Pet Fish Store Insurance

Getting insurance for your pet fish store is essential.

Pet fish stores need to be protected against claims arising from things like animal welfare concerns, breaches of contracts, and violations of health and safety regulations.

For example, your store has been failing to properly maintain the aquariums it keeps its fish in, or you knowingly sell a sick fish to a customer without disclosing it.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Pet Fish Store

General liability insurance is — generally speaking — one of the most important insurance policies for pet fish stores.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, your pet fish store might also benefit from other types of policies. Additional coverage policies that can often be important for trucking companies include:

- Workers’ compensation insurance: A policy that is legally required for any business with part-time or full-time employees.

- Commercial property insurance: Covers the cost of repairing or replacing business-owned supplies, equipment, and real estate if damaged by specific events.

- Business interruption insurance: Will help to keep your store afloat if it needs to close down its operations following an incident like a fire.

When it comes to the types of vendors that you can buy coverage from, there are two key types of providers to keep in mind:

- Traditional brick-and-mortar insurers — Includes firms like The Hartford and Nationwide.

- Online insurers — Includes firms like Tivly and Ergo Next.

Typically, firms in the online insurer category tend to be more sought-after because their policies are extremely good value, particularly when compared to those of traditional insurers.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

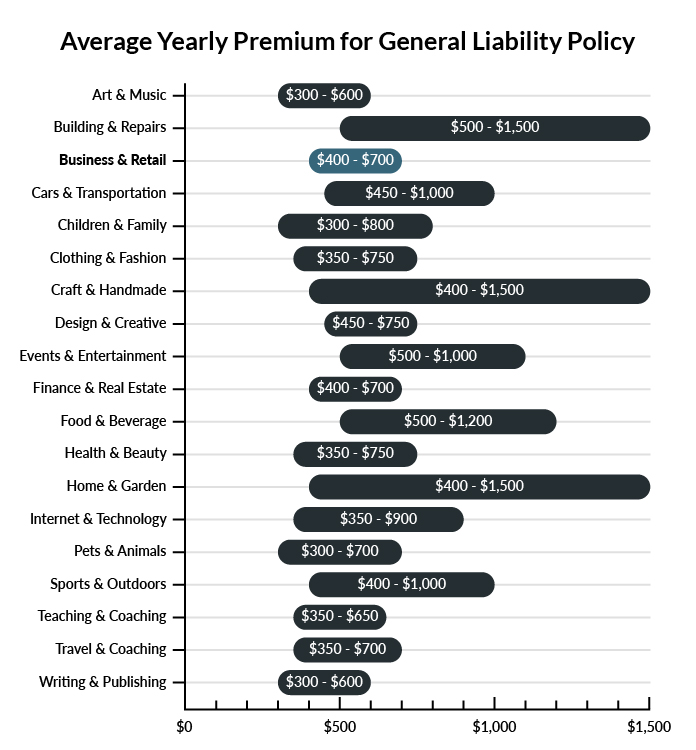

On average, pet fish stores in America spend between $400 – $700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a pet fish store to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Pet Fish Store

Example 1: An employee is helping a customer find a few plants for their fish tank when they accidentally spill some water on the floor. As the customer heads to the cashier, they slip and fall, breaking their wrist and sustaining a concussion. Your general liability insurance policy will likely cover their medical costs and your legal fees in any potential lawsuit.

Example 2: You’re setting up a new display when one of the delivery drivers accidentally trips over an extension cord and crashes into it. The accident leaves the driver with a very serious head injury. General liability insurance will likely pay for the driver’s medical bills and replace the damaged merchandise as well.

Example 3: After opening a second retail location, you’ve decided to revamp your logo and start running new advertisements in the local papers and on TV. A few weeks after the campaign launches, you receive a call from your lawyer stating that a competitor is threatening to sue your business because your logo infringes on their copyright. General liability insurance will likely cover your legal fees and any subsequent settlement payouts.

Other Types of Coverage Pet Fish Stores Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Workers’ Compensation Insurance

Workers ‘compensation coverage is designed to help pay for medical expenses, disability benefits, and even death benefits if your employees are injured in a work-related accident. Most states require businesses with employees to carry this coverage.

Commercial Property Insurance

Commercial property insurance will help cover the cost of replacing or repairing owned real estate, equipment, or inventory that is damaged in a covered event such as a fire, storm, or act of vandalism.

Business Interruption Insurance

If you ever have to shut down regular business operations following a fire or other incident, you may find it difficult to keep your business afloat due to the loss of income. Business interruption insurance will help make up for some of this loss. This coverage is typically available as part of a business owner’s policy.

Data Breach Insurance

It’s common practice nowadays for many retail businesses to offer a rewards program for their loyal customers. When your customers sign up, they often provide sensitive private information like phone numbers, personal addresses, and even credit card information. If your business falls victim to a cyber attack, data breach insurance can help to cover any related costs from a lawsuit.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your pet fish store:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Pet Fish Store Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. Opting not to obtain business insurance for your pet fish store before its launch is an incredibly risky decision that could spell disaster if one of the many risks it could face actually happens.

What’s more, in some cases, your business may be deemed as run illegally if it forgoes specific policies it is required to carry (e.g., commercial auto insurance).

Not necessarily. Certain exceptions may be written directly into your pet fish store insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.