Quickbooks Online Review

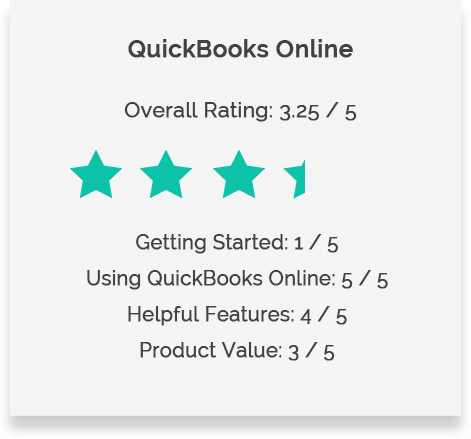

QuickBooks Online (QBO) is the latest and greatest accounting system offered by Intuit, the creators of Quicken and QuickBooks. It is one of the first cloud-based accounting solutions, and combines the best qualities of a desktop accounting system with mobility, advanced collaboration features, and integrations with hundreds of online services. Since launching in 2004, QBO has grown incredibly popular. With over 1 million small and medium sized businesses users, QBO is the best selling accounting system in the world.

This product has all of the accounting features you need to take your business from startup to success. While it isn’t our top-rated choice of small business accounting programs, it’s a great option with features that make it perfect for many businesses.

Overview

Specifically designed for small businesses, QuickBooks Online provides all the functions you need to support the establishment and growth of your company. QBO is exceptional for managing payroll and invoicing, and its mobile app is robust. The program easily links to third party apps to extend its functions and enhance the user experience. Customer support is its biggest weakness in terms of both telephone wait times and quality of instructional information online. Set up is challenging and, depending on a user’s background, may require professional support. Once it’s up and running, the system easily manages the tasks needed to support your business at all stages of growth.

Ready to Get Started?

Click below to try out QuickBooks Online free for 30 days and save 30% for the first 6 months.

PROS

- Great report types and options that provide exceptional operational data

- Has strong accounting capabilities to meet all your business needs

- Good mobile app that allows you to take your data anywhere

- Links to other apps allow you to further customize your experience

CONS

- Poor customer service that includes long wait times for assistance and overall unresponsive service

- The Intuit online payment acceptance option has a reputation for unreliability, leaving your business waiting for its money and giving your customers a poor experience

- Complicated set up that allow simple errors can become long-term problems

- Fees are charged to correct problems and address other issues

- Some users complain that the system is slow to load and navigate

Getting Started and Support

On QBO, set up is the most difficult part of the process as it is cumbersome and provides little in-program support. There are no prompts to let you know that you need to perform other tasks before completing the one you are doing. This can lead to frustration and errors that will affect your data later. While there are challenges with the system, data import is very straightforward, although you may need to switch screens to manage the task depending on where you are in the system. This program lacks the intuitive flow that allows non-accountants to quickly set up the systems, however, the effort is worthwhile as the end result is an effective tool that will help you manage your company:

Set Up

The set up process starts with your account settings, located within the gear icon at the top right of your screen. Here you can input and update your basic information including company name, your name, type of business, etc. From this setting you can also manage users and other background functions. From there you go to your home page which is a customizable desktop. One of the first options they present is “Get Set Up by a Pro” which involves additional charges. As the process isn’t as intuitive as other software options, this may be a good, but expensive, choice to get the set up done as quickly as possible.

Customer Service

The biggest weaknesses of QBO is the lack of quality customer service. Their direct customer service option is strictly by phone and during heavy call times you can spend hours waiting to talk to someone who may or may not be able to address your needs. If you need to call multiple times to address an issue, you may be required to start the conversation from the beginning if the prior customer service representative did not input your data into the system. There is no option to receive a call from a service rep or send in a help ticket for later response.

