Antique Store Insurance

Getting insurance for your antique store is essential.

Antique stores need to be protected against claims involving things that threaten their financial assets and are likely to happen, such as misrepresentation and breach of contract.

For example, an employee may accidentally claim an antique is authentic, which could result in your store needing to pay damages if the customer decides to sue.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for an Antique Store

General liability insurance is — generally speaking — one of the most important insurance policies for antique stores.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

That being said, due to the unique set of risks that antique stores face, many find it beneficial to hold a number of supplementary coverage policies in addition to general liability. Some of these policies include:

- Crime insurance

- Commercial property insurance

- Home-based business insurance

When looking for providers from which to purchase business coverage for your antique store, you are generally faced with two distinct options:

- Traditional brick-and-mortar insurers: These providers, which are some of the largest in the US, use insurance agents in order to offer very personalized coverage. However, their higher overheads may translate into higher premiums.

- Online insurers: These providers take advantage of AI to offer recommendations and help with the need for an agent. This, combined with lower overheads, enables these insurers to offer similarly personalized insurance that is more affordable.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

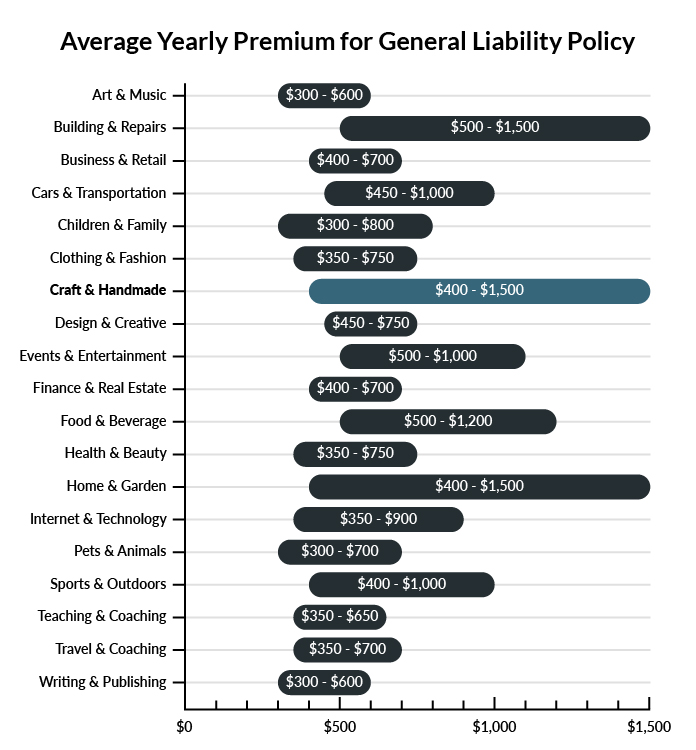

The average antique store in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a antique store to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Antique Store

Example 1: In your shop, a freelance antique consultant/dealer is working on her laptop as an intermediary, working out a deal between you and a remote customer. An employee accidentally spills his coffee on her laptop, which is worth several thousand dollars. If you were found liable, general liability insurance would probably help cover some of the damages.

Example 2: A customer brings a very valuable vase into your store for an estimate. You accidentally drop it on the floor, and it shatters. If liable, your business would probably be covered for some of the estimated damages or a settlement reached between you and the customer.

Example 3: One of your employees, who manages the antique business’s online presence, jokingly tweets about another local antique shop being “run by crooks.” He retracts the tweet, but it becomes a popular meme featuring an image of the other antique business’ storefront. Your business is sued for slander. General liability insurance would likely cover some of what your business owes in damages or any settlement reached.

Other Types of Coverage Antique Stores Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

An antique store absolutely cannot do without a commercial property policy to cover its inventory. Antiques are often irreplaceable vestiges of the past. Only in a colloquial sense are these objects “priceless” — to your business, they are worth a great deal. In the event of disasters like fire or violent weather, your inventory can be covered under a commercial property policy for any damages incurred.

Crime Insurance

Many valuable antiques are small enough to be carried off in the blink of an eye. Crime insurance covers instances of employee theft of business or client property, as well as losses resulting from a forgery. So if a customer asks you to estimate the value of his antique collection and it is stolen overnight by an employee, crime insurance can provide coverage. Alternatively, if a valuable signed document is purchased by your business, and it turns out to be a worthless forgery, this too can be covered by a good crime insurance policy. Other coverage includes digital fraud and the theft of actual money on your premises.

Home-Based Business Insurance

If you prefer to save on rent and operate out of your own house, this can be a wise choice. Don’t assume that your standard home insurance will act as coverage for issues that arise in the context of your business operation. You may be found liable for damages incurred on the premises of your house during business hours.

This policy can be purchased as part of a business owner’s policy or as an extension (known as a rider) to your existing homeowner’s insurance policy.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your antique store:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Antique Store Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It is generally recommended, yes. Due to the unique risks faced by antique stores, it is critical to obtain the right business insurance before your antique store gets up and running to protect yourself against any unforeseen risks.

Even if this isn’t the case, your antique store may be legally required to carry certain types of insurance policies (e.g., workers’ compensation, commercial auto) in order to operate legitimately.

Not necessarily. Certain exceptions may be written directly into your antique store insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.