Beekeeping Business Insurance

Getting insurance for your beekeeping business is essential.

Beekeeping businesses need to be protected against claims such as product liability, property damage, personal injury, and breach of contract.

For example, you could be held responsible to compensate an employee who suffered a serious bee sting on your property, or one of your vendors could claim that you didn’t fulfill your agreed-upon contract.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Beekeeping Business

General liability insurance is — generally speaking — one of the most important insurance policies for beekeeping businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

While general liability is an important part of your overall coverage, your beekeeping business may find some of the following additional insurance policies to be beneficial as well:

- Commercial property insurance

- Business interruption insurance

- Product liability insurance

- Home-based business insurance

When searching for insurance for your beekeeping business, you will generally be presented with two distinct types of providers to choose between:

- Traditional brick-and-mortar insurers: Providers, such as Hiscox and The Hartford, are trusted to provide reliable insurance options due to their decades of experience. While very reputable, their coverage often comes at a premium due to the higher operating costs of managing a physical store and insurance agent.

- Online insurers: By sacrificing both of these expenses, these providers are able to use AI technology to provide customers with similarly accurate insurance online at a much cheaper rate. As these providers’ lower costs are not achieved at the expense of quality, we generally recommend this choice for new small businesses.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

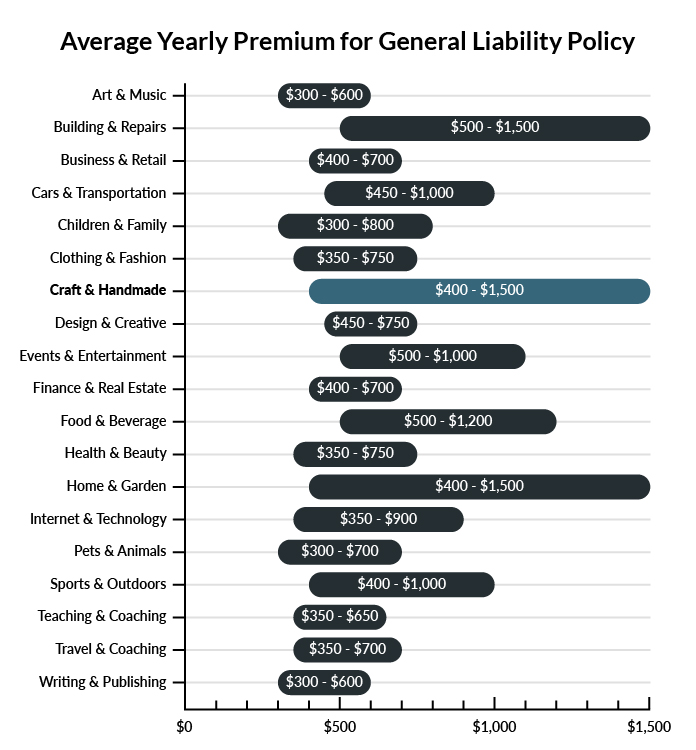

The average beekeeping business in America spends between $400-$1,500 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a beekeeping business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Beekeeping Business

Example 1: A client comes by to inspect the premises and watch some of the beekeeping action. He stays back from the hives but ends up getting stung by a bee anyway. The client discovers that he is severely allergic to bees, requiring serious medical attention. In the event that your business is found liable, general liability insurance would probably help to cover court-mandated damages or a settlement.

Example 2: An independent service is transporting your bees and equipment to another site. One of the transporters doesn’t wear the proper beekeeping gear, and when he accidentally drops a container full of bees, he is swarmed and stung many times. General liability insurance would probably help cover the damages to the transporter or a settlement agreed upon by your business and the transporter’s lawyer.

Example 3: Some children visit your farm on a field trip, but one child is so frightened that she runs away, falls, and injures her arm. If found liable, your business would probably be covered for damages or settlements through general liability insurance.

Other Types of Coverage Beekeeping Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Commercial Property Insurance

A lot of special care and equipment go into professional beekeeping. Your delicate instruments, containers, and bee populations are critical to the ongoing success of your operation. In the event of a fire or violent weather damage, a commercial property policy can help cover any sustained losses. This policy is a must-have for many businesses, and it can keep a company afloat when equipment, inventory, or any owned real estate are damaged.

Business Interruption Insurance

Business interruption insurance is an important policy for beekeepers, who depend on the ongoing productivity of their bee populations to make products for consumers. In the event that a disaster strikes, like a tornado or a fire, it may not be enough to have commercial property coverage. Business interruption policies allow a company to recoup losses suffered during the time spent re-establishing the business and starting up again.

Estimated losses in revenue, training for new workers to use complex machinery, and even temporary relocation costs are all examples of items potentially covered by business interruption insurance.

Product Liability Insurance

Most beekeeping operations profit by acquiring honey and other bee-based materials, which they can turn around and sell. If your products are found responsible for damages of any kind to a customer, it can lead to a serious lawsuit. Keep your business covered in the event of product-caused damages with a product liability policy. You never know exactly how your inventory will be used or abused by consumers, so this is almost always a smart purchase for businesses that depend on the sale of material goods.

Home-Based Business Insurance

If you run your beekeeping business from home, you may find that standard home insurance does not apply to business-related accidents or injuries occurring on your home property. Home-based business insurance is designed for exactly this situation, providing commercial liability coverage to businesses that operate from home. Business owners shouldn’t feel obligated to pay huge costs for renting or purchasing a separate place to conduct their work. This policy can be obtained as part of a business owner’s policy or added to home insurance as a rider extension.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your beekeeping business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Beekeeping Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

Prioritizing obtaining insurance before your beekeeping business launches is key to safeguarding it from the many potential liabilities it can be exposed to (such as personal injury or product liability).

Moreover, it is highly likely that certain policies will be a legal requirement for your beekeeping business to be run legitimately (such as workers’ compensation and commercial auto insurance).

Not necessarily. Certain exceptions may be written directly into your beekeeping business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.