Videos, Prompts and Help

The QBO system has an extensive tutorial video library that addresses many questions. Unfortunately, many of the videos present little valuable information such as screen shots and explanations of how to manage specific tasks. There is also a selection of recorded and live webinars that are designed to address specific needs. These are more helpful than the videos but may not address your specific questions. There is also a Frequently Asked Questions (FAQ) list under their help menu that provides answer to common issues. Unfortunately, this feature does not always work. There are no prompts in the system to suggest next steps or alert you that you need to complete another task before performing the one you are attempting. This can result in hours of time and frustration as you try to figure out why you can’t do what you want to do. Some of the videos can help with these issues but you need to know what the problem is to find a solution. You can take an online class to learn how to set up and use QBO but there is a charge for this service.

Data Import and Export

Under the settings section there are a list of tools that include data import and export. You can easily access the import function from most screens if you know where to look. You can import Excel spreadsheets and CSV structured data into the system. You can import inventory data into the system, but be aware that if you click on “New” you are prompted to enter the data but if you click the down arrow next to “New” you are given the option to import data. The same is true for customer and vendor lists, which can be tricky if you don’t realize that there are in fact two connected buttons rather than one. While there is a prompt to import data from the computer-based QuickBooks to QBO, ther as in other systems.

Using QuickBooks Online

While set up can be a struggle, QBO has many excellent operational features that make the product a good choice for many small businesses. The program includes effective payroll management, great reporting options, excellent invoicing and payment management systems and tax support. The mobile app allows you to manage many functions on the go and you can share data but you are more limited with this system than with others. In addition, many users find the system slow to load and navigate between windows, both on the desktop and app versions. This causes some frustration with users who prefer a more responsive system.

Banking and Transactions

It is very easy to link bank accounts and credit cards to your account straight from your home page. Once you have done this, you can begin managing your transactions. The program comes with an extensive chart of accounts that you can use or modify to meet your needs. Simply assign each banking transaction to the designated account and you will be able to track expenses and income.

Invoicing and Payment

QBO excels at creating and sending invoices. You select your customer, a product or service description, sales tax if applicable, and even include attachments. Once you have created the invoice you can send it to the customer with an imbedded payment button for quick and easy response. With a simple click, they can pay the invoice. You are notified when this happens and later your system will update to reflect that the funds were deposited in your bank account. This function applies whether you are using a third party app, such as paypal or square, or Quickbooks, Payments [link here to Quickbooks Payments section] as long as the apps are linked to your QBO system.

Once you send an invoice, you can visit the Customer section of your homepage and see the exact status of the payment process. Within this section you can also import existing customer data from your computer or add the data manually. In system also makes it incredibly easy to use this section to send emails to select groups of clients which you can use as part of your marketing processes.

Reporting

This program has excellent data analysis and reports that address everything from sales to employee management (time sheets). They are easy to customize so you can create exactly what you need and your customized reports are kept in their own section so you can easily find what you need.

One of the best reports to get a great overview of your business is “Company Snapshot.” With a push of a button, you will see a report with six data screens:

- My Income

- My Expenses

- Previous Year Income Comparison

- Previous Year Expense Comparison

- Who Owes Me (Accounts Receivable)

- Whom I Owe (Accounts Payable)

You can select specific dates or accounts for this report and quickly view your exact financial position.

There is the option to print these reports right on the screen (printer icon) and you can export the data from several reports to Excel or a PDF with ease. This is a great feature that provides you with the analysis and insight you need to grow your business.

Taxes

The QBO system has a designated Sales Tax option on the left side of the screen. Here you record how much sales tax you owe to various revenue entities as well as when payments are made. The reports section of the program provides all the details you need to prepare your personal and/or business taxes, including income, expenses and other write-offs. They make tax preparation easier and less frustrating for you and/or your accountant.

Mobility

The free QBO app for Android or iPhone is available directly in the system and is easy to download and use. The program shows you your standard home page and allows you to send invoices, reconcile bank transactions and perform other tasks with ease. You can also use it to accept payments in a store or at an event using third party apps or an Inuit merchant account. Unfortunately, at this time the mobile app does not allow employees to log on and update their timesheets. When you have employees working off site, they have to return to your office to update their sheets, which can be inconvenient.

Data Sharing

The QBO system limits the number of people who can access your data. All subscription levels allow for up to two accountants and/or bookkeepers to review your data but you are otherwise limited to 1, 3 or 5 individuals. This can be in issue if you have partners or want to make information easily available to potential investors.

