How to Form a Series LLC

A Series LLC offers a special kind of liability protection to an umbrella of businesses under unified ownership. Read our What is a Series LLC page to learn how they can be used to protect investments and safely scale your business.

Select Your Step

Form a Series LLC in Your State

Set Up Your Series LLC

In this guide, we will use the terms “Parent” and “Child” to describe the relationship between the two layers of companies. These terms are much more approachable and understandable than their legal terms. The proper terms for parent and child are “Series LLC” and “Individual Protected Series”.

- Parent LLC = Series LLC (sometimes referred to as “Master LLC”)

- Child LLC = Individual Protected Series (sometimes referred to as “Individual Series”, “Protected Series”, or “Cell”)

Step 1: Name Your Series LLC

Series LLC naming rules vary from state to state. First, you should follow your state’s specific rules for naming an LLC. Then, to clear up legal confusion, experts suggest using a general set of rules when naming a series LLC.

Need help naming your business? Check out our LLC Name Generator.

General series LLC naming guidelines:

- Use the word “protected series” within the name of each company.

- Name the parent LLC in a way that distinguishes it from the child series.

- Include the full name of the parent LLC in the name of each child series.

- The name of the child series should include the name of the assets it holds. This creates a clearer asset picture to the public and creditors.

Example of a series LLC naming system:

My Holdings Co., LLC, a series LLC

123 Main Street., LLC, an individual protected series of My Holdings Co., LLC, a series LLC

123 Division ST., LLC, an individual protected series of My Holdings Co., LLC, a series LLC

Step 2: Choose a Registered Agent

A registered agent is a person or business that sends and receives legal papers on your behalf.

These documents include official correspondence like legal summons and document filings, which your registered agent will receive and forward to you.

Most states require every LLC to nominate a registered agent. Your registered agent must be a resident of the state you're doing business in, or a corporation authorized to conduct business in that state. To learn more about choosing a registered agent, check out our article What is a Registered Agent?

Check out the Top 7 Registered Agent Services from our friends at Startup Savant.

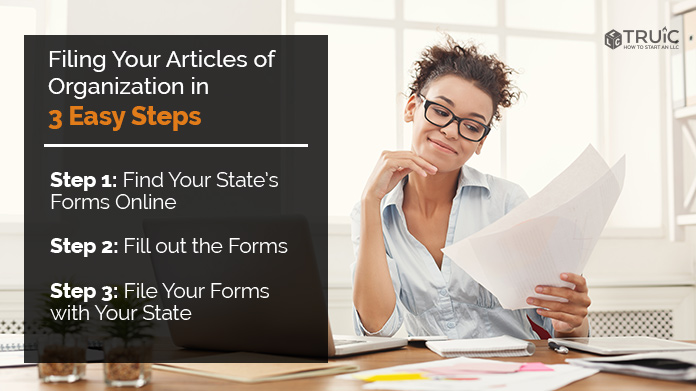

Step 3: Document Your Series LLC

Some states require business owners to give details about their series LLC on their articles of organization and some state’s do not.

For your state's specific guidelines, visit our state guide.

Step 4: Create a Series LLC Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership structure and member roles of your new LLC. A series LLC requires a carefully written operating agreement to assure your series is protected.

Each state has their own rules about how to draft a series LLC operating agreement. For your state's specific guidelines, visit our state guide.

Frequently Asked Questions

Yes, in many states that allow the series LLC, you can add individual series by amending your operating agreement. To learn more about how to change an existing LLC into a series LLC in your state, choose your state from the list below.

No, but California allows foreign Series LLCs to register as a foreign LLC. Each individual series is required to pay an $800 annual tax. A series LLC will not be granted the individual protection by California courts that is given by states that honor the series LLC structure.

A Texas series LLC works by separating the assets and operations of individual series LLCs under the umbrella of a master LLC. Each individual series is protected from losses suffered by the other series LLCs and the master LLC.

Setting up a series LLC in Texas is a straightforward process. We provide an easy to follow step-by-step guide for forming your Texas LLC.

A master LLC, also called a parent LLC, is the main LLC that the individual series are connected to. The master LLC is legally protected from liabilities and losses incurred by the series. The master LLC files taxes on behalf of the full series.

An LLC is a single limited liability company. A series LLC is a limited liability company with a unique structure. A series LLC consists of a master LLC with one or more individual series LLCs branching off from it. The individual series are protected from liabilities and losses suffered by the other individual series and the master LLC. Read our What is an LLC guide to learn more about setting up an LLC.

The cost of forming a Series LLC can vary between $50-$1,000. Choose your state from the list below for the exact fees for forming a series LLC.

Most real estate investors use their series LLC to place each investment property into an individual series. This protects each investment property from any losses or lawsuits incurred by a particular property. To learn more about setting up a series LLC for your real estate business, click on your state from the list below.