Assisted Living Business Insurance

Getting insurance for your assisted living center is essential.

Assisted living centers need to be protected from claims arising from things like illnesses arising from food, slip and fall injuries, or errors in medication.

For example, a resident failed to receive their medicine due to an administrative error, or one of your aides doesn’t provide the proper assistance and causes a resident to injure themselves.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for an Assisted Living Business

General liability insurance is — generally speaking — one of the most important insurance policies for assisted living centers.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

In addition to general liability, there are several other policies that your assisted living center may find beneficial, including:

- Professional liability insurance

- Commercial umbrella

- Workers’ compensation insurance

There are typically two main types of insurers available to businesses searching for coverage:

- Traditional brick-and-mortar insurers: These providers represent some of the biggest in the US (such as The Hartford and CNA). They are considered trustworthy and reliable due to the number of decades they have offered insurance, though their prices can sometimes be higher.

- Online insurers: By taking advantage of AI (in the place of an insurance agent), online providers are able to offer customers tailored quotes that match the quality of traditional insurers but at an affordable rate.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

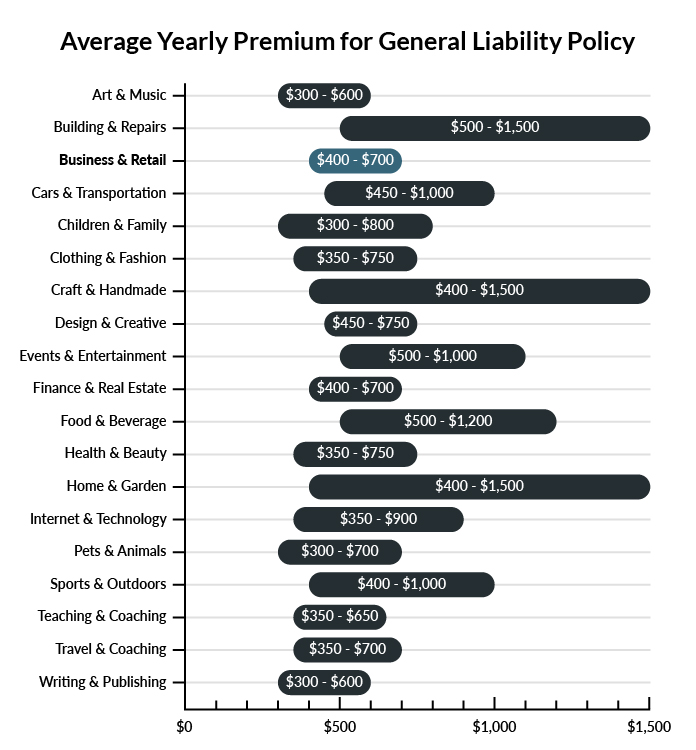

The average assisted living facility in America spends between $400-$700 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for an assisted living business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for an Assisted Living Business

Example 1: During the night, a resident calls for help to use the bathroom. No one hears her, and she slips and falls on her way to the bathroom, breaking her hip. If found liable, general liability insurance would likely help to cover damages owed by your business, including court-mandated payments and settlements.

Example 2: A resident receives some food he should not be eating due to a menu mix-up. He goes into diabetic shock, leading to serious medical complications. If found liable, your business would probably be covered by general liability insurance for resulting damages, medical payments, or settlements.

Example 3: A visiting family member asks one of your employees to park her car as she hurries toward her father’s room. The employee obliges her, but it is a stick shift and he drives it into a pillar supporting your building’s resident pickup/dropoff area. General liability insurance would probably help in covering any damage to the customer’s car.

Other Types of Coverage Assisted Living Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

Businesses that are responsible for completing complex or sensitive work often benefit from professional liability insurance. This policy is particularly important for an assisted living business that performs the valuable care work of helping the elderly live dignified lives. In the event that your business undertakes careful medical assistance that ultimately goes wrong, a professional liability policy can protect you from serious losses.

Commercial Umbrella Insurance

Commercial umbrella policies are a great idea for any business that performs sensitive work in general. While ineffective alone, an umbrella policy is purchased atop other maximized policies, allowing for additional coverage normally ignored by standard insurance. For an assisted living business with so many complex variables in play, this policy can keep you covered in the event of unanticipated damages.

Workers’ Compensation Insurance

If your business expands beyond a point where you can reliably manage your clients independently, you’ll need a workers’ compensation policy to cover your employees. Part-time and full-time employees must be covered by compensation insurance as a matter of law. This policy will provide coverage for employees who are injured on the job, including disability and death benefits resulting from work incidents.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your assisted living business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Assisted Living Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, it is highly recommended.

Due to an assisted living center’s nature – which involves looking after elderly and vulnerable individuals – it comes with inherent risks that necessitate adequate business insurance to avoid financial losses.

Furthermore, in many instances, some forms of insurance can even be a legal requirement of operation if you use any vehicles at your center or hire aides.

Not necessarily. Certain exceptions may be written directly into your assisted living business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.