Intuit has created relationships with many banks and you can share information with many of them to secure financing, if available, without designating them as a “user.” In other situations, you can email, print and fax, scan or send reports, but the limited user numbers might delay your ability to respond to data requests. When you do add users, there is a specific tool under the settings section that allows you to easily manage which users can view what data. This feature is very convenient and one of the best we’ve seen.

Quickbooks Payments

In addition to linking payment apps, such as Stripe and Square, to the program to accept payments, QBO allows you process charges directly through Intuit by setting up Quickbooks Payments. This option lets you to accept free bank transfers as well as credit card payments. You can email invoices from your mobile device and your accounts will automatically update when money is deposited into your bank account. While this is a great feature, there have been complaints of the system being unavailable to accept payments and slow to use.

QuickBooks charges a fee to processing payments:

- QuickBooks Invoice paid by credit card: 2.4% + 25¢

- My Expenses

- Other credit card payments: 2.9% + 25¢

Fees are highly competitive with other popular payment processing providers. For example, Stripe charges 2.9% plus 30¢ per swipe.

Helpful Features

QuickBooks Online has many additional features and add-ons that make this system a good choice for small business owners. Their payroll options are among the best available and QBO integrate with third-party apps with ease. The home page (dashboard) can be customized to show the information you want to see when open the program. You can also import other business files to keep everything in one convenient location. The system handles multiple currencies so you can manage international transactions with ease.

Payroll

QBO gives you two choices with payroll: you can purchase it as a separate package with their subscription levels or as bundled into their subscriptions, which is the less expensive option. Intuit two payroll options through QBO: Enhanced and Full Service.

EnhancedThis level provides easy to use tools for you to manage your own payroll functions. Key features are:

- Easy Use – enter hours only

- Payment by direct deposit or check

- Free expert support

- Electronic filing of W-2s at the end of the year

- All payroll tax forms included

As the name states, Intuit manages every step of your payroll from set up to year-end taxes. This package includes all of the Enhanced features plus:

- Intuit files and makes the payments (using your money, of course)

- A no tax penalties guaranteed – with restrictions

- Intuit completes your payroll set up for you

- Free year-end forms are included

QBO supports payroll and payroll taxes in all states and includes tools that make it easy to ensure your employees get paid accurately and on time. For example, employees can update their time sheets online using Quickbooks. Unfortunately, some of these features are not currently available using Quickbooks mobile app.

While QBO’s offers strong payroll solutions that will work for most new and small businesses, it is not a fully integrated HR solution: it lacks features such as paid-leave accounts and time-off requests that become more important as a company grows beyond it’s initial 20-30 employees.

Customizable Dashboard

When you open the QBO program, your home page appears. This is essentially your dashboard and shows you graphics of the information you choose, such as profits, losses, accounts receivables, and budgets. Click on the “X” to hide screens you don’t want to see and other choices will appear. You can’t reorganize the screens but you can see the data you want.

Add-Ons/Extensions

Every level of this system has great app support. Whether you are downloading the free mobile app to your phone or device, linking apps you already use such as paypal, of adding apps to customize your QBO experience, it’s as easy as clicking a button. The App Center has over 400 third party apps that integrate with the system. While there are many app categories there are a few that are extremely beneficial for small business owners:

- Customer Relationship Management (CRM) – these apps allow you to link and track marketing functions to your customer data base.

- Time Tracking – enhance your timesheet capabilities with one of the many excellent apps.

- Point of Sale – link to credit card payment options such as paypal or square to make it easy for clients to pay.

- Documents – manage your upload files more efficiently with several options.

QBO allows you to select the app and immediately link it to your account, paying any fees to the third party venders directly. Some apps are free but others have a one-time or annual use charge which you can pay through direct link you find in the QBO system. This one-stop shopping is a great way to use tools you are already familiar with and link them to your new accounting package.

Multiple Currencies

QBO supports multiple currencies and you can:

- Assign a currency to customers, vendors, banks, and credit cards.

