Body Waxing Business Insurance

Getting insurance for your body waxing business is essential.

Body waxing businesses need to be protected against things like claims of negligence, personal injury, misrepresentation, and breach of contract.

For example, a customer could suffer skin irritation or burns during the waxing process, or one of your waxers could be found to be overstating their qualifications.

We’ll help you find the most personalized and affordable coverage for your unique business.

Recommended: Ergo Next Insurance is dedicated to matching small businesses with the right policy at the best price.

Best Insurance for a Body Waxing Business

General liability insurance is — generally speaking — one of the most important insurance policies for body waxing businesses.

Some of the risks general liability insurance covers are:

- Bodily injury

- Property damage

- Medical payments

- Legal defense and judgment

- Personal and advertising injury

In addition to general liability insurance, your body waxing businesses may find any of the following policies to also be beneficial:

- Professional liability insurance

- Commercial property insurance

- Workers’ compensation insurance

- Product liability insurance

When shopping for insurance for your body waxing business, you’ll typically be faced with the choice between one of two distinct types of providers:

- Online insurers: A more modern type of insurer that provides accurate and reliable insurance more conveniently and cheaply than their traditional counterparts. This is possible due to their utilization of AI and purely online nature, which allows them to minimize overheads.

- Traditional brick-and-mortar insurers: Includes the likes of CNA and The Hartford, which are known for providing reliable and accurate insurance. By running physical storefronts and employing insurance agents, their overheads may be higher and prove to be costlier on the consumer side.

Let’s Find the Coverage You Need

The best insurers design exactly the coverage you need at the most affordable price.

Cost of General Liability Insurance

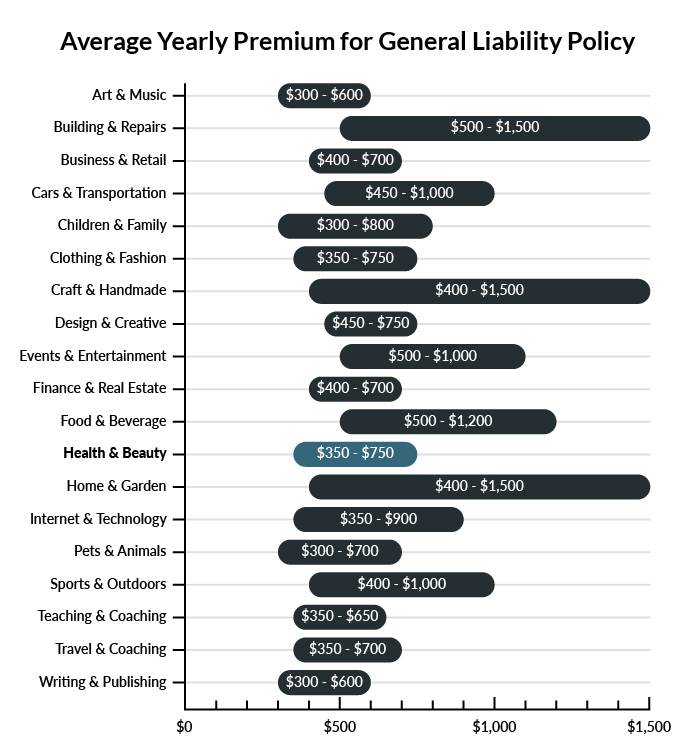

The average body waxing business in America spends between $350-$750 per year for $1 million in general liability coverage.

Compare the average cost of general liability insurance for a body waxing business to other professional industries using the graph below.

Several factors will determine the price of your policy. These include your:

- Location

- Deductible

- Number of employees

- Per-occurrence limit

- General aggregate limit

You may be able to acquire general liability insurance at a discounted rate by purchasing it as part of a business owner’s policy (BOP) rather than as a standalone policy.

A BOP is a more comprehensive solution that includes multiple forms of coverage, such as business interruption and property insurance.

Find the Best Rate

Discover the best coverage at the lowest rate in our cheapest business insurance review.

Common Situations That General Liability Insurance May Cover for a Body Waxing Business

Example 1: A customer fails to inform your business that he is allergic to a particular brand of body wax that you commonly use. He suffers a severe reaction to your wax and requires prompt medical attention and an ambulance. If found liable, your business would likely be covered by general liability insurance, including court-ordered damage payments or any settlements reached.

