vote (i.e., all owners must agree) or by a majority vote (based on the number of members or based on LLC units).

This article should also note that members can not act individually to authorize action on behalf of the LLC without prior approval by all members.

Manager-managed LLCs should also establish who the manager is and how their title is determined.

Single-Member LLCs

A single-member LLC need only note that all management, voting decisions, and member authority lies with the sole owner.

Article 3. Capital Contributions

Article 3 lists any initial contributions that have been made or will be made by members.

If additional capital is to be raised by existing members or by the admission of new members, multi-member LLCs should indicate whether these decisions will be made by majority vote or unanimous vote.

Single-member LLCs should still detail whether they are making initial capital contributions and that raising additional capital is at their sole discretion.

Article 4. Distributions

The distributions article lays out how the LLC will distribute its profits and when; distributions of losses should also be noted.

For a multi-member LLC, profits and losses may be distributed based on LLC unit percentages.

In contrast, all profits and losses are allocated to the owner of a single-member LLC.

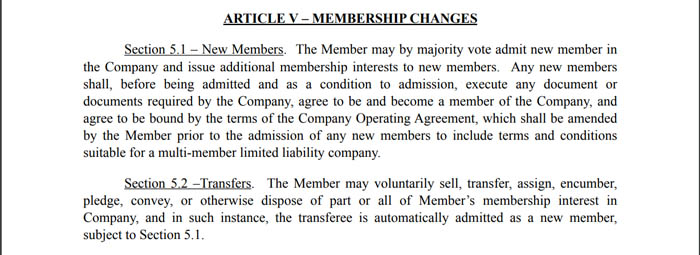

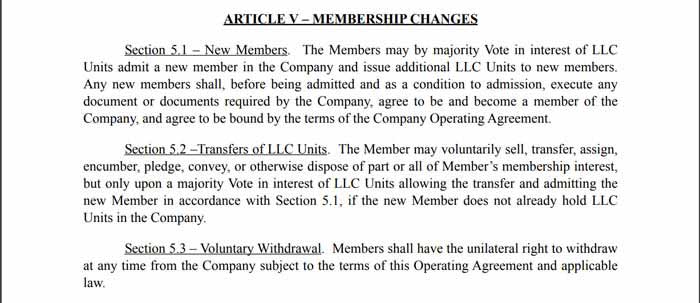

Article 5. Membership Changes

Your LLC will need to determine the procedures for adding or removing members as well as how member interest will be transferred (if at all).

A single-member LLC owner is the only person who needs to approve whether a new member can be added and how membership interest will need to be transferred.

(Note that once new members are added, a new operating agreement will need to be drafted to accommodate the provisions of a multi-member LLC.)

Multi-member LLCs will need to specify how voting to add or remove members and transfer LLC units will be handled.

Article 6. Dissolution

This final article should explain what will happen if and when the LLC must be dissolved. If the LLC is only going to be active for a specified period of time, the end date or event would be noted here. Otherwise, the LLC is assumed to exist in perpetuity.

A multi-member LLC should list how voting for dissolution will occur and how members will distribute any remaining assets upon dissolution.

Dissolution and distribution of assets for a single-member LLC will remain with the owner.

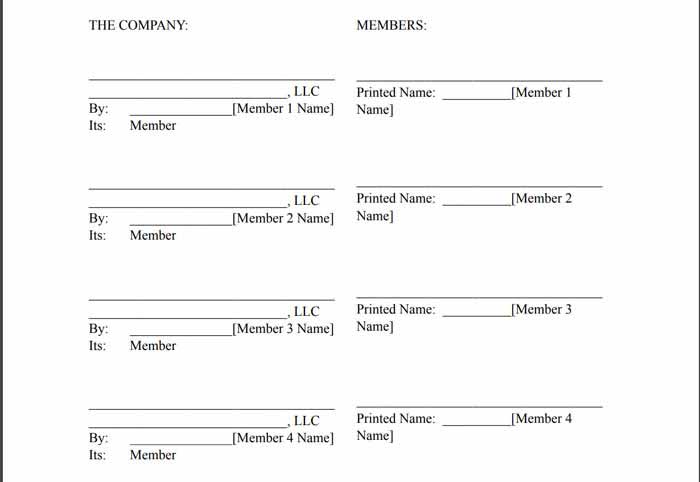

Execution

Once you’ve finished drafting your operating agreement and all members approve of its contents, each member should sign and print their name on behalf of the company and as a member.

After Creating Your Operating Agreement

Once you have finished your operating agreement, you won’t need to file it with the state. You’ll need to keep it for your records and give copies to the members of your LLC.

Following any major company event, such as adding or losing a member, it is a good idea to review and consider updating the operating agreement.

Depending on how your operating agreement is written, it may require some or all of the members to approve an amendment to the document.

FAQ

You write a simple operating agreement by outlining the business's basic details, the members and their ownership percentages, capital contributions, profit and loss distribution, membership changes, decision-making process, dispute resolution methods, and concluding with signatures from all members.

Ownership and management of company property, a crucial subset of company assets, are detailed in the operating agreement. The document can establish rules for the purchase, use, and sale of property, thus helping prevent potential disputes.

Yes, you can create your own operating agreement for your LLC. It's crucial, however, to understand that operating agreements should be tailored to your business's specific needs and comply with state laws. We recommend using a sample LLC operating agreement to get familiar with the process before drafting your own.

An operating agreement template for an LLC is a preformatted document that outlines the basic structure and elements of an operating agreement. You can fill in your business-specific details. It often includes sections for ownership, capital contributions, profit distribution, decision-making, and dispute resolution.

The key elements of an LLC operating agreement are: company details, member details and ownership percentages, capital contributions, profit and loss distribution, rules for membership changes, the decision-making process, dispute resolution methods, and signatures from all members.

While some states may use different terminology, there's no difference between an LLC agreement and an operating agreement. They're two names for the same document. This agreement outlines the operating rules, ownership, and structure of a limited liability company (LLC).

The operating agreement serves as a detailed extension of the Articles of Organization. The Articles of Organization, filed with the state, officially establish the existence of your LLC. They contain basic information about your business, like the name, address, and members. However, they don't usually cover the detailed operational and managerial aspects that an operating agreement does.

The operating agreement is vital in protecting company assets. It defines each member's capital contribution to the LLC, which could be in the form of money, services, or property. The agreement outlines how these assets will be managed, used, and divided among members, providing a layer of protection and clarity.

DISCLAIMER

The documents above are provided "AS IS" and with "ALL FAULTS." We disclaim any warranties, including but not limited to warranties of fitness for a particular purpose. The Documents may be inappropriate for your particular circumstances. By downloading the documents, you agree that this is not intended to and does not constitute legal advice, recommendations, mediation, or counseling under any circumstance and that no attorney-client relationship is formed.