- Track and manage currency exchange rate fluctuations. QuickBooks downloads exchange rates every four hours from WOSD (Wall Street on Demand). You can also manually enter exchange rates and revalue them, if needed.

- Pay and receive payments in a vendor’s or customer’s currency.

- Revalue a currency.

You must turn this feature on and once it’s activated you can’t delete it or hide it from your home page. The system automatically defaults your home currency to your current one and this, too, cannot be changed. There have been some user complaints about this feature, specifically issues with recording overseas transactions.

Files

You can upload any business files into the QBO system, which allows you to have all relevant information, such as incorporation papers, contracts, and other information, in one place and available wherever you go. The files are stored in a section called “Attachments” under the List section of Settings. Importing is easy and you can attach anything in nearly any format including photos and Word documents. You can identify the type of file it is and sort or batch accordingly.

Product Value

Overall, QBO is strong system; it will cover all of your accounting basics and then some. For the reasonably low starting price of $15 per month, most new and small businesses can get a lot of value out of QBO.

On the other hand, QBO is more expensive than other programs in market with similar capabilities, especially after adding on payroll services. In addition, QBO’s value to a new business owner is limited by certain issues with the system:

- Lack of customer service and in-program help for initial set up.

- The slow responsiveness of the system and limitation on the number of users are also problems.

- Some functions, such as Quickbooks Payments, the help pages, and other processes don’t work consistently.

QBO offers three plan options that are offered at a 30% discount for the first 6 months. You can also register for a free 30-day trial of any of these plans.

SimpleStart $15/month

This basic plan allows only one user and includes the ability to:

- Track income and expenses

- Manually create and send invoices

- Send estimates

- Print checks and record transactions

- Integrate with all available applications

- Invite up to two accountants to access your data

- Access and use 20 available business reports

This level is a great choice for companies in the startup phase. You can track income and expenses which will identify tax write-offs and make tax preparation a breeze. The reports functions make it easy to collect and analyze this and other important information. If you don’t need multiple users, SimpleStart is a great choice for a company just starting out.

Essentials $30/month

This package allows access for up to three users. It includes the above features and adds additional components to your system:

- Increases access to 40 business reports

- Set up invoices to bill on a recurring schedule

- Manage and pay bills from vendors

- Enter bills and schedule payments for later

- Control what your users can access

The Essentials subscription is the best choice for launching and establishing a new business. You will now need invoicing and payment options as well as more detailed reports for cash flow and profit/loss management and this level delivers those services. You can add employees, business partners or investors to the plan and manage what information they are allowed to view.

Plus $40/month

Up to five people can now access the information and includes all the capabilities available through the SmartStart and Essentials package and adds these features:

- Access and use of over 60 business reports

- Create and send purchase orders

- Track inventory

- Prepare and print 1099s

- Give employees limited access to enter time worked

- Create budgets to estimate income and expenses

- Categorize income and expenses using class tracking

- Track sales and profits for each location

For companies that are growing or expanding, this is the best choice. There are many necessary functions available at this level, specifically budgeting and class tracking of income and expenses, which allows you to place specific types of income or expenses into a “class” and have those items automatically categorized the way you designate on an ongoing basis. The ability to budget, produce 1099s for independent contractors and track data by location gives you the tools you need to take your business to the next level.

Payroll-Bundled Package Costs

You can add payroll to any of these levels for an additional fee, but you receive the best price if you bundle the packages together. Since the SimpleStart package is best for startups you are unlikely to need payroll, but it is an option.

- SimpleStart and Enhanced Bundle: $59/month

- SimpleStart and Full Service Bundle: $114/month

- Essentials and Enhanced Bundle: $69/month

- Essentials and Full Service Bundle: $129/month

- Plus and Enhanced Bundle: $79/month

- Plus and Full Service Bundle: $139/month

Conclusion

QuickBooks online is a good choice for small business owners, but the challenging set up and limited customer support can be frustrating. Once the system is in place, it provides powerful tools to manage your business. The overall cost is higher than with other programs but it has one of the best payroll packages available. The mobile capabilities are strong but some features, such as time sheet updates, cannot be performed through the app. Overall, QBO can be a good option for your business.