How to File a Connecticut LLC Certificate of Organization

The Connecticut Certificate of Organization is the LLC form you fill out and file with the state to form an LLC.

Follow the steps in our How to File a Connecticut LLC Certificate of Organization guide below to get started.

Or simply use a professional service:

Northwest ($29 + State Fees)

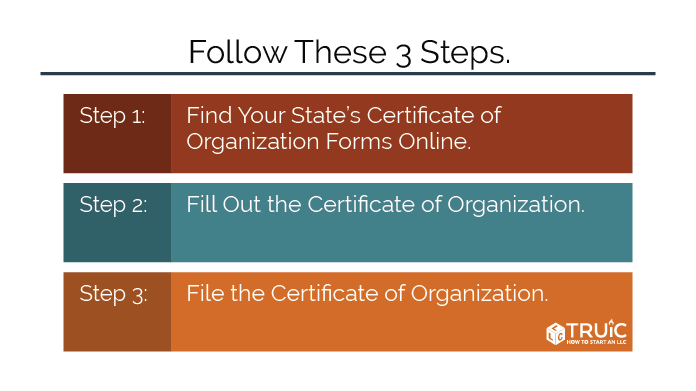

Filing the Connecticut Certificate of Organization Is Easy!

We’ll take you through three easy steps for filing the Connecticut LLC Certificate of Organization.

- Get Your Certificate of Organization Forms

- Fill out the Certificate of Organization

- File the Certificate of Organization

Step 1: Get Your Certificate of Organization Forms

You can download and submit your Connecticut Certificate of Organization by mail or in person, OR you can file online. For this first step, choose your preferred method below.

Get Your Certificate of Organization

OPTION 1: Create a new account with the CT.gov website. After logging into your Account Dashboard, hover over “Start Your Business” in the top menu and select “Start Your Business” from the dropdown.

Create Account– OR –

OPTION 2: Access the Certificate of Organization PDF from the Connecticut Secretary of State. This form will need to be submitted to the Secretary of State’s Office.

Download PDFStep 2: Fill Out the Certificate Of Organization

In this step, we will help you complete the Connecticut Certificate of Organization.

You will need to know the following information to complete each section:

- Entity Name and Address

- Registered Agent Name and Registered Office Address

- Governing Authority Type

Entity Name and Address

Having a creative and smart business name is important but not as important as having a legally correct name.

When you choose a name for your business, you have to make sure the name:

- Meets Connecticut naming guidelines.

- Is not already in use by another business in Connecticut.

Follow the Connecticut Naming Guidelines:

- Your name must contain the words “limited liability company” or the abbreviation “L.L.C.” or “LLC.” “Limited” may be abbreviated as “Ltd.,” and “company” may be abbreviated as “Co.”

- Your name cannot include words that could confuse your LLC with a government agency (FBI, Treasury, State Department, etc.).

- Your name must be distinguishable from any existing business in your state. We will help with this step in the search for your business name section below.

- Your name must not include any words that imply that the company is organized for anything other than its permitted purpose.

In some states, certain words (e.g., Bank, Attorney, University) may require additional paperwork and a licensed individual to be part of your LLC.

Check Name Availability:

Is your name available in Connecticut? Make sure the name you want isn’t already taken by doing a name search on the Connecticut Secretary of State website.

To learn more about naming your business, including best practices and creative branding, visit our How to Name a Business in Connecticut guide.

Not sure what to name your business? Check out our Business Name Generator.

Register Your Domain Name:

We recommend checking to see if your business name is available as a web domain. Even if you don’t plan to make a business website today, you may want to buy the URL in order to prevent others from acquiring it.

Registered Agent and Registered Office

A registered agent accepts and sends legal documents on your LLC’s behalf. When you register your Connecticut LLC, you are required to list your registered agent and your registered office.

Your registered agent can be anyone 18 years or older that lives in Connecticut. Your registered agent must always be available at the registered office during regular business hours. Your registered office address cannot be a P.O. box.

To learn more about choosing a Connecticut registered agent, read our How to Choose a Connecticut Registered Agent guide.

To learn more about what a registered agent does and how to choose one, read our What is a Registered Agent guide.

Governing Authority Type

You must state whether or not your LLC will be managed by managers or by its members. You must also list the names and addresses of each member or manager.

To learn everything you need to know about choosing your management structure, read our Management by Members or Managers guide.

Step 3: File the Certificate of Organization

To register your LLC, you will need to file the Certificate of Organization with the Secretary of State.

There are two ways to file your Certificate of Organization:

- Complete the forms online.

- Submit a hard copy by mail or in-person.

File the Connecticut Certificate of Organization

OPTION 1: Create a new account or login to file online. Then, fill out the required fields and submit.

File Online– OR –

OPTION 2: Mail the Certificate of Organization to the Connecticut Secretary of State or submit it in person.

Download PDFState Filing Cost: $120

Mailing Address:

Business Service Division, Connecticut Secretary of the State

P.O. Box 150470

Hartford, CT 06115

Office Address:

Business Service Division, Connecticut Secretary of the State

30 Trinity St.

Hartford, CT 06106

Steps After Your Connecticut LLC Is Officially Formed

Once you’ve filed your Certificate of Organization, you should take the following steps:

Create an Operating Agreement

A Connecticut LLC Operating Agreement is a legal document that outlines the ownership structure and member roles of your LLC.

In Connecticut, you aren’t required to have an Operating Agreement to officially form an LLC, but it’s still a good idea to have one. You can start your operating agreement before, during, or after you file your Certificate of Organization.

Your operating agreement will be kept in your LLC’s private business records; you do not file it with the state.

Use our free Operating Agreement Tool to draft a customized operating agreement for your LLC.

Get an EIN

An Employer Identification Number (EIN) is like a social security number for your LLC. You will need an EIN if you want to hire employees or open business bank accounts.

You can get your EIN for free through the IRS website, via fax, or by mail. If you would like to learn more about EINs and how they can benefit your LLC, read our What is an EIN article.

Open a Business Bank Account

Using dedicated business banking and credit accounts is essential to protect your business’ corporate veil. When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your LLC is sued.

For reviews on some of our most trusted business banks, visit our Best Banks for Small Business review.

Get Licenses and Permits

When you are registering an LLC, you need to determine if your business needs any licenses or permits to remain compliant. On the federal level, there are a handful of business activities that require licenses or permits.

Find out how to obtain necessary licenses and permits for your business or have a professional service do it for you:

- Federal: Use the U.S. Small Business Administration (SBA) guide to federal business licenses and permits.

- State: Apply for or learn more about licenses, permits, and registration with Connecticut’s Business Licensing and Registration website.

- Local: Contact your local county clerk and ask about local licenses and permits.

State of Connecticut Quick Links

Connecticut Online Business Filing

Connecticut Business Licensing and Registration

Brand Your Business

The strongest and most memorable businesses are built on a solid brand. When developing your brand, think about what your business stands for. Customers and clients are looking for companies that have a compelling brand, as much as they are shopping for high-quality products and services.

Creating a logo for your business is vital for increasing brand awareness. You can design your own unique logo using our Free Logo Generator. Our free tool can help you design your own unique logo for your new business idea.