Example 2: A customer dozes off during his session and wakes up to find that he has been treated according to a different customer’s scheduled appointment. He has rashes on his body where certain oils were applied. He claims that his health is a crucial element of his professional life and files a lawsuit to cover a period of time that he cannot work. If liable for the error, your company would probably be covered by general liability insurance for resulting damage estimates or a settlement.

Example 3: A customer is accidentally sealed in a tanning bed due to a broken mechanism. When she is finally released, her skin looks red and she is visibly shaken. She says she is traumatized and in great pain. If found liable for this incident, your business would probably be covered by general liability insurance for any damages owed or settlements reached.

Other Types of Coverage Body Waxing Businesses Need

While general liability is the most important type of insurance to have, there are several other forms of coverage you should be aware of. Below are some of the most common types of coverage:

Professional Liability Insurance

Body-waxing businesses perform delicate services that are profoundly impactful to their clientele’s physical comfort. For that reason, this is one business that absolutely needs professional liability insurance. If a customer doesn’t like the way their procedure turned out or feels that they have been significantly wronged by your methodology, they may opt to sue. Rather than pay huge amounts in damages, a smart body waxing business will be insured for professional liability and deflect most of the financial damages incurred by lawsuits of this nature.

Commercial Property Insurance

On location at its storefronts, a body waxing business will maintain and utilize cosmetic equipment, supplies, machinery, and even inventory. One of the most serious hits a business can take is to lose massive amounts of money in unexpected disasters like a fire or violent weather. If your business is impacted by such a loss, you’ll be looking at not only the loss of your material assets but the cost of reacquisition. Commercial property insurance provides coverage for commercial inventory/equipment as well as damage to owned real estate.

Workers’ Compensation Insurance

While a body waxing business could function with you as its exclusive owner and worker extraordinaire, you have a lot to gain by bringing employees on board to expand the business and increase revenue. That being said, part-time and full-time employees legally require you to carry workers’ compensation insurance. Through this policy, employees will be covered for injuries sustained on the job. They will also be provided disability and death benefits, improving the financial security of not only your workers but of their families as well.

Product Liability Insurance

Many body waxing businesses also sell products. In an industry like health and cosmetics, your business is probably better off with something to protect it from lawsuits that arise through product use. For instance, if a customer sustains an injury or other medical damages due to a product you sold, you could be held liable for the cost of medical treatments. Don’t be caught off guard by a surprising misuse of your merchandise—product liability insurance is drafted for exactly this reason.

Additional Steps To Protect Your Business

Although it’s easy (and essential) to invest in business insurance, it shouldn’t be your only defense.

Here are several things you can do to better protect your body waxing business:

- Use legally robust contracts and other business documents. (We offer free templates for some of the most common legal forms.)

- Set up an LLC or corporation to protect your personal assets. (Visit our step-by-step guides to learn how to form an LLC or corporation in your state.)

- Stay up to date with business licensing.

- Maintain your corporate veil.

Body Waxing Business Insurance FAQ

Yes, absolutely. You will need to first get a quote from an online business insurance provider like Ergo Next Insurance. Ergo Next allows you to then purchase a policy immediately and your coverage will be active within 48 hours.

A typical business owner’s policy includes general liability, business interruption, and commercial property insurance. However, BOPs are often customizable, so your agent may recommend adding professional liability, commercial auto, or other types of coverage to your package depending on your company’s needs.

“Business insurance” is a generic term used to describe many different types of coverage a business may need. General liability insurance, on the other hand, is a specific type of coverage that business owners need to protect their assets.

It‘s highly recommended, yes. Foregoing adequate insurance will leave your business unprotected against a range of potential risks (e.g., claims of negligence and personal injury).

In some situations, businesses may be mandated by law to carry certain types of insurance, such as workers’ compensation and commercial auto insurance.

Not necessarily. Certain exceptions may be written directly into your body waxing business insurance policy, and some perils may be entirely uninsurable.

Yes, an LLC is meant to create a legal barrier between your business and your personal assets and credit. If you haven’t formed an LLC yet, use our Form an LLC guide to get started.

An LLC doesn’t protect your business assets from lawsuits and liability– that’s where business insurance comes in. Business insurance helps protect your business from liability and risk.