Business Insurance Requirements by State

Different states have different business insurance requirements.

We’ll help you find information about the types of small business insurance that are required or recommended in your particular state with our Business Insurance Requirements by State guides below.

Alternatively, you can use a top-rated insurer to find the best insurance coverage.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policies at the best price.

Small Business Insurance by State Guides

We’ve compiled guides for each of the 50 states to help you understand business insurance in your state.

Choose your state to get started:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

How Much Does Business Insurance Cost?

The cost of business insurance varies based on certain factors. These include:

- The type of business you own

- The size of your business

- The location of your business

- The value of your assets

- The level of coverage you need

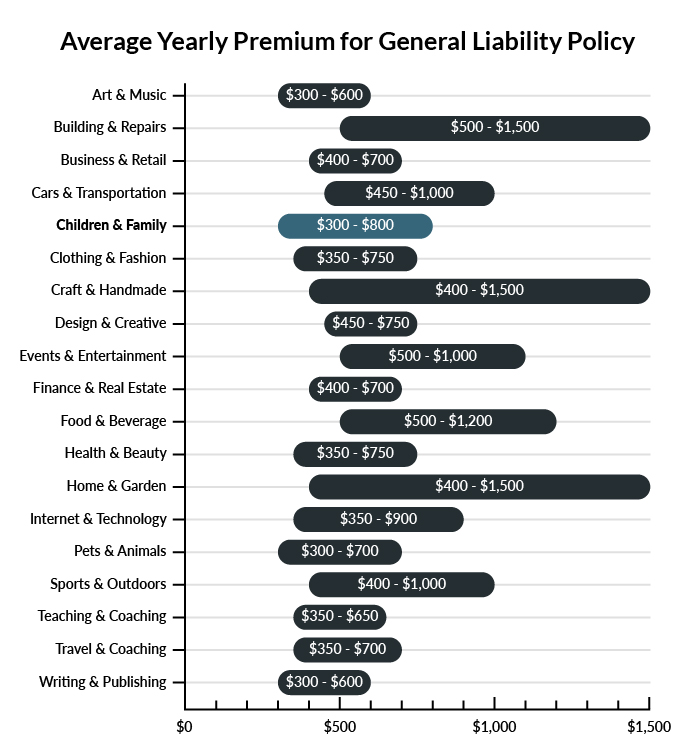

Business insurance is relatively affordable. We recommend that all small businesses carry at least general liability insurance. The average cost of general liability insurance is detailed below:

To get an accurate estimate of how much small business insurance will cost in your state, it’s best to get a quote based on your business’s specific needs.

Protect Your Business Today

Use an online insurance provider to save time and money. Get an accurate quote in three minutes or less.

Types of Business Insurance by State

When you think about business insurance, you can think of different types of insurance falling into two categories: those that are legally required and those that are recommended.

Required Business Insurance

The types of insurance that are required for small businesses can vary by state and by industry.

According to the Small Business Administration (SBA), some common types of insurance that may be required include:

Workers’ Compensation

Workers’ compensation insurance is mandatory in most states. This insurance provides coverage for employees who are injured or become ill on the job.

Unemployment Insurance

Employers are required to pay unemployment insurance taxes in most states. This insurance provides benefits to employees who have lost their jobs through no fault of their own.

Commercial Auto Insurance

Commercial auto insurance provides coverage for accidents that occur while using your business vehicles. If your business owns or leases vehicles, you may be required to carry commercial auto insurance.

Be sure to check with your state’s insurance department or a licensed insurance agent to find out what types of insurance are required for your specific industry and location.

Stay within your budget. Explore our Affordable Insurance Review to find the right match.

Recommended Business Insurance

In addition to the types of insurance that are required by law, there are also types of insurance that are often recommended for small businesses. These include:

General Liability Insurance

General liability insurance is not always required by law, but it is highly recommended. This insurance provides coverage for claims of bodily injury or property damage that occur on your business premises or as a result of your business operations.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, provides coverage for claims of negligence or mistakes made in the course of your professional services. This insurance is typically required for certain professions, such as doctors, lawyers, and accountants.

Business Property Insurance

While commercial property insurance is not required by law, it is highly recommended to protect your business assets. This insurance provides coverage for damage to your business property, including buildings, equipment, and inventory.

Cyber Liability Insurance

With more and more business operations taking place online, cyber liability insurance is becoming increasingly important for small businesses. This insurance provides coverage for data breaches, cyberattacks, and other cyber-related losses.

Umbrella Insurance

Umbrella insurance is recommended for businesses with high-risk operations or assets. This insurance provides additional liability coverage beyond the limits of your other insurance policies.

Where Can I Get Small Business Insurance in My State?

There are a number of different options for getting small business insurance in your state. Here are a few options to consider:

Insurance Companies

Many insurance companies offer small business insurance policies, including general liability, professional liability, property insurance, and more.

You can search for insurance companies online or work with an insurance agent to find the right coverage for your business.

Insurance Agents

Insurance agents can work with you to determine what types of insurance your business needs and help you find policies that meet your specific requirements.

Independent insurance agents can help you compare policies from multiple insurance companies to find the best coverage at the best price.

State Insurance Departments

Each state has its own insurance department that regulates insurance companies and agents operating within that state. You can visit your state’s insurance department website to find information about insurance requirements and regulations in your state.

SBA

The Small Business Administration (SBA), though it doesn’t offer insurance, does offer a variety of resources for small business owners that are looking for insurance.

You can visit the SBA website to learn more about how to get insurance.

FAQs

The types of commercial insurance required in your state may vary depending on the state and the type of business you have. Typically, businesses are required to have workers’ compensation insurance. However, there may be additional requirements for certain industries or professions.

The types of small business insurance recommended in your state may also vary depending on the state and the type of business you have. However, some common types of insurance that are often recommended for small businesses include property insurance, professional liability insurance, cyber liability insurance, and business interruption insurance.

The cost of small business insurance in your state can vary widely depending on the size of your business, the industry you operate in, and the specific types of insurance you need. The best way to get an accurate estimate of the cost of insurance for your business is to get a quote based on your specific needs.

There are several options for getting small business insurance in your state, including insurance companies, insurance agents, and online insurance marketplaces. You can also check with your state’s insurance department or the Small Business Administration (SBA) for additional resources.

Workers’ compensation insurance is a type of insurance that provides benefits to employees who are injured or become ill as a result of their work. In most states, businesses are required to carry workers’ compensation insurance, although the specific requirements can vary.

General liability insurance is a type of insurance that provides coverage for a wide range of potential risks, including bodily injury, property damage, and advertising injury. In many states, businesses are required to carry general liability insurance, although the specific requirements can vary.

Yes, many insurance companies and online marketplaces offer small business insurance policies that can be purchased online. However, it’s important to carefully review the policy details and make sure that you are getting the coverage you need before making a purchase.