Top Reasons to Start Flipping Houses as a Business

A house flipping business buys property at a deep discount, then repairs and renovates the home to sell at a higher price. This business offers potential for a high return on investment and, if done right, can parlay into your sole income.

We developed this guide to bring you the top five reasons why you should start a house flipping business.

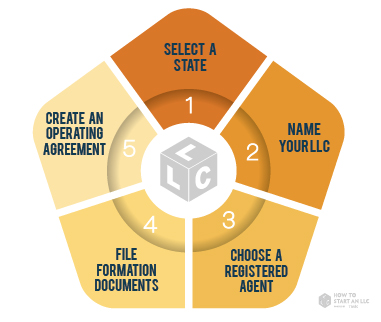

Recommended: For a step-by-step guide to house flipping, check out our article on how to start a house flipping business.

1. Low Startup Costs

Starting a house flipping business can be done with little to no money — if you secure an adequate funding source. Here are a few funding sources you could potentially work with to start your house flipping business:

Friends and family — To lessen the risk of using solely your own money, you can combine funds with friends and/or family. It is important, however, to use an attorney to get terms in writing beforehand to avoid conflict.

Additional Funds — If you have additional funding such as a 401k, Roth IRA, Home Equity Line of Credit, or savings, these can be used to finance your real estate investment.

Bank Loans — Since your business is new, it may be difficult to obtain a bank loan in the beginning though it is possible. However, the company owner will have to guarantee the loan personally, which makes this option risky.

Hard Money Loans — Essentially, a hard money loan is a cash loan compiled by a group of investors who allocate a manager to grow their investment following strict terms and conditions. The nature of a hard money loan is an expectation of a quick return on investment.

Private Money — Private money is a loan from a single private lender, not a combination of lenders. For example, if your family member has a large sum of money, they are willing to lend to you for the project. The terms and conditions of this loan vary depending on the agreement.

Traditional Mortgages — There are several types of traditional mortgages, including conventional, Federal Housing Assistance (FHA), FHA 203k, Veteran’s Assistance, and Rural Development. Each traditional mortgage variation can be applied based on your finances, employment background, and location of the property.

Learn more about the types of mortgages available to business owners. Read our guide to Different Types of Home Loans.

2. Operate the Business From Your Home

To start a house flipping business, you don’t need an office; you can start this business from the comfort of your own home. Whether you are starting this business to replace your sole income or as a supplement to your current income, house flipping offers the flexibility to work with your schedule — unlike a 9-5 job.

The main tasks required for operating this business are the following:

- Finding properties to rehabilitate

- Finding funding sources

- Doing walkthroughs of properties virtually or in person

- Drafting contacts and making offers

- Rehabilitating the home via a contracting company

- Marketing and selling the property

Most of these tasks can be performed virtually from home. However, if you are planning to rehabilitate the home yourself, you should budget time for the number of repairs required to renovate the home.

3. Provide a Service to Your Community

House flipping can provide a wonderful service to the community by buying and repairing unwanted and distressed homes. From the homeowners to the neighbors and even your funding sources — this process can be mutually beneficial to all parties.

Homeowners

A distressed or unwanted property without the time or funding to repair can be a great burden on any homeowner. As a house flipper, you offer homeowners fair prices for houses that benefit both you and the seller. From death to divorce, many people are simply looking to get a house off their hands, and your services can help them do that in a positive and mutually beneficial way.

Neighbors

If the property has a large amount of deferred maintenance, neighbors will most likely appreciate the potential for improvement. Additionally, an improvement to the property has the potential to raise the value of the neighboring homes or make them easier to sell.

Funding Sources

Whether you are funding your project with friends and family, a private lender, or a group of lenders, house flipping is a lucrative investment that — if done correctly — can yield a high return and benefit all funding sources.

4. House Flipping Is Lucrative

The recommended amount to spend on a property you plan on flipping is between 40-60% of the after retail value (ARV). This leaves you with a hefty percentage of the profit, depending on how your project is funded, to pocket or continue to reinvest in real estate.

Example: There is a property for sale by the owner. After speaking with the owner, you settle on an offer of $100,000, and the ARV is close to $200,000 — therefore, your offer is 50% of the ARV.

Repairs during an easy to moderate house flip typically cost around $40,000, and transactional costs average around $20,000. If you are able to sell the property for $200,000, your profit will be $40,000.

For most people, this is a great return on investment (ROI) for a project that typically takes around 4-6 months to complete. From this point, you can reinvest and repeat the process to continue to grow your wealth through house flipping.

5. Create Someone’s Dream Home

Many homebuyers are looking for a house that is already upgraded and livable. Your renovations as a house flipper create the space many homebuyers are looking for while saving them the time and effort of doing a renovation themselves.

Whether you’re using a designer or trying your hand at design yourself — all the updates you make to the house you’re flipping add up to create a more livable, desirable home for prospective buyers.

Conclusion

House flipping can be a rewarding, lucrative business with the opportunity to work as a successful side business or become your sole income. If you are interested in investing in real estate and have a desire to serve your community from the comfort of your own home — house flipping may be the perfect business for you.

Frequently Asked Questions

Ideally, it should take about four to six months to flip a house, including purchasing, rehabilitating, and selling the property. Keep in mind, every rehabilitation’s timeline will vary from property to property.

If you don’t have the capital to invest in house flipping, you can look for funding in many other ways such as private lenders, bank loans, and hard money loans.

This is dependent on your time, location, and available capital. However, full-time house flippers complete 2-7 house flips per year on average. Every state is different, however, so check with your state government for rules and regulations.

Example: In Michigan, if you sell more than five houses in a year, it is considered practicing real estate without a license. Therefore, you could be subject to penalties.