Baby Store Insurance

Getting insurance for your baby store is essential.

Baby stores need to be protected against things like claims of product liability, breach of warranty, negligence, and false advertising.

For example, a crib sold by your store breaks due to a defect and injures a customer’s child, or a customer claims that your store’s prices are higher than shown in your advertising campaign.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Baby Store

General liability insurance is — generally speaking — one of the most important insurance policies for baby stores.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

Even so, your baby store could potentially benefit from adopting other supplementary coverage, such as:

- Product liability insurance

- Commercial property insurance

- Workers’ compensation insurance

- Business interruption insurance

You are generally presented with two broad options when it comes to where to buy your business insurance from:

- Traditional brick-and-mortar insurers: This category includes some of the most renowned providers in the US. While they are trusted due to their years of experience, the high overhead costs of these providers often mean they can be quite costly.

- Online insurers: On the other hand, online providers minimize their overheads by basing themselves fully online and using AI technology to offer quotes instead of an insurance agent. The result is highly personalized and reliable insurance that is affordable.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

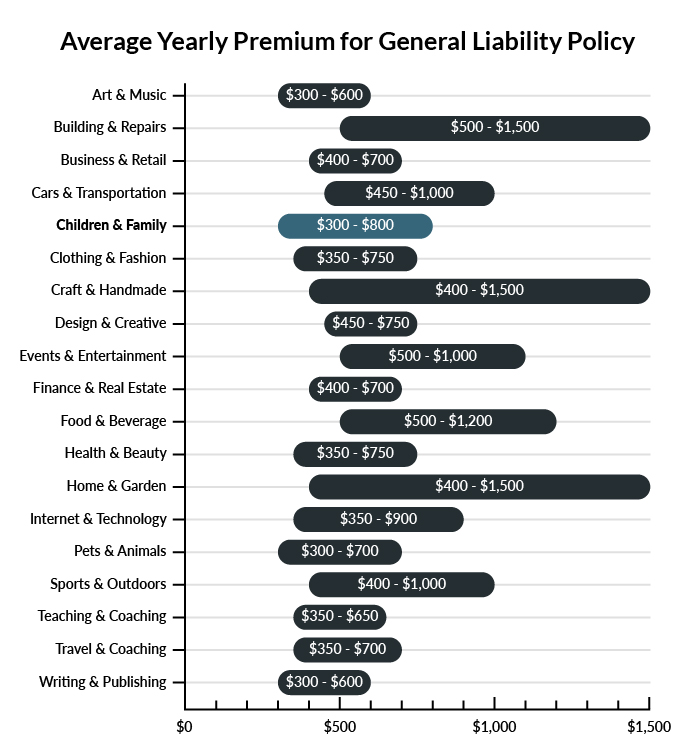

The average baby store in America spends between $300-$800 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a baby store to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Baby Store

Example 1: A customer sets his baby on a fold-out shelf that he assumes is meant for diaper changing. The shelf is actually a panel that opens for access to an air duct below. It flips downward, dropping the infant on the floor and causing a serious head injury. If found liable, your business would probably be covered by general liability insurance for any resulting settlement or court-mandated medical payments.

Example 2: A mother allows her child to wander while she shops in your store. The child pulls out a shopping cart and begins using it to roll around the store. One of your employees asks him to stop, but the boy rides his cart into a product display, knocking it down onto his head. If found liable for the accident, general liability insurance could probably help cover any medical expenses or settlements.

Example 3: Your business owns both its storefront and the surrounding parking lot, including a large parking garage. Finding it difficult to navigate through your garage, a customer turns the wrong way into a one-way passage and collides head-on with another car. If found liable, your business could probably rely on general liability insurance to assist in coverage for anything a court decided you owed or any settlement reached.

Other Types of Coverage Baby Stores Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Product Liability Insurance

Infants are among the most vulnerable consumers, and it is highly important that any products intended for their use be deemed completely safe. However, if a mistake is made, or a manufacturing error occurs, a baby toy or consumable could prove harmful, or even lethal, to an infant. Product liability insurance is always worth acquiring for baby storees.

While your company may exercise incredible caution and run its inventory through a safety research process, even a responsible baby business owner needs to make sure that their losses are covered in the event that one of their sold products harms an infant.

Commercial Property Insurance

Nearly all businesses would be wise to pick up a commercial property policy. If your storefronts contain valuable merchandise, an investment in this policy can make the difference between going out of business and overcoming a setback. When fires or violent weather impact your business, damaging or destroying costly chunks of your inventory, commercial property insurance covers the value of these losses, plus damages to any owned real estate. It can also cover damages to equipment like motorized pallet carriers and similar indoor vehicles.

Workers’ Compensation Insurance

A business is only as productive as its employees, and if you are bringing hired help on board, this policy is essential. Workers’ compensation insurance is mandatory for businesses with part-time or full-time employees. Workplace accidents are covered by this insurance, including the provision of disability and death benefits. Workers and their families deserve coverage, comfort, and peace of mind. A compensation policy provides exactly that while protecting your business from damages to employees that occur on-site.

Business Interruption Insurance

Working especially well in tandem with commercial property insurance, this policy covers unfortunate businesses that suffer serious losses due to fires, tornadoes, and similar disasters. Business interruption insurance assists in covering estimated profit losses during downtime, and it can sometimes cover costs associated with temporarily relocating your business. An interruption policy can be the difference between crippling financial damages and a challenging setback.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your baby store:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Baby Store Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Yes, we would advise obtaining business insurance before starting. As a consequence of the inherent risks associated with baby products, it is unwise to open yourself up to any potential claims unprotected.

It is worth being aware that, depending on your baby store’s situation, it may be legally mandated to carry certain types of business insurance before opening.

Not necessarily. Certain exceptions may be written directly into your baby store insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.