Top Reasons to Start a Rental Property Business

A rental property business acquires residential, commercial, or vacation property at below market value, then rents it out. This passive income can be used to supplement monthly earnings or can become your sole livelihood.

We developed this guide to bring you the top five reasons why you should consider starting a rental property business.

Recommended: For a step-by-step guide to buy and rent real estate, check out our article on how to start a rental property business.

Why Start a Rental Properties Business?

There are many reasons why you should know how to start a rental property business. But what are the main benefits of running this type of company? Here, we’ve listed the top five reasons why starting a rental properties business is an excellent choice for most any entrepreneur.

SKIP AHEAD

1. Low Startup Costs

Starting a buy and rent real estate business can be done with little to no money — if you secure an adequate funding source to ensure the mortgage and any additional expenses are covered. Here are a few funding sources you could potentially work with to start your buy and rent real estate business:

Friends and family — To lessen the risk of using solely your own money, you can combine funds with friends and/or family. It is important, however, to use an attorney to get terms in writing beforehand to avoid conflict.

Additional Funds — If you have additional funding such as a 401k, Roth IRA, Home Equity Line of Credit, or savings, these can be used to finance your real estate investment. It is encouraged that you speak with your advisor.

Bank Loans — Since your business is new, it may be difficult to obtain a bank loan in the beginning though it is possible. However, the company owner will have to guarantee the loan personally, which makes this option risky.

Hard Money Loans — Essentially, a hard money loan is a cash loan compiled by a group of investors who allocate a manager to grow their investment following strict terms and conditions. The nature of a hard money loan is an expectation of a quick return on investment.

Private Money — Private money is a loan from a single private lender, not a combination of lenders. For example, if your family member has a large sum of money, they are willing to lend to you for the project. The terms and conditions of this loan vary depending on the agreement.

Traditional Mortgages — There are several types of traditional mortgages, including conventional, Federal Housing Assistance (FHA), FHA 203k, Veteran’s Assistance, and Rural Development. Each traditional mortgage variation can be applied based on your finances, employment background, qualifications, and location of the property.

Learn more about different types of home loans available for LLC owners. Read our Types of Mortgages for Small Business Owners guide.

2. Operate Your Business From Home

To start a buy and rent real estate business, you don’t need an office; you can start this business from the comfort of your own home. Whether you are starting this business to replace your sole income or as a supplement to your current income, rental properties offer the flexibility to work with your schedule — unlike a 9-5 job.

The main tasks required for operating this business are the following:

- Finding a good rental property yourself or via an investor-friendly realtor

- Buying the property

- Rehabilitating the property yourself or via a contractor

- Marketing the rental and finding a tenant

- Managing the property yourself or via a property manager

You can perform most of these tasks virtually from home. However, if you are planning to rehabilitate the home yourself, you should budget time for the number of repairs required to renovate the home.

To lessen the workload further, using a property management company offers you less responsibility over the vetting process, providing a great option for new property owners.

3. Provide Housing for Your Community

Many people are either unable or uninterested in buying a home. By leasing your rental property, you provide a livable, comfortable home for someone while saving them the responsibility and financial commitment required to buy a home.

Here are a few ways to elevate your rental property’s livability:

- Repaint the walls a neutral color

- Replace old/rusted bathroom fixtures

- Update kitchen appliances/counters within your budget

- Offer free yard maintenance

Baselane offers a banking platform designed with real estate investors in mind to easily collect revenue, maintain books and file taxes so you can focus on running your real estate investment business.

4. Great Long Term Investment

Any type of real estate investment can be a great, lucrative decision. However, buying and renting your property offers long term returns on investment and the opportunity to increase your earnings as the area your property is locating in grows.

A few tips to finding a property that has the potential to generate more income over time:

- It’s easily walkable to businesses and restaurants

- It doesn’t require a lot of maintenance or rehabilitation to be rentable

- It’s close proximity to major cities, colleges, highways, or universities

- There is a low crime rate in the area

- The value of homes in the area are rising

5. Opportunity to Reinvest in Your Business

Once you have mastered acquiring and managing your first rental property, you can use the earnings to reinvest in additional property and expand your business.

For example, if your first property is a single-family home, you could invest in a bigger property such as a multi-family residence or small apartment building in order to increase the number of monthly payments you are able to accrue. With a buy and rent real estate business, there is plenty of room for growth and expansion — making it perfect for new business owners looking to make real estate investment a career.

Conclusion

A buy and rent real estate business can be a rewarding and lucrative investment if you keep up with proper maintenance and acquire good tenants — it can even become your sole income. If this sounds like the right path for you, a buy and rent real estate business could be a great fit for your lifestyle for little to no money to start.

Frequently Asked Questions

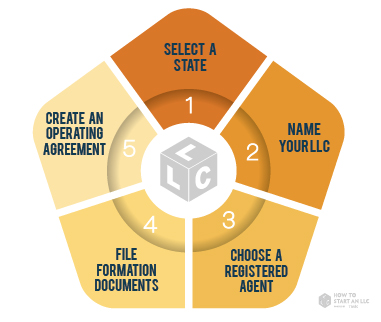

We recommend starting an LLC for a buy and rent real estate business. This business structure is easy to maintain and form, making it ideal for new business owners.

You can buy an investment property with little to no money in a few ways via a private lender, traditional mortgage, or by combining the funding you have with friends and family.

To determine whether a rental property will be a good investment, talk to experienced real estate investors and people in the community you are looking to buy in.

Next, evaluate the property and determine the amount of repair the property will need to undergo to be livable and the amount of money you will need to make this a good investment.