Bitcoin Mining Business Insurance

Getting insurance for your bitcoin mining business is essential.

Bitcoin mining businesses need to be protected against claims involving events like hacks and data breaches, property damage, and copyright infringement.

For example, if a fire breaks out at your business’s premises due to your mining equipment overheating, you will likely have to pay compensation for any damage caused to neighboring properties.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Bitcoin Mining Business

General liability insurance is — generally speaking — one of the most important insurance policies for bitcoin mining businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Your business might not be sufficiently protected from the risks involved in the bitcoin mining industry with general liability insurance alone. Instead, you may need some of the following policies in order to keep your business fully protected:

- Workers’ compensation insurance: In most states, there is a minimum number of employees past which businesses are legally obligated to carry workers’ compensation insurance.

- Commercial property insurance: Significant investment in equipment will be required in order to get your bitcoin mining business off the ground. This covers the cost of replacing or repairing damaged equipment.

When looking to acquire business insurance, you are generally faced with two main types of providers to choose from: traditional and online.

We would recommend opting for online insurers most of the time as they are increasingly able to provide you with high-quality insurance quickly and affordably.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

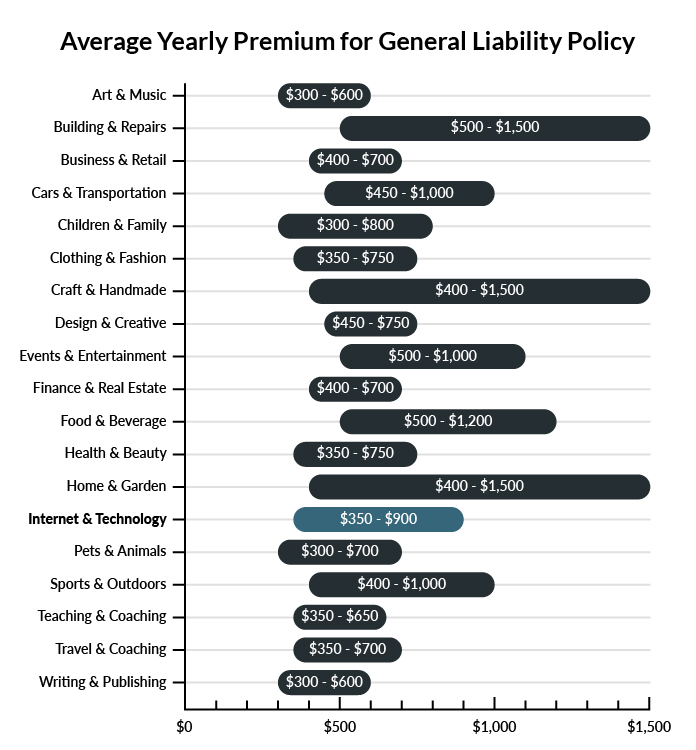

On average, Bitcoin mining companies in America spend between $350 – $900 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a Bitcoin mining business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Bitcoin Mining Business

Example 1: After you sell 25 mining rigs to a partnered business, you find yourself in a breach of contract and deceptive trade practices lawsuit as a result of your hosting facility having “unreliable power”. Here, general liability insurance would cover the cost of a legal battle, as well as the cost of a settlement outside of court (if applicable).

Example 2: After claiming that your Bitcoin facility violates zoning laws and produces significant noise, your business is forced to shut down and relocate, as well as pay an exorbitantly high settlement outside of court. Here, the cost of the settlement will be covered by your general liability insurance coverage.

Example 3: After failing to disclose a variety of high-profile disputes that have affected the corporation’s financials with your shareholders, you face a lawsuit alleging that you recklessly overstated the business’s profitability. Regardless of how the case progresses in court, general liability insurance will protect your business’s assets from the claimants.

Other Types of Coverage Bitcoin Mining Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

The equipment you use to mine Bitcoin required a significant investment on your part. If you were to lose that equipment in an event like a fire, you would be forced to replace it before you could get back to mining and bringing in income. With commercial property insurance, as long as your property was damaged by a covered event, you should be able to get help from your insurer to replace it.

Workers’ Compensation Insurance

If you have employees, your state probably requires that you carry workers’ compensation insurance. The workers’ comp policy you have will ensure that your employees are protected if they are injured performing job-related duties. For example, if an employee gets carpal tunnel, the workers’ comp policy would pay for his or her medical treatment. It would also help pay for his or her lost wages while recovering.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your Bitcoin mining business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Bitcoin Mining Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Next Insurance. Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It is likely you will need some form of business insurance in order to launch your bitcoin mining business (e.g., workers’ compensation insurance if your workforce is large enough).

That being said, whether or not your business is required by law to carry it, it is a good idea to find the right bitcoin mining business insurance as it protects your company’s assets from the threats of this industry.

Not necessarily. Certain exceptions may be written directly into your Bitcoin mining business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.