Barber Shop Business Insurance

Getting business insurance for your barber shop is essential.

Running a barber shop may seem like a simple business, but it comes with its own set of challenges and risks. Just like any other type of business, there are numerous pitfalls and hazards that you need to be aware of.

Business insurance can provide coverage for physical injuries sustained by customers or employees, damage to your property, legal fees to defend against a lawsuit, and even compensation to the plaintiff if you are found liable.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Barber Shop Business

General liability insurance is — generally speaking — one of the most important insurance policies for barber shops.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability insurance can cover a broad range of risks, it may not provide coverage for all the potential perils faced by your business. In such cases, you may need to consider obtaining specialized policies that offer coverage for specific types of risks, such as:

- Commercial property coverage: This type of insurance will indemnify your business for expenses incurred in repairing damage to the premises that house the barber shop. Damage covered typically includes that caused by fire, flood, vandalism, burglary and theft.

- Commercial auto insurance: This is a legal requirement in all states. Auto insurance provides funds to compensate those injured in a collision and for vehicle repairs.

- Business income coverage: provides protection against certain financial losses incurred if the business is unable to operate because of fire, flood, a power outage and many other adverse circumstances.

When acquiring your business coverage, you will generally be able to choose between the following two types of insurers:

- Traditional brick and mortar insurers: These are firms, like State Farm, that have been underwriting property and casualty risks for decades. They generally market their products through a network of brokers and agents.

- Online insurers: These providers use a host of advanced digital technologies and novel channels to assess risk and distribute insurance products, which they are generally able to do with great success and at less cost than their traditional counterparts.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

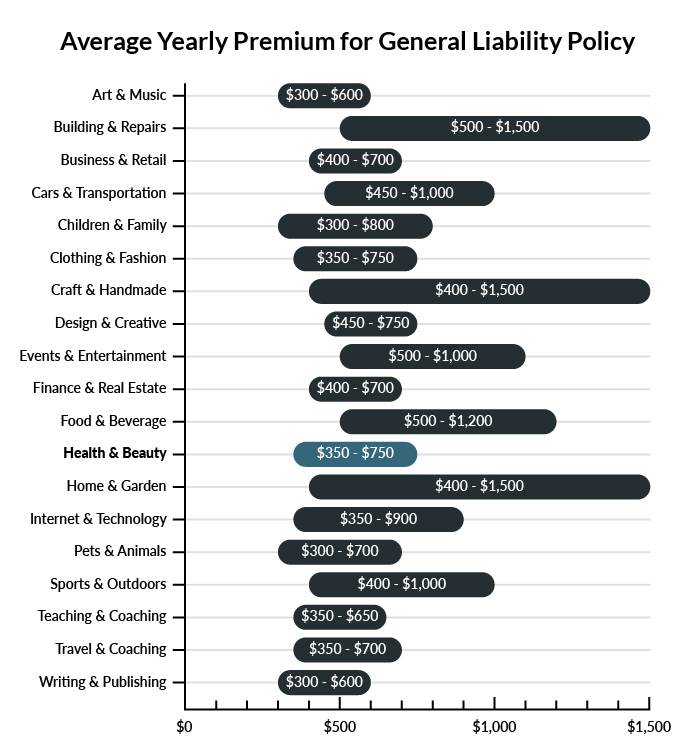

The average barber shop in America spends between $350 – $750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a barber shop business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Barber Shop Business

Example 1: A customer stumbles while getting out of their chair and strikes their chin on the counter. General liability insurance would likely cover medical care associated with the incident.

Example 2: A contracted hairdresser trips over supplies that are left on a stairway, sustaining multiple injuries as they fall down the steps. General liability insurance would probably cover the injuries as long as the hairdresser was an independent contractor. (The injuries would fall under workers’ compensation if the hairdresser was an employee.)

Example 3: When talking with a new customer, an employed hairdresser makes disparaging remarks about the haircut they received elsewhere. The remarks get back to the other hairdresser, who believes that the comments are unwarranted and negatively impact their competing business’s reputation. They file a slander lawsuit seeking compensation. General liability insurance would probably cover the lawsuit.

Other Types of Coverage Barber Shop Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

As a business that employs skilled workers, your barber shop may need professional liability insurance. This coverage protects against errors in work, and it’s available for a variety of different professionals.

When purchasing this coverage, make sure you understand and communicate to all hairdressers who is covered by your chosen policy. Coverage might extend to employees only, or it may also cover people working as independent contractors. Whichever option you ultimately get, you’ll want to let everyone know so that they can make their own informed decisions about whether they need additional protection.

Commercial Property Insurance

If your barber shop owns its building, you probably want to insure the building with commercial property insurance. Coverage often also covers items located inside an insured building, such as chairs, mirrors, and other fixtures.

Communicate to hairdressers what your property insurance does and doesn’t cover. It may not cover equipment and supplies that hairdressers themselves own, and they’ll want to know if they need to purchase insurance for their personal equipment.

Commercial property insurance can be bought as part of a business owner’s policy (BOP).

Home-Based Business Insurance

If you run a one-person barber shop from your home, home-based business insurance is more appropriate than commercial property insurance. Home-based business insurance normally covers business-related risks that are excluded from traditional homeowner’s insurance policies.

Home-based business insurance may be bought through a BOP, or it’s sometimes possible to acquire as a rider that’s added to your homeowner’s insurance.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your barber shop business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Barber Shop Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes. It is essential to buy business insurance before launching your business. Failure to obtain coverage from the first day can put your enterprise in danger, both from unforeseen events and legal noncompliance.

Legal regulations mandate certain types of insurance, like workers’ compensation and commercial auto insurance. Additionally, your business may require other forms of insurance to safeguard against specific risks, like property damage and customer injuries.

Not necessarily. Certain exceptions may be written directly into your barber shop business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.